Key Market Trends and Insights:

- The fortified eggs market in North America held the dominant share in 2024 and is projected to grow at a CAGR of 10.8% over the forecast period.

- By country, India secured the dominant position in 2024 and is expected to witness a CAGR of 11.2% over the forecast period.

- By micronutrient, omega-3 fatty acids are expected to grow at a CAGR of 10.7% over the forecast period.

- Food processing applications are projected to register a CAGR of 10.8% during the forecast period.

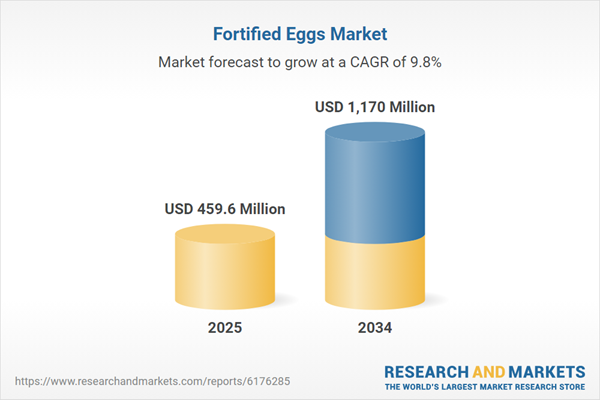

Market Size & Forecast:

- Market Size in 2024: USD 459.60 Million

- Projected Market Size in 2034: USD 1.17 billion

- CAGR from 2025 to 2034: 9.80%

- Dominant Regional Market: North America

Another factor supporting this growth is the rising health concerns among consumers surging the demand for alternative food items offering health benefits similar to traditional animal-based products. This, in turn, is contributing to the increasing consumption of functional food products like fortified eggs containing essential nutritional needs without compromising dietary needs. With this trend, both animal and plant-based fortified eggs have emerged as a practical choice to bridge nutritional gaps without needing major changes in eating habits. Their versatility in usage for breakfast, baking, and other meals further boosts their usage in health-forward meal planning, thereby fueling global fortified eggs industry growth.

Moreover, the ongoing veganism trend has pushed manufacturers to develop unique fortified, plant-based alternatives. One prime example reflecting this trend is the introduction of vegan liquid eggs launched by Aldi UK in January 2025. This liquid egg product is fortified with vitamins B12 and vitamin D along with high protein content can be scrambled, baked, and used in making omelets. Such innovations are catering to diverse dietary preferences, further fueling the global fortified eggs market expansion.

Key Trends and Recent Developments

June 2025

Incofin Investment Management, via N3F and GAIN, invested in Mkuza Chicks to modernize poultry operations in Tanzania. This upgrade was made to increase production of high-quality eggs, strengthen food security in the region, and support the company’s growth in the global fortified eggs market.June 2025

Eggoz, a leading egg producer, successfully raised $20 million in Series C funding to scale its fortified egg offerings across India. With this investment, the company expanded its tech-enabled supply chains and provided wide access to vitamin and omega-3-enriched eggs.April 2025

UNICEF, Pristine Foods Ltd., and the Ministry of Health in Uganda collaboratively launched the EPIC initiative to support Uganda’s 2030 target of reducing child stunting. The program introduced 12-gram powdered egg sachets packed with nutritional equivalent of whole egg, as an economical option to increase the nutrient and protein intake in children's diet.March 2025

The subsidiary firm of Ghitha Holdings, AI Ain Farms, which is also the largest egg producer in the UAE, acquired the Al Jazira Poultry Farm, a Dubai based egg facility. With this acquisition, the company strengthened its position in the poultry sector.Rising prevalence of micronutrient deficiencies

Widespread prevalence of micronutrient deficiencies is fueling demand for fortified eggs in the global fortified eggs market growth. As per credible sources, over 2 billion people suffer from micronutrient malnutrition globally. Among this, 372 million children below the age of five and 1.2 billion women from the reproductive age-group face deficiencies of nutrients such as vitamin D, iron, iodine, and omega-3 fatty acids. These statistics highlight significant growth in serious health concerns, specifically across the low and middle-income economies, contributing to the increasing reliance on fortified eggs. Since fortified eggs also provide essential nutrients, they have emerged as practical and easily accessible food items to be included in regular diets, positioning them as an effective intervention in resolving global nutritional gaps.Rising food tech advancements and investments for innovations

Ongoing advancements in food technology coupled with the rising investments in plant-based nutrition are boosting global fortified eggs market growth. Innovative processing techniques, like precision fermentation, bioengineering, and growing demand for alternative protein sources, are pushing the development of fortified egg products. These products closely mimic the taste and functionality of natural eggs, along with added nutritional benefits. Simultaneously, increasing investor interest in sustainable food solutions is demanding large-scale production capabilities, thereby fueling market growth. For example, in April 2025, Eat Just and Vegan Food Group collaborated to introduce JUST Egg in the European Union and the United Kingdom, supported by a funding of £11.25 million.Shift towards plant-based eggs amid rising concerns regarding avian flu

The rapid consumer shift towards plant-based food products due to the avian flu outbreak across major countries in the world has significantly favored global fortified eggs market growth. According to the CDC reports, as of April 2025, over 950 confirmed human cases of H5 bird flu, with a 50% fatality rate. In 6 European countries 20 infections and four fatalities were reported, while in the U.S. alone, there were 70 confirmed and probable cases and one death. The outbreaks have led to price instability along with substantial poultry culling, which has impacted the egg supply chain. This has created a great opportunity for fortified eggs businesses, amid the growing consumer worries about food safety and zoonotic infections.Growing demand for sustainably produced eggs amid shift towards ethical consumption

The ongoing shift towards ethical and sustainable farming has positively impacted global fortified eggs market growth. Consumers these days are prioritizing animal welfare, environmental responsibility, and food transparency, pushing the production of cage-free, organic, and pasture-raised eggs. Ethical farming practices provide hens with better living conditions, simultaneously contributing to better egg quality with higher nutritional value. Additionally, these practices support rural economies by including small-scale farmers into a high-value production cycle. Considering this shift, in June 2025, Happy Hens Farm unveiled India’s first cage-free training facility and fortified egg line enriched with folate. Such initiatives are expected to support market growth.Growing number of government health Initiatives & school meal programs

Increasing number of institutional feeding programs and school meals initiatives by government have increased the demand for fortified eggs, thereby contributing to the global fortified eggs industry revenue growth. Government organizations are making efforts to combat malnutrition by promoting access to protein-rich and nutritional foods, such as fortified eggs, especially in rural and underserved areas, further fueling market growth. For example, in December 2024, SKM Egg Products Export Limited was chosen to supply eggs under the Tamil Nadu ICDS tender, highlighting how government partnerships are accelerating fortified egg adoption.Global Fortified Eggs Industry Segmentation

The report titled “Global Fortified Eggs Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Micronutrient

- Vitamins

- Omega-3 fatty acids

- Others

Market Breakup by Application

- Food Processing

- Food Service Industry

- Retail/Household

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Fortified Eggs Market Share

By micronutrient, Omega-3 fatty acids hold the largest share in global fortified eggs market

The Omega-3 fatty acid segment market is experiencing robust growth and is set to expand at 10.7% CAGR through 2034 driven by increasing demand for sustainable and multifunctional sources of essential nutrients. Traditional sources of protein and nutrients like fish and supplements face challenges such as high costs, environmental concerns, and supply limitations. This has prompted a shift toward alternative terrestrial sources like Omega-3-enriched meat and eggs. Additionally, ongoing efforts to increase awareness regarding the health implications of omega-3 deficiency are further boosting market expansion. For example, in August 2024, NIPN-Ethiopia organized a seminar highlighting the potential of producing Omega-3-rich meat and eggs through feed formulations to fill nutritional gaps sustainably.Meanwhile, the vitamins segment is set to witness the fastest growth in the global fortified eggs industry owing to the rising prevalence of vitamin deficiencies fueling the need for fortified eggs in addressing nutritional gaps.

Whereas the vitamins segment is drawing steady business in the global fortified eggs market attributed to the increasing consumer acceptance of functional and premium eggs. The growing adoption of holistic nutrition and clean-label foods have contributed to the rising demand for vitamin-enriched eggs such as A, D, B-complex, and E. Retailers, wellness brands, and e-commerce platforms are proactively marketing these products with clear health claims, impacting consumer confidence. For instance, in December 2024, CIC launched Besto Omega 3 Eggs in Sri Lanka, fortified via vegetarian feed with elevated levels of Omega-3, Vitamin A, D3, B9, and E, reflecting how premium offerings tailored to modern health demands are proplling the market growth.

By application, food processing application segment captures the largest market share

The food processing segment is a leading driver in the global fortified eggs market, growing at a robust CAGR of 10.8%. Rapid urbanization is fueling increased consumption of processed meat, and other convenient food options as more people shift to convenient and nutritious food options. For example, in India, around 35 percent of the population lives in urban areas, a figure expected to reach 50% by 2047, signaling the rising demand for processed and fortified products. Additionally, fortified eggs are highly preferred in baked goods, ready-to-eat meals, and nutrient-enhanced formulations. Health awareness and stricter food safety regulations further boost fortified egg adoption in food processing worldwide.On the other hand, the food service segment is the fastest growing application segment in the global fortified eggs market attributed to the fast-expanding food service sector. For instance, as per the US Department of Agriculture, the sales from foodservice outlets reached USD 1.54 trillion in 2024, with both full-service and limited-service establishments contributing nearly equally. This highlights the potential for increasing use of fortified eggs for preparation of nutrient-rich meals. Ongoing trends like clean eating and functional foods have pushed consumers to make healthy choices, surging the demand for ingredients like fortified eggs that boost nutritional value. Moreover, institutional food services such as hospitals and schools are increasingly including fortified eggs to improve diet quality for vulnerable populations.

Global Fortified Eggs Market Regional Analysis

By region, North America leads the global fortified eggs market growth

North America holds the dominant share in the global fortified eggs market growth due to the growing consumer preference for high-potency, non-fish alternatives. This, in turn, has pushed market leaders to develop clean-label and fortified food innovations. For instance, in October 2023, DSM-Firmenich launched life’s®OMEGA O3020 in North America, the first single-source algal omega- 3 with a natural EPA:DHA ratio and double the potency of fish oil.A major boost came in January 2025, when the U.S. Food and Drug Administration officially recognized eggs as a "healthy food" under its new guidance. This landmark decision validated the nutritional value of eggs in supporting overall wellness, further providing multiple market growth opportunities.

The MEA region is experiencing the fastest growth in global fortified eggs industry at 9.8% CAGR through 2034 attributed to the rising consumer demand for functional foods that support heart, brain, and immune health. In addition to this, food producers are investing in nutrition-led innovation by incorporating sustainable, plant-based feed solutions to naturally enrich eggs with nutrients like Omega-3 DHA. Hence, the dual focus on consumer wellness and clean-label product development is fueling the consumption of fortified eggs across the region. To cite an instance, in April 2023 Humanativ and Tanmiah Food Company partnered to launch Omega-3 enriched poultry products in Saudi Arabia.

Competitive Landscape

Prominent companies operating in the global fortified eggs market include Burnbrae Farms Limited, Eggland’s Best, LLC, Cal-Maine Foods, Inc., Farm Pride, Wilcox Family Farms, Organic Valley, Nutri Group Inc., and other emerging players. These firms are making efforts to meet the escalating consumer demand for nutrient-rich and functional foods. Additionally, several companies are focused on creating brand trust and driving innovation in organic, sustainable, and ethically sourced products. This aligns well with evolving dietary preferences and expands their market reach across retail and foodservice channels.Strategically, some companies are making massive investments in feed formulations advancements, sustainable farming practices, and are striving to achieve product certifications to differentiate their fortified egg offerings. Furthermore, by carrying out marketing efforts focused on wellness and eco-conscious production, fortified eggs are gaining traction across growing consumer segments. Also, partnerships with retailers and distributors improve accessibility and shelf presence, further strengthening the foothold of these market participants in both domestic and export markets.

Burnbrae Farms Limited

Founded in 1940, Burnbrae Farms Limited is headquartered in Lyn, Ontario, and Canada. The company offers a wide variety of shell eggs, liquid eggs, and hard-boiled egg products. The enterprise significantly contributes to the global fortified eggs market by positioning itself as a leading supplier of Omega-3 enriched and vitamin-enhanced eggs.Eggland’s Best, LLC

Eggland’s Best, LLC was established in 1992 and is based in New Jersey, USA. It is known for its premium eggs enriched with Omega-3, vitamin D, and other nutrients. Throughout the years, a firm has emerged as a pioneer in the fortified egg space, widely recognized for setting industry standards in nutrition and taste.Cal-Maine Foods, Inc

Cal-Maine Foods, Inc., based in the USA, is the largest producer and distributor of fresh shell eggs in the U.S. Founded in 1969, it offers both conventional and specialty eggs and has its specialty lines such as Eggland’s Best and Farmhouse Eggs. Additionally, the company is significantly investing in developing Omega-3 enriched eggs and extended-shelf-life liquid egg products through acquisitions and R&D.Farm Pride

Farm Pride is an Australia based supplier of fresh, liquid, and nutrient-rich egg products in the Australian egg market. The company supports fortified egg innovation through its Omega-3 enriched offerings aimed at health-focused consumers.Other players in the global fortified eggs market include Wilcox Family Farms, Organic Valley, Nutri Group Inc., and others.

Key Highlights of the global fortified eggs market:

- Historical performance analysis and accurate market forecasts through 2034

- Insightful overview of product innovations, including plant-based and omega-3 enriched offerings

- In-depth competitive landscape featuring key domestic and international fortified egg producers

- Regional analysis highlighting emerging economies and market hotspots

- Investment-focused outlook supported by data-driven insights on revenue potential and growth.

Table of Contents

Companies Mentioned

- Burnbrae Farms Limited

- Eggland’s Best, LLC

- Cal-Maine Foods, Inc.

- Farm Pride

- Wilcox Family Farms

- Organic Valley

- Nutri Group Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 459.6 Million |

| Forecasted Market Value ( USD | $ 1170 Million |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |