The market’s expansion is being driven by the rising number of individuals with physical impairments, a growing elderly population, increasing neurological and trauma-related cases, and the surging demand for robotic rehabilitation across clinical and home settings. Rehabilitation robots are reshaping how recovery is delivered after neurological disorders, spinal cord injuries, surgeries, or age-related mobility challenges. These robotic systems are increasingly adopted in outpatient centers, hospitals, and home care settings, offering targeted therapy that enhances motor recovery and mobility. Continuous improvements in sensor integration, real-time motion tracking, AI-driven response mechanisms, and cloud-enabled therapy data are transforming traditional rehabilitation into a highly personalized and effective process. Integration with telehealth platforms and electronic medical systems is also enabling therapists and clinicians to tailor and monitor treatments remotely. As demand grows, companies are introducing more ergonomic, patient-centric robotic devices built with biocompatible materials and enhanced user interface designs. Increased funding, favorable healthcare policies, and ongoing product innovations continue to support long-term growth across developed and emerging economies.

The upper extremity segment will grow at a CAGR of 14.4% through 2034. Its growth is propelled by the effectiveness of robotic-assisted rehabilitation in improving limb coordination and strength. These systems are being widely implemented in clinical and residential settings to support quicker and more targeted recovery of the arms, shoulders, and hands. Their growing popularity is closely tied to rising awareness of personalized therapy benefits and improved outcomes in stroke and orthopedic rehabilitation.

The exoskeleton robots segment is expected to grow at a CAGR of 14.8% during 2034. Increasing focus on wearable robotic systems for mobility support, coupled with the growing incidence of spinal cord injuries and neurological conditions, is pushing the adoption of exoskeletons. These systems offer enhanced strength, gait training, and posture support, and their use is steadily rising in aging care, physical therapy, and post-injury rehabilitation. Rapid advancements in lightweight material design and adaptive AI capabilities are making them more accessible for widespread clinical deployment.

North America Rehabilitation Robots Market held 43.8% share in 2024. The region benefits from an advanced healthcare ecosystem, high investment in robotics innovation, and broad awareness of robotic therapy’s benefits. The United States plays a key role in this regional dominance, with substantial insurance coverage, rising rates of neuromuscular disorders, and strong institutional support for integrating robotic technologies into rehabilitation programs. Partnerships between technology developers and medical research institutions continue to foster breakthroughs, while expanding use in long-term care and outpatient facilities further drives market momentum.

Leading companies in the Global Rehabilitation Robots Market are Cyberdyne, DIH, REX BIONICS, myomo, KINOVA, Ekso Bionics, FOURIER, tyromotion, BioXtreme, LIFEWARD, BIONIK, LEADERS REHAB ROBOT, and Rehab-Robotics. Companies in the Rehabilitation Robots Market are focusing on product innovation by integrating AI algorithms, smart sensors, and cloud-connected platforms to deliver personalized and data-driven therapy. Leading players are expanding their global footprint through strategic partnerships with healthcare providers, research institutions, and distributors. Investment in R&D remains a top priority to develop compact, user-friendly, and affordable devices suitable for diverse rehabilitation needs. Many firms are strengthening their home care offerings, targeting aging populations and long-term care markets.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Rehabilitation Robots market report include:- BIONIK

- BioXtreme

- Cyberdyne

- DIH

- Ekso Bionics

- FOURIER

- KINOVA

- LEADERS REHAB ROBOT

- LIFEWARD

- Myomo

- Rehab-Robotics

- REX BIONICS

- Tyromotion

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

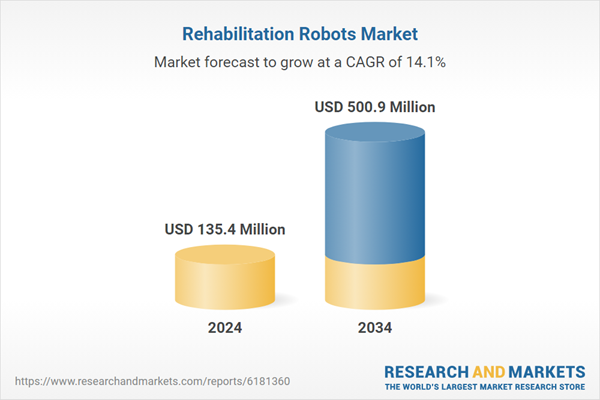

| Estimated Market Value ( USD | $ 135.4 Million |

| Forecasted Market Value ( USD | $ 500.9 Million |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |