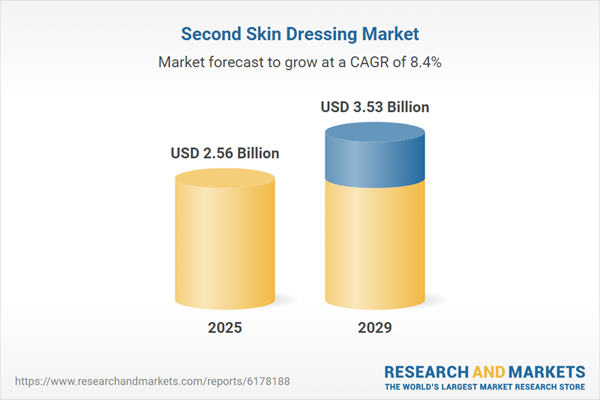

The second skin dressing market size is expected to see strong growth in the next few years. It will grow to $3.53 billion in 2029 at a compound annual growth rate (CAGR) of 8.4%. The growth during the forecast period is expected to result from the rising incidence of chronic wounds, wider adoption of minimally invasive surgeries, expansion of the geriatric population, growing need for faster recovery and shorter hospital stays, and stronger emphasis on infection prevention. Key trends anticipated in the forecast period include innovations in biocompatible materials, incorporation of antimicrobial features, advancements in hydrogel and silicone technologies, development of breathable and highly flexible dressing designs, and integration of moisture-retentive layers.

The increasing number of diabetes cases is expected to contribute to the expansion of the second skin dressing market. Diabetes is a chronic condition marked by elevated blood sugar levels due to the body’s inability to produce or properly use insulin. The rise in diabetes is largely attributed to inactive lifestyles and poor dietary habits, which lead to obesity and insulin resistance. Second skin dressings support individuals with diabetes by shielding wounds, preserving a moist healing environment, and minimizing the risk of infection. This is especially important since diabetic patients often experience delayed wound healing. For example, in March 2024, the Office for Health Improvement and Disparities reported that between March 2022 and March 2023, the percentage of patients with type 1 diabetes receiving all eight recommended care processes rose by 22 percent, while those with type 2 diabetes saw a 21 percent increase. Additionally, the percentage of patients reaching target HbA1c levels increased to 37.9 percent, the highest figure ever recorded by the National Diabetes Audit. As a result, the growing prevalence of diabetes is supporting the development of the second skin dressing market.

The rise in healthcare spending is expected to support the growth of the second skin dressing market. Healthcare spending includes all financial resources allocated to the prevention, diagnosis, treatment, and management of health conditions among individuals and populations. This increase is driven by aging populations that require more extensive medical care, long-term support, and access to advanced treatment options. As healthcare investment rises, hospitals, clinics, and individuals are better able to purchase advanced wound care products, explore innovative dressing technologies, and implement modern care strategies that improve healing outcomes and lower the risk of complications. For instance, in May 2023, the Office for National Statistics reported that healthcare spending in the United Kingdom reached approximately 354.88 billion dollars in 2022, reflecting a 0.7 percent increase in nominal terms compared to the previous year. This trend in rising healthcare expenditure is positively influencing the second skin dressing market.

Leading companies in the second skin dressing market are developing innovative products such as advanced plasters to accelerate healing, enhance patient comfort, and lower the risk of infection and scarring. These advanced plasters are designed to replicate the properties of natural skin, offering features such as flexibility, transparency, breathability, and controlled drug release to support faster and more effective wound healing. In January 2025, Beiersdorf AG, a manufacturing company based in Germany, introduced a Second Skin Protection plaster designed to improve wound coverage and healing speed. It utilizes hydrocolloid technology to absorb fluid and maintain a moist environment, which encourages faster healing and reduces the chances of infection and visible scarring. The plaster is ultra-thin, waterproof, and flexible, providing a secure fit even on difficult areas such as elbows and knees. It aims to deliver a high-quality treatment for everyday minor injuries while educating users about the benefits of modern wound care practices and moving away from outdated approaches.

Major players in the second skin dressing market are Cardinal Health Inc., Avery Dennison Corporation, Nitto Denko Corporation, Smith & Nephew plc, Coloplast A/S, Hartmann Group, ConvaTec Group PLC, Integra LifeSciences, DeRoyal Industries Inc., Winner Medical Co. Ltd., Scapa Healthcare, DermaRite Industries LLC, Anhui Jinye Industrial Co. Ltd., ACTO GmbH, Beiersdorf AG, Advancis Medical, Amparo Medical Technologies Inc., Gujarat Healthcare, Jiangsu WLD Medical Co. Ltd., Wuhan Huawei Technology Co. Ltd., Yangzhou Goldenwell Import & Export Co. Ltd., Zhejiang Bangli Medical Products Co. Ltd.

North America was the largest region in the second skin dressing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in second skin dressing report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the second skin dressing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

Second skin dressing is a transparent, highly flexible, and biocompatible wound covering that closely replicates the natural characteristics of human skin to protect wounds, burns, or surgical sites. It creates a moist environment that supports healing, lowers the risk of infection, improves patient comfort, and reduces scarring to aid faster recovery.

The primary product categories of second skin dressing include hydrocolloid dressings, hydrogel dressings, foam dressings, film dressings, alginate dressings, and others. Hydrocolloid dressings consist of gel-forming materials that absorb wound exudate while preserving a moist healing environment. These products are distributed through hospital pharmacies, retail pharmacies, online pharmacies, and other channels. They are widely applied in the treatment of chronic wounds, acute wounds, surgical wounds, burns, and related conditions, with end users including hospitals, clinics, homecare facilities, and other healthcare settings.

The second skin dressing market research report is one of a series of new reports that provides second skin dressing market statistics, including second skin dressing industry global market size, regional shares, competitors with a second skin dressing market share, detailed second skin dressing market segments, market trends and opportunities, and any further data you may need to thrive in the second skin dressing industry. This second skin dressing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The second skin dressing market consists of sales of silicone dressings, polyurethane dressings, and collagen dressings. Values in this market are ‘factory gate’ values; that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values and are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Second Skin Dressing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on second skin dressing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for second skin dressing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The second skin dressing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Product Type: Hydrocolloid Dressings; Hydrogel Dressings; Foam Dressings; Film Dressings; Alginate Dressings; Other Product Types2) By Distribution Channel: Hospital Pharmacies; Retail Pharmacies; Online Pharmacies; Other Distribution Channels

3) By Application: Chronic Wounds; Acute Wounds; Surgical Wounds; Burns; Other Applications

4) By End-User: Hospitals; Clinics; Homecare Settings; Other End-Users

Subsegments:

1) By Hydrocolloid Dressings: Thin Hydrocolloid; Extra-Thin Hydrocolloid; Non-Adhesive Hydrocolloid2) By Hydrogel Dressings: Sheet Hydrogel; Amorphous Hydrogel; Impregnated Hydrogel

3) By Foam Dressings: Polyurethane Foam; Silicone Foam; Adhesive Foam

4) By Film Dressings: Transparent Film; Semi-Permeable Film; Adhesive Film

5) By Alginate Dressings: Calcium Alginate; Sodium Alginate; Mixed Alginate

6) By Other Product Types: Collagen Dressings; Silicone Dressings; Composite Dressings

Companies Mentioned: Cardinal Health Inc.; Avery Dennison Corporation; Nitto Denko Corporation; Smith & Nephew plc; Coloplast A/S; Hartmann Group; ConvaTec Group PLC; Integra LifeSciences; DeRoyal Industries Inc.; Winner Medical Co. Ltd.; Scapa Healthcare; DermaRite Industries LLC; Anhui Jinye Industrial Co. Ltd.; ACTO GmbH; Beiersdorf AG; Advancis Medical; Amparo Medical Technologies Inc.; Gujarat Healthcare; Jiangsu WLD Medical Co. Ltd.; Wuhan Huawei Technology Co. Ltd.; Yangzhou Goldenwell Import & Export Co. Ltd.; Zhejiang Bangli Medical Products Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Second Skin Dressing market report include:- Cardinal Health Inc.

- Avery Dennison Corporation

- Nitto Denko Corporation

- Smith & Nephew plc

- Coloplast A/S

- Hartmann Group

- ConvaTec Group PLC

- Integra LifeSciences

- DeRoyal Industries Inc.

- Winner Medical Co. Ltd.

- Scapa Healthcare

- DermaRite Industries LLC

- Anhui Jinye Industrial Co. Ltd.

- ACTO GmbH

- Beiersdorf AG

- Advancis Medical

- Amparo Medical Technologies Inc.

- Gujarat Healthcare

- Jiangsu WLD Medical Co. Ltd.

- Wuhan Huawei Technology Co. Ltd.

- Yangzhou Goldenwell Import & Export Co. Ltd.

- Zhejiang Bangli Medical Products Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | October 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.56 Billion |

| Forecasted Market Value ( USD | $ 3.53 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |