Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Fiber Cement Roofing Market refers to the industry focused on the production, distribution, and installation of roofing materials made from fiber cement, a composite building material composed of cement reinforced with cellulose fibers. Fiber cement roofing products, such as corrugated sheets, slates, and flat panels, are widely used in residential, commercial, industrial, and agricultural construction due to their superior durability, resistance to fire, and minimal maintenance requirements. These products are particularly effective in harsh weather conditions, making them a preferred choice in both urban and rural settings. The market encompasses various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users across diverse application areas.

Key Market Drivers

Increasing Urbanization and Infrastructure Development

The rapid pace of urbanization and infrastructure development globally is a significant driver for the Fiber Cement Roofing Market, as it fuels demand for durable, cost-effective, and sustainable roofing materials. Urban populations are projected to grow substantially, necessitating robust construction solutions to accommodate expanding residential and commercial needs.Fiber cement roofing, known for its resilience against harsh weather, fire, and pests, is increasingly preferred in urban settings where longevity and low maintenance are critical. Developing economies, particularly in Asia-Pacific and Africa, are witnessing a surge in construction activities due to government initiatives promoting affordable housing and infrastructure projects.

These regions prioritize materials that offer structural integrity and weather resistance, making fiber cement an ideal choice for roofing applications. Its ability to withstand extreme conditions, such as heavy rainfall and high winds, ensures its suitability for urban environments prone to diverse climatic challenges. Furthermore, the material’s versatility allows it to meet varied architectural demands, enhancing its adoption in modern cityscapes. As governments invest in sustainable urban planning, fiber cement roofing aligns with green building standards, further boosting its demand in infrastructure-driven markets.

According to the United Nations, global urban populations are expected to increase by over 2 billion people by 2050, with 68% of the world’s population projected to live in urban areas. In 2021, urbanization rates in Asia and Oceania rose from 43.3% to 50.0%, and Africa saw a 4.6% increase, driving construction demand. This urbanization trend supports an estimated 4-5% annual growth in global construction output, significantly increasing the need for fiber cement roofing materials.

Key Market Challenges

Health and Environmental Concerns Related to Raw Materials

One of the most critical challenges impeding the growth of the Fiber Cement Roofing Market is the persistent health and environmental concerns associated with the raw materials used in the manufacturing process. Fiber cement roofing materials often contain silica, cement, and in some legacy cases, asbestos. Although modern manufacturing standards have phased out the use of asbestos in many developed countries, its historical association with fiber cement products continues to cast a shadow over the industry. Even without asbestos, the high content of crystalline silica used in the mixture can pose serious respiratory hazards when inhaled during cutting, drilling, or handling. Exposure to respirable crystalline silica dust is known to lead to severe health conditions such as silicosis and lung cancer, raising significant occupational safety concerns for installers and workers across the value chain.In addition to health risks, the environmental footprint of cement as a raw material also presents substantial regulatory and reputational challenges. The cement industry is among the largest emitters of carbon dioxide globally, and fiber cement manufacturing contributes to the overall environmental burden. As governments across various regions adopt stricter emission regulations and environmental sustainability targets, the fiber cement industry is under increasing scrutiny. Regulatory compliance requires companies to invest in environmentally friendly production technologies and emissions control systems, which may elevate operational costs and erode profit margins.

Moreover, growing consumer awareness of environmental and health issues has led to a shift in preference toward more sustainable and non-toxic building materials. Green building certifications and sustainable construction trends are encouraging builders and developers to seek alternatives with a lower environmental impact. Consequently, manufacturers in the fiber cement roofing segment face mounting pressure to innovate and reformulate their products using eco-friendly raw materials without compromising performance. The transition to safer and greener inputs, however, requires substantial investment in research and development, process redesign, and quality testing, which can be time-consuming and capital-intensive.

Key Market Trends

Rising Adoption of Sustainable and Eco-Friendly Roofing Materials

A prominent trend reshaping the Fiber Cement Roofing Market is the increasing adoption of sustainable and environmentally responsible building materials. As climate change and environmental sustainability become central themes in both public policy and private sector development, fiber cement roofing has emerged as a preferred solution for builders, architects, and regulators seeking low-impact construction alternatives. Fiber cement roofing products, composed of cement, cellulose fibers, and mineral fillers, are known for their durability, long service life, and resistance to extreme weather conditions, which reduces the frequency of replacement and waste generation.What further strengthens the position of fiber cement roofing in this sustainability narrative is the growing movement toward green building certifications, such as Leadership in Energy and Environmental Design and Building Research Establishment Environmental Assessment Method. These standards prioritize the use of recyclable, non-toxic, and energy-efficient construction materials, aligning perfectly with the characteristics of fiber cement. Unlike other roofing solutions that may contain synthetic components or release harmful volatile organic compounds, fiber cement products are inert and do not pose risks to indoor air quality.

In addition, manufacturers are increasingly investing in product innovations to reduce the environmental footprint of fiber cement by utilizing recycled content and low-carbon production technologies. Efforts to optimize energy usage, reduce water consumption, and minimize emissions during the manufacturing process are becoming a core part of product development strategies. This aligns with the global push toward decarbonization in the construction materials sector.

Governments across multiple regions are also promoting sustainable construction practices through incentives, subsidies, and procurement policies, further encouraging the adoption of fiber cement roofing. For example, developing economies in the Asia Pacific region are integrating sustainability into their infrastructure plans, creating new opportunities for eco-friendly roofing products.

Key Market Players

- Etex Group

- James Hardie Industries PLC

- Cembrit Holding A/S

- Swisspearl Group AG

- CSR Limited

- Everest Industries Limited

- Visaka Industries Limited

- Ramco Industries Limited

- Mahaphant Fibre Cement Co., Ltd.

- Hume Cemboard Industries Sdn. Bhd.

Report Scope:

In this report, the Global Fiber Cement Roofing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Fiber Cement Roofing Market, By Product Type:

- Corrugated Sheets

- Flat Sheets

- Slates

- Customized Shapes

Fiber Cement Roofing Market, By Application:

- Residential

- Commercial

- Industrial

- Agricultural

Fiber Cement Roofing Market, By End User:

- Construction Industry

- Agriculture Sector

- Industrial Infrastructure

- Warehousing

Fiber Cement Roofing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fiber Cement Roofing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Etex Group

- James Hardie Industries PLC

- Cembrit Holding A/S

- Swisspearl Group AG

- CSR Limited

- Everest Industries Limited

- Visaka Industries Limited

- Ramco Industries Limited

- Mahaphant Fibre Cement Co., Ltd.

- Hume Cemboard Industries Sdn. Bhd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

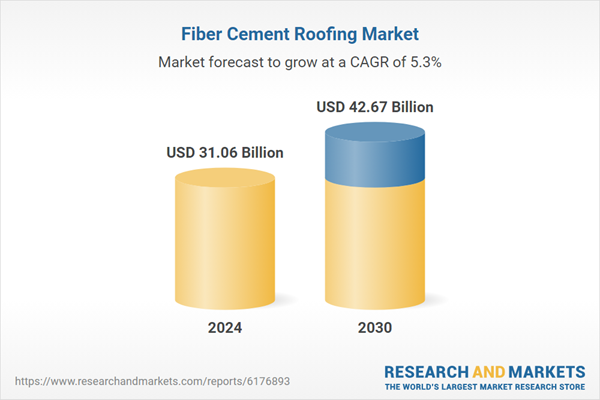

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.06 Billion |

| Forecasted Market Value ( USD | $ 42.67 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |