The growth is driven by the continued expansion of aircraft fleets, growing air traffic, rising emphasis on maintenance and upgrades, and the increasing affordability and availability of aftermarket parts. As airlines operate larger and older fleets, the demand for part replacements, MRO services, and component upgrades is rising steadily. The aftermarket segment has become critical for sustaining operational efficiency, extending fleet lifespan, and ensuring safety standards. With the aviation industry focusing on cost-effective and regulatory-compliant parts, airlines are adopting advanced aftermarket solutions to minimize downtime and improve fleet readiness. Additionally, modern predictive maintenance technologies and robust servicing infrastructure are boosting the replacement cycle. The global trend of low-cost carriers and regional air travel expansion is also increasing aircraft utilization, further accelerating aftermarket part demand across commercial, cargo, and defense aviation segments.

The rotable parts segment is projected to grow at a CAGR of 7.6% between 2025 and 2034, fueled by higher aircraft utilization rates and the aging of existing fleets. The rising need for efficient repairable components and global expansion in regional aviation markets, especially in the Asia-Pacific and Middle East, are major contributing factors. Manufacturers must innovate to improve component longevity and integrate predictive maintenance tools that help airlines anticipate part wear, optimize repairs, and manage inventory more effectively across rapidly expanding routes.

The OEM segment was valued at USD 37.9 billion in 2024. Airlines continue to prefer original equipment due to regulatory adherence, warranty assurances, and the reliability of certified parts that guarantee aircraft performance and passenger safety. To stay ahead, OEM providers are focusing on strengthening partnerships with major airlines, expanding their global service footprint, refining quality control, and embedding smart technology into components to meet evolving aviation standards and reduce operational risks.

U.S. Aircraft Aftermarket Parts Market was valued at USD 16.8 billion in 2024. Growth in the country stems from strong airline activity, a high concentration of commercial airports, expanding travel routes, and faster adoption of innovative maintenance tools and diagnostics. Manufacturers looking to tap into this demand are ramping up their product offerings, enhancing collaboration with regional carriers, and staying aligned with evolving aviation safety requirements.

Key players actively shaping the Global Aircraft Aftermarket Parts Market include Aventure International Aviation Services LLC, Parker Hannifin Corporation, GKN Aerospace, Rolls-Royce plc, TP Aerospace, Textron Aviation, Moog Inc., The Boeing Company, Bombardier Inc., HEICO Corporation, RTX Corporation, Eaton Technologies, Martin-Baker Aircraft Co. Ltd., Meggitt PLC, Safran Group, GE Aerospace, Airbus SE, AJW Group, AAR Corp., Honeywell International Inc., Houston Precision Fasteners (HPF), and Apollo Aerospace Components Ltd. Companies are expanding their global presence through partnerships with MRO service providers and airlines to ensure consistent availability of parts across key regions. Many are investing in predictive maintenance technologies to offer data-driven solutions that reduce aircraft downtime. Strategic acquisitions, warehouse automation, and global distribution network expansion are helping firms shorten delivery times and streamline supply chains.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Aircraft Aftermarket Parts market report include:- Honeywell International Inc.

- GE Aerospace

- Rolls-Royce plc

- The Boeing Company

- Airbus SE

- North America

- AAR Corp.

- Bombardier Inc.

- HEICO Corporation

- Moog Inc.

- Parker Hannifin Corporation

- RTX Corporation

- Textron Aviation

- Asia Pacific

- Aventure International Aviation Services LLC

- Europe

- AJW Group

- Apollo Aerospace Components Ltd.

- GKN Aerospace

- Martin-Baker Aircraft Co. Ltd.

- Meggitt PLC

- Safran Group

- TP Aerospace

- Eaton Technologies

- Houston Precision Fasteners (HPF)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | September 2025 |

| Forecast Period | 2024 - 2034 |

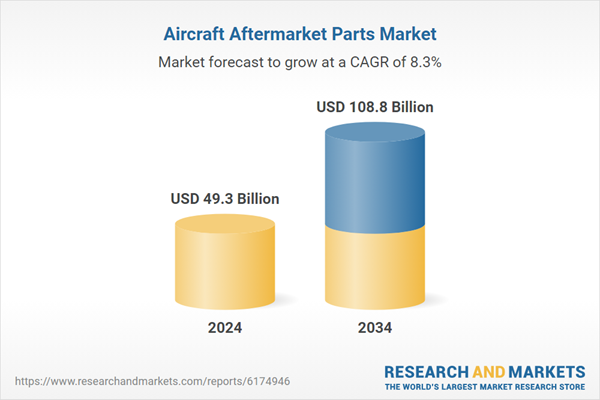

| Estimated Market Value ( USD | $ 49.3 Billion |

| Forecasted Market Value ( USD | $ 108.8 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |