The growth is fueled by the rising global prevalence of chronic illnesses such as cardiovascular diseases, diabetes, and mental health conditions. These ongoing healthcare challenges are driving demand for digital therapeutics, which deliver cost-efficient, scalable, and personalized treatment alternatives. These software-driven medical interventions are increasingly integrated with artificial intelligence, wearables, gamification, and behavioral health tools that improve adherence, patient outcomes, and engagement. Designed to work either independently or in conjunction with traditional treatments, these tools are becoming a cornerstone of modern healthcare. As providers and patients increasingly seek flexible and non-invasive solutions, the appeal of digital therapeutics continues to grow. Their ability to deliver clinically proven outcomes while reducing overall care costs makes them particularly attractive to employers, insurers, and public health systems. Growing support from payers and expanded regulatory acceptance across major markets are further accelerating development and deployment across therapeutic areas, from metabolic conditions to mental wellness.

The software segment held a 54.3% share in 2024 and is anticipated to reach USD 41.6 billion by 2034, growing at a CAGR of 25.9%. This segment includes both on-premise and cloud-based platforms that enable tailored therapeutic interventions based on user data, behavioral trends, and AI-driven algorithms. These solutions not only promote habit formation and chronic disease management but are also widely adopted due to their scalability and accessibility across digital devices such as smartphones, computers, and tablets. The growing ease of access and ability to deliver continuous care remotely make software-based digital therapeutics a preferred model in preventive and ongoing treatment frameworks.

The diabetes segment generated USD 2.3 billion in 2024. Increasing rates of all forms of diabetes, Type 1, Type 2, and gestational, are contributing to rising demand for tools that enable real-time monitoring and sustainable lifestyle changes. Digital therapeutics provide tailored interventions, including behavioral coaching, glucose tracking, medication reminders, and analytics-based insights, positioning them as key components in long-term diabetes care plans. This segment continues to benefit from growing patient awareness and clinical recognition of DTx in metabolic health management.

North America Digital Therapeutics Market held 58.1% share in 2024. The region’s strong healthcare infrastructure, rising prevalence of chronic conditions, and favorable regulatory landscape are boosting adoption. In the U.S. and Canada, employers are increasingly including DTx platforms in workplace wellness strategies to enhance employee health outcomes and reduce insurance expenditures. Additionally, widespread reimbursement availability and robust technology adoption are supporting the integration of DTx into mainstream clinical and wellness environments.

Key players in the Global Digital Therapeutics Market are Teladoc Health, Virta Health, LifeScan, Hyfe, Omada Health, Akili Interactive, Pear Therapeutics, Orexo, Otsuka Holdings, Click Therapeutics, Propeller Health (ResMed), and AmerisourceBergen. To strengthen their presence, digital therapeutics companies are focusing on strategic partnerships with payers, pharmaceutical firms, and healthcare systems to broaden reach and ensure reimbursement coverage. Many are expanding their global distribution networks to penetrate emerging markets while investing heavily in R&D to enhance platform functionality using AI, machine learning, and real-time patient monitoring. Regulatory approvals remain a priority, with companies working closely with agencies to gain faster clearances. Integration with electronic health records and telehealth platforms is another core focus, aimed at improving interoperability and patient engagement.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Digital Therapeutics market report include:- AmerisourceBergen

- Akili Interactive

- Click Therapeutics

- Hyfe

- LifeScan

- Omada Health

- Orexo

- Otsuka Holdings

- Pear Therapeutics

- Propeller Health (ResMed)

- Teladoc Health

- Virta Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

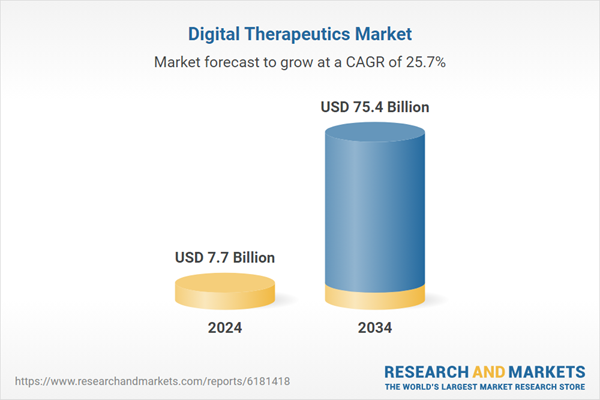

| Estimated Market Value ( USD | $ 7.7 Billion |

| Forecasted Market Value ( USD | $ 75.4 Billion |

| Compound Annual Growth Rate | 25.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |