Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Technological Advancements in Seed Coating

The United Kingdom's agricultural sector is undergoing a transformation, driven by the dual imperatives of improving crop productivity and ensuring environmental sustainability. At the heart of this evolution lies the seed coating material market, a niche but crucial segment poised for sustained growth. One of the most significant factors propelling this market forward is technological advancement in seed coating processes and materials.Modern seed coating technologies have evolved far beyond simple colorant applications. Today, they encompass sophisticated formulations that incorporate polymers, micronutrients, biological agents, and active crop protection chemicals. These advancements have enabled a more precise and efficient delivery of essential growth agents directly to the seed, resulting in enhanced germination rates, improved seedling vigor, and increased resilience against pests and diseases.

For instance, the integration of microencapsulation and controlled-release mechanisms in seed coatings allows for a gradual and timely release of nutrients and fungicides, minimizing waste and maximizing efficacy. These innovations contribute to better crop establishment, particularly in the UK where fluctuating weather patterns and soil conditions can hinder seed development.

The rise of precision agriculture has further amplified the role of advanced seed coatings. By integrating GPS technology, sensors, and data analytics, farmers can tailor their seed coating strategies to specific soil profiles and climatic conditions. This level of customization enhances input efficiency and reduces production costs - key considerations in the highly competitive UK agriculture market.

Additionally, the compatibility of modern seed coatings with automated planting machinery ensures uniform seed distribution and coating coverage, translating to consistent crop performance across large-scale farming operations.

Technological innovation has also intensified competition among seed coating material manufacturers. Leading companies are investing heavily in research and development (R&D) to differentiate their products through improved functionality, safety, and environmental compliance. These efforts are not only expanding the product portfolio available to UK farmers but are also fostering collaborations between agri-tech firms, seed producers, and academic institutions.

In March 2025, five UK-based agritech companies, selected through a competitive process, visited the International Crops Research Institute for the Semi-Arid Tropics (ICRISAT) to foster collaboration in late-stage R&D, investment, and market access for advanced agricultural technologies. The visit was part of the UK-India Agri-Tech Accelerator programme, led by the UK Agri-Tech Centre in partnership with the UK government. The initiative aims to address critical challenges in India’s agricultural sector, identify opportunities for UK-India agri-tech collaboration, promote networking to showcase UK expertise, support the commercialisation of technologies tailored for the Indian market, and accelerate export opportunities and foreign direct investment.

Key Market Challenges

Climate Variability and Environmental Concerns

Despite the benefits that seed coating technologies offer in enhancing crop resilience, the United Kingdom's increasing climate variability presents a significant challenge to their consistent effectiveness. Unpredictable weather events - such as unseasonal rainfall, prolonged droughts, and extreme temperature fluctuations - can adversely affect the performance of coated seeds. For instance, excessive moisture may lead to premature leaching of active ingredients from the seed coating, reducing their intended efficacy. Conversely, insufficient soil moisture due to drought conditions may hinder the activation of coating agents designed to support early germination and root development.Additionally, there is growing scrutiny from environmental stakeholders regarding the composition and biodegradability of certain seed coating materials. While the industry is moving toward more sustainable and eco-friendly formulations, many conventional coatings still rely on synthetic polymers, chemical fungicides, and colorants. These substances, if not properly regulated or degraded, may accumulate in the soil over time, potentially affecting soil microbiota, reducing fertility, and disrupting the natural ecosystem balance.

Key Market Trends

Transition to Bio-Based and Biodegradable Coatings

In light of growing environmental awareness and tightening regulatory frameworks, the United Kingdom seed coating material market is witnessing a notable shift toward the adoption of bio-based and biodegradable coating solutions. Traditional seed coatings have often relied on synthetic polymers derived from petrochemical sources, many of which are non-biodegradable and contribute to long-term soil contamination and microplastic accumulation. These environmental drawbacks have intensified calls from both regulatory bodies and sustainability-conscious stakeholders for greener alternatives.As a result, market participants are increasingly investing in the research and development of seed coatings formulated from renewable, plant-based materials. Promising innovations include the use of plant protein-based binders - such as those derived from soy, corn, or wheat - which offer effective adhesion while being fully biodegradable and non-toxic to the environment. Another noteworthy advancement is the incorporation of microfibrillated cellulose, a sustainable material extracted from plant fibers. Known for its excellent film-forming and moisture-retention properties, microfibrillated cellulose enhances seed protection and germination while naturally decomposing in the soil without leaving harmful residues.

These bio-based formulations offer dual benefits: they support sustainable agricultural practices by minimizing the environmental footprint of farming inputs, and they help growers meet increasingly stringent agro-environmental compliance requirements, both domestically and across export markets.

Key Market Players

- BASF plc

- Bayer UK

- Germains Seed Technology

- Croda International Plc.

- Clariant Services UK Ltd.

- SilviBio Limited

Report Scope

In this report, the United Kingdom Seed Coating Material Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United Kingdom Seed Coating Material Market, By Crop Type:

- Fruits & Vegetables

- Cereals & Grains

- Oilseeds & Pulses

- Others

United Kingdom Seed Coating Material Market, By Additive:

- Polymers

- Colorants

- Pellets

- Minerals/Pumice

- Others

United Kingdom Seed Coating Material Market, By Region:

- Scotland

- South-East

- London

- South-West

- East Anglia

- Yorkshire & Humberside

- East Midlands

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United Kingdom Seed Coating Material Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF plc

- Bayer UK

- Germains Seed Technology

- Croda International Plc.

- Clariant Services UK Ltd.

- SilviBio Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 83 |

| Published | September 2025 |

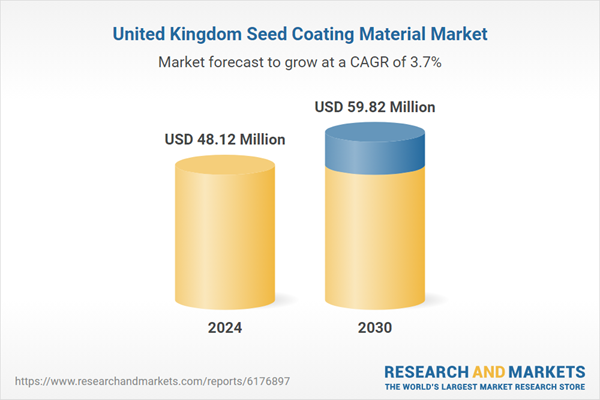

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 48.12 Million |

| Forecasted Market Value ( USD | $ 59.82 Million |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 6 |