Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

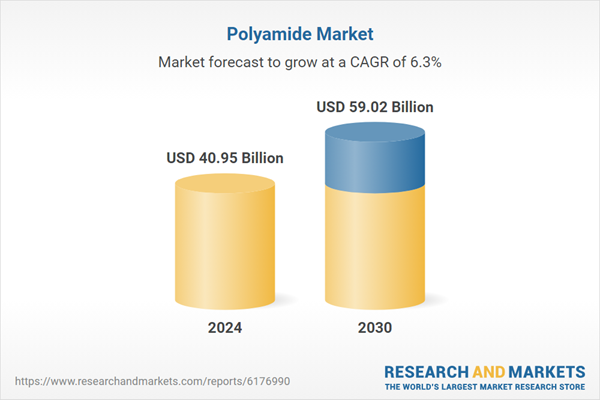

The polyamide market is positioned for sustained growth, driven by accelerating industrial activity, innovations in high-performance and reinforced grades, and the shift toward lightweight, durable, and sustainable solutions. With continuous product development and diversification across emerging and established applications, polyamides are expected to retain a critical role in supporting the performance, efficiency, and sustainability objectives of modern industries worldwide.

Key Market Drivers

Rapid Growth in Automotive and Transportation Sector

The rapid growth in the automotive and transportation sector is a key driver of the global polyamide (PA) market, as manufacturers increasingly adopt high-performance materials to meet evolving demands for efficiency, safety, and sustainability. Polyamides, particularly engineering-grade variants such as PA6, PA66, and glass-fiber reinforced grades, are favored for their combination of mechanical strength, thermal stability, chemical resistance, and lightweight characteristics, making them ideal replacements for traditional metals and other polymers in critical automotive components.Global automotive manufacturers are under pressure to reduce vehicle weight to improve fuel efficiency and comply with stringent emissions regulations. Polyamides enable lightweighting without compromising structural integrity or durability. They are widely used in under-the-hood components, engine covers, radiator end tanks, fuel lines, gears, and bearings, where metals were traditionally employed. By substituting metals with PA-based components, manufacturers achieve significant weight reductions, lower fuel consumption, and reduced carbon emissions.

Global electric vehicle (EV) adoption is reaching unprecedented levels, with sales surpassing 17 million units in 2024, representing more than 20% of the total new car market. The accelerating shift toward electric vehicles is further boosting polyamide demand. EVs require high-performance, heat-resistant, and lightweight materials for battery housings, electric motors, cooling systems, and electrical insulation.

Polyamides’ excellent dielectric properties and thermal stability make them indispensable in ensuring safety, efficiency, and longevity of EV components, positioning PA as a critical material in the growing EV market. Polyamides are increasingly used in automotive parts exposed to extreme temperatures, chemicals, and mechanical stress. Their superior resistance to wear, corrosion, and high temperatures extends the lifespan of components such as fuel systems, hydraulic lines, and electrical connectors. This performance reliability makes PA a preferred material in modern vehicles, particularly in high-stress applications where safety and durability are paramount.

Key Market Challenges

Fluctuating Raw Material Prices

One of the foremost challenges impacting the polyamide market is the volatility of raw material prices, particularly petrochemical derivatives such as caprolactam and hexamethylene diamine, which are key feedstocks for PA production. Price fluctuations can be driven by crude oil market instability, supply chain disruptions, and geopolitical tensions. This volatility affects manufacturing costs and can lead to inconsistent pricing for end-users, making polyamide less attractive compared to alternative polymers in cost-sensitive applications. Manufacturers often face pressure to balance quality, performance, and pricing, which can limit market growth, especially in regions with price-sensitive consumers.Key Market Trends

Shift Toward Bio-Based and Sustainable Polyamides

A significant trend shaping the polyamide market is the increasing adoption of bio-based and environmentally sustainable grades. Manufacturers are developing polyamides derived from renewable feedstocks such as castor oil and other bio-based intermediates, which reduce dependency on petroleum-based materials and lower the carbon footprint. These innovations align with global sustainability mandates, circular economy initiatives, and consumer demand for greener products. The shift toward sustainable polyamides is particularly prominent in the automotive, textile, and packaging sectors, where eco-friendly materials are gaining strategic importance.Key Market Players

- BASF SE

- Evonik Industries AG

- Arkema group

- Solvay

- Domo Chemicals

- dsm-firmenich

- LANXESS

- DuPont de Nemours, Inc

- TORAY INDUSTRIES, INC

- Celanese Corporation

Report Scope:

In this report, the Global Polyamide Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Polyamide Market, By Product:

- Polyamide 6

- Polyamide 66

- Bio-based Polyamide

- Specialty Polyamides

Polyamide Market, By Application:

- Engineering Plastics

- Fibers

Polyamide Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Polyamide Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Evonik Industries AG

- Arkema group

- Solvay

- Domo Chemicals

- dsm-firmenich

- LANXESS

- DuPont de Nemours, Inc

- TORAY INDUSTRIES, INC

- Celanese Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 40.95 Billion |

| Forecasted Market Value ( USD | $ 59.02 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |