This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The market has witnessed several key trends, including the adoption of sustainable materials and eco-friendly manufacturing practices, with biodegradable and recycled materials increasingly used to reduce environmental impact. Additionally, there is a growing emphasis on customized solutions to meet specific project requirements, leading to increased demand for tailored product offerings.

Companies operating in the corrugated pipe market employ a variety of marketing strategies to promote their products, including digital marketing campaigns, participation in trade exhibitions, and collaborations with construction firms and municipalities, often highlighting durability, cost-effectiveness, and environmental benefits in promotional materials to attract a broader customer base. The production and use of corrugated pipes are subject to various regulations and certifications to ensure safety and quality, such as programs from the National Corrugated Steel Pipe Association (NCSPA), which certify that products meet industry standards and comply with regional building codes and environmental regulations.

The market's future growth will likely be fueled by continued infrastructure development, urbanization, and the increasing need for sustainable and efficient piping solutions. The growing investment in infrastructure projects worldwide is expected to drive the demand for corrugated pipes in the coming years. For instance, according to a report by the World Bank, infrastructure investment is projected to reach $9 trillion annually by 2030.

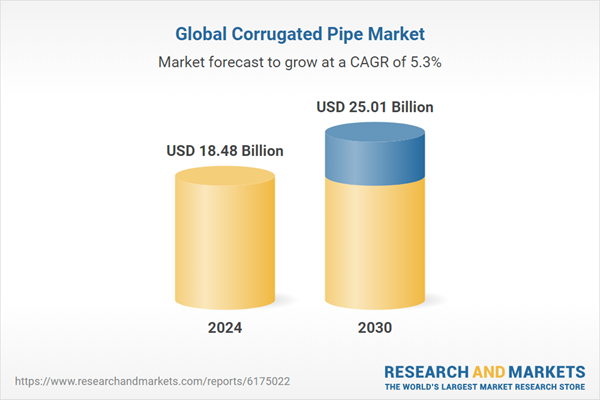

According to the research report “Global Corrugated Pipe Market Outlook, 2030”, the Global Corrugated Pipe market is projected to reach market size of USD 25.01 Billion by 2030 increasing from USD 18.48 Billion in 2024, growing with 5.28% CAGR by 2025-30.The ongoing construction boom in emerging economies, particularly in the Asia-Pacific region, further amplifies the demand for these piping systems. Sustainability initiatives are also playing a key role in market growth, as governments and private sectors focus on eco-friendly infrastructure, encouraging the use of recycled and biodegradable materials in corrugated pipe manufacturing.

Technological advancements have improved pipe strength, durability, and environmental resistance, ensuring reliability across diverse applications, from urban infrastructure to agricultural projects. Opportunities abound for manufacturers through the rising need for customized piping solutions tailored to specific project requirements, driving innovation and product development. Additionally, industry events, conferences, and exhibitions serve as crucial platforms for networking, knowledge exchange, and collaborations among manufacturers, suppliers, and end-users, fostering business growth and technological progress.

The volatility and fluctuation in prices of raw materials is significantly impacting the growth of the global corrugated pipe market. Corrugated pipes are made from materials like steel, aluminum, plastic and clay, and the prices of these raw materials are subjected to constant fluctuations depending on various global economic and geopolitical factors. For instance, steel is the most widely used raw material for manufacturing corrugated metal pipes.

Other supporting factors include increasing government investments in water management, drainage, and sanitation projects, which boost demand for advanced corrugated pipe systems. The market is also witnessing strategic partnerships and expansions by key players to enhance production capacities and enter new regional markets. Interesting facts include the rising use of corrugated pipes in unconventional applications such as cable protection and green building projects, highlighting their versatility and growing importance.

Market Drivers

- Infrastructure Development and Urbanization: Rapid urbanization and the expansion of infrastructure projects worldwide are major drivers of the corrugated pipe market. Governments are investing heavily in developing roads, highways, transportation systems, and utility networks to enhance connectivity and cater to the needs of growing populations. Corrugated pipes, known for their durability, flexibility, and cost-effectiveness, are increasingly being used in drainage systems, culverts, and other applications where efficient water management and structural support are paramount.

- Sustainability and Regulatory Compliance: There is a growing emphasis on sustainable infrastructure materials, driven by stringent environmental regulations. Modern corrugated pipes made from materials like high-density polyethylene (HDPE) and polypropylene (PP) offer increased durability and lifespan compared to traditional materials. Plastic corrugated pipes are gaining popularity due to their lightweight nature and resistance to corrosion, making them ideal for applications in stormwater management and sewage systems.

Market Challenges

- Fluctuating Raw Material Prices: The prices of raw materials used in manufacturing corrugated pipes, such as steel, aluminum, and plastics, are subject to fluctuations due to global economic factors. These price variations can impact production costs and profit margins for manufacturers, posing a challenge to maintaining competitive pricing and steady supply chains.

- Environmental Regulations and Recycling Challenges: While there is a push towards sustainable materials, the recycling of corrugated pipes, especially those made from composite materials, presents challenges. The complexity of recycling processes and the lack of standardized practices can hinder the adoption of eco-friendly solutions. Additionally, stringent environmental regulations require manufacturers to invest in research and development to produce recyclable and biodegradable piping options, which can increase production costs.

Market Trends

- Technological Advancements in Pipe Manufacturing: Advancements in manufacturing technologies have led to the development of lightweight and durable corrugated pipes. Innovations such as the integration of sensors and smart monitoring systems are creating new revenue streams for market players. These technologies enhance the performance and functionality of corrugated pipes, making them suitable for a wider range of applications, including telecommunications and renewable energy projects.

- Customization and Tailored Solutions: There is a growing demand for customized corrugated pipe solutions to meet specific project requirements. Manufacturers are focusing on offering tailored products that cater to the unique needs of various industries, including agriculture, construction, and wastewater management. This trend is driven by the need for efficient and cost-effective solutions that align with local regulations and environmental considerations.HDPE is the largest material type in the global corrugated pipe industry due to its superior durability, chemical resistance, and cost-effectiveness, making it ideal for diverse applications across infrastructure and construction projects.

Additionally, HDPE exhibits outstanding resistance to corrosion, abrasion, and chemical attack, which ensures longevity even when exposed to aggressive environmental conditions, acidic or alkaline soils, and various industrial chemicals. Unlike traditional materials such as concrete or metal, HDPE does not rust, rot, or corrode, reducing the frequency and cost of maintenance and replacement, a key factor driving its adoption globally. Another contributing factor is its lightweight nature, which simplifies transportation, handling, and installation, lowering overall project costs and accelerating construction timelines.

HDPE pipes also offer flexibility, allowing them to absorb ground movements and vibrations without breaking, which is particularly important in earthquake-prone or unstable soil regions. Moreover, the material is environmentally friendly, as it can be fully recycled, aligning with the increasing emphasis on sustainable infrastructure development worldwide. Technological advancements in pipe extrusion and corrugation processes have further enhanced the performance characteristics of HDPE pipes, enabling the production of larger diameter pipes with higher structural integrity and longer service life.

Drainage is the largest application in the global corrugated pipe industry due to the widespread need for efficient water management and flood prevention in urban, agricultural, and industrial areas.

The dominance of drainage as an application type in the global corrugated pipe industry is primarily driven by the critical need for effective water management across residential, commercial, industrial, and agricultural sectors. Corrugated pipes are highly suitable for drainage systems because of their structural strength, flexibility, and resistance to corrosion, which allow them to efficiently handle large volumes of stormwater, groundwater, and wastewater without frequent maintenance or risk of failure. In urban areas, rapid population growth and expansion of cities have intensified the demand for robust drainage infrastructure to prevent flooding, waterlogging, and soil erosion, ensuring public safety and protecting property.

Similarly, in agriculture, efficient drainage is essential to remove excess water from fields, maintain soil health, and improve crop yield, making corrugated pipes a practical solution for irrigation runoff and subsurface drainage systems. The versatility of corrugated pipes, particularly those made from high-density polyethylene (HDPE), allows them to be installed in varied terrains and soil conditions, including areas with high water tables or shifting ground, which traditional rigid pipes struggle to accommodate.

Additionally, drainage systems often require long service life, chemical resistance, and flexibility to absorb environmental stresses - all characteristics where corrugated pipes excel. Industrial sectors also rely on these pipes to manage wastewater and runoff efficiently, minimizing environmental contamination and complying with stringent regulations.

Double-wall corrugated pipes are the largest in the global corrugated pipe industry due to their superior strength, durability, and cost-effective performance in demanding drainage and infrastructure applications.

Double-wall corrugated pipes dominate the global corrugated pipe market because they offer a combination of structural strength, flexibility, and efficiency that meets the demands of modern infrastructure and drainage systems. These pipes feature a smooth inner wall for optimal fluid flow and a corrugated outer wall that provides high resistance to external loads and soil pressure, making them highly durable even under heavy traffic conditions, deep burial, or shifting soil. This dual-structure design ensures minimal friction loss and prevents blockages, which is critical for drainage, sewage, and stormwater management systems, while the corrugated exterior maintains structural integrity against compressive forces.

Compared to single-wall pipes, double-wall pipes provide enhanced mechanical strength without significantly increasing material usage, offering a cost-effective solution for large-scale construction projects. They are particularly suitable for applications requiring long-term reliability, such as urban drainage networks, highway underpasses, and agricultural irrigation, where structural failure or frequent maintenance would be both costly and disruptive. The use of materials like high-density polyethylene (HDPE) in double-wall pipes further enhances chemical resistance, longevity, and flexibility, allowing the pipes to withstand environmental stresses such as temperature fluctuations, soil movement, and chemical exposure.

Additionally, double-wall pipes are easier to handle, transport, and install due to their lightweight nature, which reduces labor and logistical costs and accelerates project timelines. Regulatory standards and engineering guidelines often favor double-wall pipes for drainage and stormwater systems because of their proven performance under high load conditions, further reinforcing their widespread adoption.

Pipes with diameters less than 300 mm are the largest in the global corrugated pipe industry due to their widespread applicability in residential, municipal, and small-scale drainage systems.

The dominance of sub-300 mm corrugated pipes in the global market is primarily driven by their versatility, cost-effectiveness, and suitability for a wide range of applications where smaller diameters are sufficient to handle water flow efficiently. These pipes are extensively used in residential drainage, stormwater management, sewage systems, and agricultural irrigation, where the volumes of water to be transported do not necessitate larger diameters. Their smaller size allows for easier handling, transportation, and installation, reducing labor and logistical costs, which is particularly beneficial in densely populated urban areas or locations with constrained access.

Sub-300 mm pipes are also preferred for retrofitting existing infrastructure, where space limitations require compact solutions that can be seamlessly integrated with current drainage networks. Additionally, these smaller pipes are compatible with modular piping systems, making them suitable for large-scale distributed applications, such as roadside drainage, building plumbing, and localized flood control systems, where multiple interconnected pipes are more practical than a few large-diameter alternatives.

Economically, the lower material requirement of smaller pipes results in reduced manufacturing costs, making them more affordable for municipal authorities, contractors, and agricultural users, thereby driving higher adoption globally. The high demand is further supported by technological improvements in materials such as high-density polyethylene (HDPE), which ensure that even smaller-diameter pipes maintain sufficient structural integrity, chemical resistance, and durability to perform reliably under varied soil and environmental conditions.

Municipal and infrastructure end users dominate the global corrugated pipe industry due to the high demand for reliable drainage, sewage, and stormwater management systems in urban development and public projects.

The municipal and infrastructure segment has emerged as the largest end-user type in the global corrugated pipe industry, driven primarily by the rapid urbanization and continuous expansion of cities worldwide. Governments and local authorities invest heavily in the construction and maintenance of public utilities, including stormwater drainage, sewer networks, potable water systems, and flood management projects, all of which heavily rely on corrugated pipes for their durability, flexibility, and cost-effectiveness.

Corrugated pipes, particularly those made from high-density polyethylene (HDPE), are favored for these applications because they can withstand high loads, resist chemical and environmental degradation, and provide long-term performance with minimal maintenance. Urban infrastructure projects often require piping systems that can adapt to challenging terrains, shifting soils, and high traffic areas; the combination of structural strength and flexibility offered by corrugated pipes meets these demands effectively. Additionally, government regulations and standards for municipal infrastructure emphasize longevity, sustainability, and resilience, which aligns well with the attributes of corrugated pipes.

Large-scale public works, including road and highway drainage, airport stormwater systems, and railway infrastructure, rely extensively on these pipes for their efficient water conveyance and structural reliability. Furthermore, the increasing focus on climate-resilient urban planning has amplified the need for robust drainage and sewage solutions capable of managing extreme weather events, such as heavy rainfall and flooding.

Municipal projects, by nature, involve high-volume procurement, contributing significantly to the market size compared to smaller-scale industrial or residential applications.Asia Pacific is the largest region in the global corrugated pipe industry due to rapid urbanization, large-scale infrastructure projects, and growing demand for efficient water management systems.

The Asia Pacific region dominates the global corrugated pipe market primarily because of its ongoing urban expansion, industrial growth, and substantial investments in infrastructure development. Countries such as China, India, Japan, and Southeast Asian nations are witnessing accelerated urbanization, leading to increased demand for residential, commercial, and municipal water management solutions, including stormwater drainage, sewage systems, and irrigation networks.

Corrugated pipes, especially those made from high-density polyethylene (HDPE), are highly suitable for these applications due to their durability, corrosion resistance, flexibility, and cost-effectiveness, which make them ideal for large-scale deployment in varied terrains and soil conditions. The rapid development of roads, highways, railways, airports, and urban drainage projects in the region has further boosted the demand for corrugated pipes, as they provide structural strength to withstand heavy traffic loads and environmental stresses while enabling efficient water flow.

Additionally, Asia Pacific has a large agricultural base requiring extensive irrigation and drainage systems, which contributes significantly to the consumption of corrugated pipes in smaller diameters for efficient water management. Government initiatives promoting sustainable infrastructure, flood control, and smart city development also play a crucial role in driving the market, as authorities increasingly prefer long-lasting and low-maintenance piping solutions.

Furthermore, the cost advantages of locally manufactured pipes and the availability of raw materials such as HDPE have made corrugated pipes more accessible and affordable, accelerating adoption across both developed and developing economies in the region. Industrialization, combined with rising population density, has created a strong need for effective urban water and wastewater management, positioning Asia Pacific as a hub for corrugated pipe demand.

- In May 2025, Advanced Drainage Systems has acquired River Valley Pipe, a privately owned pipe manufacturer based in the United States. River Valley Pipe specializes in high-performance corrugated plastic pipe systems tailored for the agriculture sector. The acquisition strengthens Advanced Drainage Systems' position in the corrugated pipe market.

- In May 2025, SIBUR has introduced a new polypropylene grade, PPI003 EX, featuring enhanced strength and tailored for corrugated pipe production. This development allows Russian manufacturers to replace imported alternatives, reducing reliance on foreign suppliers and lowering raw material costs.

- In April 2024, Ameritex expanded into the corrugated plastic pipe market to diversify its product offerings and meet growing industry needs.

- In 2021, Vinidex introduced a sustainable stormwater drainage system, focusing on environmentally responsible water management solutions.

- In 2020, Molecor launched a new range of oriented PVC pipes for large-scale infrastructure projects, enhancing its product portfolio.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Drainage Systems, Inc.

- Jain Irrigation Systems Ltd.

- FRÄNKISCHE Group

- Murrplastik Systemtechnik GmbH

- TDM Group Limited

- Astral Limited

- Pars Ethylene Kish Co.

- Contech Engineered Solutions LLC

- JM Eagle Inc.

- Lane Enterprises, Inc.

- Ferguson Enterprises Inc.

- WL Plastics LLC

- Schlemmer

- PIPELIFE International GmbH

- Bina Plastic Industries Sdn. Bhd.

- Supreme Industries Limited

- Jindal Plast India

- Dutron Plastics Private Limited

- Dura-Life India Private Limited

- Corr Plastik Industrial Ltda

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 204 |

| Published | October 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.48 Billion |

| Forecasted Market Value ( USD | $ 25.01 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |