United States Electric Vehicle Aftermarket Industry Overview

The ecosystem of components, services, and solutions that sustain electric vehicles (EVs) after they are first sold is known as the EV aftermarket. Specialized parts like high-voltage batteries, electric drivetrains, charging stations, regenerative braking systems, and software upgrades are needed for EVs, in contrast to the conventional aftermarket. EV-specific accessories, diagnostics, and maintenance services are also included in this sector. As more EVs are owned, more of them go out of warranty, opening doors for specialized suppliers and independent service providers. In addition to ensuring EV longevity, efficiency, and personalization, the aftermarket is essential to facilitating the shift to environmentally friendly and electrified modes of transportation.As EV adoption picks up speed across the country, the U.S. EV aftermarket is expanding rapidly. The need for new batteries, charging stations, software updates, and maintenance services is growing as more EVs enter the used car market and their warranties expire. While newcomers provide charging and diagnostic solutions, independent workshops and large suppliers like Bosch and ZF are growing EV-specific product lines. Aftermarket demand is further increased by government subsidies for clean mobility and the development of charging infrastructure. The U.S. aftermarket is evolving from a specialized to a mainstream business as EV penetration increases, generating substantial opportunities in the areas of components, maintenance, and technology-driven service networks.

Growth Drivers for the United States Electric Vehicle Aftermarket Market

Infrastructure for Charging Expansion

In the US, expanding charging infrastructure is increasing aftermarket prospects. With the help of federal funding through the NEVI program, more than 183,000 public charging ports had been built in the United States by the middle of 2024. The need for aftermarket services including household and public charging station installation, maintenance, and upgrades is fueled by this increase. Rising competition and consumer choice are highlighted by companies like MSI, who just joined the U.S. market with their EV Life Series chargers. As more EV owners look for dependable charging choices, aftermarket suppliers are taking advantage of software-enabled energy management, hardware updates, and tailored solutions to satisfy expanding infrastructure requirements.Rising EV Adoption

One of the main factors propelling the EV aftermarket's expansion is the rise in the use of EVs in the United States. Demand for aftermarket services like tires, software updates, battery replacements, and maintenance solutions is rising rapidly as more people and companies switch to electric vehicles. Since early EV models are now no longer covered under warranty, independent workshops and specialty suppliers have a lot of opportunity to fill the gap. Consistent aftermarket growth is ensured by this growing vehicle base, which benefits technology-driven diagnostic firms, service providers, and parts manufacturers. In the end, growing EV adoption is changing the aftermarket environment and opening up long-term prospects for efficiency, innovation, and environmentally friendly transportation options.Developments in Technology

The aftermarket is changing as a result of EV technological advancements, opening up new service and product opportunities. The need for specialist maintenance and repair is being driven by innovations like over-the-air updates, regenerative braking, and better battery technology. In North America, ZF Aftermarket introduced 25 Electric Axle Repair Kits in 2024, enabling shops to service EV drivetrains without having to replace them entirely. In a similar vein, software-enabled diagnostics are increasing repair accuracy and efficiency. Aftermarket options are growing as OEMs and suppliers such as Bosch, Continental, and Magna increase their portfolios of EV-focused parts. Better vehicle longevity and performance are guaranteed by these developments, which also give independent service providers the means to compete in the dynamic EV market.Challenges in the United States Electric Vehicle Aftermarket Market

Battery Prices and Recycling Concerns

One of the most urgent issues facing the U.S. electric vehicle aftermarket is battery-related. Since lithium-ion batteries are still the priciest part of an EV and can cost hundreds of dollars to replace, pricing is a major worry for buyers. Furthermore, there is currently a lack of extensive infrastructure for recycling EV batteries, which poses supply chain and sustainability issues. Ineffective recycling could result in the waste of precious resources like nickel, cobalt, and lithium, which would increase dependency on imports. The transition to a completely circular and sustainable EV environment is slowed down by these cost and recycling issues, which further restrict repair alternatives and prevent significant aftermarket accessibility.High Initial Outlay of Funds

High upfront costs are a problem for the US EV aftermarket, particularly for independent repair shops and service providers. Electric car maintenance necessitates the use of high-voltage safety equipment, specialist diagnostic tools, and technician training - all of which are expensive. Given the present, albeit increasing, EV penetration, many smaller workshops find it difficult to justify these expenses. As a result, consumers have fewer options for aftermarket services and entry barriers are created. Meeting changing regulatory requirements also increases the strain on finances. The aftermarket runs the danger of expanding more slowly in the absence of wider affordability and incentives for workshops to update, which would concentrate service capabilities among larger companies rather than a diverse supplier base.California Electric Vehicle Aftermarket Market

With a significant rate of EV adoption in the US, California is the biggest market for EV aftermarket services. Demand for batteries, chargers, and specialized maintenance services is fueled by strong governmental incentives, aggressive zero-emission car targets, and a vast charging infrastructure. The state's sizable fleet of used EVs opens up prospects for software updates and replacement parts, while independent workshops and OEM suppliers are growing their EV-focused offers. Aftermarket development is strengthened by California's innovation ecosystem, which includes businesses that are at the forefront of green mobility. California continues to be the most dynamic state-level market for EV aftermarket growth due to growing consumer adoption and ongoing regulatory support, providing long-term prospects for service providers and suppliers.Texas Electric Vehicle Aftermarket Market

Due to increased EV usage, expanding charging networks, and investments in battery and component manufacturing, Texas is quickly emerging as a major EV aftermarket hub. It is a vital site for aftermarket providers due to its robust logistics infrastructure and strategic position. With an emphasis on batteries, tires, and drivetrain repairs, independent workshops and dealerships are starting to broaden their EV repair skills. The demand for replacement parts and customization is further boosted by the state's sizable population and rising interest in electric vehicles and SUVs. Texas has a rapidly growing aftermarket environment that combines the strength of traditional automobiles with the momentum of electrification, thanks to both public and private investment in EV infrastructure.New York Electric Vehicle Aftermarket Market

The state's robust clean energy regulations and urban mobility efforts are driving the growth of New York's EV aftermarket. Replacement batteries, charging devices, and software-based improvements are becoming more and more in demand as EVs are being used more often for both private and public transportation. Innovation in aftermarket solutions is bolstered by the existence of research and advanced production facilities. Independent repair shops are expanding their customer service options by starting to invest in EV-specific equipment and training. Additional factors driving replacement and maintenance requirements are the expanding used EV market in cities like New York City. Strong growth for the state's EV aftermarket is guaranteed by policy incentives and environmental standards.Florida Electric Vehicle Aftermarket Market

With one of the highest rates of car ownership in the nation and growing EV usage, Florida's EV aftermarket is expanding quickly. The need for battery maintenance, chargers, and aftermarket modifications is fueled by the state's sustainable transportation efforts and growing charging infrastructure. Aftermarket opportunities for servicing and maintaining EV fleets are growing as a result of the robust tourism industry and the widespread presence of rental and fleet vehicles. While suppliers focus on places with high demand, such as Miami and Orlando, independent repair shops are starting to invest in EV skills. Access to EV parts is also improved by Florida's important port-based trade ties, which promote ongoing aftermarket expansion and diversification.Recent Developments in United States Electric Vehicle Aftermarket Market

- With its EV Life Series chargers, which come with variants with both NACS and SAE J1772 connectors, lengthy IP-rated cables, app monitoring, and various power/output options, MSI made its debut in the U.S. EV charger market in September 2025.

- ZF Aftermarket made it easier to fix and increase aftermarket efficiency by releasing 25 Electric Axle Drive fix Kits for the U.S. and Canada in August 2024. These kits allow independent workshops to service EVs without removing the electric axle.

- Coulomb Solutions Inc. debuted its Advanced Accessory Module (AAM) at ACT EXPO in May 2024. The AAM is a compact, fully integrated unit that integrates charging, high-voltage power delivery, accessory electronics, and thermal control.

United States Electric Vehicle Aftermarket Market Segments:

Replacement Parts

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting & Electronic Components

- Wheels

- Others

Vehicle Type

- Passenger Car

- Commercial Vehicle

Distribution Channel

- Authorized Service Centers (OEMs)

- Premium multi-brand service center

- Digital Aggregators

- Others

States-Market breakup in 29 viewpoints:

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia

- New Jersey

- Washington

- North Carolina

- Massachusetts

- Virginia

- Michigan

- Maryland

- Colorado

- Tennessee

- Indiana

- Arizona

- Minnesota

- Wisconsin

- Missouri

- Connecticut

- South Carolina

- Oregon

- Louisiana

- Alabama

- Kentucky

- Rest of United States

All companies have been covered from 5 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- SWOT Analysis

- Sales Analysis

Key Players Analysis

- 3M

- ABB Ltd.

- EVBox Group

- ChargePoint Inc.

- Webasto SE

- Siemens AG

- Bosch Automotive Sevrice Solution Inc.

- Schneider Electric SE

Table of Contents

Companies Mentioned

- 3M

- ABB Ltd.

- EVBox Group

- ChargePoint Inc.

- Webasto SE

- Siemens AG

- Bosch Automotive Sevrice Solution Inc.

- Schneider Electric SE

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

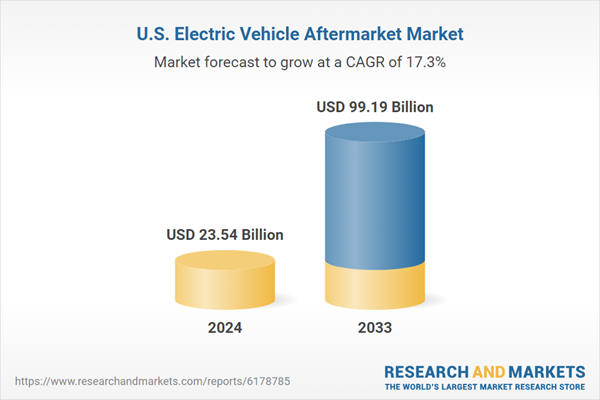

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | September 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 23.54 Billion |

| Forecasted Market Value ( USD | $ 99.19 Billion |

| Compound Annual Growth Rate | 17.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |