Key Market Trends and Insights:

- The North skin care market dominated the market in 2024 and is projected to grow at a CAGR of 7.9% over the forecast period.

- By distribution channel, supermarkets and hypermarkets are projected to witness a CAGR of 6.9% over the forecast period.

- By type, the body care segment is expected to register 7.9% CAGR over the forecast period with due to rising health and wellness awareness.

Market Size & Forecast:

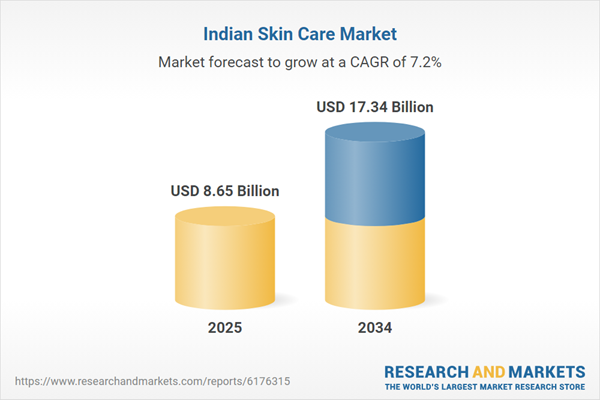

- Market Size in 2024: USD 8.65 Billion

- Projected Market Size in 2034: USD 17.34 Billion

- CAGR from 2025-2034: 7.20%

- Fastest-Growing Regional Market: North India

The India skin care market value is rising with increased internet access and disposable incomes are unlocking potential in smaller cities and rural India. As per DataReportal, there were 751.5 million internet users during the start of 2024 in India. E commerce platforms are reaching new audiences with affordable skincare, leading to significant growth outside metros. Platforms like Nykaa, Amazon, Meesho, and Purplle have tailored their interfaces and logistics to cater to vernacular languages and cash-on-delivery preferences, enhancing trust and accessibility.

The influence of K-beauty and J-beauty is surging the popularity of serums, ampoules, gel-based moisturizers, sleeping masks, and double cleansing rituals among Indian consumers. India skin care brands are increasingly incorporating snail mucin, fermented rice water, ceramides, and hyaluronic acid into their formulations. In December 2024, Nykaa exclusively launched South Korea’s skincare label Numbuzin in India (30-item range), offering numbered, targeted, K-beauty routines via its platform. Local players are also launching hydration-centric products inspired by Korean layering techniques.

Key Trends and Recent Developments

July 2025

Luxury botanical skincare brand Chantecaille, entered the Indian market via a strategic partnership with Luxasia, Asia’s leading luxury beauty distributor. Available via Nykaa, Tira, and SS Beauty, the launch features curated flagship products backed by an online campaign supported by influencer collaborations.May 2025

Chennai startup Aestura partnered exclusively with Nykaa to launch in India. This helped the brand to launch its flagship Atobarrier 365 range, including cleanser, hydro essence, lotion, cream, and soothing cream on Nykaa’s app, website, and retail, boosting the India skin care market revenue.October 2024

Bayer’s Consumer Health division introduced Bepanthen in India, backed by a dermatology survey revealing that almost 1 in 2 Indians experience dry skin. This fragrance-free, paraben-free range, enriched with Pro-Vitamin B5 and prebiotics offers moisturizers and cleansers for sensitive, eczema-prone skin.August 2023

Australian clinical skincare brand Skin O₂ partnered with Baccarose, India’s foremost luxury beauty distributor. This strategic alliance positions Skin O₂ in elite Indian retail segments alongside brands like Shiseido and Armani, leveraging Baccarose’s extensive distribution network.Ingredient-Led, Dermatologist-Inspired Products

The India skin care market is gaining traction with consumers increasingly demanding ingredient-led and dermatologist-inspired products. As a result, brands are focusing on transparent labelling, clinical testing, pH-balanced formulas, and science-backed claims. In May 2025, Lotus Herbals introduced Lotus Derma Botanics, India’s first "dermaceutical" brand blending clinical actives with botanical extracts.Growth in Men’s Skincare & Grooming

The male grooming segment in India is transitioning beyond shaving kits, with growing demand for cleansers, anti-acne treatments, and anti-ageing skincare. Brands are launching dedicated men’s lines to capitalize on rising awareness among men about skin health. For instance, in December 2023, premium men’s grooming brand Bravado, a launched in India by introducing 23 eco-friendly, plant-based grooming products.Personalization & Skin-Tech Integration

AI-driven skin diagnostics, virtual try-ons, and AR/VR tools are transforming product discovery and personalization in the India skin care industry. In June 2025, Taiwan-based skincare-tech platform Skin Beauty Pal launched in India with AI-powered skin analysis capable of diagnosing acne, pigmentation, wrinkles, and more with dermatologist-level precision. Consumers expect tailored routines based on individual skin needs. Virtual skin analysis and skin-tech platforms are enhancing engagement and conversion for brands.Innovation in Formats & Waterless Products

Consumers favour easy-to-use, multifunctional formats, such as serum-in-oil blends, waterless and hydration boosters. Sheet masks and stick masks offer mess-free application and targeted benefits, ideal for on-the-go use. In January 2025, Skinvest relaunched its signature product, the CEO Serum, with an upgraded formulation featuring 25 active ingredients. The trend toward waterless beauty is driven by sustainability, travel-friendliness, and potency.Rise of Clean, Vegan & Cruelty-Free Beauty

Awareness of ingredient safety and environmental impact is accelerating the clean, vegan, and cruelty-free skin care demand in India. Brands offering toxin-free, ethically produced products with sustainable packaging are winning preference, especially among millennials and Gen Z. In April 2024, Bengaluru-based AFFOREST launched India’s first-ever Jackfruit Skincare Range, featuring a foaming cleanser, gel crème moisturizer, under-eye crème, and bedtime serum.India Skin Care Industry Segmentation

The report titled “India Skin Care Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Facial Care

- Body Care

- Others

Market Breakup by Product Type

- Face Creams and Moisturisers

- Cleansers and Face Wash

- Face Masks and Packs

- Body Creams and Moisturisers

- Sunscreen

- Body Wash

- Others

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Market Breakup by Region

- North India

- East India

- South India

- West India

India Skin Care Market Share

Body Care to Lead in the Market with Innovations

The body care segment is growing steadily in the India skin care industry due to rising health and wellness awareness. Products include body lotions, scrubs, washes, oils, and specialized treatments, such as stretch mark creams. Demand is driven by consumers wanting all-over hydration and smooth skin, especially with increasing use of natural and organic ingredients. Brands have made strides here, tapping into Ayurveda-inspired formulations. In July 2025, Apollo AyurVAID rolled out its first line of clinically validated Ayurveda products, including body creams, foot care, lip balm, and herbal soaps.Cleansers and Face Wash Leads the Market with Rise in Launches

Cleansers and face washes are a core part of every skincare routine in India, catering to a wide range of skin types and concerns. Popular products include Cetaphil Gentle Cleanser, Himalaya Neem Face Wash, and Minimalist Salicylic Acid Cleanser. Consumer interest in pH-balanced, sulfate-free, and dermatologically tested formulations is on the rise, especially among younger urban audiences. The category is also expanding with oil-based cleansers, foam formats, and double-cleansing routines influenced by Korean and Japanese beauty trends now gaining traction in Indian skincare.Face masks and packs are driving the India skin care market development due to their instant results and pampering appeal. In February 2025, Beauty by BiE launched its DND Overnight Mask to hydrate, repair, and rejuvenate skin overnight. Sheet masks have surged in popularity for offering hydration, glow, and anti-pigmentation benefits. Clay masks target oily and acne-prone skin. This segment is also growing rapidly, especially among Gen Z and working women who indulge in weekly skincare rituals.

Specialty Beauty Stores Leads the Market via Metro & Tier-1 Cities

Specialty beauty stores have become popular destinations for skincare discovery and experience-led purchases. These stores focus on premium and imported brands, offering curated selections, skin consultations, and product sampling. The environment is tailored for dermatologist-recommended and ingredient-focused brands, such as The Ordinary, Innisfree, Foxtale, and Plum. Specialty stores are primarily found in metros and tier-1 cities, serving skincare-savvy consumers who value guidance and variety.Online is the fastest-growing channel of the skin care market in India. Several platforms have revolutionized access to both Indian and international skincare brands. In July 2025, Anaaya Cosmetics partnered with Zepto to offer its clean, cruelty-free skincare products with 10-minute delivery across major Indian cities. Online platforms offer personalized recommendations, AI skin assessments, exclusive launches, and discounts. Brands like Minimalist, Dot & Key, and Earth Rhythm are D2C-first and thrive through e-commerce.

India Skin Care Market Regional Analysis

West India Leads the Skin Care Market Growth with Higher Incomes

West India, especially Mumbai, Pune, Ahmedabad, and Surat, has a mature and growing market driven by young working professionals, fashion-forward consumers, and high disposable incomes. The humid climate increases demand for lightweight, gel-based, and non-comedogenic skincare. Retail chains like Reliance Tira and Health & Glow are expanding aggressively in this region. In June 2024, Reliance Retail's beauty platform, Tira launched its first skincare brand Akind in Mumbai.South India skin care industry is witnessing rapid growth, particularly among IT professionals and urban millennials. The warm climate influences preferences for hydrating, non-sticky, and matte-finish products. Bengaluru is a hotbed for green beauty and ingredient-led D2C brands like Afforest and Suganda. The region is also a key market for cosmeceutical and dermatology-driven products, on account of the rising skin health awareness. South India’s adoption of modern skincare practices and e-commerce buying is further making it a high-potential region.

Competitive Landscape

Key players in the market are employing a mix of innovation, localization, and digital transformation to capture diverse consumer segments. Ingredient-led branding is a dominant strategy, with players highlighting actives like niacinamide, hyaluronic acid, and retinol to appeal to educated, efficacy-driven buyers. Simultaneously, Ayurveda and natural formulations continue to thrive, with brands like Kama Ayurveda and Forest Essentials catering to tradition-oriented consumers. Many are launching clinically backed and dermatologist-recommended lines to build trust.Digital-first and D2C models are accelerating growth, with companies leveraging e-commerce, influencer marketing, and AI-powered skin diagnostics to offer personalized solutions and convenient access. Regional brands are targeting Tier 2 and 3 markets with affordable SKUs, sachets, and vernacular content. Multinational brands entering India are partnering with local retailers like Nykaa, Tira, and Shopper’s Stop to build omnichannel presence. These moves are collectively helping in the growth of the India skin care market.

L'Oréal S.A

Founded in 1909 and headquartered in Clichy, France, L’Oréal is a global beauty leader known for L'Oréal Paris and Garnier. It has pioneered beauty tech with AI-based skin diagnostics and sustainable packaging. L’Oréal consistently ranks among top R&D spenders in cosmetics and champions inclusive, science-backed skincare.Estée Lauder Companies Inc.

Established in 1946 in New York City, Estée Lauder has grown into a luxury beauty powerhouse with brands like Clinique, MAC, and La Mer. Renowned for its premium skincare innovations and personalized beauty experiences, it was among the first to integrate virtual try-on and data-driven customization in high-end skincare.

Procter & Gamble Co

Procter & Gamble, founded in 1837 and headquartered in Cincinnati, the United States, owns major skincare brands like Olay and SK-II. This India skin care company excels in consumer-focused R&D, advancing tech like skin analysers and smart moisturizers.Beiersdorf AG

Founded in 1882 in Hamburg, Germany, Beiersdorf is best known for its iconic NIVEA brand. The company is recognized for its deep skincare science and focus on skin barrier health and its innovations include microbiome-supporting formulas and eco-conscious packaging.Other key players in the India skin care market report include L'Occitane International S.A., Groupe Clarins, Unilever Plc, Mountain Valley Springs India Private Limited (Forest Essentials), LVMH Moet Hennessy Louis Vuitton SE (Sephora), Lotus Herbals Pvt Ltd. and others.

Key Features of the India Skin Care Market Report:

- Comprehensive quantitative analysis of market size and growth forecasts to 2034.

- Segmentation by type, product type, distribution channel, and regional markets for detailed insights.

- Competitive landscape profiling major brands and their strategic initiatives.

- Consumer behaviour trends and preferences shaping product demand.

- Impact assessment of regulatory policies and economic factors on market dynamics.

- Inclusion of emerging trends such as clean beauty, Ayurveda, and technology integration.

Table of Contents

Companies Mentioned

- L'Oréal S.A

- Estee Lauder Companies Inc.

- Procter & Gamble Co.

- Beiersdorf AG

- L'Occitane International S.A.

- Groupe Clarins

- Unilever Plc

- Mountain Valley Springs India Private Limited (Forest Essentials)

- LVMH Moet Hennessy Louis Vuitton SE (Sephora)

- Lotus Herbals Pvt Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.65 Billion |

| Forecasted Market Value ( USD | $ 17.34 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |