United Kingdom Confectionery Industry Overview

One of the most active markets in the food and beverage sector is the confectionery sector in the United Kingdom. It includes gum, sugar confections, and chocolate, all of which are widely consumed in British society. Holidays like Christmas and Easter, when chocolate and sweets are staples of customs, see seasonal demand at its highest. In order to appeal to a wide range of customer demographics, niche and premium manufacturers have been bringing artisanal, organic, and functional confectionery products to the market alongside legacy brands.The changing retail dynamics and distribution tactics are driving a dramatic revolution in the confectionery market in the United Kingdom. With more than 48,590 locations nationwide in 2022, convenience stores continue to rule the retail market and offer consumers never-before-seen access to confections. Aldi said in 2023 that it would open 100 new stores in the UK over the next two years, demonstrating the relentless expansion of major retail chains. Lidl GB's strategic objective to achieve 1,100 outlets by the end of 2025 complements this retail expansion, highlighting the industry's dedication to improving physical retail presence while adjusting to shifting consumer preferences.

Consumer buying habits are changing as a result of the confectionery industry's digital transformation, with the UK showing very high rates of digital adoption. In 2023, 82% of UK citizens made at least one online transaction, and the nation had an outstanding 97.8% internet penetration rate, with 66.11 million users. In order to match changing consumer expectations, this digital revolution has forced established manufacturers and merchants to improve their online presence and provide creative solutions like subscription services, tailored product suggestions, and seamless omnichannel experiences.

In the UK candy sector, producers are responding to consumers' increasing demand for healthier options, which is driving product innovation. With 67% of customers choosing milk chocolate, 22% choosing dark chocolate, and 11% choosing white chocolate in 2022, the industry has seen a dramatic shift in chocolate preferences. Given that 4.3 million individuals in the UK were diagnosed with diabetes in 2023, this trend is especially pertinent. As a result, manufacturers are working to create sugar-free and reduced-sugar alternatives while still providing the decadent experience that consumers have come to anticipate.

Key Factors Driving the United Kingdom Confectionery Market Growth

Strong Cultural Affinity and Seasonal Consumption

Confectionery holds a special place in UK culture, with deep-rooted traditions driving year-round demand. Seasonal events such as Christmas, Easter, and Valentine’s Day create significant spikes in chocolate and sweet sales, supported by gifting culture and promotional campaigns. Consumers associate confectionery with indulgence, comfort, and celebration, making it an integral part of both everyday snacking and special occasions. This consistent cultural connection ensures a stable baseline demand across product categories, while also providing opportunities for limited-edition products and themed innovations. Seasonal packaging, festive assortments, and heritage branding play important roles in reinforcing consumer loyalty. The ability of confectionery to serve as both an impulse purchase and a symbolic gift gives it a versatile appeal, cementing its place as a reliable growth driver in the UK food and beverage landscape.Premiumization and Ethical Sourcing Trends

The shift toward premiumization is a defining factor in the UK confectionery market. Consumers are increasingly drawn to high-quality chocolates, artisanal sweets, and gourmet offerings that deliver unique taste experiences. Ethical sourcing has also become a key purchase driver, with growing emphasis on fair-trade cocoa, sustainable farming practices, and eco-friendly packaging. Brands that communicate transparency in sourcing and production methods are gaining trust among conscious buyers. Premium confectionery is not only associated with superior taste but also with healthier, responsibly sourced ingredients, which align with evolving lifestyle preferences. This trend has allowed companies to differentiate themselves and capture higher margins, while meeting consumer demand for authenticity and sustainability. As a result, premium and ethically sourced confectionery continues to fuel market growth, appealing to both mainstream and niche customer segments across the UK.Innovation in Health-Oriented Confectionery

Rising consumer awareness of health and wellness is influencing product innovation in the UK confectionery market. Traditional sugary products face growing scrutiny, prompting manufacturers to develop healthier alternatives. Innovations include sugar-free, reduced-calorie, vegan, and plant-based confectionery options that cater to health-conscious and ethically minded consumers. Functional confectionery infused with added vitamins, minerals, or protein is also gaining traction as consumers seek indulgence without compromising nutrition. Regulatory initiatives targeting sugar reduction have further accelerated reformulation efforts, pushing brands to adapt while maintaining taste and appeal. These developments are not limited to niche players - mainstream brands are also diversifying portfolios to retain competitiveness. Health-oriented confectionery is broadening the market’s appeal, attracting consumers who might otherwise limit sweet consumption. This innovation-driven shift is strengthening the market by balancing indulgence with evolving wellness trends.Challenges in the United Kingdom Confectionery Market

Raw Material Price Volatility

The UK confectionery market faces significant challenges due to the volatility of raw material prices, particularly cocoa, sugar, and dairy, which form the backbone of product formulations. Fluctuations in global supply, influenced by climate change, political instability in producing countries, and shifting agricultural yields, create cost uncertainties for manufacturers. Rising input costs often squeeze margins, particularly for mid-sized and smaller players unable to hedge effectively or negotiate favorable contracts. Passing on these cost increases to consumers is difficult in a highly competitive market where price sensitivity remains a concern. Additionally, premium and ethically sourced ingredients, though in demand, further elevate costs. This volatility not only affects profitability but also complicates long-term planning and innovation strategies. Managing supply chain risks while maintaining affordability and quality continues to be a persistent challenge for confectionery producers in the UK.Regulatory and Health-Related Pressures

Regulatory scrutiny presents another substantial challenge for the UK confectionery industry. Government initiatives targeting sugar reduction, calorie labeling, and restrictions on advertising sugary products to children have forced companies to reformulate products and adjust marketing strategies. Compliance requires significant investment in R&D, labeling, and product innovation, adding operational complexity and cost. These regulations coincide with shifting consumer sentiment toward healthier lifestyles, placing confectionery brands under pressure to balance indulgence with nutritional responsibility. Non-compliance can result in reputational risks, legal repercussions, and loss of consumer trust. While healthier confectionery options present opportunities, reformulation efforts may alter taste or brand identity, complicating consumer acceptance. The convergence of regulatory pressures and consumer expectations is reshaping the industry landscape, requiring manufacturers to innovate responsibly while navigating complex legal and health-related frameworks.United Kingdom Confectionery Market Overview by States

The United Kingdom confectionery market demonstrates diverse growth patterns across London, Scotland, West Midlands, and Yorkshire and the Humber, influenced by demographics, cultural preferences, retail infrastructure, and consumer demand for premium and health-oriented products. The following provides a market overview by States:London Confectionery Market

London stands as a leading hub for confectionery consumption in the UK, driven by its dense population, cosmopolitan culture, and strong retail presence. The city’s diverse demographic mix supports demand for both traditional sweets and innovative premium offerings. Consumers in London are particularly responsive to health-oriented, vegan, and ethically sourced confectionery products, reflecting broader lifestyle and wellness trends. High disposable incomes and gifting traditions also encourage strong sales of artisanal and luxury chocolates. The region benefits from a wide distribution network, spanning supermarkets, specialty shops, and online channels that cater to convenience-driven urban lifestyles. Seasonal events, cultural festivals, and tourism further boost confectionery demand, creating opportunities for limited-edition launches and unique packaging. London’s role as a trendsetter market makes it a focal point for innovation and premiumization within the UK confectionery industry.Scotland Confectionery Market

Scotland’s confectionery market reflects a blend of traditional preferences and emerging consumer trends. Heritage sweets and locally popular products remain integral to the cultural fabric, driving steady baseline demand across categories. However, rising health consciousness is influencing consumer choices, prompting interest in reduced-sugar and vegan alternatives. Scotland’s strong tourism sector also contributes to confectionery sales, particularly artisanal and gift-oriented products. Regional players often leverage local flavors and heritage branding to differentiate themselves in a competitive landscape. Retail channels include supermarkets, convenience stores, and growing e-commerce platforms that improve access to a wider variety of confectionery options. Seasonal events and festive traditions continue to drive spikes in sales, ensuring sustained demand. While economic pressures and raw material costs present challenges, Scotland’s confectionery market remains resilient, balancing traditional loyalty with growing appetite for innovation and healthier alternatives.West Midlands Confectionery Market

The West Midlands serves as an important contributor to the UK confectionery market, supported by its industrial heritage and growing urban centers. The region demonstrates strong demand for mainstream confectionery products, with consumers also showing interest in premium and healthier alternatives. Local manufacturers play a significant role, offering both mass-market and specialty products tailored to evolving preferences. Retail distribution is well-developed, with supermarkets, specialty stores, and online platforms providing widespread accessibility. Affordability remains a key driver, though premium offerings are gaining traction among younger and urban consumers. Seasonal spikes in consumption during holidays and festivals further support market activity. Despite challenges related to regulatory pressures and raw material costs, the West Midlands market continues to expand, driven by a mix of traditional demand, innovation, and consumer openness to health-conscious confectionery options.Yorkshire and the Humber Confectionery Market

Yorkshire and the Humber has a longstanding association with confectionery production and consumption, benefiting from both heritage brands and emerging players. The region’s confectionery market reflects strong cultural ties, with traditional sweets and chocolates retaining popularity. At the same time, changing consumer habits are creating opportunities for low-sugar, vegan, and premium offerings. The presence of established manufacturers contributes to regional employment and ensures strong supply chain networks. Distribution spans supermarkets, convenience outlets, and online platforms, which are increasingly important in catering to younger, digital-savvy consumers. Seasonal events and gifting traditions contribute to sales peaks, while regional pride in local products supports brand loyalty. Challenges such as raw material costs and regulatory compliance affect producers, but the region remains a key contributor to the overall UK confectionery market, balancing tradition with modern innovation.Market Segmentations

Type

- Chocolate

- Sugar Confectionery

- Cookies

- Ice Cream

Distribution Channels

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceuticals and Drug Stores

- Specialty Stores

- Online

- Others

Region

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and the Humber

- East Midlands

- Others

All the Key players have been covered

- Overviews

- Key Persons

- Recent Developments

- SWOT Analysis

- Revenue Analysis

Company Analysis:

- August Storck KG

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero International SA

- General Mills Inc.

- HARIBO Holding GmbH & Co. KG

- Kellogg Company

- Lotte Corporation

- Mars Incorporated

Table of Contents

Companies Mentioned

- August Storck KG

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero International SA

- General Mills Inc.

- HARIBO Holding GmbH & Co. KG

- Kellogg Company

- Lotte Corporation

- Mars Incorporated

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | September 2025 |

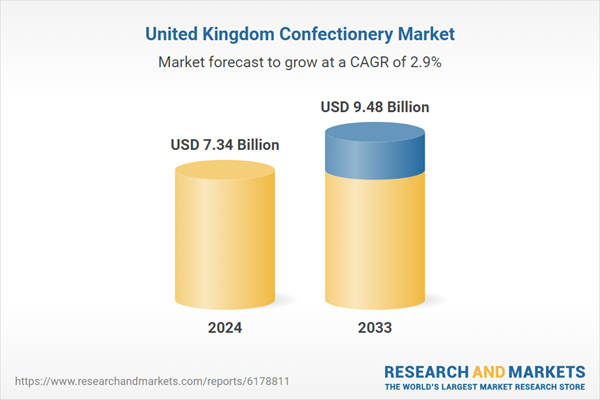

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.34 Billion |

| Forecasted Market Value ( USD | $ 9.48 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 8 |