Singapore Luxury Goods Industry Overview

High-end items that prioritize exclusivity, quality, and prestige are known as luxury goods. Fashion, jewelry, watches, leather goods, cosmetics, cars, and lifestyle accessories are among them. These goods appeal to customers looking for prestige and one-of-a-kind experiences because they are frequently linked to excellent craftsmanship, creative design, and premium pricing. In addition to being useful, luxury products have social and emotional significance as symbols of money, refinement, and individual preference. To generate aspirational appeal, the market uses marketing, storytelling, and brand legacy. Luxury businesses are now able to reach a wider audience while retaining exclusivity because to globalization and digital platforms, striking a balance between accessibility and the appearance of luxury.A growing number of high-net-worth individuals and rising disposable incomes are driving the luxury goods sector in Singapore by allowing consumers to spend more on high-end goods. Retail sales at upscale boutiques and shopping centers are increased by tourism, especially from affluent tourists in Asia. E-commerce platforms increase accessibility, while social media and influencer marketing promote aspirational consumption and brand recognition. Rich customers are drawn to Singapore because of its status as a shopping destination with advantageous tax laws, top-notch retail facilities, and global brand recognition. Furthermore, rising demand for customized, limited-edition, and eco-friendly luxury goods propels market expansion and establishes Singapore as one of Asia's top destinations for luxury goods.

Growth Drivers for the Singapore Luxury Goods Market

Rising wealth and HNWIs population

The market for luxury goods in Singapore is driven in large part by rising affluence and a growing number of high-net-worth individuals (HNWIs). The Credit Suisse Research Institute estimates that in 2024, there will be 330,752 HNWs and 1,739 UHNWs in Singapore. This significant concentration of wealth not only increases the consumption of luxury goods but also encourages the entry of global luxury brands into the market to serve this affluent demographic. As a global financial hub, Singapore draws a sizable number of HNWIs and UHNWIs, which contributes to the market's growth. Furthermore, the nation's strong retail infrastructure, advantageous tax laws, and stable economy all contribute to the success of the luxury goods industry. Singapore's status as a major market for luxury goods in the Asia-Pacific area is cemented by the existence of upscale shopping areas, upscale shops, and unique retail experiences, all of which increase the allure of luxury goods among wealthy customers.Expansion of luxury e-commerce platforms

The Singaporean luxury goods market is significantly influenced by the growth of luxury e-commerce platforms. By providing a smooth online shopping experience, these platforms are progressively meeting the rising demand for high-end goods. Increased internet connectivity and smartphone adoption, along with improved digital infrastructure, have made it possible for luxury brands to reach a wider audience. Additionally, wealthy customers are drawn to services like virtual try-ons, tailored recommendations, and exclusive online collections. The growth of luxury e-commerce in Singapore is further fueled by the ease of shopping from home, safe payment methods, and effective delivery services. The market is expanding and consumer behavior is changing as a result of this trend. Additionally, luxury labels and e-commerce platforms are collaborating to develop exclusive partnerships that provide online buyers with limited-edition products and unique experiences. Digital marketing tactics and social media's increasing sway are also important factors in the promotion of luxury items on these channels.Influence of social media and celebrity endorsements

The Singaporean luxury goods sector is heavily influenced by social media and celebrity endorsements. Social media's pervasiveness has changed how customers find and interact with premium brands. Luxury brands can reach a wider audience and establish aspirational value by showcasing their products on platforms like Instagram, Facebook, and TikTok. Celebrity endorsements, which capitalize on the popularity and legitimacy of well-known individuals, increase this influence even more. Celebrities frequently set trends, and buyers find luxury brands more appealing when they are associated with them. These endorsements are crucial in influencing consumers' decisions to buy in Singapore, where social media usage is widespread and brand awareness is high. The Department of Singapore Statistics reports that in 2024, 165% of Singaporeans were using mobile devices. The Department of Singapore Statistics' "InfoComm and Media" report, highlights the wide reach of digital platforms. Furthermore, including influencer marketing - in which social media stars endorse high-end products - has emerged as a crucial tactic for companies. Strong fan bases and specialized appeal allow influencers to successfully target particular customer segments, increasing engagement and revenue.Challenges in the Singapore Luxury Goods Market

Availability of counterfeit products

One of the biggest problems facing the Singaporean luxury goods market is the existence of fake goods. The exclusivity and perceived value of luxury brands are undermined by counterfeit goods, which are sold for a fraction of the price of genuine items. This damages consumer trust and reduces revenue for legitimate manufacturers and retailers. High-quality replicas can now be produced more easily thanks to technological developments, and online platforms offer practical distribution channels. Additionally, counterfeit goods weaken brand equity and make it challenging for businesses to uphold their premium status. Fakes may be chosen by customers looking for less expensive options, which would further reduce sales of genuine goods. Strict laws, more consumer awareness, and effective anti-counterfeiting tactics are needed to address this problem and safeguard market confidence and brand integrity.Intense Market Competition

Fierce competition is a major restraint in the Singapore luxury goods market. The presence of numerous established brands alongside new entrants intensifies rivalry, making it challenging for companies to differentiate their offerings. This competitive environment often drives aggressive pricing, promotional campaigns, and innovation races, which can pressure profit margins. Companies are also compelled to invest heavily in marketing and branding to maintain their position, increasing operational costs. Market saturation further complicates growth, as new entrants struggle to establish a foothold while existing players face continuous pressure to retain customer loyalty. Evolving consumer preferences for personalized and unique experiences add another layer of complexity, making the competitive landscape highly dynamic and challenging for market participants.North East Singapore Luxury Goods Market

The North-East region of Singapore has seen growing demand for luxury goods, driven by rising disposable incomes and an increasing number of affluent residents. Residential developments and urbanization have led to a higher concentration of premium retail outlets and shopping complexes. Consumers in this region are increasingly influenced by social media trends, brand prestige, and exclusive offerings. E-commerce platforms complement physical stores, providing convenient access to high-end fashion, jewelry, and lifestyle products. Tourism also contributes to sales, as visitors seek premium goods during their stay. Sustainability and limited-edition items are particularly appealing, reflecting a growing interest in personalized and environmentally conscious luxury. Overall, North-East Singapore represents a steadily expanding market for high-end consumer products.Central Singapore Luxury Goods Market

Central Singapore is the country’s primary luxury shopping hub, encompassing iconic districts like Orchard Road and Marina Bay. The region benefits from high foot traffic, international tourism, and a dense population of high-net-worth individuals. Luxury retail stores, flagship boutiques, and premium malls offer a wide range of fashion, accessories, jewelry, and lifestyle products. Brand-conscious consumers in the area value exclusivity, quality, and innovative design. Social media, influencer marketing, and experiential retail enhance engagement and drive demand. The presence of luxury hotels and entertainment venues further boosts spending. Central Singapore remains the focal point for both domestic and international luxury consumption, reinforcing its position as the leading market for high-end goods in the country.West Singapore Luxury Goods Market

West Singapore’s luxury goods market is gradually expanding, supported by growing affluence and urban development. High-income residential areas and upcoming commercial hubs attract demand for premium fashion, accessories, and lifestyle products. While retail density is lower than in Central Singapore, shopping centers and malls in the region increasingly host international luxury brands. Consumers are influenced by brand reputation, quality, and social status, with e-commerce platforms complementing physical retail channels. Tourism and regional visitors also contribute to market growth. Additionally, sustainability and limited-edition products appeal to the region’s environmentally conscious and trend-aware consumers. West Singapore presents emerging opportunities for luxury brands aiming to expand beyond the central business districts.France Taxi Market Segments:

Product Type

- Clothing and Apparel

- Footwear

- Eyewear

- Jewelry

- Leather Goods

- Watches

- Other

End User

- Men

- Women

- Unisex

Distribution Channel

- Single Brand Stores

- Multi Brand Stores

- Online Stores

- Other

Region

- North-East

- Central

- West

- East

- North

All companies have been covered from 5 viewpoints:

- Company Overview

- Key Persons

- Recent Development & Strategies

- SWOT Analysis

- Sales Analysis

Key Players Analysis

- LVMH Moët Hennessy Louis Vuitton

- Kering SA

- Richemont SA

- The Swatch Group Ltd

- Rolex SA

- Chanel SA

- PVH Corp

- The Estée Lauder Companies

- Ralph Lauren Corporation

- Prada SpA.

Table of Contents

Companies Mentioned

- LVMH Moët Hennessy Louis Vuitton

- Kering SA

- Richemont SA

- The Swatch Group Ltd

- Rolex SA

- Chanel SA

- PVH Corp

- The Estée Lauder Companies

- Ralph Lauren Corporation

- Prada SpA.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

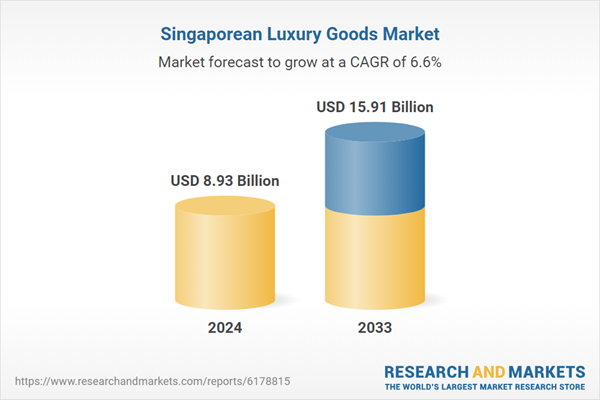

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | September 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 8.93 Billion |

| Forecasted Market Value ( USD | $ 15.91 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Singapore |

| No. of Companies Mentioned | 10 |