This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Retail analytics also plays a pivotal role in shaping marketing and promotional strategies, enabling retailers to segment audiences, tailor campaigns, and predict purchasing behaviors, which enhances customer engagement and brand loyalty. The growing use of digital platforms and social media has further amplified the importance of data-driven marketing to reach and retain consumers effectively.

In May 2023, NIQ introduced a Connected Collaboration platform empowered by data assets of Rite Aid and NIQ's top data science and software. The all-inclusive platform offers manufacturers and retailers a single solution across different use cases, from market understandings to supply chains to loyalty/customer, everything in one solution at Rite Aid.

At the same time, the market’s expansion is influenced by policy, regulatory, and certification frameworks, particularly data protection and privacy regulations such as the European Union’s General Data Protection Regulation (GDPR), which set global standards and require retailers to ensure compliance while maintaining consumer trust. In addition, industry certifications and regulatory adherence are becoming essential for retailers aiming to expand globally and safeguard sensitive consumer information.

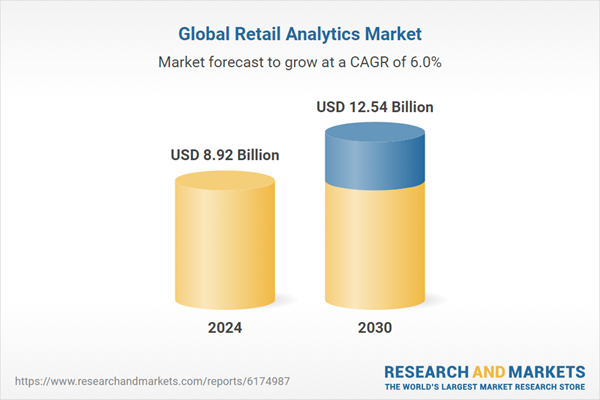

According to the research report "Global Retail Analytics Market Outlook, 2030,", the Global Retail Analytics market was valued at more than USD 8.92 Billion in 2024, and expected to reach a market size of more than USD 12.54 Billion by 2030 with the CAGR of 5.97% from 2025-2030. Retail analytics covers advanced technologies, such as big data and data mining, to gain meaningful business insights and evaluate massive datasets. It aids businesses in drawing effective strategies for their activities based on customer behavior patterns. The need to improve sales performance and revenue generation and identify customer preferences and trends will likely propel market growth.

Retail solutions integrated with Artificial Intelligence (AI) deliver intelligent insights to fuel sales and enhance customer experience. For instance, March 2023, Adobe announced the launch of Adobe Product Analytics, a new tool in Adobe Experience Cloud that combines customer experience understandings across marketing and products to benefit vendors dedicated to customer experiences.

The demand for efficient shelf space management is growing to cater to the specific preferences of customers visiting retail stores and reduce the financial impact of several assortments. For instance, In January 2023, EY launched EY Retail Intelligence, a solution that enhances the customer shopping experience using Microsoft Cloud and Cloud for Retail.

This solution offered omnichannel, personalized shopping, product sustainability information, and step-change improvements in decision-making. AI-powered shopping events, such as Black Friday and Cyber Monday, demonstrate how retailers can use chatbots and recommendation engines to enhance user experiences and boost conversions. Strategic partnerships between retailers and technology providers, like Sainsbury’s collaboration with Microsoft to integrate AI capabilities, are accelerating the adoption of advanced analytics solutions and fostering innovation in the sector.

Market Drivers

- Rising Demand for Personalized Customer Experiences: Retailers are increasingly leveraging analytics to understand customer behavior, preferences, and purchasing patterns. By analyzing data from multiple touchpoints, such as online browsing history, in-store interactions, and social media engagement, retailers can offer highly personalized promotions, product recommendations, and loyalty programs. This not only enhances customer satisfaction but also increases conversion rates and repeat purchases. The shift toward omnichannel retailing has further fueled this demand, as companies aim to create a seamless and tailored shopping experience across physical and digital channels.

- Growth of E-commerce and Omnichannel Retailing: The rapid expansion of e-commerce and omnichannel retail strategies has created massive volumes of consumer data. Retail analytics tools help businesses interpret this data, optimize pricing strategies, manage inventory more efficiently, and forecast demand accurately. By integrating online and offline sales data, retailers can gain a comprehensive understanding of their operations and customer preferences. This data-driven approach enables more efficient marketing campaigns, reduces operational costs, and improves the overall supply chain efficiency. As e-commerce continues to grow globally, the reliance on retail analytics solutions is expected to rise significantly.

Market Challenges

- Data Privacy and Security Concerns: With the increasing reliance on data-driven strategies, retailers face significant challenges in managing customer data securely. Regulations such as GDPR, CCPA, and other regional data protection laws impose strict compliance requirements, making it challenging to collect, store, and use customer data. Retailers must invest heavily in secure infrastructure and ensure transparent data handling practices to maintain consumer trust. Data breaches or misuse of sensitive customer information can lead to financial losses, reputational damage, and legal penalties, which pose substantial challenges to the adoption of retail analytics solutions.

- High Implementation and Integration Costs: Implementing retail analytics solutions requires substantial investments in software, hardware, and skilled personnel. Small and medium-sized retailers often struggle with the high cost of deploying these systems and integrating them with existing IT infrastructure. Moreover, ensuring seamless integration across various channels such as e-commerce platforms, point-of-sale systems, and CRM software can be complex and resource-intensive. These financial and operational barriers can limit the adoption of retail analytics, particularly among smaller retailers or those in emerging markets.

Market Trends

- Adoption of Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are increasingly being incorporated into retail analytics platforms to provide predictive insights and automate decision-making processes. These technologies enable retailers to forecast demand more accurately, optimize pricing dynamically, and enhance customer engagement through intelligent recommendations. The use of AI-driven analytics also supports real-time inventory management and fraud detection, allowing businesses to operate more efficiently. This trend reflects the growing move toward intelligent, automated analytics solutions in the retail sector.

- Real-Time Analytics and Cloud-Based Solutions: Retailers are increasingly shifting to cloud-based analytics solutions to process large volumes of data in real time. Cloud platforms provide scalability, flexibility, and lower upfront costs compared to traditional on-premises systems. Real-time analytics allows retailers to respond instantly to changes in customer behavior, stock levels, or market trends, enabling more agile decision-making. This trend is particularly significant in the context of fast-paced retail environments where rapid adjustments can drive competitive advantage and improve operational efficiency.The software component leads the global Retail Analytics industry because it provides the critical tools and platforms that enable retailers to collect, process, and analyze vast volumes of consumer and operational data efficiently.

One of the key reasons for software’s leading position is its ability to process and analyze massive datasets generated through multiple channels - online, offline, and mobile - allowing retailers to gain a holistic view of their business operations. Unlike hardware or service components, software offers scalability, flexibility, and continuous improvement through updates, enabling retailers to adapt quickly to changing market trends and consumer behaviors.

The rise of cloud-based retail analytics software has further reinforced its dominance, as these solutions reduce the need for high upfront infrastructure costs, offer real-time processing, and support seamless integration with other business systems, including point-of-sale platforms, e-commerce portals, and supply chain networks. Additionally, software-driven analytics empowers retailers to implement advanced technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), which enhance predictive modeling, automate routine processes, and provide personalized customer experiences at scale.

Supply Chain Management (SCM) leads in the global Retail Analytics industry because analytics enables retailers to optimize inventory, reduce operational costs, and enhance the efficiency and responsiveness of the entire supply chain.

Retailers operate in highly competitive environments where demand patterns fluctuate rapidly, and efficient supply chain operations are vital to maintaining profitability and customer satisfaction. Retail analytics tools provide a comprehensive view of supply chain processes, including procurement, warehousing, distribution, inventory management, and logistics, allowing retailers to make data-driven decisions at every stage. By leveraging predictive analytics and demand forecasting, retailers can anticipate product demand more accurately, avoid stockouts or overstock situations, and optimize inventory levels across multiple channels and locations.

This is particularly significant in omnichannel retailing, where inventory must be dynamically allocated between stores, distribution centers, and e-commerce fulfillment centers to meet real-time customer demand. Additionally, analytics supports route optimization, supplier performance monitoring, and cost management, enabling businesses to minimize transportation expenses, improve delivery timelines, and negotiate better terms with suppliers.

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) within retail analytics further enhances SCM by automating routine tasks, predicting disruptions, and enabling prescriptive solutions that recommend optimal actions in real time. The COVID-19 pandemic underscored the importance of supply chain analytics, as retailers faced sudden shifts in consumer behavior, supply shortages, and logistical challenges, demonstrating that real-time data insights are critical to maintaining operational continuity.

Hypermarkets and supermarkets lead the global Retail Analytics industry because their large-scale operations, high transaction volumes, and diverse product portfolios generate massive data that necessitates advanced analytics for efficient management and enhanced customer insights.

Hypermarkets and supermarkets dominate the global Retail Analytics market due to their inherently complex operations and the vast amount of data they generate from daily transactions, inventory movements, and customer interactions. These retail formats typically offer an extensive range of products across multiple categories, from groceries and household items to electronics and apparel, attracting a large and diverse customer base. Managing such scale requires sophisticated analytics solutions to optimize inventory, pricing strategies, and supply chain operations while ensuring high service levels.

Retail analytics helps hypermarkets and supermarkets track purchasing trends, identify top-selling products, forecast demand accurately, and manage promotions effectively, allowing retailers to reduce waste, improve stock availability, and enhance profitability. Additionally, these retail formats deal with high footfall and frequent purchases, generating granular customer data that can be leveraged for segmentation, personalized marketing, loyalty programs, and enhancing the overall shopping experience. With the growing adoption of omnichannel strategies, hypermarkets and supermarkets increasingly integrate offline and online sales data, requiring advanced analytics platforms to provide a unified view of operations and customer behavior.

This integration allows retailers to implement targeted promotions, optimize store layouts, manage staffing efficiently, and ensure seamless customer experiences across physical and digital channels. Furthermore, hypermarkets and supermarkets often operate on thin profit margins, making efficiency improvements through predictive analytics, dynamic pricing, and automated replenishment systems essential for maintaining competitiveness.

Cloud deployment leads the global Retail Analytics industry because it enables retailers to access scalable, flexible, and cost-efficient analytics solutions that support real-time insights and omnichannel operations.

Cloud deployment has emerged as the leading choice in the global Retail Analytics market due to its ability to provide retailers with scalable, flexible, and cost-effective analytics infrastructure, addressing the growing need for real-time data processing and decision-making. Traditional on-premises analytics systems often require substantial upfront investments in hardware, software, and IT personnel, along with ongoing maintenance costs, which can be a barrier for many retailers, particularly small and medium-sized enterprises.

In contrast, cloud-based solutions offer pay-as-you-go models, eliminating heavy capital expenditures while providing the flexibility to scale computing resources according to fluctuating data volumes and business needs. Retailers increasingly operate in omnichannel environments, collecting massive amounts of data from in-store point-of-sale systems, e-commerce platforms, mobile applications, and social media. Cloud deployment allows seamless integration of these diverse data sources, enabling a unified view of operations and customer behavior.

Real-time analytics powered by cloud infrastructure helps retailers monitor inventory, track sales trends, optimize pricing, and respond quickly to changes in consumer demand, enhancing operational efficiency and competitiveness. Moreover, cloud platforms facilitate collaboration across departments, stores, and regions by providing centralized access to dashboards, reports, and predictive insights, ensuring consistent decision-making and strategic alignment.

Advanced technologies such as artificial intelligence (AI) and machine learning (ML) are also more easily deployed in cloud environments, supporting predictive modeling, personalized marketing, automated inventory replenishment, and supply chain optimization.North America leads the global Retail Analytics industry because of its advanced technological infrastructure, high adoption of data-driven retail strategies, and the presence of major retail and analytics solution providers.

North America holds a leading position in the global Retail Analytics market due to a combination of advanced technology adoption, a mature retail ecosystem, and strong investments in data-driven solutions. The region is home to some of the largest and most technologically sophisticated retail chains, including hypermarkets, supermarkets, specialty stores, and e-commerce platforms, which generate enormous volumes of consumer, transactional, and operational data. Retailers in North America increasingly leverage this data to enhance customer experiences, optimize supply chains, implement dynamic pricing strategies, and forecast demand accurately, driving significant adoption of analytics solutions.

The presence of advanced IT infrastructure, including high-speed internet, cloud computing, and state-of-the-art data centers, supports the deployment of sophisticated retail analytics platforms capable of real-time processing and predictive modeling. Moreover, North America hosts several leading global analytics and software providers, which continuously innovate and offer comprehensive solutions tailored to various retail segments, including AI-driven insights, machine learning algorithms, and omnichannel analytics platforms.

The region’s high consumer awareness and preference for personalized shopping experiences have further fueled the need for analytics to support targeted marketing, product recommendations, and loyalty programs, enhancing customer engagement and retention. Regulatory frameworks in North America, while stringent, also encourage transparent data management and analytics practices, allowing retailers to collect and utilize customer insights responsibly while maintaining trust. Additionally, the growth of e-commerce and the increasing convergence of online and offline retail channels in North America have emphasized the importance of integrated analytics platforms that provide a unified view of customer behavior and business operations.

- In February 2024, Kroger collaborated with Intelligence Node, an AI retail analytics company, to drive marketplace listings. With the partnership, Kroger is aiming to offer clearer and more instructive product guides for third-party vendors.

- In January 2024, Microsoft announced the launch of new GenAI tools for the retail industry. The tech company is adding industry-precise features in Data Fabric with GenAI Copilots developed to enhance personalized shopping experiences and help forefront workers in real-time.

- In October 2023, Criteo, the commerce media company, and GroupM, WPP’s media investment group, announced the first Asia Pacific partnership to Unify product sales data with proximity-based insights, enable omnichannel commerce through in-store and retail media integration, and strengthen omnichannel commerce media capabilities for GroupM clients in the region.

- In September 2023, Oracle, in partnership with Uber, announced Collect and Receive, a new offering on the Oracle Retail platform connecting retailers and consumers to enhance and enrich last-mile delivery. Supported by the Oracle Retail Data Store and cloud platform technologies, retailers can link to Uber Direct, the company's delivery solution, through pre-integrated APIs.

- In September 2023, Priority Software acquired Retailsoft, a developer of innovative technology solutions for optimizing retail business efficiency and enhancing revenue growth. In addition, Priority is expanding the scope of its Retail Management Products and delivering significant value to Retailers by integrating Retailsoft's solutions.

- In June 2023, in partnership with Google, Salesforce expanded strategic partnerships to help businesses utilize data and AI to deliver more personalized customer experiences, better understand customer behavior, and run more effective campaigns at a lower cost across marketing, sales, service, and commerce.

- In March 2023, KPMG, one of the leading providers for professional service firm, announced the launch of innovative product to expand the retail analytics capacities for bolstering the business further. Key features of this product include advanced data analytics tools, machine learning algorithms, and predictive capabilities.

- In January 2023, AiFi, a startup that aims to enable retailers to deploy autonomous shopping tech, partnered with Microsoft to launch a preview of a cloud service called Smart Store Analytics. It provides retailers with AiFi's technology, including shopper and operational analytics, for their fleets of smart stores.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- SAP SE

- Microsoft Corporation

- SAS Institute Inc.

- Amazon Web Services, Inc.

- Oracle Corporation

- Strategy Inc.

- Salesforce, Inc.

- Qlik

- Teradata Corporation

- Zebra Technologies Corporation

- Algonomy Software Private Limited

- International Business Machines Corporation

- Blue Yonder Group, Inc.

- HCL Technologies Limited

- Alteryx Inc.

- WNS Global Services

- RetailNext

- Polestar Analytics

- Woopra, Inc.

- Kyvos Insights, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | October 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.92 Billion |

| Forecasted Market Value ( USD | $ 12.54 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |