This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The demand for audio codecs continues to rise, driven primarily by the proliferation of smartphones, tablets, smart TVs, and wireless audio devices, as well as the growing consumption of streaming media across platforms. Marketing and promotion of audio codecs are increasingly regulated to ensure transparency and fairness, with authorities such as the Federal Trade Commission (FTC) in the United States and the Autorité de Régulation Professionnelle de la Publicité (ARPP) in Europe enforcing strict guidelines on advertising claims and ethical practices.

Moreover, emerging regulations, such as California’s 2024 law requiring disclosure of revocable digital media licenses, are reshaping how codec technologies are marketed and sold. Certification and licensing also play a crucial role in the market, as major companies like Fraunhofer, Dolby, and Samsung hold extensive patent portfolios covering widely-used codecs, making the management of Standard Essential Patents (SEPs) vital to avoid legal disputes and ensure fair access to technology.

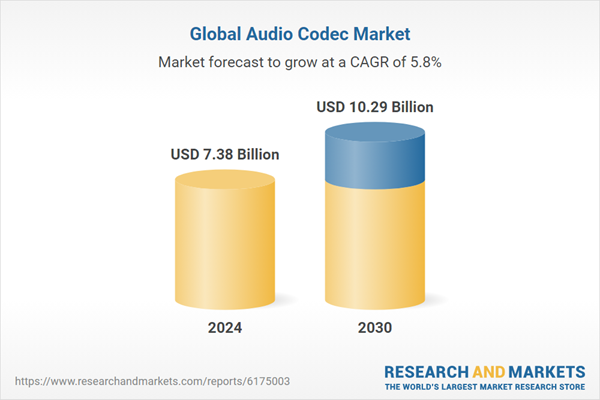

According to the research report "Global Audio Codec Market Outlook, 2030,", the Global Audio Codec market was valued at more than USD 7.38 Billion in 2024, and expected to reach a market size of more than USD 10.29 Billion by 2030 with the CAGR of 5.81% from 2025-2030. The rise of music and video streaming platforms has also created a pressing need for efficient audio compression to deliver high-fidelity content seamlessly, while the expansion of IoT devices has amplified the requirement for codecs that integrate smoothly into connected ecosystems.

Emerging opportunities in the market include the development of standardized wireless audio codecs aimed at improving fidelity and reducing latency, and the integration of artificial intelligence in codec design to enhance compression techniques and preserve audio quality. Additionally, the surge in home entertainment systems, smart speakers, and connected audio devices has created further demand for codecs capable of supporting multi-channel and immersive audio formats, such as Dolby Atmos and DTS: X. Opportunities in research and development are abundant, with companies investing in AI-assisted codecs that dynamically adjust compression based on the content type, improving efficiency and user experience.

Market participants are also exploring collaborations with streaming platforms, device manufacturers, and software developers to integrate advanced codecs seamlessly, creating bundled solutions that enhance value propositions. Trade shows, such as the Consumer Electronics Show (CES) and Audio Engineering Society (AES) conventions, serve as significant platforms for demonstrating technological advancements, networking with potential partners, and promoting new codec solutions to global audiences. Consequently, manufacturers are addressing the expectations of studio and live performance users by incorporating leading-edge features. For example, in June 2025, Cirrus Logic Inc. released a line of professional-quality DACs and the CS4282P audio codec for musicians, live performers, and recording engineers requiring high-fidelity audio.

Market Drivers

- Surge in Streaming Services: The global adoption of streaming platforms such as Spotify, Apple Music, and YouTube has drastically increased the demand for high-quality audio codecs. Consumers now expect crystal-clear sound and minimal latency while streaming music, podcasts, and videos. This has encouraged service providers to adopt advanced codecs that balance audio fidelity with efficient bandwidth usage. The growing prevalence of smartphones, smart speakers, and tablets has further fueled this demand, as these devices enable users to consume audio content anywhere, anytime.

- Advancements in Neural Audio Codecs: Innovations in neural audio codec technology have significantly boosted the market. Techniques such as Enhanced Residual Vector Quantization (ERVQ) and Normal Distribution-based Vector Quantization (NDVQ) allow for more efficient audio compression without compromising quality. These codecs are particularly important for applications that require real-time audio streaming, such as voice assistants, video conferencing, and online gaming. The enhanced compression efficiency ensures that high-quality audio can be transmitted even over low-bandwidth networks, making these advanced codecs a critical driver of market growth.

Market Challenges

- Compatibility Issues Across Diverse Platforms: One of the major challenges in the audio codec market is ensuring compatibility across different devices, platforms, and operating systems. Each hardware or software environment may have specific requirements that can complicate codec implementation. For instance, a codec optimized for mobile devices may not perform efficiently on desktop systems or smart TVs. These compatibility issues can lead to higher development costs, extended deployment timelines, and potential performance inconsistencies, which can slow market adoption.

- Patent Disputes and Licensing Complexities: Another challenge is the complex patent and licensing landscape surrounding audio codecs. Leading companies, including Apple, Google, and Fraunhofer Institute, hold essential patents and proprietary technologies that create barriers for newcomers. Licensing fees and legal disputes can delay the rollout of new codec technologies and increase production costs for manufacturers. Such intellectual property issues can also limit innovation and restrict smaller companies from fully participating in the market.

Market Trends

- Integration of AI and Machine Learning: AI and machine learning are transforming audio codec development by enabling smarter audio compression and real-time sound optimization. AI-powered codecs can dynamically analyze audio signals, adapting compression to maintain high quality while reducing data size. This is particularly useful for streaming, video conferencing, and IoT applications where bandwidth may fluctuate. The integration of AI is not only improving audio fidelity but also creating opportunities for new applications, such as adaptive spatial audio for VR and AR experiences.

- Rise of Immersive Audio Experiences: The demand for immersive audio experiences in gaming, virtual reality (VR), augmented reality (AR), and home entertainment is driving the development of specialized codecs. Technologies like Dolby Atmos and DTS: X are being increasingly incorporated to provide spatial audio experiences, where users perceive sound from different directions and distances. This trend is pushing codec developers to focus on 3D audio, multi-channel support, and higher sample rates, creating opportunities for differentiation in competitive entertainment and gaming markets.Hardware codecs lead the global audio codec industry due to their superior performance, low power consumption, and ability to deliver high-quality, real-time audio processing compared to software-only solutions.

Another crucial factor contributing to the dominance of hardware codecs is their energy efficiency. In battery-powered devices like smartphones, tablets, wireless headphones, and smart speakers, conserving power is a critical concern, and hardware codecs require significantly less energy than software-based solutions performing similar tasks. This efficiency not only extends battery life but also reduces heat generation, which is vital for maintaining the reliability and longevity of compact electronic devices. Additionally, hardware codecs support a broad range of audio formats and compression standards, including both lossy and lossless codecs, enabling manufacturers to deliver high-quality audio experiences across diverse platforms without taxing the main processor.

Mobile phones and tablets dominate the global audio codec market because these devices drive the highest demand for high-quality, real-time audio processing due to their widespread use for streaming, communication, and multimedia applications.

The mobile phone and tablet segment has emerged as the largest application type in the global audio codec market, largely driven by the explosive growth in smartphone and tablet adoption worldwide. These devices have become central to daily life, serving as primary tools for communication, entertainment, and productivity. The ever-increasing consumption of digital media, including music streaming, video streaming, video conferencing, and gaming, has created an unprecedented demand for high-quality audio processing. Audio codecs play a critical role in enabling clear, efficient, and seamless audio transmission in these scenarios, ensuring minimal latency, high fidelity, and compatibility across a variety of audio formats.

The rapid evolution of mobile technology, including the shift toward 5G networks, has further intensified the demand for advanced audio codecs capable of supporting high-bandwidth applications while maintaining power efficiency. Mobile devices are particularly constrained in terms of processing power and battery capacity, which makes hardware-based audio codecs highly desirable, as they provide efficient encoding and decoding without heavily burdening the CPU or draining the battery.

In addition, smartphones and tablets are increasingly integrating multimedia features such as high-resolution audio playback, voice assistants, noise cancellation, and spatial audio, all of which rely on sophisticated audio codec technologies. The proliferation of streaming services and social media platforms has also amplified the need for codecs that can compress audio efficiently while preserving quality, enabling smooth content delivery even over variable network conditions.

AAC (Advanced Audio Codec) leads the global audio codec market because it delivers superior audio quality at lower bitrates, making it the preferred choice for streaming, broadcasting, and mobile applications worldwide.

AAC (Advanced Audio Codec) has established itself as the leading technology standard in the global audio codec market due to its exceptional efficiency and versatility in delivering high-quality audio across a wide range of devices and applications. Unlike older formats such as MP3, AAC is designed to provide better sound quality at comparable or even lower bitrates, which is essential in today’s data-sensitive streaming environments, particularly on mobile networks and online platforms. This capability has made AAC the preferred codec for major digital platforms, including streaming services, video conferencing applications, and broadcast channels, where maintaining audio fidelity while minimizing data usage is critical.

Another factor contributing to AAC’s dominance is its widespread compatibility and industry adoption. AAC is supported natively across virtually all modern devices, from smartphones, tablets, and laptops to smart TVs, gaming consoles, and automotive infotainment systems. This cross-platform support allows content creators and distributors to use a single codec standard while ensuring consistent audio performance for end-users, reducing the complexity of managing multiple codec formats. Additionally, AAC supports a variety of advanced audio features, including multichannel audio, low-latency streaming, and enhanced error resilience, which are increasingly important for immersive audio experiences in gaming, virtual reality, and live streaming applications.

Lossy compression leads the global audio codec market because it efficiently reduces file sizes while maintaining acceptable audio quality, making it ideal for streaming, mobile applications, and bandwidth-constrained environments.

Lossy compression has emerged as the dominant type in the global audio codec market due to its unique ability to balance audio quality with data efficiency, a critical requirement in today’s digital ecosystem where streaming and mobile consumption drive demand. Unlike lossless compression, which preserves every bit of the original audio but results in large file sizes, lossy codecs remove imperceptible or redundant audio information to significantly reduce file size without noticeably affecting sound quality. This makes them highly suitable for applications such as music streaming, online video platforms, mobile communications, and broadcasting, where bandwidth and storage limitations are major concerns.

The widespread adoption of streaming services like Spotify, YouTube, and Apple Music has particularly fueled the growth of lossy compression, as these platforms prioritize delivering high-quality audio quickly and efficiently to millions of users worldwide. In mobile devices, which dominate the audio consumption market, lossy codecs ensure that users can store more songs, podcasts, or videos while minimizing storage usage and conserving battery life during playback. Furthermore, lossy compression formats such as AAC, MP3, and Ogg Vorbis are designed to provide high-fidelity audio even at low bitrates, making them highly versatile across different device types, network conditions, and content types.

Audio codecs with DSP (Digital Signal Processing) functionality lead the global market because they offer enhanced audio quality, real-time signal manipulation, and advanced features, making them essential for modern multimedia and communication applications.

DSP-enabled codecs are designed to process audio signals in real time, performing complex operations such as noise reduction, echo cancellation, dynamic range compression, equalization, and spatial audio enhancement. These capabilities are crucial for applications that demand high-fidelity sound and clarity, such as mobile phones, tablets, smart speakers, automotive infotainment systems, and professional audio equipment. In today’s multimedia-driven environment, users expect seamless audio experiences, whether they are streaming music, participating in video calls, playing games, or consuming immersive content like virtual and augmented reality.

DSP functionality allows audio codecs to meet these expectations by intelligently manipulating audio signals to improve quality, remove unwanted artifacts, and adapt to varying acoustic environments. Another key factor driving the dominance of DSP-enabled codecs is their efficiency in handling audio workloads without overburdening the main processor. By offloading intensive audio processing tasks to dedicated DSP hardware or integrated DSP units within the codec, devices can achieve lower latency, reduced power consumption, and smoother multitasking performance an especially critical consideration for battery-powered mobile devices and portable electronics.

Furthermore, DSP-enabled audio codecs provide versatility across multiple audio formats and applications, supporting both lossy and lossless compression while enhancing playback quality through sophisticated algorithms.Asia Pacific leads the global audio codec market due to its large consumer electronics manufacturing base, rapid smartphone adoption, and increasing demand for high-quality multimedia and streaming services.

The Asia Pacific region has emerged as the largest market for audio codecs globally, driven by a combination of technological, economic, and demographic factors that collectively foster high demand for advanced audio processing solutions. One of the primary drivers is the region’s dominant role in consumer electronics manufacturing, particularly in countries like China, Japan, South Korea, and India. These nations are home to leading smartphone, tablet, and smart device manufacturers that integrate audio codecs into their products, creating a robust ecosystem for codec adoption.

The rapid proliferation of smartphones and tablets across urban and semi-urban populations has further fueled demand, as these devices rely heavily on audio codecs for streaming music, video, and communication applications. With millions of users consuming digital content daily, the need for high-quality, low-latency, and energy-efficient audio processing solutions has become critical, positioning audio codecs as a core component in the mobile ecosystem.

Additionally, the region’s growing internet penetration and expansion of high-speed networks such as 4G and 5G have significantly boosted multimedia consumption, including online streaming platforms, gaming, and video conferencing services all of which require advanced audio codecs to ensure clear and seamless audio experiences. Asia Pacific also benefits from a thriving electronics component supply chain, which enables the rapid production and integration of sophisticated codecs into various devices at competitive prices, further cementing the region’s leadership.

- In June 2025, Barix AG launched the Annuncicom AHE-YA404, an analog headend with VoIP SIP support and onboard amplification, to connect IP intercom and paging systems with legacy 4-wire installations. It enables two-way HDX communication and room monitoring without needing to replace existing speaker/microphone panels or cabling.

- In October 2024, ATC Labs launched enhanced versions of its Perceptual SoundMax audio processing and ALCO Professional IP Soft Codec product lines, integrating AI-based models for improved real-time audio decisions and immersive spatial sound. These updates include the new AIdeal Audio platform, SpatialMax Immersive Audio, and expanded API availability across embedded platforms, to elevate professional and broadcast audio experiences.

- In August 2024, Sony Corporation and AIROHA Technology Corp formed a strategic partnership, with Airoha officially recognized as an LDAC Technical Partner. This partnership focuses on expanding Sony’s LDAC high-resolution Bluetooth audio technology, with Airoha integrating LDAC into its Bluetooth audio platforms and supplying over 70 million compatible chips worldwide, supporting a broad range of devices.

- In March 2024, The AEQ introduced the Solaris Codec. Solaris is designed to support numerous STL links, remote contributions, and other broadcast applications.

- In February 2024, Sony India released its latest innovation, the XAV-AX8500. This innovation includes adjustable features that improve the in-car visual and auditory experience for users. The system uses LDAC technology to improve sound quality, allowing clients to enjoy Bluetooth wireless audio at 96 kHz/24-bit sampling.

- In January 2024, Vortex Communications, an IP CODEC developer, announced that its CallMe IP soft audio CODEC can be used on Rode's RodeCaster Pro-II and Duo portable audio mixers, effectively creating a mixer with a built-in audio CODEC that allows for audio contribution from off-location guests, contributors, or piped-in audio sources, as well as potential audio delivery of audio programming to off-location recipients such as a broadcast studio.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Qualcomm Incorporated

- Microsoft Corporation

- Sony Group Corporation

- Synopsys, Inc.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Renesas Electronics Corporation

- STMicroelectronics NV

- Realtek Semiconductor Corp.

- Dolby Laboratories, Inc.

- Cirrus Logic Inc.

- ESS Technology, Inc.

- Synaptics, Inc.

- Cadence Design Systems Inc.

- Asahi Kasei Corporation

- RealNetworks LLC

- Ittiam Systems Private Limited

- Barix AG

- MainConcept GmbH

- Fraunhofer-Gesellschaft

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | October 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.38 Billion |

| Forecasted Market Value ( USD | $ 10.29 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |