Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The global heat induction cap liner market sits at the intersection of product integrity, regulatory compliance, and brand experience, enabling hermetic sealing, leak prevention, shelf-life extension, and tamper evidence across a wide array of rigid containers. Adoption is broad in food and beverages, pharmaceuticals and nutraceuticals, personal care and cosmetics, household and industrial chemicals, agrochemicals, and automotive fluids - anywhere a secure, contamination-resistant closure is non-negotiable. Operationally, induction sealing has become a “no-touch” inline process compatible with high-speed packaging lines and diverse cap/container geometries, reducing rework and returns while improving line efficiency and quality yields.

Material innovation is a defining theme: aluminum-foil-based structures remain the workhorse for reliable heat transfer and barrier performance, while polymer layers (commonly PE and PP) must match the container resin for strong bonds. The mix now increasingly includes microwave-susceptor optimization, peelable layers tuned for consumer opening forces, vented constructions to manage internal pressure in volatile or fermenting products, and low-energy formulations that seal at lower wattage settings to curb power draw and heat exposure for sensitive contents. Sustainability pressures are reshaping specifications: brands are requesting mono-material compatibility to ease recycling, inks and adhesives with lower VOCs and extractables, PVC-free chemistries, and thinner gauges that cut material intensity without compromising seal integrity.

Key Market Drivers

Rising demand for tamper-evident and safety packaging

Tamper evidence has moved from “nice to have” to a routine specification across many packaged goods, driving steady adoption of induction cap liners. Over the last decade manufacturers have shifted tamper standards into procurement contracts with target compliance windows often expressed in calendar years (e.g., 2015-2024 adoption waves). Retail and regulatory programs commonly require visible tamper features on high-risk SKUs; in practice this results in conversion rates per category that exceed 60% for risk-sensitive SKUs. Typical supplier contracts for tamper-evident components span 3-7 years, producing multi-year demand visibility for liners.On the production floor, automatic induction sealers account for a substantial portion of installed sealing equipment - many plants report automatic systems representing roughly 40-50% of sealing stations - increasing consistent liner usage. Quality KPIs tighten: plants target inline seal acceptance rates of 98-99.5%, with failure tolerance often set under 1% before corrective action. Leakage and tamper incidents are tracked closely; brands aim to keep leakage incident counts below 1-2 events per million units shipped for premium SKUs.

When a single tampering incident occurs on a high-value product, conversion programs typically require trial and rollout cycles across product families numbering 3-12 SKUs in the first 6-12 months. Return-rate benchmarks are numeric too - acceptable return rates for leakage are often under 1-2% - which creates measurable procurement drivers to switch to induction liners that demonstrably reduce leak-related returns. In short, defined calendar targets, multi-year contracts (3-7 years), high inline acceptance goals (98-99.5%), low failure tolerances (< 1%), and SKU conversion counts (3-12 SKUs per incident-driven program) combine to make tamper evidence a quantifiable, large-scale driver for liner adoption.

Key Market Challenges

Rising Raw Material Volatility

The heat induction cap liner market is heavily dependent on polymers such as polyethylene (PE), polypropylene (PP), and aluminum foils for their sealing properties. Price fluctuations in crude oil directly affect resin costs, while global aluminum price volatility impacts foil supply stability. Manufacturers face difficulties maintaining cost competitiveness when polymer prices can rise by 12-18% within a quarter, disrupting procurement budgets. In 2023, several resin suppliers reported shortages that extended lead times from an average of 4 weeks to nearly 9 weeks, affecting liner production schedules.Another concern is that thinner-gauge liners, developed to reduce material use, are highly sensitive to raw material inconsistencies, increasing defect rates by 7-9%. Currency exchange fluctuations also worsen import costs in emerging economies, where up to 65% of raw materials are still imported. This creates pressure on margins and pushes small-scale converters to either raise prices or reduce production. For global suppliers, hedging strategies and multi-source procurement are necessary, but these solutions often add 5-8% to operating costs. As sustainability goals push brands toward recyclable or PVC-free liners, the reliance on alternative polymers with less established supply chains further heightens risks. Hence, raw material volatility remains a structural challenge that not only affects profitability but also creates uncertainty in meeting customer commitments.

Key Market Trends

Growing Penetration in E-commerce and Direct-to-Consumer Packaging

The boom in e-commerce has elevated packaging reliability as a critical factor. Heat induction liners provide tamper evidence and leak prevention during long-distance shipping, making them a preferred choice for online food, cosmetic, and nutraceutical brands. In 2024, more than 55% of nutraceutical shipments in North America and Europe were sealed with induction liners to ensure spill-free delivery. Packaging designed for courier handling now integrates pressure-sensitive or vented induction liners to prevent swelling or leakage.Rising returns due to damaged packaging - estimated at 12-14% in cosmetics - have accelerated liner adoption across online-first brands. Moreover, fulfillment centers operating high-speed packaging lines require induction sealing equipment capable of supporting rapid cycles. As direct-to-consumer subscription models expand, consistent liner quality becomes central to customer loyalty. This trend is expected to accelerate as global online retail penetration crosses 25% of FMCG sales by the next five years.

Key Market Players

- Tekni-Plex, Inc.

- Selig Group

- Bluemay Weston Limited

- B&B Cap Liners LLC

- Pres-On Corporation

- Low’s Capseal Sdn Bhd

- Well-Pack Industries Co., Ltd.

- Tien Lik Cap Seal Sdn Bhd

- Captel International Pvt Ltd.

- Enercon Industries Corporation

Report Scope:

In this report, the Global Heat Induction Cap Liner Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Heat Induction Cap Liner Market, By Material Type:

- Plastic

- Glass

- Others

Heat Induction Cap Liner Market, By Liner Type:

- One-piece Induction Liners

- Two-piece Induction Liners

Heat Induction Cap Liner Market, By Application:

- Food & Beverages

- Pharmaceuticals & Nutraceuticals

- Cosmetics & Personal Care

- Chemicals & Agrochemicals

- Others

Heat Induction Cap Liner Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Heat Induction Cap Liner Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tekni-Plex, Inc.

- Selig Group

- Bluemay Weston Limited

- B&B Cap Liners LLC

- Pres-On Corporation

- Low’s Capseal Sdn Bhd

- Well-Pack Industries Co., Ltd.

- Tien Lik Cap Seal Sdn Bhd

- Captel International Pvt Ltd.

- Enercon Industries Corporation

Table Information

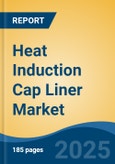

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.65 Billion |

| Forecasted Market Value ( USD | $ 1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |