The regional market operates under a highly structured ecosystem, with many manufacturers participating in collective organizations, creating a unified approach to industry development. This cohesion helps streamline innovation and compliance efforts across stakeholders. Technological advancements such as Simultaneous Localization and Mapping (SLAM) are reshaping forklift navigation by allowing operations without fixed surroundings, ideal for ever-changing warehouse environments. Modern sensor technologies are playing a pivotal role in improving safety standards and are anticipated to become baseline features in future forklift models. The demand for advanced safety systems is driven by increasingly stringent workplace safety mandates across the region. As material handling standards continue to evolve, manufacturers are adopting sensor-driven and autonomous solutions to support warehouse modernization and regulatory alignment. With rapid expansion in e-commerce and industrial automation, the forklift sector in North America is undergoing a significant transformation that prioritizes speed, safety, energy efficiency, and scalability in logistics and warehousing applications.

In 2024, the warehouse applications segment held a 30% share and is forecasted to grow at a CAGR of 7.2% through 2034. Warehousing operations have surged across North America, influenced by rising demand for fast delivery and streamlined material handling across major fulfillment hubs. These trends have fueled forklift adoption, especially in multi-shift and automated warehouse environments.

The logistics segment held a 36% share in 2024 and is expected to grow at a CAGR of 8% from 2025 to 2034, driven by demand from e-commerce and third-party logistics operators. Electric forklifts in Class I through III see a spike in adoption as companies modernize operations with low-emission, high-efficiency machinery that supports rapid inventory turnover and safety improvements. Demand is especially strong in U.S. regions with high warehousing density and rising consumer fulfillment expectations, while Canada’s growth is bolstered by the surge in cross-border logistics services.

U.S. Forklift Market generated USD 9.9 billion in 2024, securing its position as the largest forklift market in North America. Forklift use is widespread across the logistics, manufacturing, and retail sectors. Electric forklifts are gaining traction in warehouses as sustainability goals and environmental compliance become central to operational strategies. While internal combustion forklifts remain dominant in heavy-duty applications, the transition to cleaner alternatives continues to accelerate across the U.S. market.

Key companies operating in the North America Forklift Market include Hyster-Yale, Inc., Crown Equipment Corporation, Toyota Material Handling North America, Doosan Bobcat North America Inc., Jungheinrich AG, Mitsubishi Logisnext Co., Ltd., KION GROUP AG, Hyundai Material Handling Co., Ltd., Sellick Equipment Limited, Caterpillar Inc., UniCarriers Corporation, Hoist Liftruck Manufacturing, Inc., Manitou Group SA, Pettibone LLC, and Doosan Industrial Vehicle Co., Ltd. To enhance their position in the North America forklift market, manufacturers are emphasizing electric and hybrid product development aimed at improving energy efficiency and regulatory compliance. Brands such as Jungheinrich AG, Crown Equipment Corporation, and KION GROUP AG are scaling their portfolios with automation-ready forklifts and safety-enhancing sensor integrations. Companies are also forging strategic partnerships with warehouse operators to introduce fleet optimization solutions and connected vehicle systems. Expanding after-sales services and offering subscription-based maintenance plans have become key tactics for improving customer retention. Investments in smart warehouse solutions, telematics integration, and factory-direct distribution networks are enabling quicker deployment and improved end-user experience.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this North America Forklift market report include:- Caterpillar Inc.

- Crown Equipment Corporation

- Doosan Bobcat North America Inc.

- Doosan Industrial Vehicle Co., Ltd.

- Hoist Liftruck Manufacturing, Inc.

- Hyster-Yale, Inc.

- Hyundai Material Handling Co., Ltd.

- Jungheinrich AG

- KION GROUP AG

- Manitou Group SA

- Mitsubishi Logisnext Co., Ltd.

- Pettibone LLC

- Sellick Equipment Limited

- Toyota Material Handling North America

- UniCarriers Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | September 2025 |

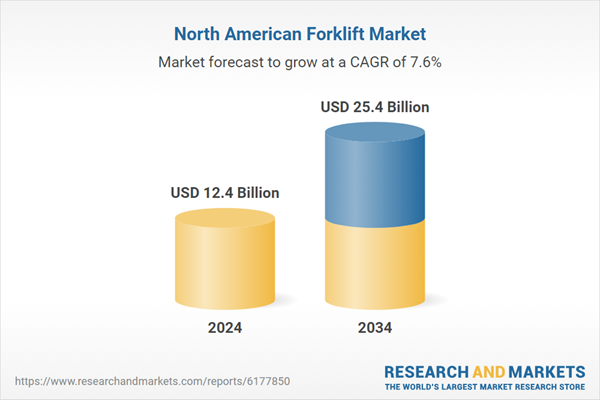

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 12.4 Billion |

| Forecasted Market Value ( USD | $ 25.4 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 16 |