Increasing pressure to build sustainable and energy-optimized infrastructure is driving global adoption of advanced asset management systems within data centers. As digital transformation intensifies, operators are prioritizing solutions that can enhance energy efficiency, reduce operational costs, and support higher compute demands. Intelligent interfaces equipped with real-time visualization and AI-driven analytics are transforming how operators interact with infrastructure, making operations more intuitive and autonomous. Software-defined architectures are gaining momentum, enabling smarter monitoring, automation, and seamless resource allocation while minimizing unplanned outages. A shift from traditional reactive approaches to proactive services such as predictive maintenance and remote management is also shaping market expansion. Growing demand for cost-effective, scalable, and regulation-compliant infrastructure across colocation and hybrid environments in emerging economies is accelerating the uptake of flexible asset management solutions. As regulatory standards and sustainability goals tighten, data center operators are investing in platforms that ensure transparency, carbon footprint tracking, and optimized capacity planning, strengthening the role of asset management in digital infrastructure.

In 2024, the software segment held a 68.4% share and is projected to register a CAGR of 12.8% through 2034. Organizations are relying more on software-based tools to manage assets with real-time visibility and predictive capabilities. These platforms enable facilities to forecast hardware failures, manage workload capacities more efficiently, and prevent unplanned downtime. With growing digital consumption, businesses are increasingly leveraging intelligent software solutions to align IT infrastructure with evolving demand, ensuring operational resilience and service continuity.

The on-premises deployment segment held a 58% share in 2024 and is expected to grow at a CAGR of 13.4% from 2025 to 2034. Industries such as finance, government, and defense that manage highly sensitive data often opt for on-premises systems to ensure data sovereignty, meet compliance requirements, and maintain full operational control. For these sectors, in-house infrastructure provides a sense of security and regulatory assurance.

U.S Data Center Asset Management Market was valued at USD 814 million in 2024. With the highest concentration of hyperscale data centers globally, the US continues to lead in technology adoption across asset management practices. Enterprises and service providers are enhancing energy efficiency, improving physical security, and reducing downtime by investing in advanced platforms. Federal and state-level support for clean energy initiatives is prompting a shift toward greener management practices. Technologies focused on real-time visibility, energy use optimization, and compliance with frameworks such as HIPAA and PCI DSS are helping operators meet operational and regulatory demands.

Key players active in the Global Data Center Asset Management Market include Huawei, Eaton, Hitachi, IBM, Nlyte Software, Vertiv, FNT, Schneider Electric, Device42, and Sunbird Software. To expand their footprint in the Data Center Asset Management Market, leading companies are deploying several core strategies. A primary focus lies in enhancing software functionalities through AI, automation, and real-time analytics to deliver intelligent monitoring and predictive maintenance. Many players are offering integrated platforms that provide visibility across hybrid and multi-cloud environments, allowing customers to simplify infrastructure management. Partnerships with hyperscalers and colocation providers are helping vendors gain access to large-scale deployments. Meanwhile, tailored solutions targeting compliance-heavy industries ensure long-term retention.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Data Center Asset Management market report include:- Microsoft

- IBM

- Oracle

- ServiceNow

- BMC Software

- Schneider Electric

- Device42

- Lansweeper

- ManageEngine

- Nlyte Software

- Vertiv

- Sunbird Software

- Eaton

- Hitachi

- Huawei

- FNT

- Freshworks

- Ivanti

- CA Technologies

- Cherwell Software

- Axios Systems

- EasyVista

- TOPdesk

- Hornbill

- InvGate

- Armis

- Lansweeper

- Axonius

- Qualys VMDR

- Tanium

- JupiterOne

- Oomnitza

- AssetSonar

- Virima

- Insight Engines

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

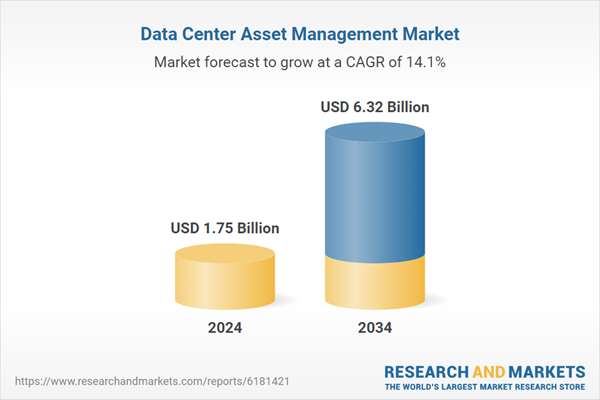

| Estimated Market Value ( USD | $ 1.75 Billion |

| Forecasted Market Value ( USD | $ 6.32 Billion |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 36 |