This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Marketing and promotional strategies have been pivotal in driving this expansion, with providers leveraging digital marketing channels, social media campaigns, influencer partnerships, and targeted advertising to attract consumers. BNPL services are often integrated seamlessly into e-commerce platforms, allowing users to select installment options during checkout, and promotional initiatives such as zero-interest offers, referral bonuses, and exclusive retailer deals further enhance user engagement and loyalty. Affirm Inc., recognized for its transparent, interest-free installment solutions and robust underwriting technology.

With a focus on responsible lending, Affirm leverages machine learning and real-time data analytics to offer tailored credit limits without hidden fees. Its partnerships with high-profile retailers such as Amazon, Walmart, and Peloton have significantly expanded its consumer reach across online and in-store channels. Affirm’s commitment to financial inclusivity and user-friendly digital experiences has positioned it as a preferred BNPL provider among Gen Z and millennial shoppers in North America.

In the United Kingdom, the Financial Conduct Authority (FCA) has introduced guidelines requiring providers to assess borrowers’ ability to repay, while in the United States, the Consumer Financial Protection Bureau (CFPB) has emphasized transparency, responsible marketing, and dispute resolution processes. Emerging certification standards also promote responsible lending practices, ethical data handling, and compliance with consumer rights regulations.

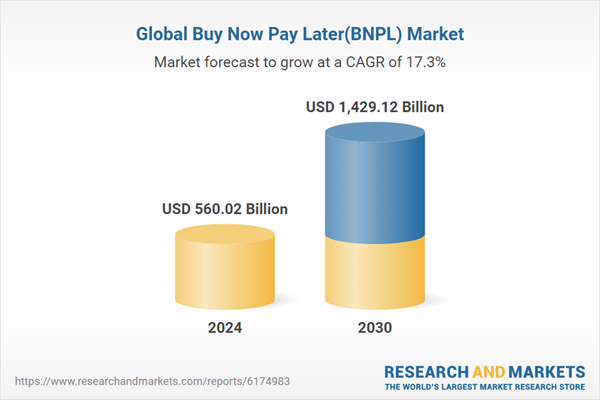

According to the research report "Global Buy Now Pay Later Market Outlook, 2030,", the Global Buy Now Pay Later market was valued at more than USD 560.02 Billion in 2024, and expected to reach a market size of more than USD 1.42 trillion by 2030 with the CAGR of 17.26% from 2025-2030. The proliferation of mobile wallets and digital payment systems has made BNPL services more accessible across regions, while younger consumers, particularly Millennials and Gen Z, increasingly prefer installment-based payment options to manage their finances without incurring high-interest debt. The COVID-19 pandemic further accelerated the shift toward online shopping, creating a favorable environment for BNPL adoption.

In addition, merchant adoption of BNPL solutions has increased, as retailers recognize that offering installment payments can boost conversion rates, average order values, and customer loyalty. The increasing number of e-commerce platforms, and rising services adoption across millennials in developed countries, have propelled the global buy now pay later market growth.

Furthermore, BNPL presents a substantial chance for growth as it aids banks in protecting their consumer finance and credit card sectors against emerging rivals.In January 2022, Santander, Spanish Bank launched its BNPL application 'Zinnia' for the Europe market. Zinnia app helps consumers to purchase with monthly interest free installment payments across European countries.

Promotional strategies such as zero-interest periods, referral bonuses, and exclusive retailer partnerships have also helped drive consumer engagement and retention. Opportunities in the BNPL market are expanding through fintech-focused events, conferences, and seminars that provide platforms for networking, knowledge exchange, and innovation. For example, Money20/20 USA, held annually in Las Vegas, brings together industry leaders to discuss the future of payments and digital finance, while the Payments Forum explores global trends in money movement, risk management, and financial innovation.

These events enable stakeholders to identify emerging market trends, form strategic partnerships, and explore technological advancements in BNPL services. Furthermore, regulatory and certification initiatives are shaping market dynamics, as governments and financial authorities introduce guidelines to ensure consumer protection, responsible lending, and transparency in marketing practices.

Market Drivers

- Rapid Growth of E-commerce and Digital Payments: The surge in online shopping and digital payment adoption has been a major driver for BNPL. Consumers increasingly prefer seamless, flexible payment methods that allow them to split purchases into installments without interest. As e-commerce platforms expand globally, BNPL solutions are being integrated as default payment options, making it easier for customers to buy more products and for merchants to boost conversion rates and average order value.

- Rising Demand for Flexible Financing Options: Consumers are increasingly seeking alternative financing methods that provide short-term flexibility without the burden of high-interest credit cards. BNPL meets this need by offering simple installment plans with minimal or no interest, making it attractive to younger consumers, budget-conscious shoppers, and those who want to manage cash flow without incurring debt.

Market Challenges

- Risk of Consumer Over-indebtedness: One major challenge is that BNPL can encourage excessive spending, especially among younger users who may underestimate the cumulative cost of multiple installment plans. This can lead to late payments, financial strain, and potential default, which in turn can affect both the consumers’ creditworthiness and the BNPL providers’ financial stability.

- Regulatory and Compliance Pressures: With rapid market expansion, governments and financial authorities are increasingly scrutinizing BNPL services to ensure consumer protection. Providers face regulatory challenges such as credit assessment requirements, reporting obligations, and restrictions on marketing to vulnerable consumers, which may limit growth and require significant compliance investments.

Market Trends

- Expansion into Essential Goods and Services: BNPL is moving beyond discretionary retail products into essentials such as groceries, healthcare, and utility payments. This trend reflects evolving consumer behavior, where flexible installment options are increasingly valued for everyday expenses, not just luxury or high-ticket items.

- Integration with Retail and Financial Ecosystems: BNPL providers are increasingly partnering with retailers, banks, and fintech platforms to embed payment solutions directly into digital and physical checkout systems. This integration enhances customer convenience, improves merchant adoption, and creates an ecosystem where BNPL becomes a standard financial service rather than a niche offering.The online channel is leading the global Buy Now Pay Later (BNPL) industry due to the surge in e-commerce adoption, seamless digital payment integration, and growing consumer preference for convenient, interest-free installment options during online purchases.

The digital nature of online transactions aligns perfectly with the BNPL model, as approvals are instant, documentation is minimal, and credit risk assessments are automated through sophisticated fintech algorithms, making the process frictionless for both consumers and merchants. Additionally, the online ecosystem provides ample opportunities for BNPL providers to partner with e-commerce marketplaces, digital wallets, and app-based platforms, increasing visibility, adoption, and trust among consumers.

Millennials and Gen Z, who represent a significant proportion of online shoppers, are highly inclined toward flexible credit options and digital payment solutions, further propelling the dominance of the online channel. Marketing strategies in the digital space, including targeted promotions, pop-ups at checkout, and personalized offers, enhance the attractiveness of BNPL services, encouraging repeated usage and brand loyalty.

The Business-to-Consumer (B2C) segment is leading the global Buy Now Pay Later (BNPL) industry due to the rapid growth of e-commerce, increasing consumer demand for flexible payment options, and the focus of BNPL providers on enhancing individual purchasing experiences.

The Business-to-Consumer (B2C) segment has emerged as the dominant end-user category in the global Buy Now Pay Later (BNPL) industry, primarily driven by the increasing consumer preference for flexible, interest-free installment options and the booming e-commerce ecosystem worldwide. In the B2C model, retailers directly target individual consumers, providing them with convenient ways to purchase goods and services without immediate full payment, which is especially attractive to millennials and Gen Z, who form a significant portion of online shoppers and prefer digital-first financial solutions.

The flexibility of BNPL enables consumers to manage cash flows, make higher-value purchases, and maintain financial liquidity, making it an appealing alternative to traditional credit cards and personal loans. Retailers and e-commerce platforms actively integrate BNPL services at checkout to boost sales, enhance customer satisfaction, and reduce cart abandonment rates, which directly contributes to the rapid adoption of BNPL in the B2C segment. Furthermore, the proliferation of smartphones, digital wallets, and mobile apps has facilitated seamless access to BNPL solutions, allowing consumers to complete transactions within minutes, creating a frictionless shopping experience that traditional payment methods cannot match.

Fintech innovations have also enabled real-time credit approvals, personalized payment plans, and risk-based credit assessments, ensuring both convenience and safety for consumers while mitigating risks for providers. The B2C segment encompasses a wide array of industries including fashion, electronics, lifestyle, travel, and food delivery, all of which are witnessing rising online demand, thereby further expanding BNPL adoption.

Millennials and Gen Z are leading the global Buy Now Pay Later (BNPL) industry due to their strong preference for digital-first, flexible, and interest-free payment solutions that align with their online shopping habits and financial lifestyles.

Millennials and Gen Z have become the primary driving force behind the global Buy Now Pay Later (BNPL) industry, largely due to their unique consumer behaviors, digital fluency, and demand for convenience and financial flexibility. This demographic, which includes tech-savvy individuals who grew up with smartphones and e-commerce platforms, prefers seamless online shopping experiences that integrate flexible payment solutions without the complexity or high-interest rates of traditional credit cards. BNPL services resonate with these consumers because they allow purchases to be split into smaller, manageable installments, enabling budget-conscious users to buy high-value or aspirational products while maintaining financial liquidity.

Both generations are highly active in online marketplaces, social commerce platforms, and app-based retail environments, which often promote BNPL as a default checkout option, making it highly accessible and convenient. Millennials and Gen Z also value instant gratification and personalized shopping experiences, and BNPL providers cater to this by offering real-time credit approvals, tailored installment plans, and loyalty incentives, enhancing engagement and encouraging repeat usage.

Furthermore, the pandemic accelerated digital adoption among these age groups, as remote shopping became the norm, further strengthening BNPL adoption as an essential tool for online spending. Unlike older generations, they are less reliant on traditional banking or credit histories, and BNPL offers them an alternative path to access short-term credit without cumbersome documentation or long approval processes.

Large enterprises and global retailers are leading the global Buy Now Pay Later (BNPL) industry because they have the scale, technological infrastructure, and consumer reach to integrate BNPL solutions seamlessly, boosting sales, enhancing customer experience, and driving widespread adoption.

Large enterprises and global retailers dominate the merchant segment of the global Buy Now Pay Later (BNPL) industry due to their ability to leverage scale, technological capabilities, and extensive consumer networks to maximize the benefits of flexible payment solutions. These organizations operate across multiple regions and e-commerce platforms, serving millions of customers with diverse purchasing needs, making them ideal partners for BNPL providers seeking rapid market penetration. Large retailers integrate BNPL directly into their checkout systems, ensuring seamless, frictionless transactions that enhance customer convenience and satisfaction, which in turn reduces cart abandonment and increases average order values.

Their robust technological infrastructure allows for sophisticated data analytics, enabling real-time credit assessments, personalized installment plans, and targeted promotions that cater to individual consumer preferences while mitigating credit risks. Furthermore, global retailers often have strong brand recognition and consumer trust, which increases confidence in BNPL services and encourages adoption among a broad customer base, including Millennials and Gen Z, who are already inclined toward digital-first, flexible payment solutions.

Large enterprises also benefit from strategic partnerships with multiple BNPL providers, financial institutions, and payment processors, allowing them to offer competitive and diverse installment options, loyalty programs, and marketing incentives that attract repeat purchases and foster long-term consumer engagement. Additionally, their presence in both online and offline channels amplifies the reach of BNPL offerings, enabling consumers to access flexible payments across multiple touchpoints, from e-commerce platforms to brick-and-mortar stores.Asia Pacific is leading the global Buy Now Pay Later (BNPL) industry due to the rapid adoption of digital payments, high smartphone penetration, and a large young population driving e-commerce growth.

The Asia Pacific region has emerged as the dominant player in the global Buy Now Pay Later (BNPL) industry, primarily driven by the region’s rapid digital transformation and the surge in e-commerce adoption. Countries such as China, India, Australia, and Southeast Asian nations have witnessed a massive shift in consumer behavior toward online shopping, fueled by widespread smartphone penetration, affordable internet connectivity, and tech-savvy younger populations. This digitally connected demographic is more inclined to adopt flexible payment solutions like BNPL, which offer instant credit, interest-free installment options, and seamless checkout experiences, thereby enhancing consumer convenience and affordability.

Furthermore, Asia Pacific hosts a significant unbanked or underbanked population, particularly in India and Southeast Asia, where traditional credit access is limited; BNPL platforms bridge this gap by offering credit access without the need for formal banking relationships. The region’s e-commerce boom, particularly in fashion, electronics, and lifestyle sectors, has created fertile ground for BNPL adoption, as retailers integrate these payment solutions to boost sales, increase average order value, and reduce cart abandonment rates.

Government initiatives promoting digital payments, cashless transactions, and financial inclusion have further strengthened BNPL growth, while fintech innovation has introduced localized solutions tailored to regional payment habits, currencies, and credit risk profiles. Additionally, partnerships between BNPL providers and leading e-commerce marketplaces, telecom companies, and financial institutions have expanded the reach and accessibility of these services, ensuring rapid scalability across urban and semi-urban areas.

- In June 2025, Klarna Inc. launched a pilot debit card in the U.S. in partnership with Visa and WebBank, allowing users to pay immediately or choose interest-free installment plans for online and in-store purchases. The card, currently under trial, will be rolled out across the U.S. and Europe later in 2025. It comes in three colors (aubergine, black, bright green) and offers tiered benefits, including free and paid versions with varying discounts and cashback. Klarna, with over 100 million global users, is seeking to compete more directly with traditional banks, despite lacking a U.S. banking license.

- In March 2025, DoorDash integrated Klarna’s Buy Now, Pay Later (BNPL) options into its app, allowing users to pay immediately, split payments into four interest-free installments, or defer payments. This move, following similar steps by GrubHub, is significant given DoorDash’s dominant 63% share of the U.S. food delivery market. Klarna, which has 93 million active users, sees this partnership as a step toward becoming the default payment platform for everyday expenses like groceries and takeout.

- In May 2023, ZestMoney announced that it plans to be profitable in 6 months. The fintech firm is said to be finalizing a new investment round from its existing shareholders, including Quona Capital, Zip, Omidyar Network India, Flourish VC, and Scarlet Digital. To ensure business continuity, ZestMoney plans to operate as a Lending Service Provider (LSP), partnering with banks and NBFCs to write out loans rather than lending directly from its balance sheet.

- In February 2023, CRED launched an application, CRED Flash, to enter into the buy now pay later service. CRED Flash would enable users to make payments on the application and across over 500 partner merchants, including Urban Company, Zpto, and Swiggy. It allows users to clear the bill in 30 days at no charge.

- In February 2023, India lifted the ban on PayU's LazyPay and some other lending apps. India's IT Ministry lifted the ban on seven high-profile lending apps, including PayU's LazyPay, Kissht, KreditBee, and Indiabulls' Home Loans, according to a person familiar with the matter, providing some relief to the fintech industry that has been reeling with immense scrutiny in recent quarters.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Affirm Holdings, Inc.

- Klarna Group plc

- PayPal Holdings, Inc.

- Zip Co Limited

- Afterpay Limited

- PayU Global B.V.

- MercadoPago

- Splitit USA Inc.

- Kueski, S.A.P.I. de C.V.

- Nubank

- The Karur Vysya Bank Limited

- RecargaPay

- Tabby FZ LLC

- Tamara Finance Company

- CredPal

- Sezzle Inc.

- Perpay Inc.

- Social Money Ltd

- Billie GmbH

- Atome

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | October 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 560.02 Billion |

| Forecasted Market Value ( USD | $ 1429.12 Billion |

| Compound Annual Growth Rate | 17.2% |

| Regions Covered | Global |