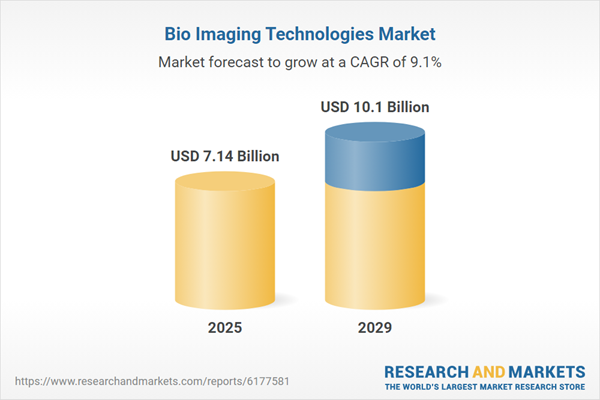

The bio imaging technologies market size is expected to see strong growth in the next few years. It will grow to $10.1 billion in 2029 at a compound annual growth rate (CAGR) of 9.1%. The growth in the forecast period can be attributed to rising demand for personalized medicine, increased need for diagnostic accuracy, broader applications in oncology, a growing emphasis on image-guided surgeries, and the expanding use of wearable imaging devices. Key trends shaping the market include the integration of cloud-based technologies, innovations in imaging systems, advancements in 3D imaging and sensor technology, the development of new contrast agents, and the creation of energy-efficient imaging solutions.

The growing utilization of diagnostic tests is expected to contribute significantly to the expansion of the bioimaging technologies market. These tests, including imaging scans, biopsies, and lab analyses, help identify, monitor, and evaluate medical conditions. The increase in demand stems from the rising prevalence of chronic illnesses, which require regular testing for timely detection and ongoing patient management. Bioimaging technologies improve these procedures by offering detailed internal visuals, enabling accurate diagnosis and monitoring. Advanced imaging techniques facilitate early detection, enhance treatment planning, and improve patient outcomes. For example, the National Health Service reported that England performed 45 million imaging tests in November 2023, up from 44 million in 2022, reflecting a 2.2% rise. This growing reliance on diagnostic procedures is driving market growth.

Companies in the bioimaging sector are increasingly introducing technologies that allow rapid, low-impact imaging. Spinning disk confocal microscopy, a fluorescence-based method, scans samples using a rotating disk with multiple pinholes, producing high-resolution 3D images of live cells with minimal phototoxicity. In May 2025, Japan’s Evident Co. Ltd. launched the IXplore IX85 SpinXL and SpinSR microscopes for live-cell imaging. The SpinXL, using CrestOptics X-light technology, offers a 26.5 mm field of view, imaging speeds up to 498 frames per second, and gentle NIR illumination for large cellular areas. The SpinSR, with Yokogawa CSU-W1 technology, achieves super-resolution imaging to 120 nm and uses Trusight SR algorithms for detailed 3D analyses. Both systems enable volumetric reconstruction with silicone gel pad objectives, giving researchers precise insights into biological structures.

In January 2025, Quanterix Corporation, a biotechnology firm based in the U.S., acquired Akoya Biosciences Inc., also a U.S.-based bioimaging company, for an undisclosed sum. The acquisition aims to deliver a fully integrated solution for detecting protein biomarkers in blood and tissue, expand Quanterix’s presence in neurology, oncology, and immunology, and enhance profitability through operational efficiencies and cross-selling opportunities.

Major players in the bio imaging technologies market are Thermo Fisher Scientific Inc., Siemens Healthineers AG, Fujifilm Holdings Corporation, Koninklijke Philips N.V., GE HealthCare Technologies Inc., Konica Minolta Inc., Agilent Technologies Inc., Keyence Corporation, Olympus Corporation, Nikon Corporation, Hologic Inc., Shimadzu Corporation, Bruker Corporation, Hamamatsu Photonics K.K., Carestream Health Inc., Esaote S.p.A., Canon Medical Systems Corporation, Carl Zeiss Meditec AG, Applied Spectral Imaging, and MARS Bioimaging Limited.

North America was the largest region in the bio imaging technologies market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in bio imaging technologies report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the bio imaging technologies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The rapid escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are significantly impacting the information technology sector, particularly in hardware manufacturing, data infrastructure, and software deployment. Higher duties on imported semiconductors, circuit boards, and networking equipment have raised production and operational costs for tech firms, cloud service providers, and data centers. Companies relying on globally sourced components for laptops, servers, and consumer electronics are facing longer lead times and increased pricing pressures. In parallel, tariffs on specialized software tools and retaliatory measures from key international markets have disrupted global IT supply chains and reduced overseas demand for U.S.-developed technologies. To navigate these challenges, the sector is accelerating investments in domestic chip fabrication, diversifying supplier bases, and adopting AI-driven automation to enhance operational resilience and cost efficiency.

Bioimaging technologies encompass a wide range of techniques used to visualize and analyze biological structures and processes within living organisms or biological samples. These technologies are essential in research and medical applications, enabling scientists and clinicians to monitor biological activity in real time or at specific stages without invasive procedures.

The main types of bioimaging technologies include confocal microscopy, super-resolution microscopy, electron microscopy, and multiphoton microscopy. Confocal microscopy is an advanced optical imaging method that employs point illumination and a spatial pinhole to eliminate out-of-focus light, producing high-resolution, high-contrast images of thick specimens. These technologies can analyze various sample types, including live cells, fixed cells, tissues, and three-dimensional (3D) samples, using contrast agents such as ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), nuclear medicine, and optical agents. Applications span oncology, cardiology, neurology, orthopedics, and other medical fields, with primary end users including hospitals, diagnostic imaging centers, research institutes, and related organizations.

The bio imaging technologies market research report is one of a series of new reports that provides bio imaging technologies market statistics, including bio imaging technologies industry global market size, regional shares, competitors with the bio imaging technologies market share, bio imaging technologies market segments, market trends, and opportunities, and any further data you may need to thrive in the bio imaging technologies industry. This bio imaging technologies market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The bio imaging technologies market consists of revenues earned by entities by providing services such as contract imaging for clinical trials and drug development, centralized image analysis and core lab services, education and training programs, digital image processing, and quality assurance. The market value includes the value of related goods sold by the service provider or included within the service offering. The bio imaging technologies market also includes sales of image analysis software, AI-powered platforms, whole-slide imaging systems, fluorescent dyes, contrast agents, radiopharmaceuticals, probe-based endomicroscopy tools, and hyperspectral imaging microscopes. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Bio Imaging Technologies Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on bio imaging technologies market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for bio imaging technologies? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The bio imaging technologies market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Technology: Confocal Microscopy; Super-Resolution Microscopy; Electron Microscopy; Multiphoton Microscopy2) By Sample Type: Live Cells; Fixed Cells; Tissues; Three-Dimensional (3D) Samples

3) By Contrast Agents: Ultrasound Contrast Agents; Computed Tomography (CT) Contrast Agents; Magnetic Resonance Imaging (MRI) Contrast Agents; Nuclear Medicine Contrast Agents; Optical Contrast Agents

4) By Application: Oncology; Cardiology; Neurology; Orthopedics; Other Applications

5) By End-User: Hospitals; Diagnostic Imaging Centers; Research Institutes; Other End Users

Subsegments:

1) By Confocal Microscopy: Laser Scanning Confocal Microscopy; Spinning Disk Confocal Microscopy; Programmable Array Microscopy2) By Super-Resolution Microscopy: Stimulated Emission Depletion Microscopy; Structured Illumination Microscopy; Single Molecule Localization Microscopy

3) By Electron Microscopy: Transmission Electron Microscopy; Scanning Electron Microscopy; Cryo Electron Microscopy

4) By Multiphoton Microscopy: Two Photon Excitation Microscopy; Three Photon Excitation Microscopy; Multiharmonic Generation Microscopy

Companies Mentioned: Thermo Fisher Scientific Inc.; Siemens Healthineers AG; Fujifilm Holdings Corporation; Koninklijke Philips N.V.; GE HealthCare Technologies Inc.; Konica Minolta Inc.; Agilent Technologies Inc.; Keyence Corporation; Olympus Corporation; Nikon Corporation; Hologic Inc.; Shimadzu Corporation; Bruker Corporation; Hamamatsu Photonics K.K.; Carestream Health Inc.; Esaote S.p.A.; Canon Medical Systems Corporation; Carl Zeiss Meditec AG; Applied Spectral Imaging; MARS Bioimaging Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Bio Imaging Technologies market report include:- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- Fujifilm Holdings Corporation

- Koninklijke Philips N.V.

- GE HealthCare Technologies Inc.

- Konica Minolta Inc.

- Agilent Technologies Inc.

- Keyence Corporation

- Olympus Corporation

- Nikon Corporation

- Hologic Inc.

- Shimadzu Corporation

- Bruker Corporation

- Hamamatsu Photonics K.K.

- Carestream Health Inc.

- Esaote S.p.A.

- Canon Medical Systems Corporation

- Carl Zeiss Meditec AG

- Applied Spectral Imaging

- MARS Bioimaging Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.14 Billion |

| Forecasted Market Value ( USD | $ 10.1 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |