Increasing emphasis on indoor air quality, coupled with growing HVAC system installations in residential environments, continues to fuel demand for advanced sensor technologies. A growing number of property owners and facility operators are turning to multi-functional sensor units to monitor temperature, humidity, carbon dioxide levels, particulate matter, and volatile organic compounds in real time. This shift is being driven by heightened consumer awareness around health, comfort, and air quality, as well as regulatory frameworks focused on environmental safety. As HVAC systems become more advanced and interconnected, the demand for precision sensors that ensure air quality and energy efficiency is rising across commercial, industrial, and residential sectors.

The wired sensors segment is predicted to generate USD 6.2 billion by 2034, maintaining its dominance in large-scale industrial and commercial spaces due to its reliability, consistent performance, and data integrity. While wireless alternatives are gaining traction, wired configurations continue to be favored in mission-critical environments where seamless communication and minimal latency are key. Manufacturers are now focusing on enhancing installation convenience and integrating wired sensors more effectively into centralized control infrastructures without compromising their core performance advantages.

The temperature sensors segment held a 36.1% share in 2024. Their integration into smart HVAC systems is becoming more sophisticated, often packaged within multi-functional devices that also detect humidity, CO2, and air pollutants. These advanced temperature sensors play a crucial role in intelligent climate regulation, adapting airflow and temperature in real-time to improve comfort and reduce energy usage. As connected buildings evolve, compact, high-accuracy sensors that align with IoT protocols are gaining favor among manufacturers and end-users alike.

North America HVAC Sensor Market held 27% share in 2024 and is projected to grow at a CAGR of 6.6% through 2034. The region’s strong momentum is driven by rising demand for energy-efficient HVAC installations and the proliferation of smart building ecosystems. The use of multi-parameter sensors in North America is steadily transforming air management strategies across residential and commercial properties, enabling automated, data-driven HVAC systems that improve compliance and occupant well-being.

Key players operating in the HVAC Sensor Market include Siemens, Johnson Controls, Honeywell International, Sensirion, and Schneider Electric. Leading companies in the HVAC sensor industry are advancing their market position by developing compact, multi-functional sensor solutions that align with the growing need for real-time monitoring and smart HVAC integration. These firms are investing heavily in R&D to create energy-efficient, IoT-compatible sensors that combine temperature, humidity, and air quality detection in a single module. Partnerships with smart building system providers and increased focus on interoperability and data analytics help enhance system-wide performance and simplify deployment.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this HVAC Sensor market report include:- Honeywell International

- Siemens

- Johnson Controls

- TE Connectivity

- Schneider Electric

- North America

- Emerson Electric

- Trane

- Amphenol

- Europe

- Belimo Holding

- STMicroelectronics

- Infineon Technologies

- APAC

- Omron

- Chino

- Acal Bfi

- Sensirion

- Sensata Technologies

- Microchip Technology

- Greystone Energy Systems

- Texas Instruments

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

| Forecast Period | 2024 - 2034 |

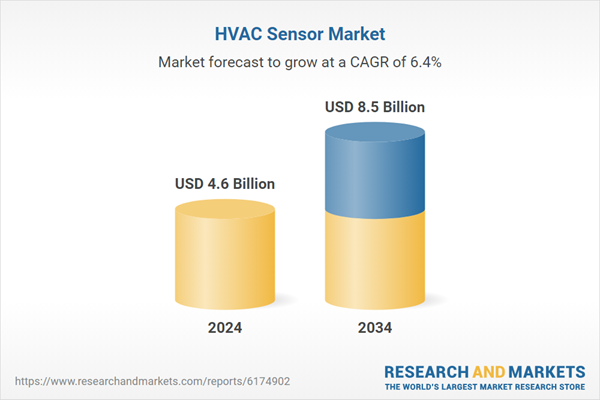

| Estimated Market Value ( USD | $ 4.6 Billion |

| Forecasted Market Value ( USD | $ 8.5 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |