Optical sensors, which convert light intensity into electrical signals, represent a rapidly expanding technology segment with diverse applications spanning biometric, medical, industrial, and automotive sectors. The market's robust growth trajectory is primarily driven by increasing technological adoption across industrial operations and expanding healthcare applications, particularly in heart rate monitoring and breath analysis systems.

Emerging Applications and Innovation

The agricultural sector has emerged as a promising new frontier for optical sensor deployment, with applications focusing on real-time pest detection and monitoring. This diversification demonstrates the technology's versatility and potential for addressing sector-specific challenges through precision monitoring and automated classification systems.Market Segmentation Dynamics

The optical sensors market encompasses several key technology segments: consumer electronics, biometrics, medical, industrial, automotive, and other specialized applications. Consumer electronics maintains a significant market position, driven primarily by ambient light sensing systems integrated into smartphones and mobile devices. These systems optimize battery performance and screen brightness based on environmental lighting conditions, enhancing user experience while extending device longevity.The consumer electronics segment benefits from sustained urbanization trends and widespread technological adoption globally. Major manufacturers continue to report strong revenue performance from smartphone sales, indicating robust demand for integrated optical sensing capabilities. This growth pattern suggests continued expansion opportunities for optical sensor manufacturers serving the consumer electronics market.

Automotive Sector Transformation

The automotive industry represents another critical growth driver for optical sensors, particularly through Advanced Driver Assistance Systems (ADAS) integration. These systems leverage optical sensing technology for camera-based applications and Light Detection and Ranging (LiDAR) systems, enabling crucial safety features such as reversing assistance and blind spot detection.Automotive manufacturers are increasingly prioritizing ADAS adoption to meet growing consumer demand for intelligent vehicle systems. This trend is supported by significant industry investments in autonomous driving technologies and strategic partnerships aimed at strengthening market positioning in key regional markets.

Regulatory Environment and Policy Support

The regulatory landscape increasingly favors optical sensor adoption through mandatory safety requirements and mobility enhancement initiatives. The European Commission's Intelligent Road Assistance regulation, effective for new vehicles, exemplifies how policy frameworks are driving systematic integration of advanced sensing technologies across the automotive sector.Such regulatory mandates create sustained demand for optical sensors by establishing baseline safety requirements that necessitate advanced sensing capabilities. This regulatory support provides market stability and predictable growth patterns for technology providers.

Market Growth Catalysts

Several factors converge to drive optical sensor market expansion. Industrial automation continues accelerating, requiring sophisticated sensing solutions for process optimization and quality control. Healthcare applications expand beyond traditional monitoring to include advanced diagnostic and therapeutic applications. The biometric security sector increasingly relies on optical sensing for identity verification and access control systems.The technology's inherent advantages - including high precision, real-time response capabilities, and adaptability to diverse environmental conditions - position optical sensors favorably across multiple industries undergoing digital transformation.

Industry Outlook

The optical sensors market demonstrates strong fundamentals across its primary application segments. Consumer electronics demand remains robust, automotive integration accelerates through ADAS adoption, and emerging applications in agriculture and specialized industrial processes expand the addressable market. Regulatory support, particularly in automotive safety applications, provides additional growth momentum while established applications in medical and biometric systems offer stability.This multi-sector demand profile, combined with ongoing technological advancement and expanding application possibilities, positions the optical sensors market for sustained growth across its diverse application portfolio.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

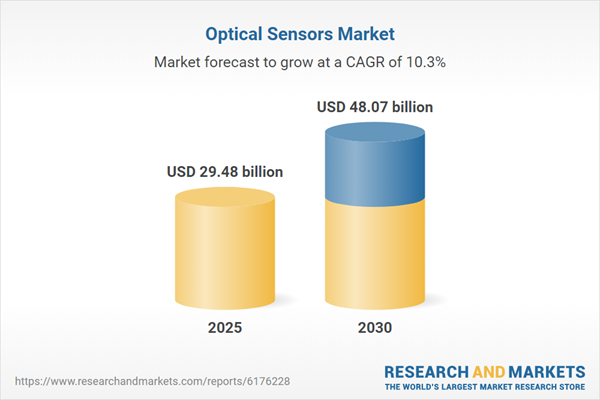

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Segmentation

By Type

- Fiber Optic Sensor

- Ambient Light & Proximity Sensor

- Image Sensor

- Photoelectric Sensor

- Others

By Light Source

- LED

- Laser

By Application

- Light Detection & Ranging (LIDAR)

- Biomedical Application

- Pressure & Strain Sensing

- Temperature Sensing

- Others

By End-User

- Electronics

- Automotive

- Aerospace

- Medical & Healthcare

- Energy & Utilities

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Honeywell International Inc

- ABB Ltd

- Analog Devices Inc

- Vishay Intertechnology Inc

- ROHM Co Ltd

- Keyence Corporation

- Rockwell Automation Inc

- Omron Corporation

- Hamamatsu Photonics K.K

- TE Connectivity

- Texas Instruments Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 154 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 29.48 billion |

| Forecasted Market Value ( USD | $ 48.07 billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |