Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Virtual Data Room Market refers to the global industry focused on providing secure, cloud-based platforms that enable organizations to store, manage, and share sensitive documents and information during complex business transactions and operations. These solutions are widely used in mergers and acquisitions, fundraising, corporate governance, legal and compliance processes, intellectual property management, and other critical business activities where confidentiality, security, and regulatory compliance are paramount.

Virtual data rooms offer controlled access, document tracking, audit trails, and encryption features that significantly reduce the risks associated with unauthorized access or data breaches. The market has grown steadily in recent years due to the increasing digitization of business operations, the globalization of corporate transactions, and heightened regulatory scrutiny across industries. Enterprises are prioritizing data security and operational efficiency, which has accelerated the adoption of virtual data rooms as a reliable alternative to traditional physical data rooms.

Additionally, the growing trend of remote work and collaboration has further boosted demand, as stakeholders require secure, real-time access to documents from multiple geographic locations. The integration of advanced technologies such as artificial intelligence and machine learning is enhancing the capabilities of virtual data rooms, enabling automated document classification, intelligent search, predictive analytics, and workflow optimization, which further drives market growth. Small and medium enterprises, in addition to large corporations, are increasingly leveraging virtual data room solutions to streamline due diligence processes, improve decision-making, and ensure compliance with industry regulations.

Cloud-based deployment models dominate the market due to their scalability, cost-effectiveness, and ease of maintenance, although on-premises solutions remain relevant for organizations with specific security or compliance requirements. Geographically, North America currently leads the market due to early adoption of technology, robust regulatory frameworks, and the presence of major service providers, while the Asia Pacific region is emerging as a high-growth market driven by increasing cross-border transactions, digital transformation initiatives, and rising awareness of data security solutions. Overall, the Virtual Data Room Market is expected to witness sustained growth over the forecast period, fueled by the convergence of technology adoption, regulatory compliance needs, and the global demand for secure and efficient information management.

Key Market Drivers

Growing Demand for Secure Data Sharing in Mergers and Acquisitions Transactions

The Virtual Data Room Market is experiencing significant growth due to the increasing demand for secure data sharing in mergers and acquisitions (M&A) transactions, which require efficient and protected exchange of sensitive information among stakeholders. As global M&A activities intensify, organizations rely on virtual data rooms to facilitate due diligence, streamline negotiations, and ensure confidentiality of financial, legal, and operational documents. These platforms offer robust security features like encryption, multi-factor authentication, and granular access controls, enabling secure collaboration across geographically dispersed teams.The complexity of modern M&A deals, often involving cross-border entities, necessitates virtual data rooms that provide centralized, cloud-based repositories for real-time document access and tracking. Industries such as finance, healthcare, and technology, where M&A activities are prevalent, depend on these solutions to protect intellectual property and comply with regulatory requirements during deal-making. Virtual data rooms reduce the risks associated with physical data rooms, such as document loss or unauthorized access, while accelerating the due diligence process through features like automated indexing and search functionalities. The rise in private equity and venture capital investments further fuels demand, as these firms require secure platforms to evaluate potential acquisitions.

Virtual data rooms also support deal transparency by maintaining audit trails, which are critical for legal and compliance purposes. The scalability of these platforms allows organizations of all sizes, from startups to multinational corporations, to manage high-stakes transactions efficiently. Additionally, the integration of artificial intelligence (AI) enhances document analysis, identifying key clauses and risks, thus reducing manual effort and improving decision-making accuracy. As businesses prioritize speed and security in M&A processes, virtual data rooms offer a competitive edge by enabling faster deal closures without compromising data integrity. The shift from physical to digital data rooms eliminates logistical challenges, such as travel and storage costs, making virtual solutions more cost-effective.

The global nature of M&A transactions amplifies the need for multilingual support and 24/7 accessibility, features that modern virtual data rooms seamlessly provide. Furthermore, the increasing complexity of regulatory frameworks, such as data privacy laws, necessitates secure platforms that ensure compliance during sensitive transactions. Virtual data rooms also cater to strategic partnerships and joint ventures, where secure data exchange is equally critical.

The market benefits from the growing trend of digital transformation, as organizations adopt cloud-based solutions to modernize their operations. The ability to customize access permissions ensures that only authorized personnel view sensitive data, reducing the risk of leaks. As M&A activities continue to rise, driven by economic recovery and industry consolidation, the Virtual Data Room Market is poised for sustained growth, offering indispensable tools for secure and efficient transaction management. The flexibility of these platforms supports diverse use cases, from fundraising to divestitures, making them integral to the M&A ecosystem. Vendors are enhancing their offerings with user-friendly interfaces and advanced analytics, further driving adoption across industries.

A 2024 global M&A survey conducted by an international business consortium revealed that 76% of organizations involved in M&A transactions adopted virtual data rooms, resulting in a 40% reduction in due diligence time and a 35% decrease in data breach incidents during deals. The survey noted that firms using virtual data rooms achieved a 25% faster deal closure rate and saved an average of USD2.8 million annually in transaction costs, highlighting their impact on efficiency and security.

Key Market Challenges

Data Security and Privacy Concerns

One of the primary challenges confronting the Virtual Data Room Market is ensuring robust data security and privacy. Organizations that rely on virtual data rooms handle sensitive information, including financial records, intellectual property, and confidential corporate documents. Any breach or unauthorized access can lead to significant financial losses, reputational damage, and legal repercussions. Despite advanced encryption and multi-factor authentication protocols, cyber threats are continually evolving, making it challenging to guarantee absolute security.Additionally, the rise in remote work and global collaboration introduces multiple access points, each of which could potentially be exploited by malicious actors. Regulatory compliance further complicates security management, as organizations must adhere to stringent data protection frameworks such as the General Data Protection Regulation in Europe, the Health Insurance Portability and Accountability Act in the United States, and other regional standards. Failure to meet these requirements can result in severe penalties and loss of business credibility. Virtual data room providers must continuously invest in advanced cybersecurity measures, regular system audits, employee training, and real-time monitoring to mitigate these risks.

However, the costs associated with maintaining such high levels of security can be substantial, particularly for small and medium enterprises, potentially limiting adoption in certain segments. Moreover, the rapid pace of technological change requires that security protocols be updated frequently, which can create operational challenges and necessitate ongoing investments in research and development. Consequently, while the demand for secure information management continues to drive the Virtual Data Room Market, the complexity of ensuring data privacy and protection remains a significant challenge that providers and end users must address effectively.

Key Market Trends

Adoption of Cloud-Based Virtual Data Rooms

A significant trend shaping the Virtual Data Room Market is the growing adoption of cloud-based solutions. Organizations are increasingly favoring cloud deployment models due to their scalability, cost-effectiveness, and ease of access compared to traditional on-premises systems. Cloud-based virtual data rooms allow users to securely store, manage, and share large volumes of sensitive information without investing heavily in infrastructure, maintenance, and IT staff. The flexibility offered by cloud platforms enables enterprises to scale storage and user access according to business requirements, supporting remote collaboration and cross-border transactions efficiently.In addition, cloud solutions integrate advanced security features such as end-to-end encryption, multi-factor authentication, and real-time monitoring, addressing concerns related to data protection and regulatory compliance. The shift toward digital transformation initiatives across industries, coupled with the rising prevalence of remote work, has accelerated demand for cloud-based virtual data rooms. Businesses now seek platforms that provide seamless access to critical documents, facilitate due diligence processes, and streamline corporate governance activities. Cloud adoption also supports integration with other enterprise systems, such as document management and workflow automation tools, enhancing operational efficiency and enabling data-driven decision-making.

As organizations increasingly conduct mergers and acquisitions, fundraising, and intellectual property management in a globally connected environment, cloud-based virtual data rooms are becoming the preferred choice. Vendors are responding by offering subscription-based models, AI-enhanced analytics, and collaborative tools within cloud platforms to attract diverse customer segments. This trend is expected to continue driving growth in the Virtual Data Room Market over the forecast period, reinforcing the strategic importance of cloud adoption for enterprises aiming to optimize secure document management and operational efficiency.

Key Market Players

- Intralinks Holdings, Inc.

- Merrill Datasite

- Box, Inc.

- iDeals Solutions

- Firmex

- Ansarada

- Citrix Systems, Inc.

- Brainloop AG

- CapLinked, Inc.

- BlackBerry Limited (WatchDox)

Report Scope:

In this report, the Global Virtual Data Room Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Virtual Data Room Market, By Application:

- Mergers and Acquisitions

- Fundraising

- Corporate Governance

- Legal and Compliance

- Intellectual Property Management

- Others

Virtual Data Room Market, By Deployment Type:

- On-Premises

- Cloud

Virtual Data Room Market, By End-User:

- Banking, Financial Services, and Insurance

- Legal Firms

- Healthcare and Life Sciences

- Information Technology and Telecommunications

- Manufacturing

- Government and Public Sector

- Others

Virtual Data Room Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Virtual Data Room Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Intralinks Holdings, Inc.

- Merrill Datasite

- Box, Inc.

- iDeals Solutions

- Firmex

- Ansarada

- Citrix Systems, Inc.

- Brainloop AG

- CapLinked, Inc.

- BlackBerry Limited (WatchDox)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

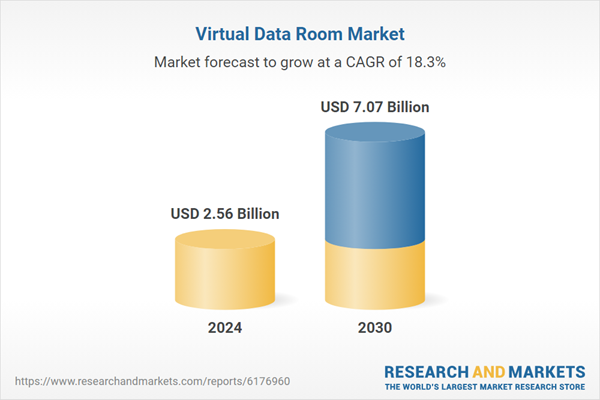

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.56 Billion |

| Forecasted Market Value ( USD | $ 7.07 Billion |

| Compound Annual Growth Rate | 18.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |