Key Market Trends and Insights:

- By raw material, wood is expected to grow at a CAGR of 6.3% over the forecast period, driven by the increasing preference for natural aesthetics.

- By distribution channel, online category is set to record the fastest growth at 6.5% CAGR, due to increased preference for online shopping.

- By type, custom kitchen cabinets are gaining significant traction for their increasing use in premium homes.

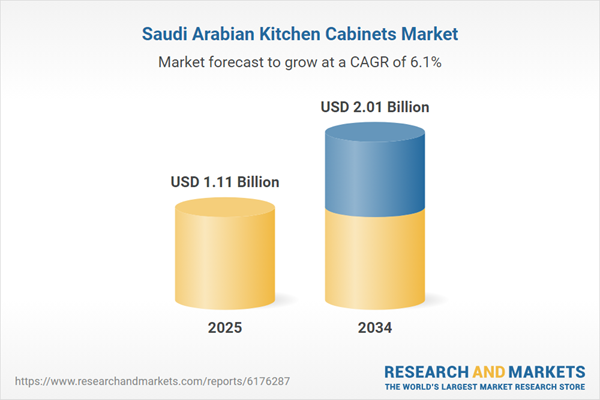

Market Size & Forecast:

- Market Size in 2024: USD 1.11 billion

- Projected Market Size in 2034: USD 2.01 billion

- CAGR from 2025-2034: 6.10%

As new homeowners increasingly invest in kitchen set ups that offer functionality, and space efficiency, the demand for kitchen cabinets is rising. In addition, this shift is also influencing the interior fit-out market and prompting suppliers operating in the Saudi Arabia kitchen cabinet market to develop flexible and innovative cabinetry options. Apart from this, the kingdom also plans to construct more than 1 million homes and develop retail and office spaces spread across millions of square meters by the end of 2030. These large-scale projects have surged the need for high-quality kitchen cabinets that are tailor made for a variety of architectural styles and are as per the consumers' preferences.

Moreover, Real Estate General Authority of Saudi Arabia estimates that the construction market is set to reach USD 101.62 billion by 2029, demonstrating a compound annual growth rate of 8% from the year 2024. This growth in the construction sector is resulting in a high demand for kitchen cabinets and interior solutions, especially modular and semi-custom cabinets. Developers prefer these options due to their cost-effectiveness and faster installation, in turn, boosting the Saudi Arabia kitchen cabinet market growth.

Description

Value

Base Year

USD Million

2024

Historical Period

USD Million

2018-2024

Forecast Period

USD Million

2025-2034

Market Size 2024

USD Million

1113.58

Market Size 2034

USD Million

2013.15

CAGR 2018-2024

Percentage

XX%CAGR 2025-2034

Percentage

6.10%6.3%

6.5%

Key Trends and Recent Developments

July 2025

Home Center launched Home Centre Collective, a live performance platform that transformed its retail spaces across Saudi Arabia and the UAE into cultural hubs. The strategy was to combine retail with live artistry, while company exhibited itself as a cultural enabler and tapped into the Saudi market by influencing demand for more design forward interiors.April 2025

Tamimi PEB, a real estate and construction company based in Saudi Arabia, announced its shift into the permanent modular construction after receiving BOPAS accreditation and the com. With this move, the company intends to support the rising need for faster, high-quality building solutions, including offsite-manufactured kitchen pods.September 2024

ZBOM opened its new store in Riyadh, Saudi Arabia, at the Al Takhassousi, Al Olaya location. With this expansion, the company strengthened its global presence and demonstrated its dedication to offering home furnishing solutions globally.May 2023

Valcucine, a prominent Italian luxury kitchen brand, introduced Riciclantica, claimed to be the world’s lightest and slimmest cabinet door. The product was launched globally, including in the Middle East as a move to address the rising demand for high-tech, customizable kitchen designs in markets like Saudi Arabia.Rapid urbanization fueling for premium kitchen cabinets

The rising disposable incomes and lifestyle upgrades among the expanding middle-class population in the kingdom is fueling the demand for stylish kitchen cabinets across households. As per estimates by the UN-Habitat, cities in Saudi Arabia are urbanizing fast with the urban population set to skyrocket up to 97.6% by 2030. This number indicates the rapid urban shift contributing to the growing installation of high-end and customized modular kitchen cabinets that complements modern living standards, thereby propelling the Saudi Arabia kitchen cabinet industry.Drastically growing construction activities

The rapid expansion of construction activities initiated by the kingdom’s strategic plan for economic diversification and urban transformation under Vision 2030. Giga projects such as NEOM, The Red Sea Global, and Diriyah are creating demand for modern residential, commercial, and hospitality infrastructure, directly surging the need for high-quality and customizable kitchen cabinets. Saudi Arabia allocated construction contracts worth USD 215.4 during the period of 2020-2025, shedding light on the kingdom’s dedication to emerging as a global hub for trade and innovation. Additionally, the government support through incentives and foreign investment policies is attracting multinational companies into the Saudi Arabia kitchen cabinet market.Rapid expansion of tourism and hospitality sector

More than 100 million tourists visited Saudi Arabia in 2023, with the tourism spending reached USD 68 million. The government has set a goal to boost GDP contributions from the tourism sector to 10% by the end of 2030, which has surged the number of investments in the development of hotels and resorts leading to 275 projects and over 67,000 rooms in the construction pipeline. For instance, in January 2023, PIF established Al-Ula Development Company to begin the regional development with hospitality construction projects requiring kitchen cabinet installations. Furthermore, programs like Tourism Investment Enabler Program and e-vise scheme expansion are significantly contributing to the Saudi Arabia kitchen cabinet industry growth.Increasing preference for Ready-to-Assemble (RTA) and semi-custom cabinets

As urban housing demand surges and project timelines tighten, these options offer an ideal combination of affordability, efficiency, and design flexibility. RTA cabinets are particularly popular among cost-conscious homeowners and developers due to their easy transportation, quick assembly, and lower installation costs. Meanwhile, semi-custom solutions appeal to consumers seeking personalized aesthetics without the high cost of fully bespoke cabinetry. This shift reflects a broader trend in Saudi Arabia toward modular, modern living spaces that are both functional and visually appealing, especially in newly built apartments, villas, and hospitality projects fueled by the Vision 2030 urbanization push.Expansion of Organized Retail and E-Commerce Channels

Growing preference for online shopping through e-commerce channels and organized retail is significantly supporting the Saudi Arabia kitchen cabinet market growth. In 2024, the number of Saudi internet users engaging in e-commerce is reached 33.6 million, exhibiting a 42% surge from 2019. Local online platforms are witnessing notable growth, pushing global players like Amazon to foray into the market to benefit from business opportunities. This digital evolution has enabled kitchen cabinet manufacturers and retailers to exhibit their broader range of modular and customized solutions directly to end users, thereby increasing the sales of kitchen cabinets through online platforms.Saudi Arabia Kitchen Cabinet Industry Segmentation

The report titled “Saudi Arabia kitchen cabinets market report and forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Raw Material

- Wood

- Metal

- Others

Market Breakup by Type

- Ready-to-assemble (RTA) Kitchen Cabinets

- Stock Kitchen Cabinets

- Semi-custom Kitchen Cabinets

- Custom Kitchen Cabinets

Market Breakup by End Use

- Residential

- Commercial

Market Breakup by Distribution Channel

- Offline

- Online

Market Breakup by Region

- Makkah

- Riyadh

- Madinah

- Qassim

- Eastern Province

Saudi Arabia Kitchen Cabinets Market Share

By raw material, wood segment accounts for the largest market share

The wood segment holds the largest share in the Saudi Arabia kitchen cabinet market. Wood is a highly preferred raw material, mainly attributed to its aesthetic appeal, durability, and suitability for sustainable construction practices. Growing demand for eco-friendly interiors has led consumers and developers to prefer cabinets made from certified, responsibly sourced wood. The implementation of Standards and Quality Law and Product Safety Law, effective from November 2024, in Saudi Arabia have set standards for product safety, environmental, and quality standards. Such regulations are pushing manufacturers to adopt low-emission, recyclable materials like wood, thereby contributing to segment growth.On the other hand, metal kitchen cabinets are gaining steady traction attributed primarily to the increasing demand in urban housing developments. The surging number of high-rise apartments and compact residential units emerging in metropolitan areas have shifted the consumers' preference for sleek, functional, and space-efficient kitchen cabinet designs. Metal cabinets are mostly made from metals such as stainless steel and aluminum, known for their resistance to heat, moisture and corrosion, making them ideal for the climatic conditions in Saudi Arabia. Their minimalist, industrial aesthetic also appeals to younger, design-conscious homeowners seeking low-maintenance yet stylish interiors, which is propelling segment growth forward.

By type, custom kitchen cabinets hold the major share

With regards to type, the custom kitchen cabinets hold the major share in the Saudi Arabia kitchen cabinet market, primarily driven by rising demand for personalized and high-end interior solutions among affluent homeowners. As luxury housing projects and private villas continue to expand, particularly in cities like Riyadh and Jeddah, consumers are seeking cabinetry that reflects their individual style, spatial requirements, and functional needs. Custom cabinets allow complete design flexibility in a way that customers can choose their preferred material, color selection, layout and finish. This makes them highly desirable in premium settings, supported by higher disposable incomes and exposure to global design trends, resulting in notable segment growth.The ready-to-assemble (RTA) kitchen cabinets segment is the fastest-growing segment in the Saudi Arabia kitchen cabinet market, due to the increasing availability of affordable, space-saving, and easy-to-install kitchen cabinet solutions. Amid the ongoing growth of urban housing projects and compact apartments, middle-income homeowners and real estate developers are demanding RTA cabinets offering an ideal blend of cost-efficiency, modern design, and quick installation. Their flat-pack format reduces shipping and storage costs, making them attractive for large-scale housing developments and DIY consumers alike, thereby promoting overall market growth.

By end-use, residential segment captures the highest share

The residential segment captures the highest share in the Saudi Arabia kitchen cabinet market, primarily driven by changing lifestyle preferences and rising demand for modern, functional kitchen spaces. As families increasingly view kitchens as multi-functional hubs for cooking, dining, and socializing, the need for well-organized, aesthetically cohesive cabinetry has grown. Younger homeowners, in particular, are leaning toward modular and semi-custom cabinets that offer both convenience and style. Additionally, exposure to global design trends through social media and interior design platforms is influencing consumer choices, encouraging the adoption of sleek, personalized cabinetry solutions that enhance overall home value and appeal.The commercial segment is expected to demonstrate stable growth, supported by the expansion of office spaces, co-living developments, and retail establishments. As Saudi Arabia diversifies its economy and attracts foreign investment, new commercial construction is steadily rising, especially in urban centers like Riyadh and Jeddah. While the demand for kitchen cabinetry in commercial settings may not match the volume of residential projects, businesses increasingly require durable, space-saving, and easy-to-maintain kitchen solutions for employee breakrooms, staff kitchens, and co-working hubs. This steady stream of development contributes to consistent demand in the commercial segment, ensuring its continued, stable role in the overall market.

By distribution channel, offline segment dominates the market

The offline segment dominates the Saudi Arabia kitchen cabinet market, primarily due to strong consumer preference for physical product assessment and face-to-face consultations when making high-value purchases. Kitchen cabinets are an essential and long-term investment in home interiors, prompting buyers to prioritize in-store experiences where they can evaluate material quality, design, durability, and color combinations in real-time. Retail showrooms and home improvement outlets offer personalized assistance, design mock-ups, and post-sale services that build trust and confidence among customers. This channel is especially preferred for custom and premium cabinetry purchases, where tactile verification and expert advice are crucial. Despite growing digital alternatives, the offline segment continues to lead due to its tangible, service-rich experience that appeals to a wide range of Saudi consumers.The online distribution channel is recording substantial revenue in the Saudi Arabia kitchen cabinet industry, resulting from the presence of a robust digital infrastructure in the Kingdom. The rate of smartphone penetration in Saudi Arabia is 97% and around 72% of the adult population own bank accounts, reflecting the consumers’ comfort with online shopping. Moreover, the availability of a wide variety of kitchen cabinet styles, virtual showrooms, and convenience of home-delivery is appealing to tech-savvy and younger buyers. Besides this, growing consumer trust in online payment systems and government efforts to boost digital commerce are further fueling the segment's growth.

Saudi Arabia Kitchen Cabinets Market Regional Analysis

Riyadh city saw completion of 157,000 new residential units in 2023, a 45 % increase over 2022, as reported by the Riyadh Development Authority, which is directly tied to Vision 2030 housing targets . This surge in new housing is driving strong demand for kitchen cabinets since virtually all modern homes include fitted kitchens. Builders increasingly specify custom-cabinetry to meet rising expectations from first-time buyers supported by government-backed Sakani homeownership programs.In Makkah, the Masar Destination megaproject, led by the Public Investment Fund, is advancing urban development, which is targeting expansion of pilgrim accommodation capacity ahead of the 2030 Umrah and Hajj goals . This government-led housing and hospitality surge has translated into a notable rise in modular kitchen cabinet installations within serviced guest units near Masjid al-Haram, thus bolstering the Saudi Arabia kitchen cabinets market revenues. Developers prefer compact, durable cabinetry suitable for high-turnover pilgrim lodging.

Competitive Landscape

The Saudi Arabia kitchen cabinets market comprises leading firms such as Inter IKEA Systems B.V., Oakcraft, PA Home, ZBOM, Al Kuhaimi Wood Industries, Alkhaleejion Kitchens, and others. To strengthen their foothold in the Saudi Arabian kitchen cabinets market, companies are increasingly focusing on localization, modular designs, and digital presence. Tailoring products to suit regional aesthetics, preferences, and spatial needs has become a key strategy. Many players are expanding their distribution through showrooms and online platforms, while also offering customization and design consultation services. Partnerships with real estate developers and interior contractors are helping brands tap into large-scale residential and commercial projects.Sustainability and innovation are emerging as major competitive levers. Manufacturers are adopting eco-friendly materials, energy-efficient production processes, and ergonomic layouts to cater to evolving consumer expectations. Smart storage solutions, soft-close systems, and tech-integrated cabinetry are becoming popular among premium buyers. In response to rising competition, firms are also boosting investments in marketing, design technology, and after-sales support to improve customer satisfaction and brand loyalty in a rapidly evolving and design-conscious market.

Inter IKEA Systems B.V.

Inter IKEA Systems B.V., established in the Netherlands, is the global franchisor of the IKEA Concept. The organization oversees brand development, design, and supply chain management across IKEA stores worldwide. It enables franchisees to operate stores under uniform brand and operational standards.

Oakcraft

Oakcraft, a U.S.-based custom cabinetry producer, is reputed for its premium, handcrafted wood cabinets designed especially for residential and commercial spaces. By combining traditional craftsmanship with modern production techniques, the company offers personalized, high-quality storage solutions.PA Home

PA Home is a leading Chinese furniture business specializing in creation of ready-to-assemble (RTA) furniture. It operates across international markets and offers a wide range of home furniture products created as per modern aesthetics, modularity, and cost efficiency.Al Kuhaimi Wood Industries

Al Kuhaimi Wood Industries, is a leading firm based in the Saudi Arabia kitchen cabinet market which manufactures high-quality wood-based products, including doors, wardrobes, and custom joinery. The company serves residential, commercial, and institutional clients across the Middle East, with a specialization in fire-rated and security wood doors.Other players in the Saudi Arabia kitchen cabinets market include ZBOM, and Alkhaleejion Kitchens, among others.

Key Highlights of the Saudi Arabia Kitchen Cabinets Market Report:

- Historical performance and accurate forecasts through 2034.

- Insights into product innovations and design trends shaping consumer preferences.

- In-depth competitive landscape profiling leading domestic and international cabinet manufacturers.

- Regional analysis identifying emerging demand hubs and growth opportunities across Saudi Arabia.

- Investment-focused outlook supported by data on construction activity, housing trends, and renovation spending.

Table of Contents

Companies Mentioned

- Inter IKEA Systems B.V.

- Oakcraft

- PA Home

- ZBOM

- Al Kuhaimi Wood Industries

- Alkhaleejion Kitchens

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.11 Billion |

| Forecasted Market Value ( USD | $ 2.01 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 6 |