Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Complex Landscape of Cutaneous T-Cell Lymphoma Foundational Insights Emerging Trends and Strategic Imperatives for Industry Decision Makers

As a rare and heterogeneous group of non-Hodgkin lymphomas, cutaneous T-cell lymphoma (CTCL) presents unique clinical and operational challenges for stakeholders across research, diagnosis, and treatment. This report begins by situating CTCL within the broader oncology landscape, underscoring its chronic course, pattern of skin involvement, and the profound impact on patient quality of life. Over the past decade, advances in immunopathology and molecular profiling have deepened our understanding of disease mechanisms, yet translating these insights into practical care remains an ongoing imperative.Transitioning from foundational science to market application, the spectrum of emerging diagnostic modalities and therapeutic approaches has catalyzed a period of rapid change. Molecular profiling techniques have refined patient stratification while novel agents-including immunomodulators and targeted therapies-have broadened the treatment arsenal. Despite these developments, gaps persist in early detection, personalized treatment algorithms, and equitable access to optimized care pathways.

In response to this evolving landscape, this executive summary synthesizes critical findings, identifies transformative shifts, and highlights strategic imperatives for decision makers. Structured across thematic analyses of market dynamics, segmentation drivers, regional trends, and competitive forces, the report delivers actionable intelligence. It empowers industry stakeholders to navigate complexity with evidence-based strategies, fostering innovation and patient-centric outcomes.

Charting Transformative Shifts in the Cutaneous T-Cell Lymphoma Landscape from Molecular Diagnostics to Precision Therapeutics and Disruptive Care Models

Advancements in diagnostic precision, therapeutic innovation, and care delivery models are reshaping the CTCL landscape at an unprecedented pace. The integration of high-resolution imaging and next-generation sequencing has redefined early detection thresholds by unveiling previously undetectable disease markers. As a result, patients who might have progressed to advanced stages can now be identified earlier, enabling more effective intervention strategies. Concurrently, digital pathology platforms and data analytics have accelerated research collaboration by democratizing access to complex histopathological datasets.On the therapeutic front, the convergence of immunotherapy, targeted small molecules, and cellular therapies has initiated a paradigm shift. Monoclonal antibodies and checkpoint inhibitors are demonstrating durable responses in subsets of refractory CTCL, while bispecific constructs and engineered T-cell approaches signal a future where specificity and efficacy go hand-in-hand. Equally transformative are emerging care delivery models that leverage telemedicine and home infusion services, improving adherence and patient experience. As precision medicine transcends the realm of theory into clinical reality, stakeholders must adapt strategies to leverage these shifts and drive sustainable growth.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Supply Chains Cost Structures and Access Dynamics in Cutaneous T-Cell Lymphoma Care

Beginning in early 2025, the implementation of revised United States tariff schedules has exerted a multifaceted influence on the CTCL supply chain and operational cost structures. Increased duties on imported reagents, diagnostic instruments, and biologic precursors have elevated acquisition costs for laboratories and manufacturers alike. In turn, these inflated input costs are exerting downstream pressure on testing facilities and clinical trial budgets, leading to a reevaluation of procurement strategies and vendor partnerships. In parallel, domestic manufacturing initiatives are gaining renewed attention as organizations seek to mitigate exposure to import tariffs and secure localized supply resilience.Furthermore, pricing strategies for advanced therapeutics are adapting to this new fiscal environment. Payers and providers are recalibrating reimbursement frameworks in response to cost inflation, prompting a shift toward value-based contracting and outcome-driven agreements. As market participants navigate these financial headwinds, there is growing impetus to optimize operational efficiencies across the product lifecycle. This tariff-driven inflection point underscores the necessity for agile pricing models, strategic sourcing, and collaborative dialogue among stakeholders to ensure continued access to critical diagnostic and therapeutic solutions.

Patient access and affordability have also felt the ripple effects of tariff-induced cost escalation. Insurance providers are scrutinizing specialty coverage more stringently, while patient assistance programs are under pressure to absorb rising treatment expenses. Importantly, healthcare systems are exploring alternative reimbursement pathways, such as bundled payments for combined diagnostic and therapeutic regimens. This recalibrated fiscal landscape demands vigilant monitoring and proactive engagement across all stakeholder groups to preserve momentum in CTCL innovation and care delivery.

Decoding Key Segmentation Insights in Cutaneous T-Cell Lymphoma Diagnostics Therapeutics Indications Stages and Care Settings to Navigate Market Complexity

Understanding the complexity of the CTCL market requires a granular examination of product-type categories. On the diagnostic side, traditional immunohistochemistry methods are increasingly complemented by advanced molecular diagnostics. Within that domain, next-generation sequencing and polymerase chain reaction platforms have emerged as powerful tools for uncovering genetic aberrations and tracking minimal residual disease. In parallel, therapeutic portfolios span conventional chemotherapy regimens alongside emerging immunotherapeutic agents. Additionally, retinoid compounds, stem cell transplantation protocols, and sophisticated targeted therapy products are gaining traction by offering differentiated efficacy profiles and safety paradigms.Equally pivotal is the segmentation by clinical indication, where the predominant manifestations of CTCL-mycosis fungoides and Sézary syndrome-drive distinct diagnostic workflows and treatment algorithms. Patients diagnosed at early stages typically follow less intensive management plans, while those in advanced stages face more aggressive therapeutic courses. This dichotomy in disease progression necessitates tailored approaches at each phase, underscoring the importance of stage-appropriate interventions. Finally, end-user environments ranging from homecare settings to hospitals and specialty clinics each play a unique role in the continuum of care, influencing deployment models, reimbursement considerations, and patient engagement strategies. By navigating these intersecting segments, stakeholders can align product development, market access, and commercial strategies to address unmet needs effectively.

Unpacking Vital Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Shaping Research Development and Patient Access in CTCL

Across the Americas, robust investment in both research infrastructure and clinical trial networks has solidified the United States as a global leader in CTCL innovation. Cutting-edge academic centers and integrated healthcare systems champion early adoption of advanced molecular diagnostics and novel therapeutic modalities. Canada, while smaller in scale, mirrors this pattern through strong public funding for translational research and progressive reimbursement pathways that facilitate patient access to emerging treatments.In the Europe, Middle East, and Africa region, the landscape is characterized by diverse regulatory frameworks and reimbursement environments. Western European countries often prioritize health technology assessments and value-based pricing, enabling wider adoption of new CTCL therapies. In Southern Europe, budgetary constraints prompt rigorous cost-effectiveness analyses, while emerging economies in the Middle East and Africa are gradually enhancing diagnostic capabilities and establishing specialized care centers. This heterogeneity demands region-specific market strategies that balance regulatory compliance with access initiatives.

Turning to the Asia-Pacific region, dynamic growth is fueled by demographic shifts, rising awareness of rare diseases, and escalating R&D investments. Japan and Australia lead in regulatory harmonization, expediting approval timelines for innovative agents. Meanwhile, markets such as China and India are witnessing the expansion of domestic diagnostic manufacturing and public-private collaborations to scale clinical research capacity. Collectively, these regional nuances underscore the imperative for adaptive engagement models and tailored market entry roadmaps.

Illuminating Strategic Moves by Leading Biopharmaceutical and Diagnostic Companies Driving Innovation Partnerships and Competitive Advantage in CTCL

Leading biopharmaceutical companies have escalated their commitments to the CTCL arena through diversified portfolios and strategic collaborations. Global oncology champions have accelerated small-molecule and biologic pipelines targeting specific T-cell pathways, while diagnostic firms have expanded their capabilities in next-generation sequencing and companion diagnostic development. Strategic partnerships between established pharmaceutical players and specialized biotech innovators have yielded co-development agreements centered on novel immunomodulatory constructs and bispecific antibodies, amplifying the collective momentum toward more precise interventions.Competitive positioning is further intensified by targeted investments in manufacturing proficiency and regulatory expertise. Several market stakeholders are constructing dedicated biomanufacturing facilities to support scalable production of cellular therapies and antibody-based products. Simultaneously, companies are engaging in rigorous regulatory dialogue to streamline approval processes and align on evidence standards. Amid this dynamic environment, a select group of organizations has also pursued acquisitions to broaden their technological breadth and reinforce commercial capabilities. This confluence of organic pipeline progression, collaborative alliances, and inorganic growth strategies defines the current corporate landscape in CTCL.

Actionable Recommendations for Industry Leaders to Accelerate Innovation Optimize Access and Strengthen Collaboration in Cutaneous T-Cell Lymphoma Management

In order to capitalize on emerging opportunities within the CTCL landscape, industry leaders should prioritize iterative investment in advanced diagnostic platforms that integrate molecular profiling and artificial intelligence-driven analytics. By fostering cross-functional collaboration between pathology, bioinformatics, and clinical teams, organizations can accelerate the translation of molecular insights into actionable patient stratification tools. Furthermore, establishing early-stage partnerships with academic centers and patient advocacy groups will catalyze real-world evidence generation and reinforce the value proposition of innovative therapies.To navigate the evolving reimbursement environment, stakeholders must develop adaptive pricing models that align payment structures with measurable patient outcomes. Engaging payers proactively in value demonstration studies and leveraging risk-sharing agreements will enhance access pathways and mitigate fiscal uncertainties. Additionally, companies should explore hybrid care delivery models-blending in-clinic services with telemedicine and home infusion capabilities-to optimize patient adherence and resource utilization. Finally, a robust supply chain strategy that incorporates localized manufacturing and diversified sourcing will safeguard against tariff-induced disruptions and ensure continuity of critical diagnostic and therapeutic supplies.

Robust and Transparent Research Methodology Combining Primary Interviews Secondary Data Triangulation and Expert Validation to Ensure Analytical Rigor

This analysis is underpinned by a comprehensive research methodology combining primary research, secondary data analysis, and rigorous validation. In the primary phase, in-depth interviews were conducted with oncologists, dermatopathologists, payers, and industry executives to capture nuanced perspectives on clinical practice trends, reimbursement dynamics, and strategic imperatives. Secondary research encompassed a thorough review of peer-reviewed literature, regulatory filings, and financial disclosures to establish a robust factual baseline.Data triangulation techniques were employed to reconcile insights from diverse sources, ensuring analytical integrity and consistency. Quantitative datasets were subjected to statistical validation to identify correlations and emerging patterns, while qualitative inputs underwent thematic analysis to uncover underlying drivers and barriers. Expert advisory panels provided critical feedback at each stage, refining key assumptions and affirming the final narratives. This methodical approach ensures that the findings presented herein are both credible and actionable for decision makers seeking to navigate the CTCL market.

Concluding Perspectives on the Future Trajectory of Cutaneous T-Cell Lymphoma Research Innovation Access and Collaborative Imperatives for Stakeholders

As the field of cutaneous T-cell lymphoma continues to evolve, stakeholders face both profound challenges and unprecedented opportunities. The convergence of molecular diagnostics, advanced therapeutics, and digital care models has catalyzed a new era of precision oncology, yet cost pressures and complex regulatory landscapes remain formidable constraints. Through a comprehensive understanding of segmentation dynamics, regional nuances, and corporate strategies, decision makers can craft informed roadmaps that balance innovation with access.Ultimately, the path forward hinges on collaborative engagement across the value chain-from research institutions and diagnostic developers to payers and patient advocacy groups. By aligning strategic investments, adapting to fiscal headwinds, and leveraging real-world evidence, industry participants can accelerate the translation of scientific breakthroughs into meaningful patient outcomes. This report serves as both a navigational compass and a strategic blueprint, guiding stakeholders toward sustainable growth and enhanced patient care in the CTCL domain.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Diagnostics

- Immunohistochemistry

- Molecular Diagnostics

- Next Generation Sequencing

- Polymerase Chain Reaction

- Therapeutics

- Chemotherapy

- Immunotherapy

- Retinoids

- Stem Cell Transplantation

- Targeted Therapy

- Diagnostics

- Indication

- Mycosis Fungoides

- Sézary Syndrome

- Stage of Disease

- Advanced Stage (IIB-IVB)

- Early Stage (IA-IIA)

- End User

- Homecare Settings

- Hospitals

- Specialty Clinics

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Bausch Health Companies Inc.

- Kyowa Kirin Co., Ltd.

- Merck KGaA

- Bristol Myers Squibb Company

- 4SC AG

- Soligenix, Inc.

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Eisai Co., Ltd.

- Helsinn Healthcare SA

- Seattle Genetics, Inc.

- Incyte Corporation

- Mundipharma International Limited

- Astellas Pharma Inc.

- Elorac, Inc.

- Allos Therapeutics, Inc.

- PharmaMar SA

- Corvus Pharmaceuticals, Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The key companies profiled in this Cutaneous T-Cell-Lymphoma market report include:- Bausch Health Companies Inc.

- Kyowa Kirin Co., Ltd.

- Merck KGaA

- Bristol Myers Squibb Company

- 4SC AG

- Soligenix, Inc.

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Eisai Co., Ltd.

- Helsinn Healthcare SA

- Seattle Genetics, Inc.

- Incyte Corporation

- Mundipharma International Limited

- Astellas Pharma Inc.

- Elorac, Inc.

- Allos Therapeutics, Inc.

- PharmaMar SA

- Corvus Pharmaceuticals, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | October 2025 |

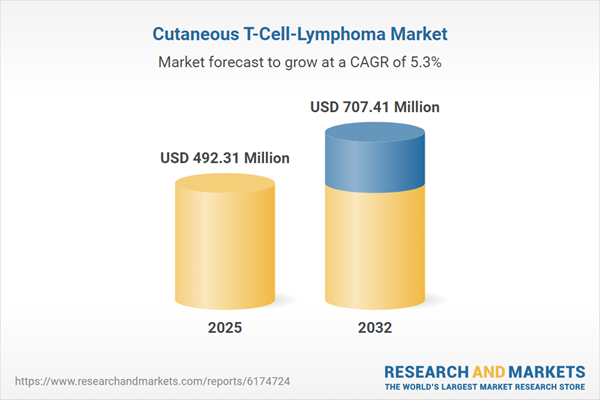

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 492.31 Million |

| Forecasted Market Value ( USD | $ 707.41 Million |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |