Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

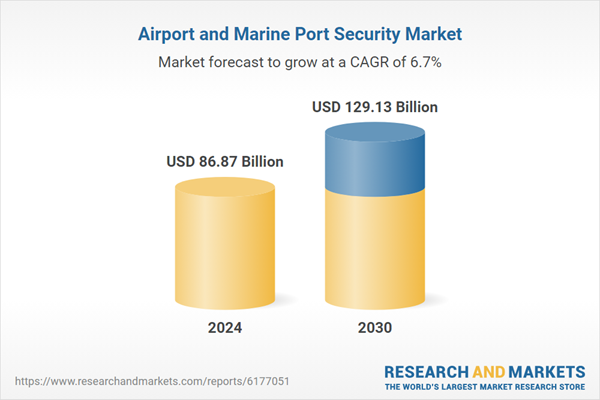

The Airport and Marine Port Security Market encompasses technologies, solutions, and services designed to safeguard airports and seaports against a wide range of security threats, including terrorism, smuggling, cyberattacks, and unauthorized access. This market includes surveillance systems, access control solutions, perimeter protection, screening and inspection equipment, fire and safety systems, and related software and services that collectively ensure the safety of passengers, cargo, and critical infrastructure.

The growing complexity of global transportation networks, coupled with increasing passenger volumes and cargo throughput, has made security a top priority for airport and port authorities worldwide. Technological advancements such as biometric identification, artificial intelligence-based surveillance, smart sensors, and automated screening systems are enhancing the effectiveness and efficiency of security operations, thereby attracting significant investment from both public and private stakeholders. Additionally, stringent government regulations and international security standards are compelling airports and ports to upgrade their security frameworks continuously.

The rise in incidents of terrorism, organized crime, and cyber threats has further accelerated the adoption of advanced security solutions, creating a robust demand for integrated security systems. Furthermore, ongoing modernization projects in emerging economies, where air travel and maritime trade are expanding rapidly, are fueling market growth by necessitating state-of-the-art security infrastructure. Strategic initiatives by leading market players, including partnerships, mergers, acquisitions, and product innovations, are also contributing to market expansion by introducing more sophisticated, cost-effective, and scalable security solutions. As global trade and tourism continue to grow, the market is expected to witness sustained expansion driven by the dual need for operational efficiency and enhanced security.

Cloud-based solutions and remote monitoring technologies are additionally enabling real-time threat detection and rapid response, further strengthening market prospects. Overall, the Airport and Marine Port Security Market is poised for steady growth in the coming years, driven by the convergence of rising security concerns, technological advancements, regulatory compliance requirements, and increasing investment in infrastructure modernization, ensuring safer and more secure air and maritime transportation networks worldwide.

Key Market Drivers

Escalating Global Terrorism and Security Threats

In the Airport and Marine Port Security Market, the persistent escalation of global terrorism and security threats serves as a primary catalyst for robust investment and innovation in protective measures. As geopolitical tensions intensify and non-state actors employ increasingly sophisticated tactics, airports and marine ports, being critical nodes in global transportation networks, face heightened vulnerabilities to attacks that could disrupt economic activities, endanger human lives, and compromise national security. This driver compels stakeholders, including government agencies, port operators, and aviation authorities, to prioritize comprehensive security frameworks that integrate intelligence sharing, advanced surveillance, and rapid response protocols.The imperative to safeguard against threats such as bombings, hijackings, and smuggling operations has led to the deployment of multi-layered defense strategies, encompassing physical barriers, behavioral analysis systems, and collaborative international partnerships. Furthermore, the evolving nature of threats, including lone-wolf actors and organized crime syndicates exploiting supply chain weaknesses, underscores the need for proactive risk assessment and continuous enhancement of security postures. By addressing these challenges, entities within the Airport and Marine Port Security Market not only mitigate immediate risks but also foster resilience, ensuring uninterrupted operations and maintaining public confidence in global travel and trade infrastructures.

This focus on countering terrorism aligns with broader objectives of economic stability, as disruptions in these sectors can cascade into significant financial losses and supply chain interruptions worldwide. Investments in this area are driven by the recognition that proactive security measures yield long-term returns through averted incidents and enhanced operational efficiency. Moreover, the integration of threat intelligence platforms enables real-time monitoring and predictive analytics, allowing for preemptive actions against potential breaches.

As threats become more asymmetric and unpredictable, the market responds with scalable solutions that adapt to diverse environments, from high-traffic international airports to remote marine terminals. This driver also influences policy formulation, where regulatory bodies mandate elevated security standards to align with international conventions, thereby stimulating market growth through compliance-driven procurements. Ultimately, the commitment to combating terrorism fortifies the Airport and Marine Port Security Market, positioning it as an indispensable component of global infrastructure protection strategies.

According to the U.S. Department of Homeland Security's Homeland Threat Assessment 2025, domestic violent extremists conducted at least four attacks between September 2023 and July 2024, driven by anti-government and racial motivations, highlighting rising threats to critical infrastructure like ports and airports. The National Terrorism Advisory System Bulletin from June 2025 notes heightened risks from cyber attacks by pro-Iranian actors on U.S. networks, with global terrorism affecting international stability. NATO reports terrorism as the most direct asymmetric threat to citizens and prosperity, with ongoing conflicts exacerbating vulnerabilities in transportation hubs.

Key Market Challenges

High Implementation and Maintenance Costs

One of the foremost challenges confronting the Airport and Marine Port Security Market is the significant financial burden associated with the implementation and maintenance of advanced security systems. Airports and marine ports require comprehensive security infrastructure that encompasses surveillance systems, access control mechanisms, screening and inspection equipment, perimeter protection, fire and safety systems, and integrated software platforms. Deploying such sophisticated solutions demands substantial capital investment, which can be particularly prohibitive for medium- and small-sized airports or ports in developing economies.Beyond initial installation, ongoing costs related to maintenance, periodic upgrades, and staff training further amplify financial pressure. Security technologies such as biometric identification, artificial intelligence-enabled video analytics, and automated threat detection systems require regular software updates, calibration, and technical support to maintain optimal performance. Additionally, security systems are highly specialized, necessitating skilled personnel for operation and troubleshooting, which contributes to operational expenditure. Budget constraints can lead to suboptimal security measures, exposing critical infrastructure to vulnerabilities and compromising passenger, cargo, and staff safety.

Furthermore, procurement of advanced equipment often involves long lead times and complex regulatory approvals, which may delay deployment and increase project costs. As a result, airport and port authorities must balance the need for state-of-the-art security solutions with fiscal prudence, often necessitating phased or incremental implementation strategies. The challenge is further exacerbated by the rapidly evolving nature of security threats, which requires continual investment to ensure systems remain effective and compliant with international standards.

Without adequate financial planning and allocation, organizations risk underinvestment in critical security infrastructure, which could impact operational efficiency, passenger confidence, and overall market growth. Consequently, the high costs of implementation and maintenance represent a substantial barrier to widespread adoption of advanced security technologies, particularly in regions where budgetary limitations and competing infrastructure priorities exist.

Key Market Trends

Adoption of Advanced Biometric and Identity Management Solutions

A prominent trend shaping the Airport and Marine Port Security Market is the increasing adoption of advanced biometric and identity management solutions. Airports and marine ports are implementing technologies such as facial recognition, fingerprint scanning, iris recognition, and palm vein authentication to enhance security and streamline passenger and cargo verification processes. These solutions enable rapid identification of individuals, reduce manual checks, and minimize the risk of unauthorized access. With growing passenger volumes and cargo throughput, conventional security methods are proving insufficient, creating demand for automated and accurate identity verification systems.Integration of biometric solutions with access control systems and surveillance infrastructure allows for real-time monitoring, immediate alerts, and faster response to potential security threats. Additionally, advanced identity management solutions facilitate a seamless travel experience, reduce bottlenecks, and enhance operational efficiency, which is a priority for airports and ports focused on customer satisfaction and throughput optimization. Governments and regulatory authorities are also encouraging the adoption of biometrics through policy mandates and security standards, further driving market growth.

Leading security technology providers are investing in research and development to enhance the accuracy, speed, and scalability of biometric systems, enabling deployment in large-scale, high-traffic environments. Cloud-based identity management platforms are increasingly being integrated to allow centralized monitoring, data storage, and analysis across multiple locations. The convergence of biometrics with artificial intelligence and machine learning technologies is improving predictive analytics, risk assessment, and threat detection capabilities. This trend is expected to continue gaining momentum as airports and marine ports strive to strengthen security, comply with international regulations, and improve operational efficiency while managing growing traffic and logistical demands.

Key Market Players

- Bosch Security Systems

- Honeywell International Inc.

- FLIR Systems, Inc.

- Thales Group

- Johnson Controls International plc

- Smiths Detection

- Vanderlande Industries

- Axis Communications AB

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

Report Scope:

In this report, the Global Airport and Marine Port Security Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Airport and Marine Port Security Market, By Component:

- Hardware

- Software

- Services

Airport and Marine Port Security Market, By Security Type:

- Access Control Systems

- Surveillance Systems (CCTV, IP Cameras)

- Perimeter Security System

- Screening & Inspection Systems

- Fire & Safety Systems

Airport and Marine Port Security Market, By Technology:

- Biometric Systems

- X-ray & Imaging Systems

- Radar & Sensor Systems

- Drone & UAV Surveillance

Airport and Marine Port Security Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Airport and Marine Port Security Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bosch Security Systems

- Honeywell International Inc.

- FLIR Systems, Inc.

- Thales Group

- Johnson Controls International plc

- Smiths Detection

- Vanderlande Industries

- Axis Communications AB

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 86.87 Billion |

| Forecasted Market Value ( USD | $ 129.13 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |