Key Market Trends and Insights

- The Middle East and Africa region is estimated to grow with the highest CAGR of 3.03% through the forecast timeline.

- By form, pure magnesium (elementary magnesium) is set to grow at a CAGR of 3.42% during the forecast period.

- By type, secondary magnesian is expected to grow with the highest CAGR of 3.96% over the forecast period.

- The global magnesium industry by die-casting application category is expected to grow at 3.83% CAGR over the forecast period.

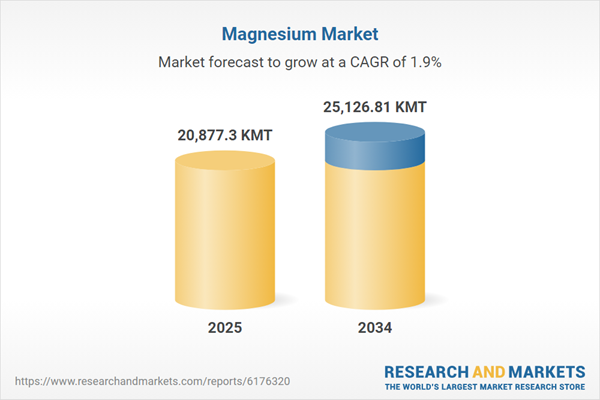

Market Size and Forecast

- Market Size in 2024: 20877.30 KMT

- Projected Market Size in 2034: 25126.81 KMT

- CAGR from 2025 to 2034: 1.87%

- Dominant Regional Market: Asia Pacific

A growing demand for agricultural production to meet the needs of an expanding population drives the use of magnesium in fertilisers. In February 2025, Grupa Azoty announced its plans to produce its new multi-component fertiliser, POLIFOSKA Multi S. The fertiliser is packed with readily soluble and plant-available nutrients, including nitrogen, phosphorus, potassium, calcium, magnesium, and sulfur.

Key Trends and Recent Developments

May 2025

Magrathea launched its next-generation magnesium chloride electrolyzer. The machine uses electricity to split magnesium salts to make magnesium metal, at its pilot facility in Oakland, California. The project strategically positions Magrathea’s technology to provide American companies with access to United Sttaes-based critical mineral supply chains amid shifting trade policies and export controls.December 2024

Baowu Magnesium Technology Co., Ltd. and Nanjing Estun Automation Co., Ltd. signed a Global New Quality Productivity Strategic Cooperation, and launched magnesium alloy robot products, creating a new blueprint for intelligent manufacturing. This collaboration showcases magnesium's expanding applications beyond automotive, reinforcing its importance in next-generation robotics and advanced industrial automation.March 2023

Latrobe Magnesium Limited chosen Samalaju Industrial Park in Sarawak, Malaysia, as the preferred site for its 100,000 tpa magnesium plant. A key advantage of this location is the availability of locally produced ferrosilicon, one of the project’s major reagent requirements.September 2022

China-based magnesium-alloy strip producer Youli commenced operations at its new strip-casting facility in Shandong. The plant is designed to manufacture hot-rolled strip ranging from 4 to 7 mm in thickness, with a mechanical capacity of up to 10 mm, and widths between 900 and 1,425 mm.Growing adoption of magnesium alloys in automobiles

The automotive industry is increasingly turning to magnesium alloys to reduce vehicle weight and improve energy and fuel efficiency. Leading manufacturers such as Audi, Daimler (Mercedes-Benz), Ford, Jaguar, Fiat, and Kia Motors have already substituted steel and aluminum with magnesium in several components. Applications include gearboxes, front-end and IP beams, steering columns, driver’s airbag housing, steering wheels, seat frames, and fuel tank covers.Expanding use of magnesium metal in titanium refinement

Sponge titanium is produced through the thermal reduction of titanium using magnesium metal, typically achieving a purity level of 99.1% to 99.7%. In 2023, China led global titanium sponge production, accounting for a share of 67% followed by Japan with 18% and Russia with 6%. Together, these three countries formed over 90% of the global sponge titanium production, driving magnesium market growth.Rising demand for wastewater treatment is driving the use of magnesium compounds

Magnesium is used in wastewater treatment primarily in the form of magnesium hydroxide, which helps neutralize acidic water and remove contaminants. It is effective in precipitating heavy metals and other harmful substances, aiding in the purification process. This makes magnesium a valuable resource for enhancing water quality and meeting environmental regulations. To meet the UN's water targets by 2030, global wastewater treatment capacity must grow by 8.56 billion cubic meters annually, supporting the demand for magnesium.The growing agricultural sector is opening new opportunities for market players

Magnesium compounds support the agricultural sector, with uses in soil remediation, wastewater treatment, and air pollution control. In livestock production, magnesium, mainly supplied as magnesium oxide, is essential for nutrition. Rising global agricultural output, which grew from USD 4.03 trillion in 2018 to USD 4.38 trillion in 2023, aids the demand for magnesium compounds.Advancements in lightweight electronics boosting magnesium demand

The consumer electronics industry is increasingly leveraging magnesium alloys for lightweight, durable casings in laptops, smartphones, cameras, and wearables. Magnesium's superior strength-to-weight ratio, electromagnetic shielding, and heat dissipation properties make it ideal for portable devices. As demand for compact, high-performance gadgets grows, especially in Asia-Pacific, magnesium usage in electronics is set to expand rapidly.Magnesium Industry Segmentation

The report titled “Magnesium Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Form

- Pure Magnesium (Elementary Magnesium)

- Market Breakup by Type Primary Magnesium Secondary Magnesium

- Market by Application Alloy Die Casting Steel Desulfurization Agent Titanium Refinement Others

- Magnesium Compound

- Market Breakup by Type Magnesium Oxide (MgO) Magnesium Chloride (MgCl₂) Magnesium Sulphate (MgSO₄) Magnesium Hydroxide [Mg(OH)₂]

- Market by Application Agriculture Steel Industry Glass Making Cement Industry Paper Industry Environmental Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Magnesium Market Share

Surging Demand for Magnesium Compounds in End-Use Markets

Magnesium oxide is increasingly deployed across the renewable energy sector for its performance-enhancing properties. In next-generation batteries, it serves as an efficiency enhancer for both lithium-ion and solid-state systems. For instance, the inclusion of 400 mg magnesium oxide additives in battery electrolytes improves thermal stability and ion conductivity, thereby extending battery life by up to 30%.In solar power applications, magnesium oxide is employed in the development of advanced coatings that increase light absorption by approximately 15%, enhancing overall efficiency. These innovations are particularly significant for countries striving to achieve net-zero emission targets while ensuring long-term grid stability and reliability.

The growing demand for magnesium compounds drives its production and aids the growth of the global magnesium market. In 2023, the global capacity for caustic calcined magnesia (CCM) was 10.5 million tonnes, dominated by China with a share of 75%. Further, the capacity for dead burned magnesia (DBM) was 11.3 million tonnes, of which 64% was located in China.

Rising Production of Primary Magnesium Contributes to Market Growth

The global primary magnesium industry has been witnessing steady growth, driven by rising demand across the automotive, aerospace, and electronic industry. In 2024, primary magnesium production reached around 1 million tonnes, marking an 11% year-on-year rise. Further, China is a leading primary magnesium producer globally. In 2023, the country’s primary magnesium production accounted for 86% of the global magnesium supply.The United States is a significant producer of secondary magnesium globally. In 2023, approximately 25,000 tonnes of secondary magnesium were recovered from old scrap and 75,000 tonnes from new scrap. Of the total secondary magnesium recovered, aluminum-based alloys accounted for about 52%, while magnesium-based castings, ingots, and other materials represented around 48%.

Die Casting Plays a Crucial Role in Driving the Demand for Pure Magnesium (Elementary Magnesium)

There is a rising demand for magnesium in die casting applications. In March 2021, Magellan Aerospace signed a 5-year renewal agreement with Avio Aero in Italy for the supply of magnesium and aluminum castings. Magnesium alloys possess exceptional strength-to-weight ratios and are upto to 70% lighter than stainless steel and a third lighter than aluminium. These are cost-effective, easy to work with, and possess the highest known damping capacity of any structural metal. These are widely used in automotive, defence, electronic, aerospace, biomedical, manufacturing, and green energy technologies. In the automotive industry specifically, the move towards electric and energy-efficient vehicles stimulates the demand for lightweight components, aiding the market growth.To meet this demand, in December 2024, SAIC Motor R&D Innovation Headquarters unveiled its self-developed second-generation magnesium alloy case for electric drive assembly, along with a three-in-one electric drive assembly equipped with this case. The company highlights this product as the world’s first mass-produced magnesium alloy housing for an electric drive system manufactured using a semi-solid processing technique. Made from AZ91D magnesium alloy, the case weighs only 13.7 kg.

The Steel Industry is a Crucial Demand Driver for Magnesium Compounds

Magnesium compounds, particularly dead-burned magnesia (DBM) and fused magnesia (FM), are essential refractory materials widely used in the steel industry due to their high thermal resistance and durability. In 2023, global DBM capacity reached 11.3 million tonnes, with China accounting for 64% of production, followed by the European Union at 12%. Similarly, China dominated global FM capacity in 2023 with an 82% share, while the EU contributed around 2%. EAFs widely use MgO carbon bricks in the slag zones of steel ladles. In 2024, in the EU, EAF-based steel plants accounted for 57% of magnesia consumption in refractories, a share projected to rise to 63% by 2034.Producers are increasingly adopting sustainable manufacturing practices to align with evolving customer demand. In May 2024, Latrobe Magnesium Ltd commissioned the first phase of its 1,000 t/y Stage 1 Demonstration Plant, producing the world’s first environmentally sustainable MgO from brown coal fly ash using its patented hydromet process. This milestone validates the technology and positions LMG to begin a bankable feasibility study and financing discussions for its fully contracted 10,000 t/y Stage 2 Commercial Plant.

Magnesium Market Regional Analysis

Asia Pacific is a Significant Consumer of Magnesium Due to a Growing Demand for Steel in End-Use MarketsThe increasing adoption of zinc-aluminum-magnesium (ZAM) coated steel is driving demand for magnesium as industries seek stronger, corrosion-resistant, and sustainable materials. This shift is strengthening magnesium’s role as a critical alloying element in the steel sector. For instance, in February 2025, in Indonesia, Tenova partnered with PT Tata Metal Lestari to install a hot-dip galvanizing line at its Sadang Plant, with a 250,000-ton annual capacity for Zn-Al-Mg, coated coils. Such projects underscore magnesium’s importance in supporting Indonesia’s industrial expansion.

Further, Europe is significantly dependent on imports to meet its magnesium demand. To reduce this dependency, in April 2024, Verde Magnesium announced its plans to invest USD 1 billion in Romania. The mine, expected to start production in 2027, could produce as much as 50% of the EU’s demand. Additionally, advancement in magnesium recycling processes to produce secondary magnesium, aid the market growth. In July 2025, Germany's Speira Group transformed magnesium recycling with breakthrough technology at its Töging facility. The automated production line now processes previously problematic oily magnesium scrap, achieving 99.2% purity, near primary-grade quality.

Competitive Landscape

The magnesium market is characterised by intense competition, with producers striving to capture market share across both primary production and recycling segments. Companies are increasingly investing in innovative technologies to differentiate themselves and address environmental concerns. For example, in September 2024, Tidal Metals unveiled its patented brine mining technology, a carbon-neutral and cost-effective alternative to China’s carbon-intensive production methods. Such advancements reflect a growing industry shift toward sustainable practices and enhanced efficiency in magnesium supply.US Magnesium LLC

US Magnesium LLC was founded in 1969 and is headquartered in the United States. The company has an annual capacity of 63,500 metric tons of magnesium and 9,000 metric tons of lithium carbonate, supported by additional chemical products from its integrated facility 60 miles west of Salt Lake City, Utah. Leveraging comprehensive truck and rail infrastructure, US Magnesium maintains extensive global distribution channels and a strong international market presence.NikoMag

Founded in 2006 and headquartered in the Netherlands, NIKOMAG, a specialised producer of high-purity magnesium products, is a key part of the NIKOCHEM Group's strategy for advanced bischofite processing. Leveraging direct access to local bischofite reserves, modern production technologies, and an advanced in-house research center, the company manufactures magnesium chloride, oxide, and hydroxide for a diverse international clientele in sectors including petroleum, metallurgy, food, power, and chemicals.Martin Marietta Materials, Inc.

Martin Marietta is a leading American-based supplier of building materials, including aggregates, cement, ready-mixed concrete, and asphalt, and is a member of the S&P 500 Index. The company is the largest producer of high-purity dolomitic lime in North America. The company’s Magnesia Specialties division manufactures high-purity magnesia and dolomitic lime products for diverse environmental, industrial, agricultural, and specialty applications both domestically and internationally.

Nedmag B.V

Nedmag specialises in extracting and processing high-purity magnesium salt from a rare bischofite layer, located 2,000 meters beneath Veendam, Netherlands, originating from the ancient Zechstein Sea. This uniquely pure resource underpins a diverse product portfolio. Supported by a dedicated research & development department, Nedmag continuously advances its products and applications for industrial and environmental markets.Other key players in the magnesium market report are Grecian Magnesite S.A., Hebei Meishen Technology Co., Ltd., Yingkou Magnesite Chemical Ind Group Co., Ltd. (Sinomagchem), Baymag Inc., Rima Industrial S.A., Shaanxi Yulin Magnesium Industry (Group) Co., LTD., Baowu Magnesium Technology Co., Ltd., and Shanxi Yinguang Huasheng Magnesium Industry Co., Ltd., among others.

Key Features of the Magnesium Market Report

- Comprehensive market size and forecast analysis from 2025 to 2034.

- Detailed segmentation by application, form, type, and region with historical trends.

- In-depth competitive landscape profiling key players and market shares.

- Pricing trends and raw material cost analysis across major regions.

- Demand-supply analysis and trade data insights with global and regional breakdown.

- Strategic insights into regulatory frameworks and emerging magnesium market opportunities.

Table of Contents

Companies Mentioned

- US Magnesium LLC

- NikoMag

- Martin Marietta Materials, Inc.

- Nedmag B.V.

- Grecian Magnesite S.A.

- Hebei Meishen Technology Co., Ltd.

- Yingkou Magnesite Chemical Ind Group Co., Ltd. (Sinomagchem)

- Baymag Inc.

- Rima Industrial S.A.

- Shaanxi Yulin Magnesium Industry (Group) Co., LTD.

- Baowu Magnesium Technology Co., Ltd.

- Shanxi Yinguang Huasheng Magnesium Industry Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value in 2025 | 20877.3 KMT |

| Forecasted Market Value by 2034 | 25126.81 KMT |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |