Key Market Trends and Insights:

- The Sulawesi private banking market dominated the market in 2024 and is projected to grow at a CAGR of 14.4% over the forecast period.

- By type, trust service is projected to witness a CAGR of 14.1% over the forecast period.

- By application, the personal segment is expected to register 14% CAGR over the forecast period with the increasing regional population of high-net-worth individuals.

Market Size & Forecast:

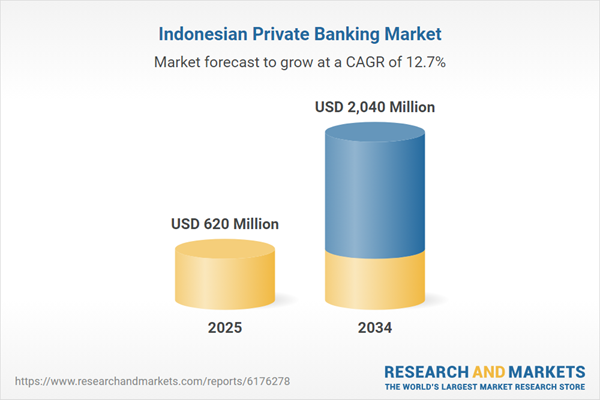

- Market Size in 2024: USD 620.00 Million

- Projected Market Size in 2034: USD 2.04 billion

- CAGR from 2025 to 2034: 12.70%

- Fastest-Growing Regional Market: Sulawesi

To address these needs, private banks are aggressively investing in the development of integrated digital platforms offering unified access to multiple financial products and services. To cite an instance, in March 2025, Maybank Indonesia launched its 360 Digital Wealth platform that allows clients to manage mutual funds, bonds, gold, and other investments through a single mobile interface, eliminating fragmented access. Such applications simplify complex wealth management procedures and provide holistic investment opportunities.

Meanwhile, the innovative digital ecosystem also attracts a growing base of tech-savvy customers who need consolidated and efficient wealth solutions, thereby boosting the Indonesia private market growth. With the expansion of digitized wealth services, global fintech and wealth-tech companies are drawn into the evolving financial ecosystem of Indonesia.

High internet penetration, presence of a wide digitally aware population, and supportive regulatory environment for innovation make the region an ideal destination for digital infrastructure investment. For instance, in February 2025, global leading digital financial platform provider, additiv expanded into Jakarta, as the country is emerging as a hub for digital financial services. The company opened an office in the premium District 8 business complex, to support digital transformation in the private banking and wealth management space of Indonesia.

Key Trends and Recent Developments

July 2025

Manulife Indonesia and Bank DBS Indonesia introduced Manulife Protection Optimum Elite, also known as Manulife PRIME, a life insurance product to support cross-generational financial planning. With the addition of this product, the company strengthened its product portfolio of legacy planning to meet the rising demand for estate-focused insurance solutions in Indonesia.July 2025

Bank Negara Indonesia (BNI) relaunched its premium banking service under ‘BNI Private’, targeting clients aging 25-40 with a focus on legacy planning, ESG investing, and global mobility. This move comes as a step towards offering holistic advisory, succession planning, and purpose-driven financial solutions to next-gen customers.December 2023

Deutsche Bank increased its capital investment to IDR 10 trillion (EUR 600 million) to extend its capability to support Indonesia’s growing corporate and financial clients. This investment highlighted the growing confidence in the economic potential of Indonesia.August 2024

Bank Aladin, a prominent digital bank based in Indonesia, announced its plans to transform the financial sector of the country by leveraging strategic partnerships and sharia-compliant banking. The company’s focus remains on boosting financial inclusion by serving underbanked populations and MSMEs.Government Initiatives Promoting Financial Inclusion

Government-led efforts to promote financial inclusion are expanding the potential client base across Indonesia private banking industry. The National Strategy for Financial Inclusion (SNKI) brings underserved segments, like MSMEs, women, and rural communities, into the formal financial system. Citing another instance, in December 2024, Asian Development Bank’s (ADB) provided USD 500 million loan under the Promoting Innovative Financial Inclusion Program, which supported the reforms to improve financial infrastructure and reach marginalized groups across Indonesia. With a growing number of individuals and enterprises gaining access to financial services, participation in formal banking is increasing, enabling private banks to venture into new markets and offer specialized financial advisory services.Bullion banking infrastructure development

The ongoing establishments of bullion banking infrastructure to support onshore gold wealth management is significantly driving the Indonesia private banking market. As Indonesia ranks among the top global gold producers worldwide, the government is making efforts to keep the gold reserves within the country. This has created new avenues for affluent individuals to access gold deposits, financing, trading, and custody services domestically. For instance, in February 2025, Pegadaian and Bank Syariah Indonesia were licensed as bullion banks, supporting Indonesia’s wealth repatriation push while streamlining investments in secure, onshore gold assets. Such initiatives enable private banks to expand their advisory offerings with gold-based solutions.Rising demand for international investment pathways

Growing demand for global mobility through citizenship-by-investment, golden visas, and foreign education among Indonesian customers is prompting private banks to expand their offerings. For instance, the new golden visa program announced in Indonesia in September 2023, encourage foreign investment by providing residency permits for a 5-10-year term, depending on investment size. Private banks are providing tailored solutions including education trust funds supporting education abroad, and cross-border estate planning services to address legal and tax complexities across multiple jurisdictions. By integrating these solutions, private banks are strengthening client relationships and positioning themselves as trusted advisors, further contributing to the Indonesia private banking market growth.Regional expansion of wealth centres

Ongoing emergence of new regional economic hubs is revamping wealth distribution in Indonesia, encouraging private banks to extend their reach beyond traditional centres like Jakarta. Developing cities and special economic zones are attracting high-net-worth individuals (HNWIs) and businesses, creating demand for localized private banking services and wealth management solutions. A prime example is the IKN Nusantara, Indonesia’s future capital city in East Kalimantan, developed in 2025, which included housing, hospitality, education, and official sectors. These investments positioned Nusantara as a major wealth centre, providing private banks with opportunities to expand their networks and services in the Indonesia private banking market.Digital integration between traditional financial institutions and fintech platforms

Digital integration between traditional financial institutions and fintech platforms enables wide access to investment products. Banks are actively leveraging Application Programming Interface (API) connectivity to deliver curated wealth management solutions to a wider consumer base across retail and elite investors. This digital synergy enhances user experience, promotes financial inclusion, and supports the growing demand for accessible, tech-driven investment tools, thereby supporting the Indonesia private banking market growth. For instance, in October 2024, Bank DBS Indonesia partnered with Moduit wealth-tech platform, to offer over 100 secondary market bonds using API integration via Moduit’s app, further simplifying bond investing for modern investors.Indonesia Private Banking Industry Segmentation

The report titled “Indonesia private banking market report and forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Insurance Service

- Tax Consulting

- Asset Management Service

- Real Estate Consulting

- Trust Service

Market Breakup by Application

- Enterprise

- Personal

Market Breakup by Region

- Sumatra

- Java

- Kalimantan

- Sulawesi

- Others

Indonesia Private Banking Market Share

By type, the trust services segment holds the largest market share

The trust services segment captures the highest portion of the market and will expand at 14.1% CAGR through 2034 driven by widespread digitization. Private banks are leveraging digital platforms to streamline onboarding, automate compliance processes, and provide seamless access to trust-related offerings like estate planning and custody. Simultaneously, the government’s gradual updates to fiduciary laws and estate planning regulations are fostering regulatory clarity. This strengthens client confidence, encourages the formalization of wealth structures, and legitimizes the role of domestic trust services in long-term asset protection and intergenerational planning.The asset management segment accounts for a significant share in Indonesia private banking market between 2025 and 2034 owing to the growing consumer demand for sustainable and responsible investment. HNWIs are shifting towards ethical wealth generation by prioritizing investments that align with Environmental, Social, and Governance (ESG) values due to the growing awareness around climate risks, social equity, and governance standards. Private banks are integrating ESG metrics into portfolio offerings to cater to this evolving investor mindset. For example, in August 2023, Bank DBS Indonesia and PT BNP Paribas Asset Management collaboratively launched the BNP Paribas Indonesia ESG Equity mutual fund. This ESG-focused product targeted priority and private banking clientele seeking both financial returns and sustainable impact.

By application, personal segment accounts for the highest revenue share

The personal application segment is estimated to grow substantially at 14% CAGR through 2034 fuelled by the increasing regional population of high-net-worth individuals, especially millennials and Gen Z inheritors, who prioritize personalized and digitally accessible wealth management solutions. Increasing financial literacy and lifestyle aspirations have led to a surge in demand for investment products, estate planning, and impact investing. Additionally, the increasing availability of digital platforms to manage portfolios seamlessly further supports segment growth. For instance, ABBANK launched a new digital banking platform, in January 2025, powered by Backbase, which simplifies financial management for entrepreneurs with features like real-time dashboards, personalized accounts, and international transfers.On the other hand, the enterprise segment in Indonesia private banking market is attributed to the growing demand among family-owned businesses and corporate leaders for sophisticated wealth management solutions integrating business and personal finances. The expansion of domestic and regional businesses increases the complexity of succession planning, tax optimization, asset protection, and fuel demand for advisory services. Furthermore, this segment benefits from growing entrepreneurial activity and corporate wealth accumulation, in Indonesia driving increased engagement with private banking products designed to safeguard and grow enterprise assets.

Indonesia Private Banking Market Regional Analysis

By region, Java dominates the market growth

Java represented 53.7% portion of the Indonesia private banking market revenue in 2024 and is growing significantly. The island has emerged as a Indonesia’s key economic and political hub due to its proximity to key financial institutions and regulatory bodies in Jakarta. This strategic location fosters regulatory clarity and boosts investor confidence. Java gains direct access to policy updates, facilitating faster adoption of innovative financial products and services. For example, the OJK’s Regulation No. 30/2024 on financial conglomerates, introduced in December 2024, exemplifies how proximity to regulators enables swift implementation of key policies strengthening Indonesia’s financial sector.On the other hand, Sumatra is experiencing the fastest growth at 12.5% CAGR through in the Indonesia private banking market. Major investments in mining, notably nickel processing at Morowali Industrial Park, and agriculture/export-oriented SMEs have helped accumulate significant local wealth. Parallel infrastructure upgrades, such as the Makassar-Bitung toll road and development of SEZs, have improved connectivity and catalysing business activity across the island. As affluent clients emerge in growing coastal cities like Makassar and Kendari, demand for trust, estate planning, and custody services from private banks is rising sharply, in turn, fuelling the market growth.

Competitive Landscape

The Indonesia private banking market is becoming increasingly competitive as players remain focused to capture a growing base of affluent individuals. Domestic institutions are focusing on personalized services, digital innovation, and tailored investment offerings to cater to the evolving needs of younger, wealthier clients. Strategies include rebranding premium services, expanding financial literacy programs, and integrating ESG and legacy planning into advisory solutions. These banks are also leveraging hybrid service models that combine digital access with high-touch, relationship-driven wealth management support.Foreign banks operating in the Indonesia private banking industry are sharpening their competitive edge by offering cross-border advisory, global portfolio access, and cutting-edge digital platforms tailored to Indonesia’s rising high-net-worth population. Many are restructuring regional operations and forming fintech partnerships to enhance product delivery and client experience. Their strategies emphasize offshore investment capabilities, succession planning, and seamless digital onboarding, further catering to the savvy Indonesian clients.

PT Bank OCBC NISP Tbk

PT Bank OCBC NISP Tbk, a leading Indonesian bank, provides a comprehensive range of financial services including commercial banking, wealth management, and consumer banking. The bank is reputed in the Indonesia private banking market for its robust customer focus and innovative digital solutions, catering to the clients across retail and corporate in Indonesia.PT Bank DBS Indonesia

The subsidiary of Singapore-based DBS Group, PT Bank DBS Indonesia is known for its digital-first approach for banking and wealth management. The bank offers customized financial services focused on private banking, investment products, and seamless digital experiences for wealthy clients.CIMB Group

CIMB Group is a prominent ASEAN universal bank based in Malaysia has significant operations across the Southeast Asian region. The firm provides a wide portfolio of banking services including retail, corporate, and investment banking, focused on regional connectivity and integrated wealth management solutions.PT Bank HSBC Indonesia

PT Bank HSBC Indonesia is part of the global HSBC Group, providing comprehensive financial and wealth management services in the Indonesia private banking industry. The bank focuses on serving high-net-worth individuals and corporate clients with expertise in international banking, investment solutions, and cross-border financial services.Other key players in the market include Hubbis (HK) Limited.

Key Highlights of the Indonesia Private Banking Market Report:

- Historical performance and accurate forecasts through 2034, enabling strategic wealth management and investment planning across Indonesia’s private banking sector.

- Insights into product innovations such as digital wealth platforms, ESG-focused investment portfolios, and Shariah-compliant financial solutions tailored for affluent Indonesian clients.

- In-depth competitive landscape profiling of domestic and international private banks, fintech partnerships, and emerging wealth management service providers expanding their footprint in Indonesia.

- Regional analysis identifying Java as the dominant market alongside rising financial hubs in Sumatra, Kalimantan, and Sulawesi driving private banking demand.

- Investment-focused outlook supported by data on infrastructure co-investments, bullion banking, and cross-border wealth advisory services shaping Indonesia’s evolving private banking landscape.

Table of Contents

Companies Mentioned

- PT Bank OCBC NISP Tbk

- PT Bank DBS Indonesia

- CIMB Group

- PT Bank HSBC Indonesia

- Hubbis (HK) Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 127 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 620 Million |

| Forecasted Market Value ( USD | $ 2040 Million |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Indonesia |

| No. of Companies Mentioned | 5 |