The expansion is fueled by rising global awareness around preventive health and a growing shift toward natural, plant-based wellness alternatives. Specialty crops, including nutrient-dense fruits, seeds, nuts, vegetables, and medicinal herbs, are being cultivated specifically for their bioactive properties and health benefits. These crops are not only used in functional foods and dietary supplements but are also gaining traction in pharmaceutical formulations, where agriculture increasingly intersects with health science. The momentum is being driven by consumers who now view food as medicine and are increasingly seeking targeted, natural solutions for long-term wellness. Demand continues to surge for ingredients perceived as immune-enhancing or stress-reducing. This interest has been amplified in recent years by global health challenges and is sustained by evolving farming practices like precision agriculture and controlled environment cultivation that allow consistent year-round harvesting. With government dietary recommendations and research institutions emphasizing whole-food nutrition, the role of specialty crops in the nutraceuticals space is becoming central to global wellness strategies.

The medicinal herbs and botanicals segment will reach USD 21.1 billion by 2034. Their widespread use stems from both traditional medicine systems and increasing validation from scientific research. Modern consumers are gravitating toward herbal-based remedies for managing stress, boosting immunity, and supporting long-term health. This segment continues to lead, backed by a consumer base that prefers natural over synthetic solutions and trusts botanical efficacy. Several herbal varieties known for supporting cognitive function, energy, and immunity have seen explosive growth in supplement applications, contributing significantly to overall market expansion.

The dietary supplements segment held a 65% share in 2024 and is forecasted to grow to USD 36.8 billion by 2034. This growth is driven by consumers shifting from generic multivitamins to targeted, plant-based formulations designed for specific health outcomes such as metabolism, brain function, and mobility. Ingredient traceability, cleaner labels, and high bioavailability have become major purchase drivers. Leading supplement manufacturers are forming strategic alliances with specialty crop producers to guarantee consistent quality and build vertically integrated supply chains. This helps ensure transparency, sustainability, and reliability, which resonate with health-conscious consumers.

U.S. Specialty Crops for Nutraceuticals Market was valued at USD 7.2 billion in 2024 and is expected to reach USD 14.16 billion by 2034. The region benefits from cutting-edge agriculture technologies, robust research capabilities, and a mature market for premium health products. States like Washington, Oregon, and California are seeing rising cultivation of high-value specialty crops focused on health-based use. The push for organic farming practices and sustainability is accelerating acreage expansion. Health-aware consumers in the U.S. are also increasingly demanding locally grown, traceable ingredients, creating opportunities for domestic growers to diversify into botanicals and functional plant-based products that meet high market standards.

Key players in the Specialty Crops for Nutraceuticals Market include Kemin, Neutragen Healthcare, Americas Heartland, Aries Agro, and Cargill. Companies in the Specialty Crops for Nutraceuticals Market are prioritizing vertical integration by investing directly in farming partnerships to secure consistent, high-quality raw materials. Many are leveraging advanced agricultural practices such as CEA (Controlled Environment Agriculture) and precision farming to ensure year-round availability and enhance yield efficiency. A major strategic focus lies in developing proprietary crop varieties rich in targeted bioactives, aligning closely with clinical research to support health claims. Businesses are expanding product portfolios with clean-label, single-ingredient supplements tailored for specific wellness goals. Certifications such as organic, non-GMO, and sustainably farmed are being used to differentiate offerings and build trust. Branding efforts increasingly highlight traceability, and companies are deepening R&D investment to link botanical efficacy with measurable health outcomes.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Specialty Crops for Nutraceuticals market report include:- Cargill

- Kemin

- Aries Agro

- Americas Heartland

- Neutragen Healthcare

- Corteva Agriscience

- Bayer Crop Science

- Syngenta Group

- AeroFarms

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

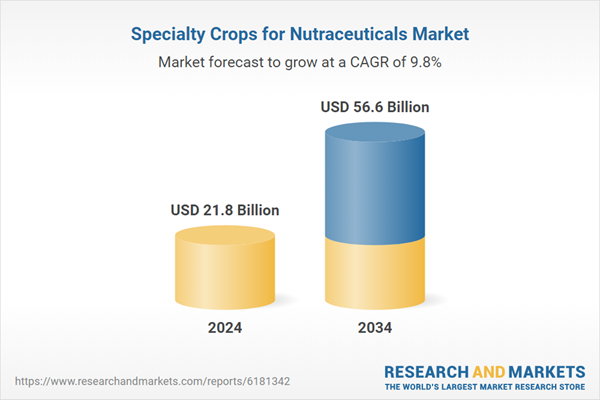

| Estimated Market Value ( USD | $ 21.8 Billion |

| Forecasted Market Value ( USD | $ 56.6 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |