Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological innovations have significantly enhanced the market’s potential. Developments in embolic materials, including cyanoacrylate-based adhesives and ethylene vinyl alcohol copolymers, have improved the safety and control of embolization procedures. Despite the optimistic outlook, the market faces challenges that could impact its trajectory. The high cost associated with embolization procedures, including the price of specialized materials and equipment, may limit widespread adoption, particularly among cost-sensitive patient populations. Regulatory requirements present another hurdle; stringent approval processes for new embolic agents can delay market entry and inhibit innovation.

Key Market Drivers

Growth in Healthcare Industry

In 2023, U.S. healthcare expenditure increased by 7.5 percent, totaling USD 4.9 trillion, which equates to USD 14,570 per capita. Healthcare spending represented 17.6 percent of the country’s Gross Domestic Product. The robust growth of the healthcare industry in the United States is a significant driver fueling the expansion of the liquid embolic agent market. Increasing prevalence of vascular diseases, such as aneurysms, arteriovenous malformations (AVMs), and other cerebrovascular disorders, has intensified the demand for minimally invasive treatment options, where liquid embolic agents play a critical role.Advancements in medical technology and a growing focus on improving patient outcomes have led healthcare providers to adopt innovative embolization techniques that rely on these agents to effectively occlude blood vessels. The 2021 American Rescue Plan Act allocated USD 1 trillion to the construction, renovation, and modernization of healthcare facilities. Additionally, in the same year, the Build Back Better Act earmarked USD 10 billion for healthcare facility-related projects. The expanding healthcare infrastructure, coupled with rising patient awareness and early diagnosis, has contributed to a higher volume of interventional procedures that utilize liquid embolic materials.

Key Market Challenges

High Treatment and Product Costs

High treatment and product costs represent a significant challenge for the United States Liquid Embolic Agent Market, impacting both healthcare providers and patients. The specialized nature of liquid embolic agents, combined with the complexity of associated endovascular procedures, drives up the overall expense of treatment. These costs include not only the price of the embolic materials themselves but also the use of advanced delivery systems, imaging technologies, and the skilled expertise required for successful intervention.The premium pricing of liquid embolic agents can limit their accessibility, especially among patients without comprehensive insurance coverage or those in cost-sensitive healthcare settings. Hospitals and surgical centers may face budgetary constraints when procuring these products, which can influence treatment decisions and potentially restrict the availability of cutting-edge embolization therapies.

Key Market Trends

Rising Preference for Minimally Invasive Procedures

The rising preference for minimally invasive procedures is a key trend driving the growth of the United States liquid embolic agent market. In the United States, laparoscopic cholecystectomy was the key procedure that drove the adoption of laparoscopy. Its widespread acceptance as the standard of care has been largely due to several advantages, including enhanced visualization, reduced risk of infection, and the ability to perform the procedure on an outpatient basis. As healthcare providers and patients increasingly seek treatment options that offer reduced risk, shorter hospital stays, and faster recovery times, liquid embolic agents have gained prominence as essential tools in interventional radiology and endovascular therapies.Minimally invasive techniques utilizing liquid embolic agents enable precise occlusion of blood vessels to treat conditions such as aneurysms, arteriovenous malformations (AVMs), and tumors without the need for open surgery. This approach not only minimizes patient trauma but also lowers complications and improves overall clinical outcomes, making it highly attractive to clinicians and healthcare systems.

Key Market Players

- Medtronic PLC

- Terumo Medical Corporation

- Boston Scientific Corporation

- Johnson & Johnson Services, Inc.

- BlackSwan Vascular, Inc.

Report Scope

In this report, the United States Liquid Embolic Agent Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Liquid Embolic Agent Market, By Product:

- Ethylene Vinyl Alcohol Copolymer (EVOH)

- Cyanoacrylates

- Others

United States Liquid Embolic Agent Market, By Application:

- Arteriovenous Malformations (AVM)

- Hypervascular Tumors

- Peripheral Vasculature Hemorrhage

- Others

United States Liquid Embolic Agent Market, By Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Liquid Embolic Agent Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Medtronic PLC

- Terumo Medical Corporation

- Boston Scientific Corporation

- Johnson & Johnson Services, Inc.

- BlackSwan Vascular, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2025 |

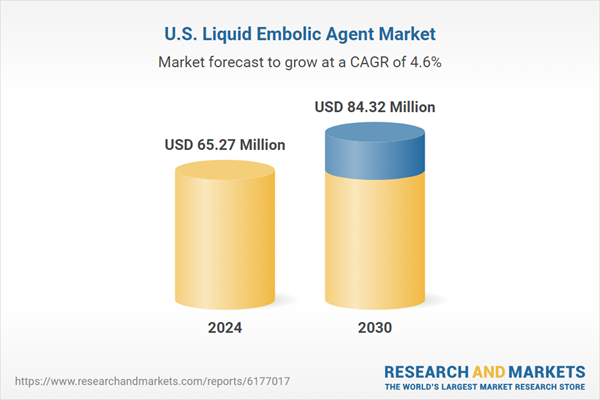

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 65.27 Million |

| Forecasted Market Value ( USD | $ 84.32 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 5 |