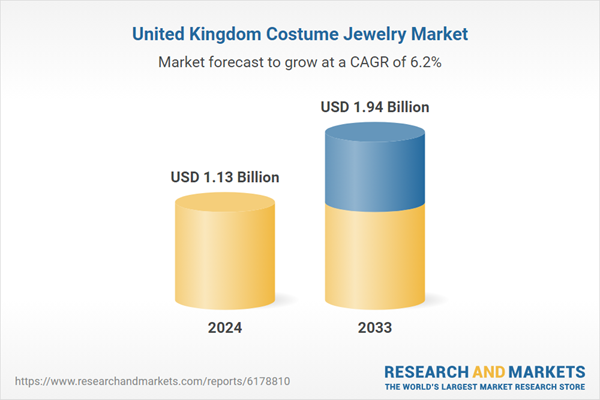

United Kingdom Costume Jewelry Market Outlook

Costume jewelry, or fashion jewelry, is jewelry made from materials that are inexpensive, mimicking fine jewelry. Usually made of plastic, glass, and base metals, it enables wearers to follow fashion at a fraction of the cost of precious metals and gems. It covers a wide variety of products, ranging from bright fashion necklaces to whimsical earrings, available to suit different tastes and aesthetics.In the UK, costume jewellery has become very popular over the years, especially with changing fashion trends. The popularity of social media sites and fashion bloggers has also contributed to the trend, encouraging people to express their individuality by sporting trend-setting accessories. Festivals and parties are ideal occasions for sporting bright, statement pieces that reflect individual personalities.

Also, the rising sustainability trend has made costume jewelry a popular option as a more sustainable alternative to conventional jewelry since it offers room for experimenting with fashion without incurring unnecessary costs. Therefore, costume jewelry continues to be a favorite aspect of British fashion today, admired for its ingenuity and affordability.

Growth Driver in the United Kingdom Costume Jewelry Market

Increasing Affordability and Fashion Trends

One of the most potent growth drivers for the UK costume jewelry market is affordability, which makes fashion accessible to a wide consumer base. Costume jewelry offers fashion-forward options to luxury jewelry at a much lower price, enabling consumers to follow changing fashion trends. Young consumers, such as millennials and Gen Z, are extremely fashion-forward and look for jewelry that can match changing clothes without any long-term commitment. This phenomenon has been fueled by social media as well as celebrity endorsements, with influencers promoting affordable statement pieces that instantly become popular. Katchin, a brand-new marketplace specifically for jewellery and watches, opened in the UK on January 25, 2023. The international platform was developed in partnership with category leader and backing partner Fossil Group and enterprise marketplace technology leader Mirakl to provide customers with a new way of buying jewellery and watches.Expansion of e-commerce and social media influence

The online environment is one of the principal growth drivers for the UK costume jewelry market. From international e-commerce behemoths to local high-street websites, online media offer customers extensive exposure to choice and variety of designs, as well as global trends. The increasing popularity of mobile shopping applications has further made buying jewelry more convenient than ever before. Social media sites such as Instagram, TikTok, and Pinterest are instrumental, with micro-creators and influencers promoting jewelry fashions that appeal to younger consumers. This synergy of social media and e-commerce generates a feedback loop of being seen, wanting, and impulse buying. July 2025, AG & Sons, long-established and reputable manufacturer of bespoke jewellery since 2005, is delighted to announce the formal opening of its new trade portal, trade.agnsons.com. This cutting-edge platform is specifically intended for retailers and trade professionals only and offers a streamlined and effective means of processing custom jewellery orders online, viewing live pricing, and monitoring progress in real time.Growing Need for Customized and Sustainable Jewelry

Sustainability and personalization are transforming the UK costume jewelry industry, serving as key drivers of growth. Contemporary consumers increasingly look for jewelry that tells their story, and as a result, there is growing demand for customized items like name necklaces, initial rings, and symbolic charms. In addition to fashion, sustainability is on the radar of UK consumers, who desire products that meet ethical and environmentally friendly values. Brands are meeting this need by launching items constructed from recycled materials, hypoallergenic metals, and eco-friendly packaging. This move is a perfect fit for the UK's overall focus on sustainability and responsible consumerism. Providing budget-friendly but ethically compatible designs assists brands in establishing credibility and loyalty. In May 2025, Hammerson collaborated with Jewells to open its first-ever stores in the UK. The jewelry chain opened four stores in Hammerson's retail centers, beginning with Westquay in Southampton and The Oracle at Reading in May, and then Bullring Birmingham and Brent Cross in London in June. Jewels is focused on demi-fine jewelry, made from gold, silver, eco-friendly lab-grown diamonds, and semi-precious stones.Challenge in the United Kingdom Costume Jewelry Market

Market Saturation and Low Differentiation

The UK market for costume jewellery is confronted with the issue of saturation, with hundreds of indigenous and foreign brands selling similar products. From the fast-fashion chains to indigenous small-time designers, too many brands confuse the scene, making it highly competitive. Saturation then results in low differentiation, with the consumer viewing many of the products as interchangeable. Because of this, brands lack distinctive identities or brand loyalty. Price competition only makes the situation more challenging, since firms often reduce prices to win over customers, at the expense of their margins. The presence of cheap imports also contributes to competitive pressures, making it difficult for locals to differentiate. Under such conditions, only those brands that prioritize effective design innovation, niche targeting, or sustainability can differentiate. Without this, market saturation continues to be a significant barrier to profitability and growth in the UK costume jewelry sector.Low Quality and Durability Issues

Another urgent challenge facing the UK costume jewelry market is low perceived quality and poor durability. Costume jewelry, which is usually manufactured from base metals, plated finishes, or man-made stones, tends to tarnish, crack, or be skin-irritating. All these issues erode consumer confidence and lower repeat sales. Most consumers perceive costume jewelry as temporary wear, not encouraging more than meager expenditures. On top of that, growing recognition of skin allergies and sensitivities complicate consumer decision-making further with the issues of nickel and other non-hypoallergenic materials. With a growing emphasis on sustainability and durability in purchases, the industry should respond to these issues by enhancing material quality, transparency, and safety. By not increasing durability and confidence, costume jewelry is in danger of being perceived as disposable fashion, which restricts opportunities for development and questions brand reputation in the UK market.United Kingdom Costume Ring Jewelry Market

The costume ring category is a colorful segment of the UK jewelry market that strongly appeals to younger, fashion-conscious consumers. Fashion rings, from simple stackable designs to statement pieces, are affordable and versatile. Rings are not just for everyday use but also for seasonal or occasion-specific buys. Online stores and quick-fashion retailers update designs repeatedly, allowing customers to track new trends at affordable prices. Customizable rings, like letters or symbolic patterns, are especially sought after, showing uniqueness and personal expression. Regardless of durability issues, costume rings are still appealing due to their affordability and repeated trend synchrony. Their status as fashion, value-priced accessories means that rings remain one of the most vibrant costume jewelry markets in the UK.United Kingdom Costume Bracelet Jewelry Market

Bracelets are a major category within the UK costume jewelry market, prized for their versatility and layering appeal. Style options include charm bracelets, cuffs, bangles, and delicate chains that may be worn separately or stacked for maximum impact. The fashion of mixing and matching bracelets complements younger buyers' demand for customizable and versatile apparel. Costume bracelets are gift favorites as well, so they are a consistent pick during birthdays, the holidays, and token-of-friendship presents. Both online and offline retailers bank on seasonal collection based on fashion seasons and popular cultural trends. Despite durability concerns, the affordability and the diversity of styles offered by costume bracelets continue to keep them in high demand. With their capacity to adapt both to formal and informal events, bracelets are still one of the most long-lasting and versatile ranges in the UK market for costume jewelry.United Kingdom Costume Necklace Jewelry Market

The UK market for costume necklaces is extremely dynamic, with a very diverse range of styles from plain pendants to chain layers and statement necklaces. Necklaces are a staple accessory for both streetwear and formal wear, which is why they are popular with all age groups. Trends on social media, such as layered chains or name necklaces, heavily impact demand. Costume necklaces are also highly available, with fast-fashion stores and online platforms constantly updating designs at discounted rates. Gift culture also contributes to this segment, since necklaces are versatile gifts. Nonetheless, problems such as tarnishing and short product life continue to be typical consumer issues. Nevertheless, the necklace category continues to succeed as a result of its trend-sensitive flexibility and price-friendliness, cementing its position as a staple of the UK costume jewelry market.United Kingdom Offline Costume Jewelry Market

Offline retail remains pivotal in the UK costume jewelry market, especially in fashion shops, department stores, and independent retailers. Physical outlets offer consumers the sensory experience of touching and trying jewelry prior to purchase, which enhances confidence and facilitates impulse buying. Costume jewelry tends to be enhanced by in-store display and promotions synchronized with fashion apparel sales, driving add-on purchases. Seasonal buying surges during festive seasons like Christmas or Valentine's Day and drive robust offline sales. Local boutiques also help through offering distinct or craft-inspired designs that stand out from mass-market offerings. However, offline retailers are threatened by competing online sources with broader inventories and competitive prices. To remain competitive, offline retailers increasingly employ omni-channel strategies, merging in-store shopping with digital marketing. In spite of adversity, offline sales continue to play a critical role, particularly for impulse buys of costume jewelry.United Kingdom Costume Women Jewelry Market

Women control the UK costume jewelry market, dominating demand in all of the key categories, from rings and earrings to bracelets and necklaces. Costume jewelry offers women affordable means of keeping up with trends while enjoying personal style. Self-buying is prevalent, reflecting independence and empowerment, as is gifting, which drives sales considerably. Social media campaigns and trend-setting by influencers are highly effective among women, especially younger women. The extensive range of designs, minimalist through statement, allows for suitability across age and style ranges. Sustainability and customization are highly influential for female purchasers, with them increasingly appreciating jewelry that showcases uniqueness and ethical considerations. With women remaining at the heart of the core consumer audience, their tastes and shifting fashion sense continue to be at the heart of defining future opportunities for the UK costume jewelry market.United Kingdom Costume Children Jewelry Market

The UK children's costume jewelry category is a niche but expanding segment, fueled by gifting culture and popularity of fun, themed accessories. Costume jewelry is bought by parents and family members for special events like birthdays, holidays, or school occasions. Best-selling products include charm bracelets, multicolored rings, and cartoon-character necklaces. Comfort and safety come first, driving demand for hypoallergenic and long-lasting materials that are child-safe. Brands typically attach designs to popular culture, using themes from film, television, or games, making jewelry more attractive to kids. Prices that keep jewelry affordable allow parents to purchase multiple items without worrying about exorbitant prices. Though not as sizeable as in adult segments, children's costume jewelry retains high emotional and cultural connotations, fueling steady growth in this niche market.London Costume Jewelry Market

London is the UK's largest and most dominant costume jewelry market, fueled by its position as a fashion capital of the world. The city's multicultural population and fast fashion culture generate demands for eclectic jewelry styles ranging from statement pieces to minimalist trends. Shopping centers like Oxford Street, Covent Garden, and city boutiques carry a mix of local talent and international fashion brands. Social networking and fashion weeks in London further reinforce trends, and costume jewelry is a central part of styling. Online shopping growth is also substantial in London, backed by London's technologically oriented consumers. Nevertheless, intense competition and fast-changing fashion cycles demand relentless innovation. London's reputation as a trendsetter ensures that it continues to influence national and global costume jewelry markets.Scotland Costume Jewelry Market

Scotland's costume jewelry industry, though smaller than in London, is significant with its mix of heritage and modern influences. Scottish consumers appreciate both price and quality, tending to look for jewelry that uses cultural themes such as Celtic motifs. The market is underpinned by gift-giving habits, tourism, and local crafts markets emphasizing one-off, handmade costume jewelry. Online sales are also increasing in Scotland, especially among young consumers who follow UK-wide style trends. Festivals that are seasonal, weddings, and celebrations also add to solid local demand. But limited availability of varied product lines in the countryside as opposed to city centers can limit market expansion. Nevertheless, Scotland's combination of tradition and contemporary fashion guarantees a rich and unique presence in the UK costume jewelry market.Market Segmentations

Product

- Ring

- Earring

- Bracelet

- Necklace

- Others

Distribution Channel

- Offline

- Online

End User

- Men

- Women

- Children

Top Regions

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and the Humber

- East Midlands

- Others

All companies have been covered with 5 Viewpoints

- Overviews

- Key Persons

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- Louis Vuitton Malletier SAS

- CARTIER

- Sabika

- Yanbal

- Richline Group, Inc.

- STELLA & DOT

- Lulu Ave

- Giorgio Armani S.p.A.

Table of Contents

Companies Mentioned

- Louis Vuitton Malletier SAS

- CARTIER

- Sabika

- Yanbal

- Richline Group, Inc.

- STELLA & DOT

- Lulu Ave

- Giorgio Armani S.p.A.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | September 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.13 Billion |

| Forecasted Market Value ( USD | $ 1.94 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 8 |