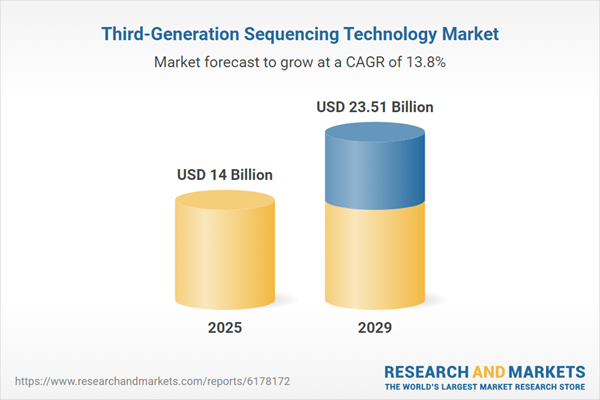

The third-generation sequencing technology market size is expected to see rapid growth in the next few years. It will grow to $23.51 billion in 2029 at a compound annual growth rate (CAGR) of 13.8%. Growth in the forecast period is expected to be supported by the increasing prevalence of chronic and infectious diseases, broader applications in clinical diagnostics, expansion into non-human genomics, greater government and private funding, and the development of sequencing infrastructure in emerging markets. Key trends anticipated for the forecast period include integration of artificial intelligence for advanced data analysis, creation of real-time portable sequencing devices, improvements in long-read sequencing accuracy, reductions in sequencing costs for broader access, and progress in personalized medicine applications.

The rise in the use of personalized medicine is anticipated to drive the expansion of the third-generation sequencing technology market in the future. Personalized medicine is an approach that customizes treatments and preventive measures based on a person’s genetic makeup, lifestyle, and environment. The growing popularity of this approach is mainly attributed to advances in genomics, which allow for accurate identification of genetic differences and more precise treatments. Third-generation sequencing technology supports personalized medicine by providing long-read, high-precision genomic data that aids in identifying genetic variations. This technology contributes to personalized treatment plans by offering in-depth insights into individual genomes, thereby improving clinical outcomes and advancing precision healthcare. For example, in February 2024, the Personalized Medicine Coalition (PMC), a nonprofit organization in the U.S., reported that the U.S. Food and Drug Administration (FDA) approved 26 new personalized medicines in 2023, a notable increase from 12 approvals in 2022. This increasing adoption of personalized medicine is a key factor in the growth of the third-generation sequencing technology market.

Leading players in the third-generation sequencing technology market are working on the development of advanced sequencing platforms, such as ultra-rapid and scalable sequencing systems, to enhance research efficiency, improve clinical application, and lower turnaround times and costs. These sequencing systems are innovative technologies that offer high-throughput, real-time genomic analysis with remarkable speed and accuracy, enabling detailed genomic profiling for a wide range of applications. For example, in February 2025, Roche Holding AG, a pharmaceutical company based in Switzerland, introduced Sequencing by Expansion (SBX) technology. This fully integrated next-generation sequencing system uses a patented biochemical process to convert DNA or RNA sequences into measurable surrogate polymers called Xpandomers, allowing for precise single-molecule nanopore sequencing. The SBX platform is equipped with ultra-rapid, scalable sequencing features and automated data analysis, producing whole-genome sequencing results in a matter of hours rather than days without requiring extensive manual work.

In February 2022, Element Biosciences Inc., a biotechnology company based in the U.S., acquired Loop Genomics Inc., a deal for which the terms were not disclosed. With this acquisition, Element Biosciences aims to enhance its sequencing portfolio by incorporating Loop Genomics' synthetic long-read technology. This acquisition is expected to strengthen Element Biosciences’ capabilities in genomics, transcriptomics, and microbiome research. Loop Genomics Inc., also a U.S.-based biotechnology firm, specializes in advancing third-generation sequencing technologies through synthetic long-read sequencing solutions.

Major players in the third-generation sequencing technology market are F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Eurofins Scientific SE, Agilent Technologies Inc., Illumina Inc., Qiagen N.V., Macrogen Inc., Myriad Genetics Inc., 10x Genomics Inc., Twist Bioscience Corporation, Takara Bio Inc., Fulgent Genetics Inc., Oxford Nanopore Technologies Limited, Ultima Genomics Inc., Element Biosciences Inc., Sophia Genetics SA, Variantyx Inc., Quantapore Inc., Phase Genomics Inc., and Singular Genomics Systems Inc.

North America was the largest region in the third-generation sequencing technology market in 2024. The regions covered in third-generation sequencing technology report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the third-generation sequencing technology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the consequent trade frictions in spring 2025 are severely impacting the healthcare sector, particularly in the supply of critical medical devices, diagnostic equipment, and pharmaceuticals. Hospitals and healthcare providers are facing higher costs for imported surgical instruments, imaging equipment, and consumables such as syringes and catheters, many of which have limited domestic alternatives. These increased costs are straining healthcare budgets, leading some providers to delay equipment upgrades or pass on expenses to patients. Additionally, tariffs on raw materials and components are disrupting the production of essential drugs and devices, causing supply chain bottlenecks. In response, the industry is diversifying sourcing strategies, boosting local manufacturing where possible, and advocating for tariff exemptions on life-saving medical products.

Third-generation sequencing technology refers to advanced DNA or RNA sequencing methods capable of reading single molecules in real time, often generating long continuous reads without requiring polymerase chain reaction amplification. Its main objective is to deliver highly accurate and comprehensive genomic and transcriptomic information, allowing the identification of structural variants, epigenetic changes, and complex regions that are difficult to analyze using earlier sequencing methods.

The primary technology types of third-generation sequencing include single-molecule real-time sequencing, transcription-mediated amplification, nanopore sequencing, sequencing by synthesis, and others. Single-molecule real-time sequencing is an advanced approach that monitors DNA synthesis by enzymes in real time, capturing fluorescent signals of each base without template amplification. The workflow consists of sample preparation, sequencing, data analysis, and data storage or management, with applications in genomics, transcriptomics, epigenomics, metagenomics, personalized medicine, and synthetic biology. These methods are used by end users such as academic institutions, clinical laboratories, pharmaceutical and biotechnology companies, research organizations, and government or non-profit institutions.

The third-generation sequencing technology market research report is one of a series of new reports that provides third-generation sequencing technology market statistics, including the third-generation sequencing technology industry global market size, regional shares, competitors with the third-generation sequencing technology market share, detailed third-generation sequencing technology market segments, market trends, and opportunities, and any further data you may need to thrive in the third-generation sequencing technology industry. This third-generation sequencing technology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The third-generation sequencing technology market consists of revenues earned by entities by providing services such as whole genome sequencing, transcriptome sequencing, epigenetic analysis, de novo genome assembly, single-cell sequencing, and structural variant detection. The market value includes the value of related goods sold by the service provider or included within the service offering. The third-generation sequencing technology market also includes sales of sequencing instruments, reagents, flow cells, sample preparation kits, nanopore devices, optical mapping systems, microfluidic chips, and sample preparation instruments. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Third-Generation Sequencing Technology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on third-generation sequencing technology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for third-generation sequencing technology? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The third-generation sequencing technology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Technology Type: Single-Molecule Real-Time Sequencing (SMRT); Transcription-Mediated Amplification (TMA); Nanopore Sequencing; Sequencing By Synthesis (SBS); Other Technology Types2) By Workflow: Sample Preparation; Sequencing; Data Analysis; Data Interpretation; Data Storage And Management

3) By Application: Genomics; Transcriptomics; Epigenomics; Metagenomics; Personalized Medicine; Synthetic Biology

4) By End-User: Academic Institutions; Clinical Laboratories; Pharmaceutical And Biotechnology Companies; Research Organizations; Government And Non-Profit Organizations

Subsegments:

1) By Single-Molecule Real-Time Sequencing (SMRT): Zero-Mode Waveguides (ZMWs); Circular Consensus Sequencing (CCS); High-Fidelity (HiFi) Reads2) By Transcription-Mediated Amplification (TMA): Qualitative Transcription-Mediated Amplification (TMA) Assays; Quantitative Transcription-Mediated Amplification (TMA) Assays; Multiplex Transcription-Mediated Amplification (TMA) Assays

3) By Nanopore Sequencing: Portable Nanopore Sequencers; Benchtop Nanopore Sequencers; High-Throughput Nanopore Platforms

4) By Sequencing By Synthesis (SBS): Reversible Terminator Chemistry; Real-Time Sequencing By Synthesis (SBS) Platforms; Short-Read Sequencing By Synthesis (SBS); Long-Read Sequencing By Synthesis (SBS)

5) By Other Technology Types: Hybrid Sequencing Platforms; Pyrosequencing; Ion Semiconductor Sequencing; Emerging Experimental Methods

Companies Mentioned: F. Hoffmann-La Roche AG; Thermo Fisher Scientific Inc.; Eurofins Scientific SE; Agilent Technologies Inc.; Illumina Inc.; Qiagen N.V.; Macrogen Inc.; Myriad Genetics Inc.; 10x Genomics Inc.; Twist Bioscience Corporation; Takara Bio Inc.; Fulgent Genetics Inc.; Oxford Nanopore Technologies Limited; Ultima Genomics Inc.; Element Biosciences Inc.; Sophia Genetics SA; Variantyx Inc.; Quantapore Inc.; Phase Genomics Inc.; Singular Genomics Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Third-Generation Sequencing Technology market report include:- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Eurofins Scientific SE

- Agilent Technologies Inc.

- Illumina Inc.

- Qiagen N.V.

- Macrogen Inc.

- Myriad Genetics Inc.

- 10x Genomics Inc.

- Twist Bioscience Corporation

- Takara Bio Inc.

- Fulgent Genetics Inc.

- Oxford Nanopore Technologies Limited

- Ultima Genomics Inc.

- Element Biosciences Inc.

- Sophia Genetics SA

- Variantyx Inc.

- Quantapore Inc.

- Phase Genomics Inc.

- Singular Genomics Systems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 14 Billion |

| Forecasted Market Value ( USD | $ 23.51 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |