Robust investments in European infrastructure are reinforcing market optimism and propelling the adoption of modern and eco-conscious forklift technologies. This upward momentum is being further supported by stronger regulatory frameworks that push manufacturers toward greener, emission-reducing solutions. The drive toward carbon neutrality, particularly under the European Union’s Green Deal initiative, is accelerating the development of low-emission industrial equipment. Companies across the region are aligning their business models with sustainability goals, not only to remain compliant but also to contribute meaningfully to long-term environmental commitments. Financial incentives from the EU for clean technology further strengthen this shift, allowing firms to innovate while benefiting economically.

The competitive dynamics of the market are being transformed by the growing demand for automation and electrification. Manufacturers are embracing these advancements to improve operational efficiency, cut maintenance expenses, and cater to evolving customer preferences. As businesses seek intelligent, clean energy solutions for material handling, the transition toward electric and automated forklifts is becoming essential for staying competitive in this rapidly changing industrial landscape.

The warehousing applications segment held a 30% share in 2024 and is set to grow at a CAGR of 5.9% through 2034. Within this segment, warehouse forklifts are vital for logistics-intensive economies, especially across regions such as the U.K., France, and Germany. As the e-commerce boom continues to shape retail and industrial distribution, companies are increasingly integrating electric forklifts for indoor operations with an eye on zero-emission goals. With limited warehouse space in dense urban centers, there’s a rising demand for narrow-aisle and space-saving designs, while automation is also being introduced to manage high-volume workflows more efficiently throughout European nations.

The logistics segment held a 37% share in 2024 and is forecasted to grow at a CAGR of 6.7% from 2025 to 2034. The logistics sector benefits from rapid growth in e-commerce, urban last-mile delivery, and 3PL operations. Demand for electric Class I-III forklifts is strong, and automated guided vehicles (AGVs) are gaining traction in advanced logistics centers. Increasing demand for temperature-controlled and cold-chain solutions is further driving forklift adoption. Efficiency, environmental compliance, and smooth performance in European logistics hubs are contributing to robust market growth.

Germany Forklift Market generated USD 4.7 billion in 2024, backed by strong policy support, technological evolution, and a focus on emissions reduction. Electric forklifts are widely adopted across Europe, supported by a comprehensive charging infrastructure and government-backed clean energy programs. Germany maintains its leadership as Europe’s top forklift manufacturing and exporting country, setting standards in electric vehicle development, automation technologies, and hydrogen-powered mobility. Its industrial ecosystem remains tightly integrated with innovation and regulatory compliance.

Prominent companies shaping the Europe Forklift Market include HUBTEX Maschinenbau GmbH, Translift Bendi Ltd, Flexi Narrow Aisle, Toyota Material Handling Europe, Jungheinrich AG, Bolzoni Group, Baumann GmbH, Crown Equipment Europe, Svetruck, Combilift, Carer, Atlet AB, Manitou Group, Hyster-Yale Europe, and KION Group AG. To boost their standing, forklift manufacturers in Europe are emphasizing R&D investments aimed at electrification, automation, and environmentally responsible technologies. Companies are redesigning fleets to meet zero-emission targets and tailoring products for specific applications like cold-chain logistics or urban warehousing. Partnerships with logistics providers and end-users help improve product relevance and customer integration. Customization, software integration, and fleet management systems are being used to differentiate offerings. Additionally, expanding regional manufacturing and service facilities helps reduce lead times and strengthen supply chains.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Europe Forklift market report include:- KION Group AG

- Toyota Material Handling Europe

- Jungheinrich AG

- Hyster-Yale Europe

- Crown Equipment Europe

- Combilift

- HUBTEX Maschinenbau GmbH

- Manitou Group

- Translift Bendi Ltd

- Flexi Narrow Aisle

- Bolzoni Group

- Svetruck

- Carer

- Atlet AB

- Baumann GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | September 2025 |

| Forecast Period | 2024 - 2034 |

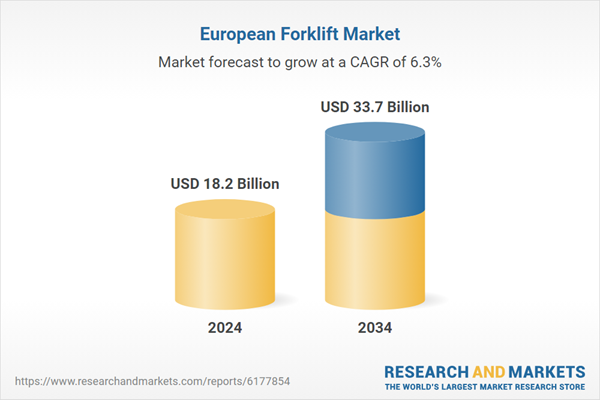

| Estimated Market Value ( USD | $ 18.2 Billion |

| Forecasted Market Value ( USD | $ 33.7 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 16 |