Plastic pigments represent specialized particulate additives integrated into polymer bases to deliver enhanced functional benefits including superior weather resistance, transparency, chemical stability, and dust resistance. These performance-enhancing particles are categorized as either organic or inorganic compounds, each offering distinct advantages for specific applications. The combination of functional benefits and aesthetic properties positions plastic pigments as essential components across multiple industries requiring both performance and visual appeal in plastic applications.

The market demonstrates strong growth dynamics driven by expanding productivity in key end-user sectors, particularly automotive and building and construction industries, where plastic pigments find extensive application in paints and coatings formulations. Technological innovations in pigment manufacturing have enabled the development of lightweight, long-lasting solutions that meet increasingly demanding performance requirements across diverse applications.

Market Segmentation Analysis

The plastic pigments market exhibits clear segmentation based on chemical composition, primarily divided into organic and inorganic categories. The organic pigment segment is projected to maintain substantial market share throughout the forecast period, driven by shifting manufacturer preferences and evolving regulatory landscapes.Growing environmental concerns regarding pollution generated during inorganic pigment manufacturing have catalyzed industry interest toward organic alternatives. This transition reflects broader sustainability trends and regulatory pressures that favor environmentally responsible manufacturing processes. Organic pigments offer comparable performance characteristics while addressing environmental and health concerns associated with traditional inorganic formulations.

The cosmetics sector represents a significant growth driver for organic pigments, where increasing awareness about ingredient safety has elevated demand for organic alternatives in products including eyeliners, skincare formulations, nail polish, and various makeup products. Consumer preference for safer, more sustainable cosmetic ingredients continues to support organic pigment adoption in personal care applications.

Primary Market Drivers

The automotive industry serves as the predominant growth driver for plastic pigments demand. These compounds provide essential thermal stability, weather resistance, and dust protection when applied as coatings on automotive components such as dashboards and bumpers. The automotive sector's post-pandemic recovery, supported by favorable investment conditions and growing demand for fuel-efficient vehicles, has stimulated production and consumption scales.Automotive applications require plastic pigments capable of withstanding extreme temperature variations, UV exposure, and environmental stresses while maintaining color integrity and surface protection. These performance requirements align perfectly with advanced pigment technologies that deliver long-term durability and aesthetic appeal.

Cosmetics Industry Growth

Rapid urbanization, improved living standards, and increased disposable income have generated substantial demand growth in cosmetics products, creating corresponding opportunities for plastic pigments manufacturers. The cosmetics industry's expansion reflects broader consumer trends toward personal care and appearance enhancement, supported by demographic shifts and evolving lifestyle preferences.Major cosmetics companies continue reporting revenue increases, particularly in emerging markets where rising affluence drives cosmetics consumption. This growth translates directly into increased demand for high-quality pigments that deliver desired aesthetic properties while meeting safety and performance standards.

Regulatory Challenges

The plastic pigments market faces significant regulatory challenges, particularly concerning volatile organic compound (VOC) emissions during manufacturing processes. Inorganic pigment production generates VOC emissions that pose serious health risks including kidney, liver, and lung damage, as well as respiratory tract infections.Government authorities have implemented stringent emission standards to mitigate these health and environmental impacts. Regulatory frameworks such as the Clean Air Act require EPA oversight of VOC emissions, creating compliance obligations that impact manufacturing operations and costs. These regulations favor organic pigment alternatives that generate fewer harmful emissions during production.

Future Market Outlook

The plastic pigments market outlook remains positive despite regulatory challenges, supported by fundamental growth trends across key end-user industries. The automotive sector's continued expansion, building and construction industry development, and cosmetics market growth provide sustained demand opportunities.Market evolution will likely favor organic pigment formulations that address environmental and health concerns while delivering comparable performance characteristics. Manufacturers investing in clean production technologies and organic pigment development are positioned to capitalize on regulatory trends and consumer preferences for sustainable alternatives.

Success in this market will depend on balancing performance requirements with environmental compliance while meeting cost expectations across diverse application segments requiring specialized pigment solutions.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Plastic Pigments Market Segmentation:

By Pigment Type

- Organic Pigments

- Inorganic Pigments

By Color

- Red

- Blue

- Green

- Yellow

- Black

- White

- Others

By Application

- Packaging

- Automotive Plastics

- Consumer Goods

- Building & Construction Plastics

- Electrical & Electronics

- Agriculture Films

- Medical Plastics

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

Table of Contents

Companies Mentioned

- BASF SE

- Clariant AG

- DIC Corporation

- Heubach GmbH

- LANXESS AG

- Venator Materials PLC

- KRONOS Worldwide, Inc.

- Plasti Pigments Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

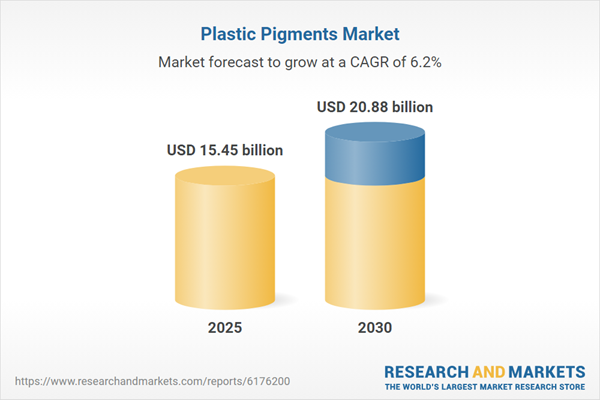

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 15.45 billion |

| Forecasted Market Value ( USD | $ 20.88 billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |