Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

With economic uncertainty impacting new car purchases, used vehicles present a cost-effective alternative, especially among young and first-time buyers. Online marketplaces like Carsome, Carlist.my, and Mudah.my are revolutionizing the sector by offering end-to-end solutions, from inspection to loan processing and home delivery, thus enhancing user experience and boosting market penetration. Increased vehicle ownership costs, such as insurance and maintenance, also contribute to the shift toward pre-owned cars, which offer better value retention.

One of the key growth drivers includes the changing perception of used vehicles, which are now viewed as reliable and affordable substitutes for new ones due to stricter quality standards and certified pre-owned programs. Financial institutions and fintech firms are offering tailored auto loan solutions for second-hand cars, widening customer access and supporting market expansion. Simultaneously, the integration of digital tools such as AI-driven car evaluations, predictive maintenance alerts, and virtual test drives is reshaping customer journeys. The market is also gaining momentum from the rising frequency of car upgrades, as consumers now prefer changing vehicles every few years to keep up with technology and style trends.

These evolving preferences are creating a healthy turnover of used vehicles with newer models entering circulation more rapidly. For instance, By the end of 2022, Malaysia's automobile ownership reached a significant milestone, surpassing 18 million units. Of this, passenger vehicles accounted for 16.6 million units, trucks totaled 1.4 million, and buses made up 63,000 units. The total number of vehicles increased by over 800,000 units compared to the previous year, driven by a record high of 720,000 new vehicle sales.

However, the market still faces a range of challenges. Issues such as lack of uniform vehicle grading, inconsistent documentation, and opaque pricing models persist in parts of the unorganized sector, undermining consumer confidence. Buyers often find it difficult to validate the history of privately sold vehicles, especially in terms of accident records, mileage tampering, and servicing inconsistencies. Warranty limitations and post-sale servicing hurdles also create friction.

Market Drivers

Digital Transformation of Used Car Transactions

Digital platforms have fundamentally changed the way consumers buy and sell used vehicles. The traditional model involving physical visits to dealerships and negotiations has evolved into a tech-driven process facilitated by online platforms. Companies like Carsome and Carlist.my provide seamless services ranging from virtual showrooms to online bookings, home inspections, price comparison tools, loan calculators, and vehicle delivery. These services empower users with data transparency, ease of use, and convenience. Artificial Intelligence and Machine Learning tools are being used for automated car valuation, fraud detection, and predictive pricing.Augmented reality features now allow potential buyers to experience vehicles through 360-degree views, reducing reliance on in-person visits. These innovations have not only accelerated purchase decisions but also enhanced trust and credibility within the market. For sellers, digital platforms provide instant quotes, inspection services, and access to a wider audience, reducing time to sale. All these services are integrated with loan approval and insurance options, simplifying the post-purchase journey. As the tech ecosystem matures and user adoption increases, digital transformation is expected to sustain rapid growth in the used car market.

For instance, according to the International Trade Administration, Malaysia remains an attractive market for eCommerce in Southeast Asia, fueled by its dynamic economy and advanced digital infrastructure. The Malaysian e-commerce market saw impressive growth, expanding by 20% in 2022. This surge is driven by a rising consumer preference for online shopping, supported by the availability of customized payment options. In 2022, 89.6% of Malaysia's population, or 29.55 million people, were active internet users, with mobile connections surpassing the total population at 127.7%. Additionally, social media engagement reached 30.25 million users, and mobile connections totaled 42.11 million, further illustrating the nation's digital adoption and eCommerce potential.

Key Market Challenges

Lack of Vehicle History Transparency

One of the most pressing challenges in the used car market is the lack of transparency regarding a vehicle’s past usage. Buyers often struggle to verify accident history, mileage accuracy, previous ownership count, and maintenance records. Many vehicles sold through informal channels come without service logs or insurance claim disclosures, which increases the risk of purchasing a poorly maintained or accident-damaged car. Odometer fraud is a persistent issue, where sellers roll back mileage to inflate the car’s value. In cases where flood-damaged or salvaged vehicles are reconditioned and sold, buyers face costly repairs and safety concerns post-purchase.The unavailability of a centralized database for verified vehicle records exacerbates this issue. While certified pre-owned programs and online platforms have attempted to address this problem with inspection reports and warranties, many traditional dealers and private sellers remain outside this verification ecosystem. This lack of transparency reduces consumer trust and slows the overall adoption rate of used car purchases. Building a secure, unified system for accessible vehicle history reports would help mitigate this long-standing problem.

Key Market Trends

Integration of Artificial Intelligence in Car Evaluation

Artificial Intelligence (AI) is becoming central to car valuation, risk profiling, and inventory management in the used car ecosystem. AI algorithms are now being used to assess fair pricing based on factors such as mileage, accident records, wear-and-tear, model demand, and seasonal trends. These tools reduce human error and speed up appraisal processes, allowing sellers to receive instant quotes while enabling buyers to determine whether they’re getting fair value.AI also helps detect anomalies like odometer tampering or inconsistent maintenance records by cross-referencing with service databases and historical pricing patterns. Platforms are integrating AI to optimize listings, predict resale timelines, and automate vehicle inspection using image recognition. This technology allows companies to scale operations efficiently while delivering highly personalized experiences to consumers. The adoption of AI is not just improving transparency - it’s enhancing trust and streamlining the used car lifecycle, making it easier for all stakeholders to navigate the market confidently.

Key Market Players

- Carlist.my

- CARSOME

- Trusty Cars Ltd

- Mudah.my Sdn Bhd

- METACAR

- Sime Darby Auto Selection Sdn. Bhd

- Pilihcar Sdn Bhd

- MT Digital Sdn Bhd

- Caricarz Sdn Bhd

- Quill Automobiles

Report Scope:

In this report, the Malaysia Used Car Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Malaysia Used Car Market, By Vendor:

- Organized

- Unorganized

Malaysia Used Car Market, By Vehicle Type:

- Hatchback

- Sedan

- Sports Utility Vehicle (SUV)

- Multi-Purpose Vehicles (MPVs)

Malaysia Used Car Market, By Sales Channel:

- Online

- Offline

Malaysia Used Car Market, By Region:

- West Malaysia

- East Malaysia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Malaysia Used Car Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Carlist.my

- CARSOME

- Trusty Cars Ltd

- Mudah.my Sdn Bhd

- METACAR

- Sime Darby Auto Selection Sdn. Bhd

- Pilihcar Sdn Bhd

- MT Digital Sdn Bhd

- Caricarz Sdn Bhd

- Quill Automobiles

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2025 |

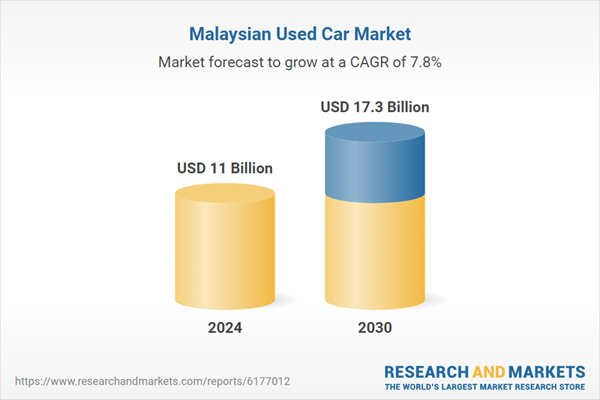

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11 Billion |

| Forecasted Market Value ( USD | $ 17.3 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Malaysia |

| No. of Companies Mentioned | 10 |