Key Market Trends and Insights:

- The West India french fries market dominated the market in 2024 and is projected to grow at a CAGR of 12.1% over the forecast period.

- By distribution channel, the online segment is projected to witness a CAGR of 15.8% over the forecast period.

- By product, the frozen segment is expected to register 11.7% CAGR over the forecast period.

- By end use, the food service segment is recording a significant CAGR propelled by the booming fast-food industry, café culture, and hotel chains.

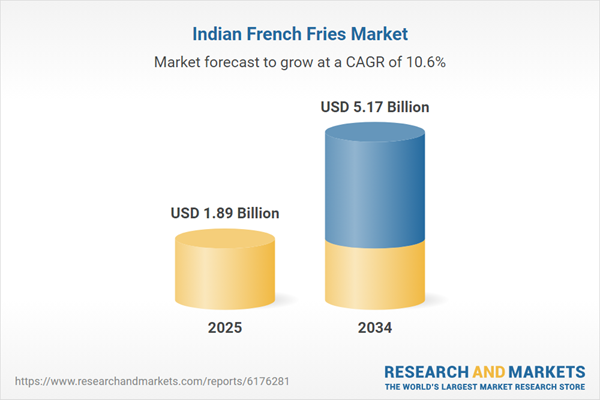

Market Size & Forecast:

- Market Size in 2024: USD 1.89 billion

- Projected Market Size in 2034: USD 5.17 billion

- CAGR from 2025 to 2034: 10.60%

- Fastest-Growing Regional Market: West India

The youth population aged between 15 to 29 years makes up nearly 40% of the country’s total population, making them a powerful consumer demography in India french fries market. French fries have become a preferred snacking option among Gen Z and millennials due to their affordability, and compatibility with a variety of dips and toppings. The trend is further amplified by the influence of social media platforms flooded with food influencers showing a variety of fries recipes or street-style adaptations that fuel experimentation.

Apart from this, the growing affinity for global cuisines is transforming the snack culture in India, positioning French fries as a ubiquitous favourite. Exposure through travel, social media, OTT content and international QSR brands has broadened consumer tastes, especially among millennials and Gen Z, which has made global-style fries instantly recognizable and desirable, boosting french fries consumption in India.

Brands are taking advantage of these trends by creating youth-centric variants such as tandoori fries, jalapeño cheese fries, and peri-peri sticks. For instance, in 2025, fast-food giants like McDonald’s and Burger King introduced Korean-inspired items like Gochujang-seasoned ‘K-fries’ and Shake-Shake Fries across their Indian stores, responding to rising demand from Korean pop culture wave.

Citing another instance, in April 2025, Goodrich Cereals, a brand known for its premium potato products, which recently launched flavour-infused frozen French fries in varieties like Onion Chilli, Classic Salted, and Oregano. Such product development keeps the product category relevant while fostering repeat consumption among young consumers. These efforts reflect how global culinary trends are driving the mainstream adoption of fries with global flavours in both foodservice and at-home consumption, thereby propelling the India french fries market growth.

Key Trends and Recent Developments

October 2023

McCain Foods, the reputed frozen food brand, introduced two new products, McCain Popcorn Fries and McCain Cheesy Pizza Fingers chips. The company tailored these products, keeping in mind the distinct preferences of our consumers, reflecting its commitment to crafting quality and tastes.April 2025

McCain Foods India partnered with Philips to introduce a range of frozen snacks designed exclusively for Air Fryers. The new range offers crispy fries with the taste and texture of restaurant-style fries, providing at-home convenience.April 2023

Himalaya Food International revived its French fries business within the frozen and canned food processing segment. The company also announced plans to set up a French fries production line with a capacity of 50,000 tonnes per annum, along with a 12,000-tonne potato specialty line, to cater to the rising demand in the India French fries market.July 2025

The Hungritos and KFC India collaborated on International French Fries Day 2025 to celebrate the growing popularity of fries in India. As Indian consumers increasingly embrace global snack trends, this collaboration blended Hungritos’ frozen food innovation with KFC’s QSR appeal to elevate brand engagement.Expansion of quick service restaurants (QSRs)

The expansion of Quick Service Restaurants (QSRs) across urban and semi-urban Indian regions is surging the demand for French fries. The growing consumers' preference for convenient, affordable, and indulgent food options has positioned fries as a staple side item in QSR menus. International and domestic QSR chains are benefiting from this rising demand by actively introducing premium potato-based snacks to a broader audience. For instance, in May 2025, Devyani International Ltd. Launched the first New York Fries outlet in India at Mumbai Airport, bringing globally popular loaded fries to Indian consumers. Such QSR expansions directly contribute to the market growth.Increasing presence of international and local brands

The India French fries market is experiencing rapid diversification, driven by the widespread presence of both international and local brands. As consumer demand shifts toward premium, customizable snacking options, brands are introducing new formats, flavours, and serving styles. Established players like McCain, HyFun Foods, and Iscon Balaji have laid the groundwork for wide distribution and consistent quality. Adding to this momentum, international brands are developing creative menus. For example, in December 2024, Omani brand Seven Fries entered India through a partnership with Franchise India. Known for its fresh, loaded fries with chicken, shrimp, and vegetable toppings, the brand aims to launch 10 outlets by 2025 across high-traffic urban locations.Growth in Frozen Food Penetration

The steady development of cold chain infrastructure is majorly driving the India French fries market growth. The increasing availability of enhanced cold storage and temperature-controlled logistics help in improving the distribution and maintaining the shelf life of frozen products. This makes French fries more accessible across retail and foodservice channels, even in smaller cities. Furthermore, this progress is supported by government initiatives focused on reducing post-harvest losses and improving supply chain efficiency. To cite an instance, under the Pradhan Mantri Kisan Sampada Yojana (PMKSY), the Government of India created 8.38 lakh MT of cold storage capacity in 2022 and continues the scheme till March 2026, with the allocation of INR 4,600 crore.Government Push for Food Processing Sector

Ongoing government support for the food processing sector, particularly in strengthening domestic production of potato-based products like French fries is a major driver boosting the India French fries market growth. Initiatives such as ‘Make in India’ and targeted subsidies for establishing processing units encourage investments in infrastructure, technology, and agri-linkages. Moreover, in recent years, Gujarat emerged as a leading hub for processed potato production due to the state-backed efforts to promote high yield. The state produces processing-grade varieties like Lady Rosetta, Kufri Chipsona, and Santana, further fuelling the India French fries industry revenue.Contract Farming and Export-Led Growth in Processed Potatoes

India has emerged as a major frozen French fries exporter, attributed to the robust processed food industry. According to industry reports, in 2023-24, India exported 135,877 tons of French fries worth INR 1,478.73 crore, and between April and October 2024 alone, the exports rose to 106,506 tons, valued at INR 1,056.92 crore. The growth is largely driven by the success of contract farming, where global and domestic food processors collaborate with farmers to cultivate processing-grade potatoes. Additionally, Indian farmers are using advanced seed varieties to produce international quality potatoes, further reducing import dependence while offering new international trade opportunities for players in India French fries market.India French Fries Industry Segmentation

The report titled “India French fries market report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Frozen

- Regular

Market Breakup by End-Use

- Food Service

- Retail

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Distributors

- Online

- Direct Purchase

- Others

Market Breakup by Region

- North India

- South India

- East India

- West India

India French Fries Market Share

By product, the frozen fries segment accounts for the largest share

The frozen fries segment currently holds the largest share of the India french fries market revenue and is set to expand at 11.7% CAGR due to their convenience and taste appeal. To capitalize on the demand, companies are actively expanding cold chain infrastructure and streamlining supply chains. Additionally, food manufacturers are increasingly entering the frozen category with ambitions to become multi-category leaders, focused on delivering innovation and value. For example, in January 2025, Allana Consumer Products Limited (ACPL) entered the frozen food space with the launch of French fries, signalling strong momentum in this evolving market.The regular French fries segment is recording steady growth in India French fries market as it benefits greatly from the country’s strong street food and local eateries culture. Particularly in Tier 2 and Tier 3 cities, freshly prepared fries remain a popular and affordable snack option among consumers who prioritize taste and freshness. Compared to frozen varieties, regular fries are more accessible and cost-effective, catering well to price-sensitive customers across diverse demographics. Many consumers prefer the texture and flavour of fries made from freshly cut potatoes, which supports steady demand in casual dining, street vendors, and quick-service outlets, thereby fuelling the segment growth.

By end-use, the food service segment amasses the highest revenue share

By end-use, the food service segment holds the largest share of India French fries market and is poised for steady expansion. Its growth is propelled by increased automation in food processing, including the use of commercial French fries cutting machines that boost efficiency and hygiene, aligning with rising demand for ready-to-eat products. The domestic French fries consumption is estimated to reach around 100,000 tons annually, valuing at INR 1,400 crore. While French fries remain one of the top-selling items at major fast-food chains, the segment is further propelled by the nationwide growth of quick-service restaurants catering to evolving snacking habits.The retail segment is witnessing notable growth in the India French fries market, driven by increasing consumer preference for convenient and indulgent snacks at home. What was once a staple of fast-food chains is now making its way into Indian kitchens, marking a reverse category creation. Frozen French fries have gained popularity as a quick, easy-to-cook option that appeals to both adults and children. With the rise of nuclear families, changing meal habits, and increased freezer penetration, fries are also replacing traditional snacks for kids. Their availability in various pack sizes and formats further supports the segment’s expanding household demand.

By distribution channel, online segment leads the India French fries market

The online channel amassed the highest sales and is poised to grow at a 15.8% growth rate between 2025 and 2034 due to the rise of instant delivery e-commerce models like Blinkit, BigBasket, and Zepto. These platforms offer a wide assortment of frozen fries, real-time discounts, and doorstep delivery, meeting the demands of urban consumers for convenience and variety. In addition, with rising smartphone penetration and digital literacy, more consumers, especially millennials, prefer ordering frozen snacks online, thereby propelling the India French fries market growth.The supermarkets and hypermarkets segment is set to expand at 12.4% CAGR through2034 driven by increasing urbanization and improved cold-chain infrastructure. Chains such as Reliance Fresh, Spencer’s, and Star Bazaar have enhanced their frozen food sections, promoting French fries through in-store displays, combo deals, and weekend offers. These retail environments allow consumers to inspect product quality and packaging firsthand, which are crucial factors influencing food purchase decisions. Besides this, the rising preference for one-stop shopping and family-sized packs is driving higher product purchases from hypermarkets among both urban and suburban households, fuelling the India French fries market growth.

India French Fries Market Regional Analysis

By region, West India region dominates the India French Fries market

West India regional share is set to expand at 12.1% growth rate from the 2025 to 2034 attributed to the strong urban demand, mature retail ecosystems, and widespread QSR presence in cities like Mumbai and Ahmedabad. Frozen fries are among the top-selling snack items in hypermarkets such as Big Bazaar and Spencer’s, replacing traditional options. Additionally, the advanced cold-chain infrastructure and food delivery network across the region ensure consistent availability, especially during peak seasons. The growing number of modern consumers further strengthens West India’s position in the market.Meanwhile, the North India region held 32.7% share of the India French fries market revenue in 2024 and is showcasing the fastest growth rate of 11.3% CAGR through 2034 attributed to the expansion of mall culture, growing number of QSR outlets, and the rising popularity of fusion variations of fries. Additionally, investments in frozen supply chains developments further support market growth. To cite an instance, in July 2025, Snowman Logistics Limited leased a new warehouse equipped with modern infrastructure in Delhi NCR to support QSRs and other industries. Moreover, growing social media influence, consumer curiosity, and spike in frozen snack purchases at supermarkets further fuels market growth especially in Tier 2 and Tier 3 urban hubs.

Competitive Landscape

India French fries market players are deploying diverse strategies to boost market penetration and meet evolving consumer preferences. Key manufacturers are investing in automation and advanced processing technologies to enhance product consistency, hygiene, and production scale, catering to the growing demand from QSRs and institutional buyers. Companies are also localizing flavours to appeal to Indian palates and offering healthier variants like air-fried or low-oil fries to attract health-conscious consumers.Simultaneously, some companies operating in the India French fries industry are expanding their retail footprint through strong distribution networks, strategic partnerships, and digital platforms. Collaborations with foodservice giants, such as KFC India’s tie-up with Hungritos, are not only elevating product visibility but also building consumer excitement around occasions like International French Fries Day. Market leaders are leveraging social media campaigns, influencer marketing, and regional branding to tap into Tier 2 and Tier 3 cities, thereby supporting market growth.

McCain Foods (India) Private Limited

McCain Foods (India), established in 1998 and headquartered in India, is a subsidiary of the global McCain Foods Limited. It manufactures a wide range of frozen potato products and snacks, including French fries and aloo tikki. The company serves both retail consumers and foodservice chains across India.HyFun Foods

HyFun Foods, established in 2012 and headquartered in India, is a leading Indian manufacturer and exporter of frozen potato-based snacks. Headquartered in Gujarat, it supplies French fries, hash browns, and more to domestic and international markets. The company focuses on quality, innovation, and large-scale production.Iscon Balaji Foods Private Limited

Iscon Balaji Foods, established in 2015 and is a Gujarat-based company specializing in frozen French fries and potato snacks. It caters to retail, foodservice, and export markets with a strong focus on product consistency. The company operates a high-capacity, modern processing facility.Pepizo Foods

Pepizo Foods, established in 2018 and headquartered in India, is an emerging player in India’s frozen snack segment. It offers a range of potato-based products like French fries and wedges for retail and HoReCa channels. The company aims to deliver taste and value through quality offerings.Other players in the India French fries market includes FastnFry Foods Company, and ChillFill Foods, among others.

Key Highlights of the India French Fries Market Report:

- Historical performance and accurate forecasts through 2034, empowering strategic decisions for frozen food manufacturers, QSR chains, and FMCG retailers.

- Product innovation trends such as masala-flavoured fries, healthier air-fried variants, and ready-to-cook frozen SKUs designed for Indian palates and convenience-driven urban households.

- Competitive landscape profiling of leading players and emerging regional brands leveraging automation, cold-chain logistics, and QSR partnerships to scale distribution and visibility.

- Regional analysis spotlighting high-growth markets like North and West India, driven by rising mall culture, QSR penetration, and urban snacking habits in Tier 1 and Tier 2 cities.

- Investment-focused outlook supported by trends in retail modernization, quick-meal preferences, and the rise of frozen food aisles in supermarkets and online grocery platforms.

Table of Contents

Companies Mentioned

- McCain Foods (India) Private Limited

- HyFun Foods

- Iscon Balaji Foods Private Limited

- Pepizo Foods

- FastnFry Foods Company

- ChillFill Foods

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.89 Billion |

| Forecasted Market Value ( USD | $ 5.17 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 6 |