Increasing implementation of stringent air quality regulations across the region is playing a critical role in driving adoption. Government bodies are prioritizing pollution control through environmental programs that focus on energy efficiency, cleaner air, and sustainable industrial growth. These initiatives are accelerating the uptake of ESP technology across key industries. Electrostatic precipitators, known for their efficiency in removing fine particulate matter from industrial emissions, are now seen as vital for controlling pollution at its source. As industrialization continues across emerging African economies, businesses are modernizing their emission control infrastructure to comply with tightening regulations. This modernization includes retrofitting older units and upgrading existing systems to ensure adherence to stricter standards, especially in high-emission sectors like cement, petrochemicals, and power generation. South Africa continues to lead the regional market due to its high dependence on coal-powered energy and heavy industries, both of which produce substantial airborne pollutants. Growing regulatory enforcement targeting these sectors is resulting in more widespread deployment of ESP systems to help achieve cleaner operations, better compliance, and improved efficiency across industrial facilities.

The dry ESP systems segment held 88.3% share in 2024 and is forecasted to grow at a CAGR of 9% through 2034. The rising need to align with international emission norms is compelling industries to adopt advanced solutions, with dry ESPs becoming integral in managing challenging pollutants like sticky or moisture-heavy particulates. These systems are gaining traction in high-emission environments due to their superior handling of complex industrial waste streams.

The tubular ESP designs segment held 84.2% share in 2024 and will grow at a CAGR of 9.3% between 2025 and 2034. Their efficiency and scalability in high-volume applications make them especially suitable for continuous operations. Tubular plate configurations offer multiple collection lanes, supporting higher throughput and enhanced filtration performance, making them the preferred option for large-scale industrial use across Africa.

The Botswana Electrostatic Precipitator Market is projected to reach USD 9.8 million by 2034. The country’s reliance on coal-based power and the growth of cement and construction sectors are creating strong demand for particulate emission control. ESP systems play a key role in managing dust and flue gases, making them critical for meeting environmental standards while maintaining operational efficiency. As infrastructure investment rises, so does the need for reliable dust collection solutions, further supporting market expansion.

Key industry participants shaping the Africa Electrostatic Precipitator Market include Mitsubishi Heavy Industries, Hitachi, J&C Engineering (Pty) Ltd, Redecam, Morobi GEECO Power (Pty) Ltd, Valmet, Siemens Energy, Sumitomo Heavy Industries, GEECOM, Lesedi, Intensiv-Filter Himenviro, Alstom, Actom, Scheuch GmbH, GEA Group, Wood Plc, FLSmidth, ANDRITZ GROUP, DGC AFRICA, Enviropol Engineers, Hamon, Babcock and Wilcox Enterprises, KC Cottrell, DUCON, DURR Group, DURAG Group, and Thermax. Companies operating in the Africa Electrostatic Precipitator Market are implementing targeted strategies to solidify their regional presence. Key approaches include strategic collaborations with local engineering and construction firms to support turnkey installation and retrofitting projects. Firms are also focusing on technological upgrades to develop more energy-efficient and maintenance-friendly ESP systems. By customizing solutions for Africa’s high-dust, high-temperature industrial environments, companies are addressing market-specific needs. Expansion of local service networks is another core tactic, enabling faster maintenance response and improved client support. Additionally, players are investing in awareness campaigns to educate industries on emission control compliance and long-term cost savings.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Africa Electrostatic Precipitator market report include:- Alstom

- Actom

- ANDRITZ GROUP

- Babcock and Wilcox Enterprises

- DGC AFRICA

- DUCON

- DURR Group

- DURAG Group

- Enviropol Engineers

- FLSmidth

- GEA Group

- GEECOM

- Hamon

- Hitachi

- Intensiv-Filter Himenviro

- J&C Engineering (Pty) Ltd

- KC Cottrell

- Lesedi

- Mitsubishi Heavy Industries

- Morobi GEECO Power (Pty) Ltd

- Redecam

- Scheuch GmbH

- Siemens Energy

- Sumitomo Heavy Industries

- Thermax

- Valmet

- Wood Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 108 |

| Published | September 2025 |

| Forecast Period | 2024 - 2034 |

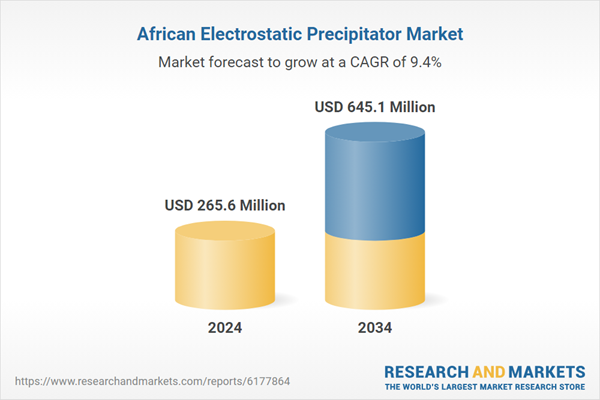

| Estimated Market Value ( USD | $ 265.6 Million |

| Forecasted Market Value ( USD | $ 645.1 Million |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Africa |

| No. of Companies Mentioned | 28 |