The trend is supported by the rise in chronic diseases and the growing elderly population, both of which contribute to the increasing demand for surgical procedures. Inhalation anesthesia offers a fast, non-invasive, and effective method of anesthesia delivery, making it widely adopted across healthcare settings. Its ability to allow rapid onset and recovery enhances its appeal in both routine and complex surgeries. Increasing investments in surgical infrastructure and a rise in outpatient procedures are pushing healthcare providers to adopt anesthetic agents that offer precision, safety, and efficiency.

Ongoing advancements in anesthesia delivery technologies are transforming clinical outcomes. Enhanced systems featuring integrated vaporizers, exhaled CO₂ monitoring, and automated agent dispensing help minimize human error and improve dosing accuracy. Intelligent systems with AI-enabled monitoring and closed-loop delivery further optimize the use of volatile anesthetics while improving patient recovery timelines. These innovations are reducing drug waste and improving safety, contributing to market expansion across hospital and ambulatory care settings. Agents offering rapid onset and shorter recovery periods align with the growing operational needs of outpatient and same-day surgical centers, boosting demand.

In 2024, the sevoflurane generated USD 1.3 billion, maintaining its leadership in the inhalation anesthesia market. Its clinical advantages, such as a fast onset and recovery profile, continue to make it the preferred agent, especially in outpatient and pediatric care. Sevoflurane’s smooth mask induction, minimal airway irritation, and compatibility with low-flow techniques contribute to its widespread use across healthcare systems aiming to reduce anesthetic exposure while maintaining efficacy.

The maintenance segment held a 67.7% share in 2024 due to its essential role in preserving anesthesia during complex and prolonged surgical interventions. The increasing number of surgeries in medical specialties such as cardiology, neurology, oncology, and orthopedic care continues to drive the segment. Volatile agents like isoflurane, desflurane, and sevoflurane remain the top choices due to their reliability and adaptability during extended procedures. Additionally, the need for quick patient recovery in ambulatory care reinforces the demand for efficient maintenance-phase agents.

North America Inhalation Anesthesia Market held a 51.7% share in 2024. Its leadership stems from a well-developed healthcare ecosystem, high procedural volumes, and the rapid integration of advanced anesthesia technology. The region continues to benefit from the presence of highly trained medical professionals and the increasing adoption of fast-acting anesthetics for outpatient use. The U.S. plays a major role in driving innovation, supported by collaborations among pharmaceutical firms and medical device manufacturers focused on optimizing inhalation anesthetic delivery.

Major players active in the Global Inhalation Anesthesia Market include Baxter, Halocarbon, Linde, Raman & Weil, Fresenius Kabi, Piramal Critical Care, Lunan Pharmaceutical, Troikaa Pharmaceuticals, AbbVie, and Aetos Pharma. Leading companies in the Inhalation Anesthesia Market are adopting a mix of strategic initiatives to bolster their global position. Many are expanding production capabilities and improving supply chain resilience to meet increasing surgical demand. A key focus is on innovation, particularly in enhancing the safety and precision of delivery systems through automation and integration of AI-powered monitoring. Strategic alliances and licensing agreements help accelerate market access and widen therapeutic portfolios. Firms are also targeting emerging markets by introducing cost-effective formulations that meet local regulatory standards.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Inhalation Anesthesia market report include:- AbbVie

- Aetos Pharma

- Baxter

- Fresenius Kabi

- Halocarbon

- Linde

- Lunan Pharmaceutical

- Piramal Critical Care

- Raman & Weil

- Troikaa Pharmaceuticals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | September 2025 |

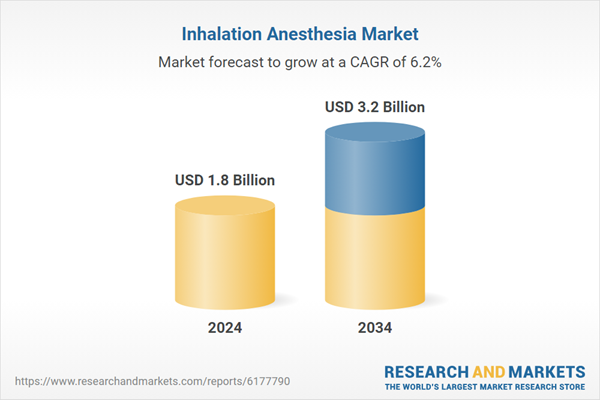

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |