Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary growth drivers is the continued reliance on small molecule therapeutics, especially in areas such as oncology, infectious diseases, and chronic illnesses. These drugs are generally more stable, easier to manufacture, and less expensive to develop compared to biologics, which makes them highly attractive to pharmaceutical and biotech companies. At the same time, regulatory and geopolitical factors are influencing business decisions. Concerns about overreliance on overseas manufacturing, particularly from Asia, have prompted greater interest in domestic production.

Key Market Drivers

Growth in Healthcare Industry

The growth of the healthcare industry in the United States has become a key driver of the small molecule CDMO (Contract Development and Manufacturing Organization) market. In 2023, U.S. health care expenditures increased by 7.5%, totaling USD 4.9 trillion, which equates to USD 14,570 per capita. Health care spending represented 17.6% of the nation's Gross Domestic Product. As demand for pharmaceutical innovation rises, particularly in small molecule therapeutics, CDMOs have increasingly become strategic partners for pharmaceutical and biotech companies aiming to bring products to market more efficiently.Approximately 129 million individuals in the U.S. are living with at least one major chronic condition such as heart disease, cancer, diabetes, obesity, or hypertension according to the U.S. Department of Health and Human Services. Notably, five of the top ten leading causes of death in the country are either directly caused by or closely linked to preventable and manageable chronic diseases.

This surge in demand is primarily driven by the growing prevalence of chronic diseases such as cancer, cardiovascular conditions, and diabetes, which continue to dominate the therapeutic landscape. Small molecule drugs remain the preferred choice for treating these conditions due to their proven efficacy, oral bioavailability, and cost-effectiveness. As a result, there has been a steady increase in new drug approvals by the U.S. Food and Drug Administration (FDA), with small molecules accounting for the majority of new molecular entities approved in recent years.

Key Market Challenges

High Capital Investment & Infrastructure Constraints

High capital investment and infrastructure constraints represent significant challenges for the United States small molecule CDMO market. Establishing and maintaining state-of-the-art manufacturing facilities requires substantial financial resources. Advanced technologies, specialized equipment, and compliance with stringent regulatory standards demand continuous investment, which can be a barrier for many CDMOs, particularly smaller and mid-sized companies.The complexity of small molecule production, including the need for sophisticated synthesis processes and strict quality controls, means that infrastructure must be both flexible and scalable. However, building such versatile facilities is costly and time-consuming. Upgrading existing plants to meet evolving regulatory requirements or to adopt new technologies further increases capital expenditures, often without immediate returns.

Key Market Trends

Growing Prevalence of Cancer

The growing prevalence of cancer in the United States is a significant trend shaping the small molecule CDMO market. In 2025, it is projected that there will be 2,041,910 new cancer diagnoses and 618,120 cancer-related deaths in the United States. The cancer mortality rate has continued to decline through 2022, resulting in the prevention of nearly 4.5 million deaths. As cancer rates continue to rise due to factors such as an aging population, lifestyle changes, and improved diagnostic capabilities, there is an increasing demand for innovative and effective oncology treatments. Small molecule drugs play a critical role in cancer therapy, offering targeted mechanisms of action, oral administration, and the ability to reach intracellular targets that biologics often cannot.This rising demand for oncology therapeutics has directly influenced pharmaceutical companies to invest heavily in research and development focused on small molecule anti-cancer agents. Given the complexity and specialized nature of manufacturing these compounds, many companies turn to contract development and manufacturing organizations to manage the development, synthesis, and scale-up processes efficiently and compliantly.

Key Market Players

- Lonza

- Catalent, Inc.

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Bellen Chemistry

- Siegfried Holding AG

- Recipharm AB

- Eurofins Scientific

- Aurigene Pharmaceutical Services Ltd

- CordenPharma International

Report Scope

In this report, the United States Small Molecule CDMO Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Small Molecule CDMO Market, By Product:

- Active Pharmaceutical Ingredients (API)

- Finished Drug Products

- Others

United States Small Molecule CDMO Market, By Application:

- Oncology

- Cardiovascular Disease

- Central Nervous System (CNS) Conditions

- Autoimmune/Inflammation

- Others

United States Small Molecule CDMO Market, By Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Small Molecule CDMO Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Lonza

- Catalent, Inc.

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Bellen Chemistry

- Siegfried Holding AG

- Recipharm AB

- Eurofins Scientific

- Aurigene Pharmaceutical Services Ltd

- CordenPharma International

Table Information

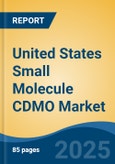

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.37 Billion |

| Forecasted Market Value ( USD | $ 34.98 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |