Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This has led to a shift towards lighter materials, such as aluminum and composite materials, in the manufacturing of axles and propeller shafts. The ongoing trend of adopting advanced technologies, such as electric and hybrid powertrains, is also contributing to the growing demand for specialized axle and propeller shaft components that are optimized for these new vehicle types. Manufacturers are continually innovating to meet the evolving requirements of both traditional internal combustion engine (ICE) vehicles and emerging electric vehicles (EVs).

Key trends driving the UK market include the growing integration of electronic systems with axle and propeller shaft components. The development of advanced driver assistance systems (ADAS) and autonomous driving technology is creating a demand for more sophisticated axle designs that can handle increased stress and ensure smoother performance. Propeller shafts are also becoming more advanced, with an increasing focus on enhancing durability and efficiency to accommodate varying driving conditions. These advancements not only improve vehicle performance but also contribute to the longevity and reliability of the drivetrain. The adoption of more efficient and environmentally friendly production processes also plays a crucial role in enhancing the overall growth prospects for the UK automotive axle and propeller shaft market.

Despite the positive market outlook, challenges such as fluctuating raw material prices and the high cost of research and development for new technologies remain significant. The complexity of integrating new technologies with existing vehicle platforms also poses a challenge for manufacturers, requiring substantial investment in infrastructure and expertise.

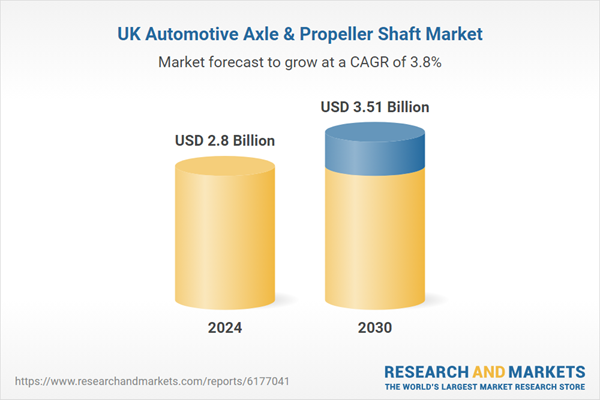

Moreover, supply chain disruptions and the increasing demand for skilled labor in advanced manufacturing techniques may hinder market growth in the short term. However, the potential for new opportunities in the form of electric vehicle platforms, lighter materials, and advancements in propulsion systems provides a promising outlook for the UK automotive axle and propeller shaft market. These factors, combined with the industry’s focus on sustainability and technological innovation, will likely shape the market's trajectory through 2030.

Market Drivers

Growing Demand for Fuel-Efficient Vehicles

With increasing consumer concerns about rising fuel prices and environmental impacts, there is a clear shift towards fuel-efficient vehicles. Automakers are prioritizing the reduction of vehicle weight and improving drivetrain efficiency, which directly influences the demand for lightweight and high-performance axles and propeller shafts. Manufacturers are optimizing designs to offer components that support better fuel economy, aligning with consumer and regulatory demands for greener transportation options. The rising popularity of compact and subcompact vehicles, which emphasize fuel efficiency, further drives the need for lighter, more efficient axle systems.This shift toward fuel efficiency is expected to continue growing as consumers and manufacturers become more focused on sustainability. For instance, the UK automotive sector remains the country’s largest exporter of manufactured goods, increasing its share to 13.9% in the first half of 2024, according to SMMT’s latest trade snapshot. In 2023, the industry contributed approximately $143.75 billion in total trade, comprising around $58.75 billion in exports and $85.0 billion in imports, driven by strong global demand for premium UK-made electrified vehicles, which are valued significantly higher than internal combustion engine models. The UK produced over 905,117 cars, 120,357 commercial vehicles, and 1.62 million engines in 2023, with 80% of cars exported to 140 markets worldwide. To sustain this momentum and enhance economic growth, SMMT has outlined key policy recommendations to support the industry’s future.

Key Market Challenges

High Cost of Research and Development

Developing new axle and propeller shaft technologies that can meet the performance and efficiency requirements of modern vehicles requires significant investment in research and development (R&D). The cost of R&D can be prohibitive, particularly as manufacturers aim to innovate to meet the growing demands of electric and hybrid vehicles. Small and medium manufacturers may find it challenging to keep up with these R&D costs, limiting their ability to remain competitive. As technologies like smart axles and lightweight materials evolve, the associated R&D costs continue to rise, creating financial pressure. Large companies may have an advantage in absorbing these costs, but smaller manufacturers could struggle to maintain innovation at the same pace.Key Market Trends

Lightweight Materials

As the automotive industry continues to focus on reducing the weight of vehicles to improve fuel efficiency and meet regulatory standards, the use of lightweight materials for axles and propeller shafts is becoming more prominent. Materials like aluminum, magnesium, and carbon fiber are increasingly being used in the manufacturing of these components to help reduce vehicle weight without compromising strength or durability. This trend is particularly important as automakers strive to meet emissions and fuel economy targets. Lighter components also contribute to improved handling and overall vehicle performance, which is increasingly important in high-performance vehicle segments. This trend toward lightweighting will likely intensify as automakers focus on electric vehicles, where weight reduction is even more critical for improving range and performance.Key Market Players

- ZF Friedrichshafen AG

- Dana Incorporated

- GKN Automotive

- American Axle & Manufacturing, Inc

- Meritor, Inc.

- Showa Corporation

- Hyundai Wia Corporation

- JTEKT Corporation

- Mark Williams Enterprises Inc.

- Schaeffler Group

Report Scope:

In this report, the UK Automotive Axle & Propeller Shaft Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UK Automotive Axle & Propeller Shaft Market, By Axle Type:

- Live

- Dead

- Tandem

UK Automotive Axle & Propeller Shaft Market, By Propeller Shaft Type:

- Single

- Multi-Piece

UK Automotive Axle & Propeller Shaft Market, By Vehicle Type:

- Passenger Car

- Commercial Vehicle

UK Automotive Axle & Propeller Shaft Market, By Region:

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UK Automotive Axle & Propeller Shaft Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ZF Friedrichshafen AG

- Dana Incorporated

- GKN Automotive

- American Axle & Manufacturing, Inc

- Meritor, Inc.

- Showa Corporation

- Hyundai Wia Corporation

- JTEKT Corporation

- Mark Williams Enterprises Inc.

- Schaeffler Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 3.51 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 10 |