Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Pharmaceutical Use of High-Purity Calcium Sulfate

The pharmaceutical sector is one of the largest consumers of high-purity calcium sulfate (HPCS), and its continued expansion is a critical growth factor for the global market. Owing to its inert nature, stability, and compressibility, HPCS is widely used as an excipient in tablet formulations, capsules, and other oral solid dosage forms. As the demand for medicines grows worldwide, so does the reliance on safe and high-quality excipients, making pharmaceuticals a central driver of HPCS consumption.The pharmaceutical industry is experiencing robust growth globally, particularly in emerging economies. According to the World Health Organization (WHO), the global pharmaceuticals market is projected to exceed USD 1.5 trillion annually by 2025. Much of this growth stems from increasing access to medicines, rising healthcare spending, and the burden of chronic diseases. For example, the International Diabetes Federation estimates that diabetes cases will rise to 643 million by 2030, substantially increasing demand for long-term therapies and, by extension, excipients used in oral medications.

More than 70% of medicines worldwide are delivered in oral solid dosage forms, such as tablets and capsules, because of their stability, ease of use, and cost-effectiveness. Excipients like HPCS are indispensable in these formulations, functioning as binders, fillers, and anti-caking agents. The U.S. Pharmacopeia (USP) lists calcium sulfate among excipients recognized for their safety and efficacy in pharmaceutical use.

High-purity grades are especially important because they ensure compliance with stringent regulatory requirements for contaminant-free drug formulations. The European Medicines Agency (EMA) emphasizes that excipients must meet high standards of purity to ensure patient safety, particularly in chronic disease therapies where long-term exposure is common.

The pharmaceutical industry is a major engine of growth for the global high-purity calcium sulfate market. Rising demand for oral solid dosage forms, growing pharmaceutical production in emerging markets, and stringent regulatory standards all point toward sustained reliance on HPCS as an excipient. With chronic disease prevalence on the rise and healthcare access expanding worldwide, the role of high-purity calcium sulfate in pharmaceutical manufacturing is set to grow significantly in the years ahead.

Key Market Challenges

Raw Material Supply and Cost Volatility

One of the most pressing challenges faced by the global high-purity calcium sulfate (HPCS) market is the dependence on raw material availability and the associated cost volatility. HPCS is primarily derived from natural gypsum deposits or produced synthetically through chemical processes. Both pathways are highly sensitive to external factors that can disrupt supply and influence pricing.Natural gypsum is a finite mineral resource, and its extraction is subject to mining regulations, land-use restrictions, and environmental protection policies in many regions. Governments across the globe are increasingly tightening restrictions on quarrying activities to reduce ecological degradation and preserve natural resources. These measures, while environmentally necessary, limit the volume of gypsum available for industrial processing. Additionally, geopolitical tensions, transportation bottlenecks, and uneven regional distribution of gypsum reserves exacerbate supply chain vulnerabilities, creating uncertainty for producers.

On the other hand, synthetic gypsum, produced as a byproduct of flue-gas desulfurization (FGD) in coal-fired power plants, faces its own set of challenges. The global shift toward renewable energy and the gradual phase-out of coal plants have reduced the availability of FGD gypsum in several developed economies. This decline restricts access to a previously reliable secondary source of raw material. Moreover, synthetic production methods that involve chemical processing demand high energy inputs, driving up operational costs, particularly in times of energy price inflation.

Key Market Trends

Sustainability & Green Manufacturing

Sustainability has emerged as a defining trend across industries, and the high-purity calcium sulfate (HPCS) market is no exception. Growing concerns about climate change, resource depletion, and environmental protection are compelling manufacturers to rethink traditional production methods and shift toward greener, more responsible practices.Producers are increasingly investing in low-emission technologies and energy-efficient processing techniques to reduce the carbon footprint associated with gypsum extraction and calcium sulfate refining. Advanced recycling and waste recovery systems are also being deployed to minimize raw material wastage and improve overall efficiency. For example, several plants are exploring the use of renewable energy sources, such as solar and wind, to power operations, while others are optimizing water recycling in processing facilities.

The emphasis on sustainability is not only driven by internal commitments but also by external pressures. Regulatory frameworks such as the European Green Deal and stricter emissions standards in North America and Asia are pushing industries to comply with eco-friendly benchmarks. At the same time, global corporations are seeking suppliers who can demonstrate sustainable sourcing and transparent environmental reporting, creating market advantages for HPCS producers that align with these expectations.

Beyond compliance, sustainable production enhances the value proposition of HPCS in applications like green construction, where eco-certified materials are prioritized, and in agriculture, where HPCS is increasingly linked to soil enrichment and sustainable farming practices. This alignment of environmental responsibility with end-user demand is making green manufacturing a cornerstone of long-term growth in the global HPCS market.

Key Market Players

- Boral Limited

- USG Corporation

- Compagnie de Saint-Gobain SA

- Beijing New Building Materials Public Limited Company

- Jonoub Gypsum

- PABCO Building Products, LLC

- Solvay SA

- Georgia-Pacific Gypsum LLC

- Knauf Digital GmbH

- Yoshino Gypsum Co., Ltd.

Report Scope

In this report, the Global High Purity Calcium Sulfate Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:High Purity Calcium Sulfate Market, By Form:

- Powder

- Granules

- Others

High Purity Calcium Sulfate Market, By End Use:

- Pharmaceuticals

- Food & Beverage

- Construction

- Agriculture

- Cosmetics & Personal Care

- Others

High Purity Calcium Sulfate Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global High Purity Calcium Sulfate Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Boral Limited

- USG Corporation

- Compagnie de Saint-Gobain SA

- Beijing New Building Materials Public Limited Company

- Jonoub Gypsum

- PABCO Building Products, LLC

- Solvay SA

- Georgia-Pacific Gypsum LLC

- Knauf Digital GmbH

- Yoshino Gypsum Co., Ltd.

Table Information

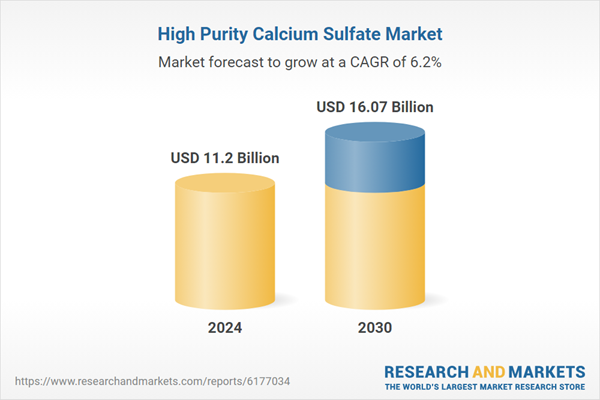

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.2 Billion |

| Forecasted Market Value ( USD | $ 16.07 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |