This robust growth is fueled by rising integration of renewable energy sources, such as wind and solar, which demand reliable energy storage systems powered by lithium-ion batteries. As usage of these batteries scales, so does the generation of end-of-life units, making advanced recycling essential to extract valuable materials and support the circular economy. The shift toward sustainability, driven by ambitious decarbonization goals and regulatory pressure, is accelerating interest in innovative recycling technologies. These systems not only limit landfill waste but also preserve critical minerals necessary for battery production. Growing dependence on imports of key raw materials like lithium, cobalt, and nickel is pushing Europe to boost its domestic recovery capabilities. The region’s increasing focus on energy independence, along with supportive policy frameworks, is paving the way for the rapid development of high-efficiency recycling infrastructure. Although some investment decisions remain pending, strong policy backing and the strategic need for resource security are reinforcing long-term market confidence across Europe.

The pyrometallurgical process segment is expected to grow at a CAGR of 20% through 2034, primarily due to its established infrastructure and ability to scale rapidly across Europe. This method offers operational flexibility by processing mixed battery chemistries without requiring intense sorting procedures. Its efficiency in recovering high-value metals like nickel, copper, and cobalt further enhances its economic viability, especially in large-volume battery waste processing. While lithium recovery remains limited in this process, the consistent demand for these essential metals keeps pyrometallurgy highly relevant for recyclers focused on maximizing material recovery rates.

The automotive segment held a 63.8% share in 2024 and is expected to grow at a CAGR of 19.8% from 2025 to 2034. This growth is strongly tied to the increasing shift toward electric mobility. With battery-powered vehicles expected to represent a substantial share of new car sales in the near future, the quantity of used batteries is projected to surge. Alongside this, manufacturing scrap from battery production lines during their scale-up phase offers a continuous source of recyclable material. These trends are intensifying the need for scalable and efficient recycling operations to recover strategic materials and support environmental goals.

Germany Lithium-Ion Battery Recycling Market held a 47.3% share and is anticipated to reach USD 5 billion by 2034. The country's strict environmental policies, including regulations that mandate battery producers to take responsibility for collecting and recycling used batteries, are creating strong tailwinds for market growth. Increasing electric vehicle registrations, surpassing 380,000 units in 2024, are also contributing to a growing pool of spent batteries. This trend is accelerating the demand for sophisticated recycling solutions that can handle high volumes and enable resource recovery for new battery manufacturing, solidifying Germany's leadership in the regional market.

Key companies driving the Europe Lithium-Ion Battery Recycling Market include Saft Group, Umicore, Accurec Recycling, Altilium Metals, Batrec AG, Ecobat, Eramet, Redwood Materials, Cylib, Cellcycle, Northvolt, Recyclus Group, Re.Lion.Bat, Stibat Service, SungEel Hitech, Stena Recycling, Fortum, Revatech, Glencore, and Tozero. To strengthen their position in the Europe Lithium-Ion Battery Recycling Market, leading companies are implementing strategies focused on vertical integration, technological innovation, and regional expansion. Many players are developing proprietary recycling methods to enhance recovery rates of critical minerals like cobalt, nickel, and lithium. Strategic partnerships with automakers and battery manufacturers allow firms to secure a steady supply of end-of-life batteries and production scrap. Several recyclers are also scaling their facilities near EV manufacturing hubs to reduce logistics costs and improve turnaround time.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Europe Lithium-Ion Battery Recycling market report include:- Accurec Recycling

- Altilium Metals

- Batrec AG

- Cylib

- Cellcycle

- Ecobat

- Eramet

- Fortum

- Glencore

- Northvolt

- Redwood Materials

- Recyclus Group

- Revatech

- Re.Lion.Bat

- Stena Recycling

- Stibat Service

- SungEel Hitech

- Saft Group

- Tozero

- Umicore

Table Information

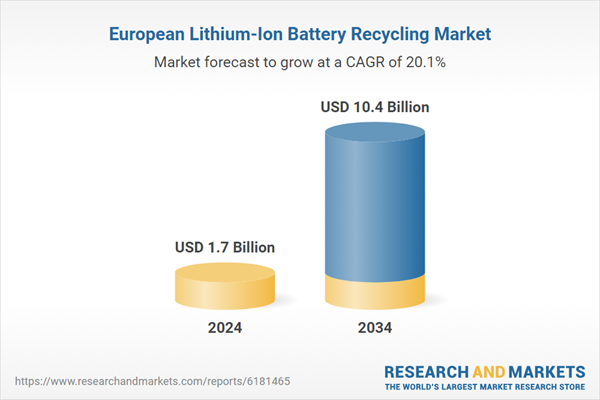

| Report Attribute | Details |

|---|---|

| No. of Pages | 102 |

| Published | October 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 10.4 Billion |

| Compound Annual Growth Rate | 20.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 21 |