Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

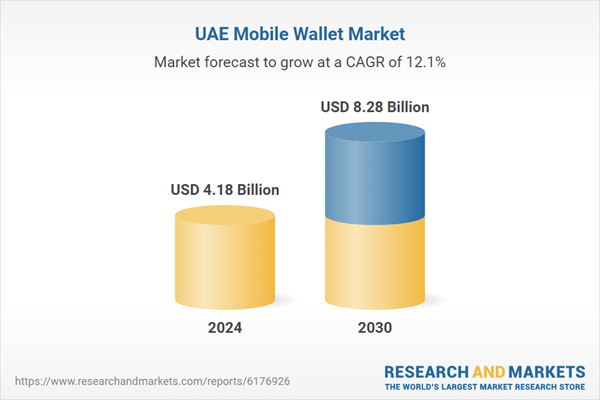

The UAE mobile wallet market is experiencing rapid growth, driven by the country’s increasing digitalization, high smartphone penetration, and strong government push toward a cashless economy. As one of the most digitally advanced economies in the Middle East, the UAE has seen a surge in consumer adoption of mobile wallets due to their convenience, security, and seamless integration with various payment platforms. The Central Bank of the UAE has played a pivotal role in fostering the sector’s growth through regulatory support and the launch of digital payment infrastructure such as the Instant Payment Platform (IPP) and Al Etihad Payments’ Aani system, which enables real-time transactions across banks. These initiatives aim to reduce the country’s dependency on cash and support the UAE Vision 2031 for a digital and sustainable economy.

The market is highly competitive, with a blend of local, regional, and international players. Prominent local wallets include Payit by First Abu Dhabi Bank, Klip backed by a consortium of major UAE banks, and e& money (formerly Etisalat Wallet), offering diverse features such as peer-to-peer transfers, utility bill payments, international remittances, and QR code-based transactions.

Startups like Ziina and Noon Pay have also entered the space, targeting younger demographics and small merchants with user-friendly and cost-effective solutions. Meanwhile, global tech companies such as Apple Pay, Google Pay, and Samsung Wallet have rapidly gained ground in the UAE by integrating with major banks and enabling NFC-based in-store and in-app payments. These wallets are particularly popular among users seeking secure biometric authentication and integration with broader digital ecosystems.

Telecom and banking institutions are increasingly launching “super apps” that combine multiple services - including e-wallets, digital banking, and e-commerce - within a single platform. This convergence trend is expected to further boost user engagement and expand use cases for mobile wallets beyond simple payments to include loyalty programs, ticketing, transport fare collection, and cross-border money transfers. Additionally, the post-COVID-19 shift toward contactless payments and e-commerce has significantly accelerated digital wallet adoption across both urban and semi-urban areas. The rising awareness of cybersecurity and data privacy has also led providers to invest in robust encryption technologies, boosting user confidence.

Key Market Drivers

Strong Government Support and Digital Infrastructure

The UAE government plays a pivotal role in driving mobile wallet adoption through regulatory frameworks and digital infrastructure development. The Central Bank’s rollout of the Instant Payment Platform (IPP) has led to a rise in transaction volumes from 2.4 million in 2019 to over 64 million in 2023. Simultaneously, the transaction value jumped from AED 6 billion to more than AED 160 billion (USD 43.57 billion).The introduction of the Digital KYC platform has streamlined onboarding processes for digital wallets, reducing processing time by nearly 60%. The Payment Systems Policy targets a 70% rise in non-cash transactions by 2025. Furthermore, over 90% of federal entities now offer digital payment options for government services, increasing wallet integration across sectors. Government-driven campaigns have also contributed to over 65% of utility and licensing payments being completed digitally. This foundational support builds trust among users and ensures scalability for providers, making the UAE an ideal market for mobile wallets.

Key Market Challenges

Limited Financial Inclusion Among Low-Income and Blue-Collar Workers

Despite the UAE's advanced digital infrastructure, a significant portion of its low-income and blue-collar workforce remains outside the mobile wallet ecosystem. Many of these workers lack access to smartphones with NFC or QR capabilities, and others have limited digital literacy, making it difficult to use wallet apps efficiently. While over 95% of UAE residents have mobile phone access, only a fraction of the labor population owns smartphones compatible with mobile wallet platforms. Language barriers and a lack of educational outreach further compound this issue.Additionally, these workers often rely on informal remittance channels or cash-based systems, reducing the incentive to switch to formal mobile wallets. Some wallets require national ID documentation or minimum balance thresholds, which can exclude certain low-wage users, especially those in temporary or undocumented employment situations. As a result, wallet providers struggle to tap into this large but underserved demographic. Addressing this challenge will require government incentives, simplified wallet apps in multiple languages, and partnerships with labor camps, employers, and NGOs to improve onboarding, trust, and ease of use.

Key Market Trends

Increasing Adoption of Biometric and Contactless Payment Technologies

The UAE’s mobile wallet market is embracing biometric and contactless technologies at a fast pace. Driven by a tech-savvy population and health-conscious behavior post-COVID-19, there has been a notable rise in fingerprint, facial recognition, and voice-based authentication features. More than 87% of UAE consumers are comfortable using fingerprint authentication, and 62% have used facial recognition for payment in the last year. Contactless cards and wallets are now accepted at over 80% of retail points-of-sale across major cities. In addition, wearable payments - using smartwatches and fitness bands - have grown among younger consumers, with 18% of digital payments made through wearables.Wallets such as Samsung Wallet and Apple Pay have capitalized on this trend, integrating secure biometric access and seamless tap-to-pay functionality. Moreover, biometric verification is being combined with AI-powered fraud detection, enhancing both security and ease of use. As consumers grow increasingly concerned about digital security, biometric features not only improve trust but also streamline transactions, encouraging repeated wallet usage. This trend is set to evolve further as the UAE continues to lead the MENA region in tech adoption and smart city initiatives.

Key Market Players

- Klip (Emirates Digital Wallet)

- e& money (Etisalat Wallet)

- Payit (FAB Payit)

- Careem Pay

- Beam Wallet

- Aani (Al Etihad Payments)

- Ziina

- PayBy

- Noon Pay

- Google Pay

Report Scope:

In this report, the UAE Mobile Wallet Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Mobile Wallet Market, By Type:

- Semi-Closed

- Open

- Closed

UAE Mobile Wallet Market, By Technology:

- Quick Response (QR) Codes

- Near Field Communication (NFC)

- Magnetic Secure Transmission (MST)

- Others

UAE Mobile Wallet Market, By Ownership:

- Telecom Operators

- Device Manufacturers

- Tech Companies

- Banks

UAE Mobile Wallet Market, By Application:

- Entertainment & Travel

- Bill Payments

- Food & Drinks

- Groceries

- Peer-to-Peer Transfer

- Others

UAE Mobile Wallet Market, By Region:

- Abu Dhabi

- Dubai

- Sharjah

- Ajman

- Umm Al Quwain

- Ras Al Khaimah

- Fujairah

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Mobile Wallet Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Klip (Emirates Digital Wallet)

- e& money (Etisalat Wallet)

- Payit (FAB Payit)

- Careem Pay

- Beam Wallet

- Aani (Al Etihad Payments)

- Ziina

- PayBy

- Noon Pay

- Google Pay

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.18 Billion |

| Forecasted Market Value ( USD | $ 8.28 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 10 |