The rising integration of pretzels into automated vending and micro-market systems is propelling the market development. Corporate offices, hospitals, and universities increasingly demand shelf-stable, portioned snacks for unattended retail. Pretzels, especially the filled, flavoured, or protein-fortified ones, meet these needs with versatility and minimal spoilage. Manufacturers are innovating with vending-optimized packaging and smart inventory solutions, making pretzels an ideal fit for tech-enabled, high-footfall environments.

Consumers view pretzels as premium gourmet product rather than salty snacks, boosting heavy demand in the pretzel market. Due to growing urbanization, industrialization, and hectic lifestyles, customers prefer ready-to-eat foods that are portable. In 2024, USDA’s Global Agricultural Trade System recorded a total of USD 4.35 billion in exports of bakery and snack goods, especially in North America and Western Europe. Pretzels are also consumed with plant-based cheese dips, craft mustard fillings, and CBD-infused coatings.

Supported by surging demand for clean-label and health-focused snacks, market players are also finding favour among millennials and Gen Z. for instance, Germany’s Federal Centre for Nutrition noted that in 2023, almost 30% of snack consumers aged 18-34 years preferred baked over fried snacks. Startups and legacy brands alike are responding to this trend by creating air-baked, high-protein variants, accelerating pretzel consumption. In the United States, pretzels fortified with pea protein and quinoa flour are appearing in co-branded athlete nutrition packs as well.

Meanwhile, the European Commission’s Smart Specialization initiative has catalysed innovation in food processing, enabling SMEs in Italy and France to scale local pretzel production with technological upgrades. Production facilities are also leveraging AI for sorting and flavour consistency, which further indicates the impact of deep technology in the food sector.

Furthermore, due to health issues such as obesity and overweight, consumers are choosing nutritious snack options. Firms are entering new markets and introducing new products based on consumer demand. For example, in August 2021, Pecan Deluxe introduced new pretzel bits. The new crushed pretzel bits come in three varieties including ordinary uncoated, milk chocolate coated, and barrier coated with cocoa butter.

Moreover, the global shift toward sustainable snacking is reshaping the overall pretzel market dynamics. B2B stakeholders are developing protein-packed mini pretzels, freeze-dried formats, and compostable wrappers extending shelf life without chemical preservatives. These developments not only meet the rising eco-conscious demand but also improve inventory turnover and cross-border shipping efficiency.

Key Trends and Recent Developments

April 2025

J&J food Foods, a food industry pioneer and manufacturer of SUPERPRETZEL launched a new recipe for National Soft Pretzel Day with a softer texture and a richer, more robust flavour. This development underlines the push for texture and flavour differentiation in the soft pretzel category, catering to changing B2B demand in foodservice and quick-serve restaurants.April 2025

Oreo developed a new limited-edition flavour: Chocolate Covered Pretzel. This innovation is Oreo's first foray into blending sweet and savoury flavours. This latest innovation consists of crispy, pretzel-flavoured biscuits gently coated with salt, combined with a creamy, chocolate crème centre. This new edition reflects growing B2B interest in sweet-savoury hybrid formats, which are resonating in co-branded snack lines and seasonal retail placements.April 2025

MCH Group partnered with Bits & Pretzels, Europe's largest entrepreneurs' festival, to launch the health.tech | global summit. This inaugural event is scheduled to take place from March 3-5, 2026, in Basel, Switzerland. The summit aims to establish Basel as a leading hub for health technology innovation, bringing together startups, established companies, scientists, policymakers, and investors from around the world. Such a collaboration enhances the cultural visibility of pretzels in premium networking and business events, indirectly supporting brand positioning and premiumisation in European B2B markets.March 2025

Utz®, a popular salty snack brand in the United States, expanded its Mixed Minis Pretzel range to include Sour Cream & Onion flavour. The new flavour is inspired by the brand's best-selling flavoured potato chip and adds a robust taste to Utz's crispy, bite-sized pretzels. This launch indicates rising innovation in flavour-forward snack formats, creating opportunities for wholesalers and institutional buyers seeking variety in compact, portioned SKUs.Growing Premiumization of Pretzels

A growing number of boutique bakeries and F&B chains are offering gourmet pretzels, especially in urban metro cities, accelerating the demand in the pretzel market. These products, ranging from truffle oil-infused twists to sourdough-stuffed creations, reposition pretzels as a premium snack. Even global foodservice giants are leveraging this emerging trend by introducing artisanal pretzel lines in airport lounges, luxury hotels, and quick-service restaurant menus, capitalizing on high-margin snack occasions. Additionally, seasonal limited-edition flavours are helping brands build exclusivity and consumer excitement, strengthening B2B supply partnerships.Health-Driven Reformulations

Low-carb, high-protein, and gluten-free variants are transforming the pretzel market trends and dynamics. The United States FDA’s “Healthy Labelling” revision in 2023 spurred a wave of reformulated snacks to meet sodium and sugar criteria. Pretzels, with their low-fat base, are ideal for enhancement using alternative grains and protein isolates. For instance, KIND Snacks launched a pretzel protein bar in 2024. Additionally, chickpea flour, quinoa, and lentil blends are being used in product formulations, aligning with clean-label preferences. This evolution is drawing attention from sports nutrition brands and hospital snack programmes looking for healthier, functional alternatives.Automation and Smart Baking Facilities

European bakeries and North American snack plants are deploying robotics and AI to improve quality consistency. For example, Germany’s Fraunhofer Institute partnered with a Bavarian pretzel maker to pilot AI-based crust monitoring systems, reducing product wastage. Smart ovens with IoT sensors now adjust bake time and moisture levels in real-time, leading to enhanced texture control in mass production.Localized Flavour Innovation

Companies are tailoring pretzel flavours to suit regional palates, stimulating the pretzel market growth. In Japan, soy-wasabi pretzels are trending; in India, masala-coated variants are growing popular in Tier 1 cities. According to industry reports, over 40% of new pretzel launches in Asia in 2024 featured indigenous flavours. Such customization strategies can help brands to scale faster in local markets while maintaining a familiar product format. Additionally, Southeast Asian markets are experimenting with pandan, lemongrass, and chili-lime flavours. This trend is boosting sales and opening up new export opportunities for regional manufacturers.Sustainable Packaging and ESG Integration

With rising ESG pressures, pretzel brands are innovating packaging solutions. For example, Campbell launched fully recyclable pretzel pouches in 2024, saving 120 tons of plastic annually. Startups like CrunchGreen are using seaweed-based wrappers in the snack segment. Meanwhile, Germany-based PackNatur is piloting compostable cellulose nets for multi-pack pretzels, targeting large retailers. These packaging advancements are enhancing shelf appeal and helping brands meet retailer sustainability.Global Pretzel Industry Segmentation

The report titled “Global Pretzel Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Hard

- Soft

- Browser based

Market Breakup by Packaging Type

- Bags

- Boxes

- Containers

- Others

Market Breakup by Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Channels

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Pretzel Market Share

By Type, Hard Pretzels Account for the Dominant Share of the Market

Hard pretzels are taking the charge in terms of the overall pretzel market development due to their longer shelf life, which makes them ideal for exports and online retail. Pretzels have become a staple in North American and European snacking culture. With rising demand for protein-rich, shelf-stable snacks, hard pretzels have also appealed to fitness communities. Innovations like keto-certified hard twists and high-fibre sticks are finding place in wellness aisles. Hard pretzels can also be made more versatile in terms of seasoning and coatings, enabling brands to introduce formats like chocolate-dipped or yogurt-glazed variants that appeal to snackers across all age groups.Soft pretzels are gaining traction in QSRs and bakery chains globally. Unlike hard pretzels, soft ones are often sold fresh, making them ideal for experiential snacking. Buns and slides are now trending in hybrid formats, even in fast-casual menus, accelerating the pretzel demand forecast. Chains like Auntie Anne’s and Wetzel’s Pretzels are experimenting with filled variants, like jalapeno-cheddar or pizza-stuffed knots. Flash-freezing technology has further enabled longer shelf lives for soft pretzels, enhancing their appeal in cross-border trade and online platforms.

By Packaging Type, Bags Hold the Leading Position in the Market

Bags dominate the market due to their cost-efficiency, portability, and compatibility with automation systems. Flexible packaging allows for portion control, resealable features, and extended shelf life, which appeals strongly to both retailers and consumers. As per the pretzel market analysis, over 55% of global pretzels were sold in bag formats. Moreover, major players like Utz and GoTo Foods have invested in mono-material, recyclable bag solutions to align with new European Union and United States plastic directives. For B2B buyers, especially large-scale distributors and supermarkets, bags offer better stacking efficiency and branding flexibility. Brands are also using QR-enabled bags to provide nutritional transparency, helping them meet evolving health-conscious consumer demand across North America and Europe.Containers are emerging as the fastest-growing packaging format driven by foodservice and club-store channels. These rigid packages, ranging from PET jars to biodegradable tubs, offer visual appeal and better protection against breakage. Bulk-buying trends, especially post-pandemic, have further fuelled their demand. Startups rolling out reusable container subscription models for office snacking and vending machine replenishment, is an emerging trend in the pretzel market. Additionally, B2B partners like stadiums, universities, and airlines are adopting portion-controlled container packs to meet hygiene and portion-consistency standards. Innovation in reusable and smart-lid technology is also attracting institutional buyers looking to reduce waste and boost brand engagement.

By Distribution Channel, Hypermarkets/Supermarkets Account for the Dominant Share of the Industry

Hypermarkets remain the go-to distribution channels, especially in North American and European markets. These outlets offer space for brand visibility and allow bundling promotions, boosting high-volume sales. Shelf-ready pretzel displays and private-label brand collaborations are driving impulse purchases among consumers. Supermarkets are also introducing QR-code-based snack pairing suggestions, placing pretzels with wines or dips to enhance shopper engagement.With the ongoing demand for subscription snack boxes, ecommerce channels like Thrive Market and SnackNation have rapidly boosted the pretzel market value. Direct-to-consumer startups like Eastern Twist are even leveraging Instagram and TikTok to attract consumers. Brands are also offering customization, wherein consumers can pick flavours, textures, and packaging styles. Amazon’s entry into private-label pretzels under its Happy Belly brand has triggered pricing innovations, further fuelling growth.

Global Pretzel Market Regional Analysis

By Region, North America Accounts for the Biggest Share of the Market

The pretzel market in North America, particularly the United States, leads in consumption and product innovation. The region has a deep-rooted pretzel culture, supported by robust snack infrastructure and aggressive retail distribution. In 2024, USDA reported pretzel production facilities grew by 11%, with expansions in Pennsylvania and Ohio. The emergence of gourmet pretzel cafes and QSR chains further amplified this growth.Asia Pacific witnesses explosive pretzel market growth, powered by young consumer bases in China, South Korea, and Japan adopting Western snacking habits. Pretzels are now appearing in lifestyle cafes and convenience store chains like FamilyMart and 7-Eleven. Cross-border e-commerce platforms such as Tmall Global are featuring premium United States-based pretzel brands with locally relevant marketing. Health-oriented baked snacks are resonating well in this region, and pretzels are being rebranded as “baked bites” to suit local consumer preferences.

Competitive Landscape

The pretzel market players are focusing on co-manufacturing, D2C expansion, and ESG goals. With rising demand for personalized and health-forward snacks, companies are investing in clean-label R&D and AI-powered baking systems. There is also an expanding scope for premium and gourmet formats, especially in urban and travel retail.Moreover, pretzel companies can find opportunities in aligning with institutional channels like airlines and universities where large-volume contracts offer stability. Furthermore, collaborations with fitness influencers and health apps to promote fortified pretzel snacks are emerging as high-return strategies. Smaller artisanal players are tapping into online micro-distribution, bypassing traditional supply chains altogether. Additionally, smart inventory tools and blockchain-backed traceability solutions are being piloted to improve transparency and reduce shrinkage across logistics networks.

Campbell Soup Company

Established in 1869 and headquartered in Camden, New Jersey, Campbell is a major player in the snack segment through its Snyder’s of Hanover brand. The company focuses on innovation via flavour fusion and has invested in recyclable packaging technology to reduce emissions across production lines.GoTo Foods LLC

Founded in 1934 and based in Georgia, United States, GoTo Foods is a D2C disruptor specializing in gluten-free soft pretzels. The company’s AI-assisted flavour testing has shortened product launch cycles and enabled real-time feedback-based product iterations.The Hershey Company

Headquartered in Hershey, Pennsylvania, and founded in 1894, the Hershey Company entered the pretzel market via its chocolate-dipped and snack mix range. The company’s acquisition of Amplify Snack Brands helped it expand its premium salty snack portfolio substantially.Utz Quality Foods, LLC

Founded in 1921 and based in Hanover, Pennsylvania, Utz operates a massive national network focused on mass-market pretzels and snack blends. Its Smart Growth plan includes acquiring local pretzel producers to scale cost-efficient regional operations.Other key players in the market are Conagra Brands, Inc., Herr's, BRETZEL BURGARD SAS, Pepsico, Inc., East Shore Specialty Foods, Inc., and Wetzel’s Pretzels, LLC, among others.

Key Highlights of the Global Pretzel Market Report:

- Historical performance and accurate forecasts through 2034, enabling procurement and portfolio planning across B2B snack distribution.

- Insights into product innovations like multi-grain twisted sticks, filled pretzel bites, and low-sodium, allergen-free formulations.

- In-depth competitive landscape profiling private-label snack makers, OEM bakery partners, and regional craft brands scaling via contract manufacturing.

- Regional analysis identifying airport concessionaires, school canteens, and QSR chains in the United States, Germany, and the UAE as high-volume demand nodes.

- Investment-focused outlook supported by retail scanner data, signalling growing traction in ready-to-bake and gourmet dipped pretzel segments.

Table of Contents

Companies Mentioned

- Campbell Soup Company

- GoTo Foods LLC

- The Hershey Company

- Utz Quality Foods, LLC

- Conagra Brands, Inc.

- Herr's

- BRETZEL BURGARD SAS

- Pepsico, Inc.

- East Shore Specialty Foods, Inc.

- Wetzel’s Pretzels, LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 153 |

| Published | October 2025 |

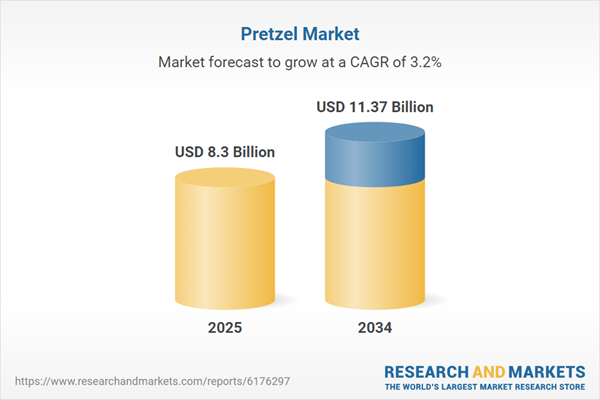

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 11.37 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |