The region is adopting smart grid technologies to modernize its power infrastructure, driving demand for advanced distribution transformers with capabilities like two-way communication and real-time monitoring. These smart transformers are crucial for enhancing energy efficiency, improving grid reliability, and integrating renewable energy sources effectively. Large-scale infrastructure developments in countries like Saudi Arabia, the UAE, and Qatar are fueling the need for durable and efficient transformers. Expanding urban areas and new commercial hubs require stronger electrical distribution systems to meet rising electricity demands. Governments are heavily investing in upgrading both transmission and distribution networks, which supports increased adoption of transformers that can handle higher loads and maintain a steady power supply. The population surge and migration into key cities amplify the need for scalable and reliable power infrastructure. Innovations in transformer technologies, including advanced winding materials and superior insulation, are boosting transformer performance and lifespan.

The shell core distribution transformers segment held a 32.4% in 2024 and is expected to grow at a CAGR of 7% through 2034. These transformers are favored in the Middle East for grid modernization because of their ability to contain magnetic flux effectively and minimize energy losses. Their compact structure fits well within space-restricted urban areas, while their efficiency levels between 98% and 99% comply with stringent energy conservation norms. As governments push smart infrastructure initiatives, shell core transformers’ support for bidirectional power flow and renewable energy variability makes them indispensable. Their compatibility with digital monitoring enables utilities to perform predictive maintenance and real-time system optimization, reducing downtime and enhancing service reliability in fast-growing distribution networks.

The utility-scale distribution transformers segment held a 52.9% share in 2024. This segment is expanding due to utilities upgrading networks to support distributed generation and energy storage. The rise of renewable energy projects, particularly solar and wind, across Saudi Arabia, UAE, and Oman, is creating demand for transformers that manage fluctuating energy inputs while maintaining grid stability. Utilities are increasingly integrating smart transformer technologies with digital monitoring tools to cut transmission losses and boost operational reliability. Qatar’s emphasis on energy-efficient infrastructure development further accelerates demand for advanced transformer solutions.

Saudi Arabia Middle East Distribution Transformer Market generated USD 583.1 million in 2024. Saudi Arabia’s Vision 2030 infrastructure initiatives are a major driving force, with plans for extensive housing developments and investments in roads, parks, and public facilities that increase electricity consumption. The combination of rapid urbanization and industrial growth pressures existing grids, necessitating the installation and upgrade of transformers to ensure reliable power delivery across residential, commercial, and industrial sectors.

Key players active in the Middle East Distribution Transformer Market include Siemens Energy, Schneider Electric, Abaft Middle East Transformer Ind. LLC, Eurogulf Transformers, Arabian Transformers, Global Transformers & Switchgears FZCO, Saudi Transformers, Alfanar Electrical Systems, Voltamp, and GE Vernova. To strengthen their foothold in the Middle East distribution transformer market, companies are focusing on several key strategies. They are investing in research and development to introduce smart, energy-efficient transformer models tailored to regional needs, including compatibility with renewable energy sources. Many are enhancing their manufacturing capabilities and expanding production capacities to meet growing demand. Collaborations with local utilities and infrastructure developers help accelerate project deployment and establish long-term partnerships. Sustainability initiatives are also prioritized, with firms adopting eco-friendly materials and designs.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Middle East Distribution Transformer market report include:- Abaft Middle East Transformer Ind. LLC

- Alfanar Electrical Systems

- Arabian Transformers

- Eurogulf Transformers

- GE Vernova

- Global Transformers & Switchgears FZCO

- Saudi Transformers

- Schneider Electric

- Siemens Energy

- Voltamp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

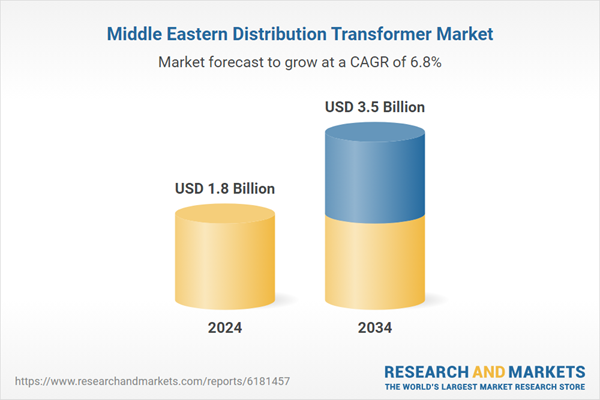

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Middle East |

| No. of Companies Mentioned | 11 |