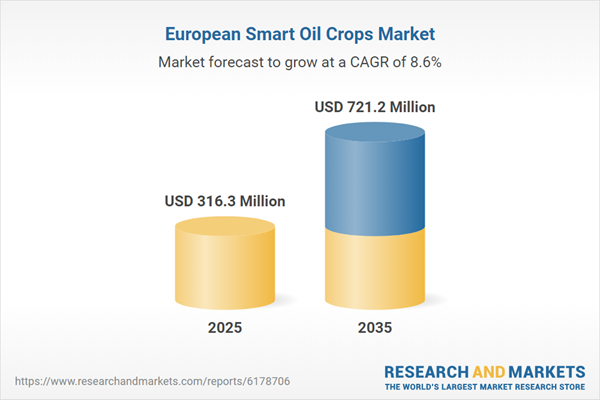

The Europe smart oil crops market is projected to reach $721.2 million by 2035 from $292.2 million in 2024, growing at a CAGR of 8.59% during the forecast period 2025-2035. The Europe smart oil crops market has been gaining substantial momentum as agricultural technologies advance to tackle challenges such as climate change, resource scarcity, and the need for higher productivity. Since 2024, adoption of precision agriculture, automation, and IoT-enabled solutions has significantly enhanced crop yields and reduced input costs across the region. Leading innovations include AI-driven tractors and smart irrigation systems that allow farmers to optimize planting, fertilization, and water usage based on real-time field data. For example, European manufacturers and distributors are introducing AI-integrated machinery and IoT-based irrigation tools, helping to conserve water in drought-prone areas while improving overall efficiency. Companies are increasingly focusing on sustainable farming practices, with AI-powered crop management solutions enabling better decision-making and resource utilization. As smart farming systems continue to expand across Europe, they are expected to play a critical role in strengthening food security, reducing environmental impact, and promoting resilient oil crop cultivation, marking a transformative shift toward more efficient, sustainable, and technology-driven agriculture in the region.

Market Introduction

The Europe smart oil crops market is witnessing rapid growth as technological innovations and sustainability initiatives reshape agricultural practices. Smart oil crops, including rapeseed, sunflower, and soybean, are increasingly cultivated using precision farming, IoT-enabled devices, and AI-powered management systems, enabling farmers to optimize irrigation, fertilization, and harvesting. These advancements are helping European farmers increase yields, reduce input costs, and improve the overall efficiency of crop production.

Rising demand for sustainable and non-GMO vegetable oils, coupled with stricter environmental regulations under initiatives like the EU Green Deal and Farm-to-Fork strategy, is driving adoption of smart oil crop farming. European consumers are increasingly prioritizing healthy and environmentally friendly products, which has encouraged producers to adopt digital farming tools, climate-smart technologies, and automated machinery to meet these expectations while ensuring food security.

Countries such as Germany, France, and Romania are leading the adoption of smart oil crop technologies, benefiting from advanced agricultural infrastructure and strong R&D investments. Meanwhile, emerging markets in Eastern Europe are gradually integrating AI, robotics, and smart irrigation systems to improve productivity and sustainability.

The Europe smart oil crops market is poised for sustained growth as precision agriculture, sustainable farming practices, and digital innovation become central to oil crop cultivation. This trend marks a transformative shift toward efficient, resilient, and environmentally responsible agriculture in the region.

Market Segmentation

Segmentation 1: by Application

- Soybean

- Sunflower

- Rapeseed (Canola)

- Others

Segmentation 2: by Equipment

- Tractors

- Planters

- Sprayers

- Harvesters

Segmentation 3: by Systems

- Navigation and Guidance Systems

- Field Sensing and Harvest Monitoring Systems

- Smart Irrigation Systems

Segmentation 4: by Software

- Farm Management and Decision Support Software

- Remote Sensing and Prescription Software

Segmentation 5: by Region

- Europe

Europe Smart Oil Crops Market Trends, Drivers and Challenges

Market Trends

- Increasing rapeseed cultivation in countries like France, Germany, and Romania due to high demand for renewable energy and food applications.

- Decline in sunflower seed production, leading to greater reliance on imports from non-EU regions.

- Growing demand for biofuel feedstock under the EU’s renewable energy initiatives.

- Rising consumer preference for non-GMO, organic, and sustainably sourced vegetable oils.

- Rapid adoption of smart agriculture technologies such as precision farming, IoT-enabled sensors, and AI-driven analytics to enhance yield and resource efficiency.

Market Drivers

- EU policies promoting agricultural self-sufficiency to reduce dependency on imports amid geopolitical uncertainties.

- Sustainability-focused regulations encouraging traceability, eco-friendly farming, and reduced deforestation.

- Expanding biodiesel and renewable energy industries boosting the need for oil-rich crops like rapeseed and soybeans.

- Consumer shift toward healthier oils with improved nutritional profiles, such as high-oleic sunflower and canola oils.

- Technological innovations enhancing productivity and enabling climate-smart farming across Europe.

Market Challenges

- Volatile raw material and input prices caused by climate variability and global supply disruptions.

- High production and certification costs for organic and sustainably cultivated oil crops.

- Import dependency for specific crops like sunflower and soybean, especially during poor harvest seasons.

- Evolving regulatory environment creating uncertainty in compliance, GMO policies, and sustainability standards.

- Slow adoption of smart farming tools among small and mid-sized farmers due to infrastructure and cost constraints.

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a detailed analysis of the Europe smart oil crops market segmented by application, equipment, systems, and software. It covers various segments within the Europe smart oil crops market, including equipment, systems, and software, providing insights into its evolving technologies and technical advantages. The equipment segment, comprising tractors, planters, sprayers, and harvesters, highlights design trends based on application-specific requirements for efficient oilseed farming. The systems segment, which encompasses navigation and guidance systems, field sensing and harvest monitoring systems, and smart irrigation systems, enables stakeholders to develop energy-efficient solutions that optimize crop management and resource utilization. The software segment, comprising farm management and decision support software, as well as remote sensing and prescription software, enables product teams to identify opportunities for innovation and adapt strategies to meet the performance, integration, and cost-efficiency demands in the smart oil crops sector.

Growth/Marketing Strategy: The Europe smart oil crops market is evolving rapidly, with key players focusing on integrating smart technologies to enhance oilseed production. Companies are expanding their capabilities by adopting precision farming, AI-driven crop management, and smart irrigation systems to increase yields, improve sustainability, and reduce environmental impact. This report tracks these developments, offering insights into how companies are leveraging innovations such as IoT-based monitoring, remote sensing, and automated machinery to optimize farming operations. It aids marketing teams in identifying high-growth opportunities, aligning value propositions with farmer needs, and creating targeted go-to-market strategies that consider regional agricultural trends, government initiatives, and the market's technological readiness.

Competitive Strategy: A thorough competitive landscape is provided, profiling leading players based on their product offerings, innovation pipelines, partnerships, and expansion plans. Competitive benchmarking enables readers to evaluate how companies are positioned across product types and application areas.

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- CNH Industrial N.V.

- BASF

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | October 2025 |

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 316.3 Million |

| Forecasted Market Value ( USD | $ 721.2 Million |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 2 |