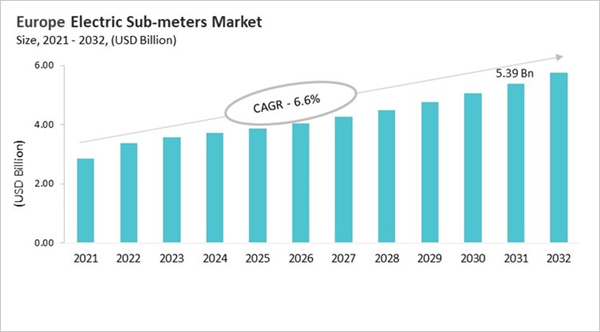

The Germany market dominated the Europe Electric Sub-meters Market by country in 2024, and is expected to continue to be a dominant market till 2032; thereby, achieving a market value of USD 1.26 billion by 2032. The UK market is exhibiting a CAGR of 4.9% during 2025-2032. Additionally, the France market is expected to experience a CAGR of 6.6% during 2025-2032. The Germany and UK led the Europe Electric Sub-meters Market by Country with a market share of 24.1% and 19.3% in 2024.

Strong policies that stress energy efficiency, climate action, and consumer rights have helped the electric sub-meter market in Europe grow. Sub-meters were first used in social housing and shared residential buildings to make sure bills were fair. They became more popular as electricity prices went up and people became worried about relying on imported fuels. EU energy rules, especially the 2012 Energy Efficiency Directive, required measuring how much energy each person used in multi-occupancy buildings. This increased demand for both residential and commercial properties. Thanks to advances in technology, electronic sub-meters can now track time-of-use, reactive power, and load profiles. This has made it possible for smart meters to be rolled out in countries like the UK and Italy. Sub-meters are now an important part of energy management systems, goals for sustainability, and the integration of renewable energy sources. This shows that the market is mature and in line with Europe's energy transition.

Some of the most important trends in Europe are supporting energy performance certifications, allowing time-of-use and dynamic pricing plans, and connecting to district heating and cooling systems. Market leaders focus on following EU rules, keeping an eye on multiple utilities, going digital with protocols that work together, and branding for sustainability. There are big companies like Siemens, ABB, and Schneider Electric, as well as smaller regional specialists who offer custom solutions, utility-affiliated suppliers, and agile startups that offer advanced analytics and AI-driven dashboards. Regulatory drivers, building certification requirements, and the use of sub-meters in larger energy management and renewable systems all affect the market. This makes Europe's approach different from that of other areas.

End Use Outlook

Based on End Use, the market is segmented into Industrial, Commercial, Residential, and Other End Use. The Industrial market segment dominated the Germany Electric Sub-meters Market by End Use is expected to grow at a CAGR of 3.9 % during the forecast period thereby continuing its dominance until 2032. Also, the Residential market is anticipated to grow as a CAGR of 5.2 % during the forecast period during 2025-2032.Type Outlook

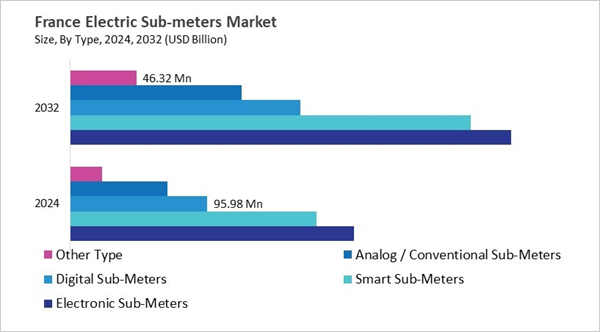

Based on Type, the market is segmented into Electronic Sub-Meters, Smart Sub-Meters, Digital Sub-Meters, Analog / Conventional Sub-Meters, and Other Type. Among various France Electric Sub-meters Market by Type; The Electronic Sub-Meters market achieved a market size of USD $199.3 Million in 2024 and is expected to grow at a CAGR of 5.9 % during the forecast period. The Analog / Conventional Sub-Meters market is predicted to experience a CAGR of 7.6% throughout the forecast period from (2025 - 2032).Country Outlook

Strict rules, advanced energy policies, and Germany's Energiewende focus on efficiency and integrating renewable energy all help the country's electric sub-meter market grow. Sub-meters are necessary in multi-family homes, businesses, and factories to make sure that costs are fairly divided and bills are clear. The EU Energy Efficiency Directive's requirements, rising electricity prices, and required smart meter rollouts all make modern, smart-enabled sub-meters more popular. Digitalization, integration with building automation, and use in renewable energy and distributed resource sites are some of the most important trends. In the competition, there are both global manufacturers and strong domestic companies that offer hardware, software, and services that meet national standards. Germany's strong regulatory environment and engineering know-how help sub-metering solutions grow and come up with new ideas all the time.List of Key Companies Profiled

- Schneider Electric SE

- Siemens AG

- Honeywell International, Inc.

- ABB Ltd.

- Itron, Inc.

- Landis+Gyr Group AG

- Eaton Corporation plc

- General Electric Company

- Mitsubishi Electric Corporation

- Xylem, Inc. (Sensus)

Market Report Segmentation

By Phase

- Three Phase

- Single Phase

By Type

- Electronic Sub-Meters

- Smart Sub-Meters

- Digital Sub-Meters

- Analog / Conventional Sub-Meters

- Other Type

By Connectivity

- Wired

- Wireless

By End Use

- Industrial

- Commercial

- Residential

- Other End Use

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Schneider Electric SE

- Siemens AG

- Honeywell International, Inc.

- ABB Ltd.

- Itron, Inc.

- Landis+Gyr Group AG

- Eaton Corporation plc

- General Electric Company

- Mitsubishi Electric Corporation

- Xylem, Inc. (Sensus)