This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Governments and regulatory bodies play a crucial role in shaping the market through mandates, policies, and standards that promote recycling and ensure product traceability, while initiatives such as design-for-recycling programs encourage manufacturers to make products that are easier to recycle at the end of their lifecycle. Despite these advancements, the industry faces challenges including contamination of recyclable streams, limited collection and sorting infrastructure, and technological constraints that can hinder efficient recycling processes. Economic factors, such as fluctuating prices of virgin plastics and the cost of advanced recycling technologies, also impact market growth.

Furthermore, the shift of consumer goods and packaging industries toward recyclable and sustainable materials is expected to augment the market growth during the forecast timeframe. Moreover, the development and advancement of products, including films, packaging bottles, cutlery, and containers, using post-consumer recycled (PCR) polymers is poised to offer exponential market growth during the forecast period.

However, plastic recycling became a severe issue during the COVID-19 pandemic due to the waste polymer collection difficulties throughout the pandemic. In addition, the disruption in the supply chain and shutdown of recycling plants due to complete lockdowns along with movement restrictions further resulted in the recycling and processing of plastics.

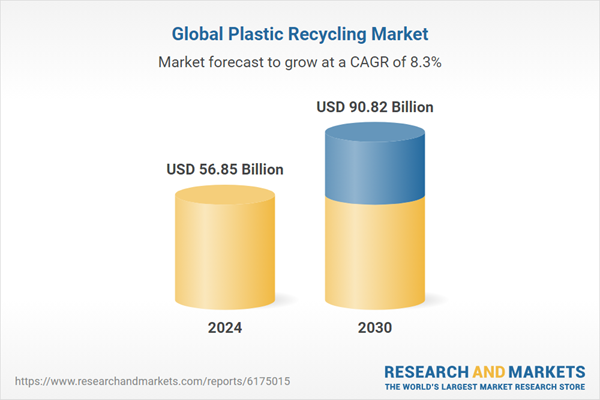

According to the research report “Global Plastic Recycling Market Outlook, 2030”, the Global Plastic Recycling market is projected to reach market size of USD 90.82 Billion by 2030 increasing from USD 56.85 Billion in 2024, growing with 8.29% CAGR by 2025-30. The primary growth factors is the escalating environmental concern over plastic pollution, which has pushed both governments and industries to prioritize recycling initiatives. Public awareness campaigns, sustainability drives, and stricter environmental regulations have all contributed to higher demand for recycled plastics, especially in packaging, automotive, and construction sectors, where eco-conscious consumers increasingly prefer products with recycled content.

Technological advancements represent another key factor, with innovations in mechanical and chemical recycling processes enhancing efficiency, reducing contamination, and expanding the types of plastics that can be processed. Advanced sorting systems, AI-driven waste segregation, and chemical depolymerization have all opened avenues to recycle plastics that were previously considered non-recyclable, thereby expanding the market potential.

Policy and regulatory frameworks also significantly influence market dynamics; for instance, countries in Europe and North America have introduced mandatory recycled content requirements and traceability standards such as the EN 15343 and design-for-recycling guidelines, which incentivize companies to incorporate recycled plastics into their products while promoting transparency and sustainability. Certifications like the Global Recycled Standard (GRS) and Recycled Claim Standard (RCS) further support market credibility and consumer trust, making certified recycled plastics more desirable and marketable.

Economic drivers, including fluctuating prices of virgin plastics and incentives for sustainable practices, also play a role, as businesses seek cost-effective ways to meet consumer demand while complying with regulations. Furthermore, consumer-driven trends, such as the popularity of eco-packaging and biodegradable alternatives, have prompted industries to explore innovative recycling methods, creating new market niches and revenue streams.

Market Drivers

- Regulatory Support and Environmental Policies: Governments worldwide are imposing strict regulations to reduce plastic waste and promote recycling. Policies mandating minimum recycled content in products, extended producer responsibility, and bans on single-use plastics are pushing industries to adopt recycling practices. This regulatory support not only ensures compliance but also stimulates investments in recycling infrastructure and technologies, creating a structured framework for market growth.

- Growing Consumer Awareness and Corporate Sustainability Initiatives: Consumers are increasingly conscious of environmental issues and prefer brands that use sustainable packaging. Corporations are responding by incorporating recycled plastics in their products and setting ambitious sustainability goals. This trend drives demand for recycled materials and encourages companies to adopt circular economy practices, thereby accelerating the overall growth of the plastic recycling market.

Market Challenges

- Inadequate Recycling Infrastructure: Many regions, particularly in developing countries, lack sufficient collection systems and recycling facilities. This results in a large portion of plastic waste ending up in landfills or the environment. The absence of proper infrastructure limits the availability of quality recycled materials and increases operational costs, posing a major hurdle for market expansion.

- Economic Viability and Material Quality Issues: Recycling plastics is often more expensive than producing virgin plastics due to high collection and processing costs. Additionally, recycled plastics can have inconsistent quality, limiting their application in certain products. Fluctuating market prices for virgin and recycled plastics further impact profitability, making economic sustainability a significant challenge for the industry.

Market Trends

- Advanced Recycling Technologies: Technological innovations such as chemical recycling, enzymatic recycling, and plastic-to-fuel processes are gaining traction. These technologies allow recycling of complex plastics, multilayer packaging, and mixed polymer waste, increasing material recovery rates and reducing dependency on virgin plastics.

- Circular Economy and Closed-Loop Systems: There is a growing shift towards circular economy models where waste is minimized, and materials are continuously reused. Brands and municipalities are investing in closed-loop recycling systems to ensure that plastics are collected, recycled, and reincorporated into new products, creating a sustainable lifecycle for materials and reducing environmental impact.Polyethylene Terephthalate (PET) dominates the global plastic recycling industry due to its widespread use in packaging, especially beverage bottles, combined with its high recyclability and strong economic value in the recycled plastics market.

Unlike other plastics, recycled PET (rPET) can be used in manufacturing new bottles, polyester fibers for textiles, packaging films, and other value-added products, making it economically attractive for recyclers. The mechanical recycling process for PET is relatively straightforward, involving collection, sorting, washing, and pelletizing, which reduces operational complexities and increases recycling efficiency. Moreover, technological advancements in sorting systems, such as near-infrared (NIR) and density-based separation, have improved the purity of PET streams, allowing higher-quality recycled outputs and promoting circular economy models.

Market demand for rPET has also surged due to increasing consumer awareness of environmental sustainability and the push from governments and international organizations for plastic waste reduction and extended producer responsibility (EPR) initiatives. Many major beverage companies and consumer goods brands have committed to incorporating recycled PET into their packaging, further boosting the market for PET recycling.

Post-consumer plastic waste leads the global plastic recycling industry because it represents the largest and most readily available stream of discarded plastics from households and businesses, creating a consistent supply for recycling operations.

Post-consumer plastic waste dominates the global plastic recycling industry primarily due to its abundance, diversity, and the structured collection systems that have been established in many regions to recover used plastics from households, commercial establishments, and municipal sources. Post-consumer plastics include materials that have served their intended purpose, such as beverage bottles, food containers, packaging films, and household goods, making them highly visible and accessible in the waste stream. The sheer volume of post-consumer plastics generated annually is enormous, driven by increasing urbanization, population growth, and the widespread adoption of single-use plastics across consumer and industrial sectors.

This consistent availability ensures that recyclers have a stable feedstock for mechanical and chemical recycling processes, enabling large-scale operations and economies of scale. Moreover, post-consumer plastics often consist of commonly used polymers such as PET, HDPE, PP, and PS, which are widely accepted by recycling facilities and can be transformed into high-quality recycled products. The recycling of post-consumer plastics is further supported by governmental regulations and extended producer responsibility (EPR) programs, which incentivize the collection and diversion of plastics from landfills and the environment.

For instance, many countries have implemented mandatory recycling targets, deposit-return schemes for bottles, and separate collection systems that prioritize post-consumer waste, creating an organized and traceable supply chain for recyclers. Technological advancements in sorting and cleaning post-consumer plastics, including automated sorting using near-infrared (NIR) spectroscopy, air classification, and washing systems, have enhanced the efficiency and quality of recycled outputs, making post-consumer plastics more economically viable.

Mechanical recycling leads the global plastic recycling industry because it is a cost-effective, technologically mature, and widely applicable method that efficiently converts post-consumer plastics into reusable raw materials.

Mechanical recycling dominates the global plastic recycling industry primarily due to its simplicity, cost-effectiveness, and versatility in processing a wide range of plastic types, particularly commonly used polymers such as PET, HDPE, PP, and PS. This process involves collecting, sorting, cleaning, shredding, and reprocessing plastic waste into pellets or flakes, which can then be used as raw material for manufacturing new products. Its technological maturity and well-established infrastructure make it the preferred choice for recycling operations worldwide. Mechanical recycling is especially effective for post-consumer plastics, which constitute the largest share of available recyclable waste.

The method allows for the retention of material value with minimal chemical alteration, making it suitable for producing high-quality recycled plastics that can re-enter the supply chain in packaging, textiles, automotive parts, and construction materials. Compared to chemical recycling, which is still emerging and often cost-intensive, mechanical recycling requires lower capital investment and operational complexity, making it accessible to both large-scale industrial recyclers and small to medium-sized enterprises in emerging markets.

Governments and regulatory bodies also favor mechanical recycling due to its immediate environmental impact, including reducing landfill dependency, lowering plastic pollution, and supporting circular economy initiatives. Furthermore, mechanical recycling is well-aligned with global sustainability trends and corporate commitments to increase recycled content in products, driven by consumer demand for eco-friendly packaging and products. Technological advancements, such as improved sorting systems using near-infrared (NIR) spectroscopy, density separation, and washing processes, have enhanced the efficiency and output quality of mechanical recycling, further reinforcing its dominance.

The packaging end-user type leads the global plastic recycling industry because packaging generates the largest volume of plastic waste, creating a steady and high-demand source for recyclers.

Packaging dominates the global plastic recycling industry primarily due to its sheer volume and widespread use across multiple consumer and industrial sectors. Plastic packaging, including bottles, containers, pouches, films, and wraps, accounts for a significant portion of global plastic production and consumption, making it the largest contributor to post-consumer plastic waste streams. This high generation of packaging waste ensures recyclers have a reliable and continuous feedstock, which is essential for maintaining the efficiency and economic viability of recycling operations.

The prevalence of single-use packaging, particularly in food and beverage industries, e-commerce, and retail, has further amplified the availability of recyclable materials. Additionally, packaging plastics are typically made from polymers like PET, HDPE, and PP, which are highly suitable for recycling through mechanical and, increasingly, chemical methods. The quality and versatility of recycled packaging materials allow them to be transformed into new packaging products, textile fibers, construction materials, and consumer goods, creating strong economic incentives for recycling companies. Regulatory pressures and sustainability initiatives also drive the focus on packaging waste.

Governments and international organizations have implemented measures such as extended producer responsibility (EPR), deposit-return schemes, and mandatory recycling targets, particularly targeting packaging materials due to their environmental impact when mismanaged. These regulations encourage manufacturers and consumers to participate actively in recycling programs, thereby boosting the collection and processing of packaging plastics.

Moreover, consumer awareness and demand for sustainable packaging solutions have grown substantially, leading major brands to adopt recycled content in their products, which increases the demand for high-quality recycled materials.Asia Pacific leads the global plastic recycling industry due to its large population, rapid industrialization, high plastic consumption, and growing investment in recycling infrastructure and technologies.

Asia Pacific has emerged as the leading region in the global plastic recycling industry primarily because it combines massive plastic consumption with rapidly expanding industrial and urban centers, creating both a high volume of recyclable plastic waste and strong incentives for recycling. The region is home to some of the world’s most populous countries, including China, India, and Indonesia, where urbanization, e-commerce growth, and packaging-intensive industries generate enormous quantities of post-consumer and post-industrial plastic waste annually. This abundant waste stream ensures a continuous supply of raw materials for recycling operations, making large-scale recycling economically viable.

Additionally, the manufacturing and packaging sectors in Asia Pacific are heavily reliant on plastics, particularly PET, HDPE, and PP, which are widely accepted by recycling processes and have high market demand as recycled outputs. Countries in the region have increasingly recognized the environmental challenges posed by plastic pollution, prompting governments to implement regulations, policies, and extended producer responsibility (EPR) frameworks that encourage recycling and waste management. This regulatory environment, combined with rising environmental awareness among consumers, has created a supportive ecosystem for the growth of recycling facilities and technologies.

Technological advancements, including automated sorting systems, washing lines, and chemical recycling innovations, are being adopted more widely in Asia Pacific, improving the efficiency, quality, and profitability of recycled plastics. Furthermore, the cost advantages of labor, land, and operations in many Asia Pacific countries have enabled both formal and informal recycling sectors to thrive, allowing plastic recovery at a scale unmatched in other regions.

- In September 2024, Indorama Ventures, Dhunseri Ventures, and Varun Beverages formed a joint venture to establish PET recycling facilities in India, aiming for an annual rPET capacity of 100 kilotons. With plants underway in Jammu and Kashmir as well as Odisha, the initiative supports India's increasing demand for recycled plastics, driven by regulatory mandates and sustainability goals. This collaboration enhances recycling infrastructure and promotes a circular economy.

- In April 2024, Veolia Huafei, the Chinese subsidiary of Veolia, expanded its partnership with L'Oréal to include more recycled plastics such as r-PP and r-PET, alongside r-HDPE. This collaboration supports L'Oréal’s sustainability goals by increasing material diversity, reducing carbon emissions, and lowering resource consumption. Veolia, a leader in ecological transformation, leverages its global recycling network, including its subsidiary Reef, to supply high-quality recycled plastics to various industries in China. The company holds major certifications and recently introduced its global recycled plastics brand, PlastiLoop, aimed at supporting a circular economy and reducing plastic pollution worldwide.

- In April 2023, Indorama Ventures and Evertis, a leader in sustainable PET barrier films, announced their collaboration to utilize flake from recycled PET trays for producing PET film suitable for food packaging trays. This partnership supports Evertis’ 2025 goal of achieving 50% post-consumer recycled content in their products.

- In February 2023, Loop Industries, SUEZ, and SK Geo Centric confirmed the Grand Est region of France as the manufacturing site to produce virgin-quality PET plastic made from 100% recycled content. The three partners plan to begin construction work in early 2025, with plant commissioning scheduled for 2027.

- In October 2023, Coca-Cola India revealed the introduction of Coca-Cola in smaller pack sizes, such as 250 ml and 750 ml bottles, made entirely from recycled plastic (rPET). These new bottles, crafted by Coca-Cola's bottling partners Moon Beverages Ltd. and SLMG Beverages Ltd., utilize 100% food-grade rPET, with the exception of caps and labels. Additionally, the bottles feature a "Recycle Me Again" prompt and a "100% recycled PET bottle" label, designed to enhance consumer consciousness regarding recycling.

- In October 2022, Veolia introduced ‘PlastiLoop,’ a new brand of recycled plastics and services, at the K 2022 fair in Dusseldorf, Germany. This new product is made possible by Veolia’s extensive network of experts and its 37 plastic recycling plants globally. This new product offers a large variety of ready-to-use recycled resins such as PET, PP, HDPE, PS, ABS, LDPE, and PC to its customers.

- In April 2022, Faurecia, a company of the Group FORVIA, and Veolia signed a Cooperation and Research Agreement to jointly develop innovative compounds for automotive interior modules, aiming to achieve an average of 30% recycled content by 2026. Through this partnership, the two companies will accelerate the deployment of sustainable solutions implemented in instrument panels, door panels, and center consoles in Europe.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Veolia Environnement S.A.

- Plastipak Holdings, Inc.

- ALPLA Group

- Suez S.A.

- Alpek S.A.B. de C.V.

- Indorama Ventures

- MBA Polymers, Inc.

- Ultra-Poly Corporation

- KW Plastics

- Waste Management, Inc.

- Republic Services, Inc.

- Seraphim Plastics LLC

- Amcor plc

- Coveris Group

- Biffa Limited

- Montello S.p.A.

- The Shakti Plastic Industries

- Far Eastern New Century

- Pashupati Group

- PT. Polindo Utama

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | October 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 56.85 Billion |

| Forecasted Market Value ( USD | $ 90.82 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |