United States Footwear Industry Overview

Technology breakthroughs, changing customer tastes, and fashion innovation all have an impact on the competitive and dynamic US footwear market. The market is divided into a number of categories, such as formal, sports, casual, and specialty footwear. The demand for athletic and performance-oriented footwear has increased dramatically due to growing health consciousness as well as the popularity of sports and fitness activities. At the same time, the market for casual and lifestyle shoes has increased due to greater awareness of comfort and style. American consumers are increasingly likely to spend money on high-quality, trend-driven footwear as a result of shifting fashion cycles and more disposable income.Rapid digitalization and the emergence of e-commerce platforms are changing the market. By providing individualized purchasing experiences, online retail has allowed brands to reach a larger audience. Furthermore, sustainability has become a major subject, with both well-known and up-and-coming businesses emphasizing ethical sourcing, eco-friendly materials, and circular business models. Customers are gravitating more and more toward goods that reflect their beliefs, which pushes producers to experiment with low-impact production techniques and recyclable materials. The customer experience has been significantly improved by the growth of omnichannel strategy and personalization choices.

Constant innovation in design, material technology, and retail strategy will influence future market expansion. Influencer marketing, social media, and celebrity partnerships are all becoming increasingly important in boosting customer engagement and brand awareness. In the meanwhile, issues with the price of raw materials, interruptions in the supply chain, and fake goods continue to exist. However, it is anticipated that the U.S. footwear market will continue to develop over the long term because to a combination of innovation, sustainability measures, and consumer-centric shopping.

Key Factors Driving the United States Footwear Market Growth

Growing Interest in Comfortable Footwear and Athleisure

One of the main factors propelling the U.S. market is consumers' growing inclination for athleisure and comfortable footwear. Customers are choosing footwear that blends athletic trends with daily fashion, emphasizing comfort, versatility, and performance. The need for sneakers, slip-ons, and cushioned shoes has increased due to the trend toward healthier living and the growth of remote work settings. In response, companies are releasing hybrid designs that appeal to a wide range of consumers by fusing fashion with practicality. Furthermore, sophisticated cushioning technologies, lightweight materials, and ergonomic features are becoming more popular. This trend is a reflection of a larger shift in consumer preferences toward fashionable, functional footwear that works for a variety of settings. The rising demand for athleisure footwear in the US is driving market expansion overall as comfort and wellness continue to be top concerns.Expansion of E-commerce and Omnichannel Retailing

E-commerce has transformed the U.S. footwear market, enabling consumers to access a vast range of products with convenience and personalization. Online platforms provide detailed product information, reviews, and virtual try-on tools that enhance the shopping experience. Leading footwear brands are investing heavily in digital strategies, combining online and offline touchpoints through omnichannel retailing. Click-and-collect, free returns, and direct-to-consumer models are strengthening customer loyalty and engagement. The rapid growth of mobile commerce and social media-driven purchasing behavior further supports online footwear sales. Additionally, data analytics and AI-based personalization are helping retailers understand consumer preferences and optimize product recommendations. This digital transformation has created a competitive advantage for brands that adapt quickly to evolving retail trends. The ongoing expansion of e-commerce and integrated retail channels remains a crucial factor driving footwear market growth in the United States.Rising Focus on Sustainability and Ethical Production

Sustainability is becoming a defining factor in the U.S. footwear market as consumers increasingly prefer eco-friendly and ethically sourced products. Brands are incorporating recycled materials, biodegradable fabrics, and low-carbon manufacturing processes into their production lines. This shift not only appeals to environmentally conscious consumers but also aligns with global sustainability goals. Companies are also emphasizing transparency in sourcing and fair labor practices, building trust among buyers. The rise of circular fashion, including repair and recycling initiatives, reflects the industry’s move toward responsible consumption. Furthermore, innovative materials such as plant-based leather and recycled rubber are gaining traction in product development. As sustainability transitions from a niche preference to a mainstream expectation, brands that adopt eco-conscious strategies are likely to strengthen their competitive position and capture a larger market share in the U.S. footwear industry.Challenges in the United States Footwear Market

Volatile Raw Material Prices and Supply Chain Disruptions

Fluctuating raw material prices and ongoing supply chain challenges pose significant hurdles for the U.S. footwear market. Leather, rubber, and synthetic materials often experience price volatility influenced by global demand, trade policies, and geopolitical tensions. These fluctuations directly impact production costs and profit margins for manufacturers. Additionally, global supply chain disruptions - such as delays in shipping, labor shortages, and manufacturing slowdowns - have led to inventory imbalances and increased lead times. Small and mid-sized brands are particularly affected due to limited bargaining power and dependence on overseas suppliers. The need for resilient supply chain strategies and local sourcing has become more evident. Brands are exploring digital supply chain solutions and nearshoring to mitigate risks, but achieving stability remains a challenge. These disruptions continue to pressure pricing, availability, and operational efficiency across the footwear industry.Intense Market Competition and Counterfeit Products

The U.S. footwear market is highly competitive, with both global brands and emerging local players vying for consumer attention. This saturation makes differentiation increasingly difficult, pushing companies to invest heavily in branding, innovation, and marketing. The rapid pace of fashion trends also forces brands to maintain agility in product development and inventory management. Additionally, the proliferation of counterfeit products - particularly through online marketplaces - poses a growing threat. Fake footwear not only affects brand reputation and sales but also undermines consumer trust. Despite enforcement efforts, counterfeit trade continues to challenge established players. Companies must enhance authentication measures, adopt traceable supply chains, and leverage blockchain or digital tagging technologies to protect brand integrity. Balancing competitive pricing with quality assurance remains essential for sustaining growth in a crowded and fast-evolving U.S. footwear market.United States Footwear Market Overview by States

Regional demand varies across the U.S., with fashion-forward states driving premium footwear sales, while southern and midwestern regions show strong demand for comfort and athletic footwear. California, Texas, New York, and Florida remain key growth markets. The following provides a market overview by States:California Footwear Market

California’s footwear market thrives on its fashion-conscious population, active lifestyle culture, and emphasis on sustainability. The state’s consumers favor versatile footwear that blends comfort with style, fueling demand across athletic, casual, and eco-friendly segments. Urban centers like Los Angeles and San Francisco act as trendsetters, influencing nationwide footwear preferences. Additionally, California’s tech-driven retail ecosystem supports e-commerce innovation and personalized shopping experiences. Local brands and startups are also gaining momentum by offering sustainable and ethically produced designs. The state’s diverse demographic ensures consistent demand for a wide range of footwear types, from luxury sneakers to affordable comfort wear. As one of the largest consumer markets in the U.S., California plays a leading role in shaping trends, fostering innovation, and driving sales within the broader footwear industry.Texas Footwear Market

Texas presents a diverse and growing footwear market characterized by strong demand for casual, outdoor, and western-style footwear. The state’s large population, varied climate, and mix of urban and rural consumers drive demand across multiple categories. Major cities such as Houston, Dallas, and Austin contribute significantly to sales through robust retail and e-commerce channels. Additionally, the popularity of outdoor and work-related footwear reflects the state’s cultural and occupational preferences. Comfort-oriented and performance-driven shoes continue to gain traction as consumers seek durability and practicality. The increasing presence of national and international brands, coupled with expanding digital retail infrastructure, supports the market’s growth. Texas’s balance of traditional and modern footwear preferences ensures sustained demand, positioning it as a vital contributor to the U.S. footwear industry.New York Footwear Market

New York’s footwear market is driven by its status as a global fashion capital and retail hub. Consumers in the state are highly trend-sensitive, with strong demand for premium, designer, and fashion-forward footwear. The presence of luxury brands, flagship stores, and fashion events fosters continuous innovation and brand exposure. New York City’s diverse population also ensures steady demand for athletic and lifestyle footwear catering to urban mobility. E-commerce adoption is high, supported by digitally engaged consumers seeking convenience and personalization. The state’s competitive retail environment encourages brands to differentiate through exclusive collections and experiential marketing. Sustainability and ethically sourced materials are gaining traction among conscious consumers. With its influence on national fashion trends and concentration of retail activity, New York remains a central driver of growth in the U.S. footwear market.Florida Footwear Market

Florida’s footwear market benefits from its warm climate, tourism-driven economy, and diverse consumer demographics. The demand for sandals, casual wear, and athletic footwear remains consistently high, reflecting the state’s lifestyle and recreational culture. Major cities such as Miami, Orlando, and Tampa serve as key retail hubs, attracting both local and tourist shoppers. The market also shows strong adoption of online and omnichannel retail strategies, enhancing accessibility and convenience. Additionally, comfort and lightweight footwear designed for year-round use appeal to Florida’s active population. The influx of international visitors and retirees further diversifies demand, boosting sales across different price points and styles. Sustainability and breathable designs are gaining attention as consumers prioritize comfort and eco-conscious choices. Florida’s unique mix of lifestyle, climate, and tourism makes it a significant region in the U.S. footwear market.Recent Developments in U.S. Footwear Market

- Lululemon debuted their first men's footwear line in February 2024, launching with the Cityverse casual sneaker. With the release of the Beyondfeel and Beyondfeel Trail running shoes in March and May, the brand went one step further. It is a calculated move to increase Lululemon's market share in foreign markets for men's footwear.

- In February 2024, Puma released the Spirex Trail sneaker in the colors "Gray Fog" and "Prairie Tan" across the US. The Spirex blends mesh, suede, and an asymmetrical design for technical streetwear, fusing the style of Y2K-era running spikes with rugged, trail-ready construction. It debuted in a few stores and online.

Market Segmentations

Product

- Non-Athletic

- Athletic

Material

- Leather

- Non-Leather

Distribution Channel

- E-Commerce

- Offline Stores

End User

- Men

- Women

- Children

States

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- New Jersey

- Washington

- North Carolina

- Massachusetts

- Virginia

- Michigan

- Maryland

- Colorado

- Tennessee

- Indiana

- Arizona

- Minnesota

- Wisconsin

- Missouri

- Connecticut

- South Carolina

- Oregon

- Louisiana

- Alabama

- Kentucky

- Rest of United States

All the Key players have been covered

- Overviews

- Key Persons

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- Nike Inc.

- Adidas AG

- New Balance Athletics, Inc.

- Asics Corporation

- LVMH Moët Hennessy Louis Vuitton SE

- Fila Holdings Corp.

- The Bata Corporation

- VF Corporation

Table of Contents

Companies Mentioned

- Nike Inc.

- Adidas AG

- New Balance Athletics, Inc.

- Asics Corporation

- LVMH Moët Hennessy Louis Vuitton SE

- Fila Holdings Corp.

- The Bata Corporation

- VF Corporation

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

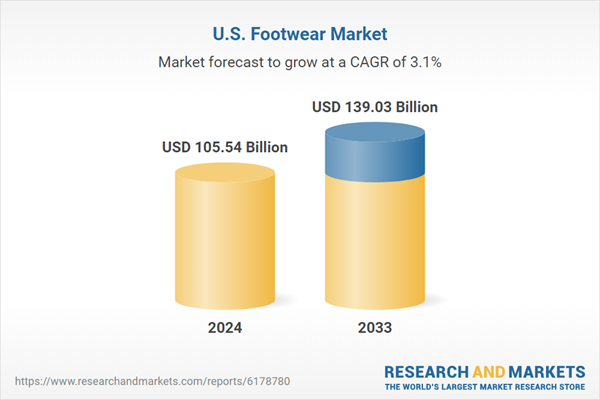

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | September 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 105.54 Billion |

| Forecasted Market Value ( USD | $ 139.03 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |