Speak directly to the analyst to clarify any post sales queries you may have.

A clear operational framing that positions unmanned aerial systems as core enablers of safety, data density, and operational agility in mining

The opening analysis frames the evolving role of unmanned aerial systems within extractive industries, situating mining drones as pivotal enablers of safer, more efficient, and data-driven operations. Over the past decade, drones have transitioned from experimental proof-of-concept tools to mission-critical assets used across exploration, asset inspection, environmental monitoring, and emergency response. This section establishes the operational context that mining executives and technical leaders must consider when evaluating integration pathways.Key enablers such as advances in sensor miniaturization, improved battery performance, and robust data processing pipelines have expanded the practical utility of drones on complex mine sites. Concurrently, fleet management technologies and third-party service models have lowered the barriers to entry for operators that lack in-house aerospace expertise. The narrative emphasizes how drones augment existing inspection regimes and geospatial workflows, enabling more frequent, higher-resolution data collection without the safety exposure of personnel.

This introduction also highlights the regulatory and workforce dimensions that influence adoption. Evolving unmanned aircraft rules and the need for certified training require coordinated change management across operational, safety, and procurement functions. By outlining these core dynamics, the section prepares readers to assess strategic priorities and operational trade-offs for integrating drone capabilities into the mining value chain.

How rapid autonomy, payload versatility, evolving service models, and regulatory pressures are fundamentally reshaping mining drone adoption and procurement strategies

The landscape for mining drones is being reshaped by multiple converging forces that are altering procurement decisions, deployment models, and technology roadmaps. On the technology side, rapid improvements in autonomy software and payload versatility are enabling beyond-visual-line-of-sight operations and multi-sensor missions that previously required specialized aircraft. These capabilities are unlocking new use cases in exploration, volumetric stockpile measurement, and continuous environmental monitoring, thereby shifting the value proposition from episodic data capture to persistent site intelligence.Commercially, service economics are transforming as operators weigh owning versus contracting drone capabilities. New commercial offerings bundle hardware, software, and mission execution under outcome-based agreements, which can accelerate adoption in asset-heavy operations with constrained capital budgets. Concurrently, ecosystem dynamics are evolving: companies that provide robust data analytics and systems integration are gaining prominence as buyers prioritize turnkey solutions that minimize internal integration burden.

Regulatory shifts and community expectations are compelling more transparent safety and environmental practices, which in turn prioritize drones that support compliance and reassurance activities. Taken together, these transformative shifts mean that stakeholders must align strategy, talent, and capital allocation to capture the full benefits of drone-enabled operations.

Assessment of how mid-decade tariff interventions reconfigured supply chains, procurement approaches, and regional sourcing strategies for drone fleets

Tariff policy interventions introduced in 2025 created a new operating layer for procurement officers and fleet managers, influencing supply chain resilience and total cost of ownership considerations. Increased duties on selected imported components and finished systems prompted buyers to reassess sourcing strategies and accelerated supplier diversification initiatives. Organizations with multi-supplier architectures or regional manufacturing partnerships experienced reduced exposure, while those dependent on single-sourced components faced extended lead times and higher acquisition costs.The tariffs also encouraged more localized supply chain activity, stimulating partnerships with regional system integrators and electronics assemblers. This localization trend had the effect of shortening lead times for critical spares and facilitating more agile maintenance and repair cycles. From an operational perspective, the tariff environment elevated the importance of standardized modular designs and interoperable payloads that can be sourced from multiple vendors, reducing the risk associated with supplier concentration.

Moreover, procurement teams adapted by prioritizing total lifecycle value and service-level contracts that included maintenance, training, and managed fleet services. In short, the tariff-driven rebalancing favored companies and operating models that were flexible, regionally anchored, and capable of delivering continuity of service under shifting trade policies.

Comprehensive segmentation insights showing how service models, sensor suites, autonomy profiles, applications, and sales channels converge to inform procurement and deployment choices

A nuanced segmentation lens reveals how different buyer needs and technical requirements shape commercial choices and operational outcomes. Based on service model, buyer decisions differentiate between Drones-as-a-Service, maintenance and repair offerings, managed fleet services, and training and certification, with the Drones-as-a-Service category further delineated across capture plus processing, data capture only, and end-to-end insights. These service distinctions influence whether organizations prioritize turnkey analytics, in-house capability development, or pay-per-mission flexibility.Based on payload and sensor attributes, mission planners evaluate options spanning gas detection, hyperspectral, LiDAR, loudspeaker and public address systems, magnetometers, multispectral sensors, radiation detectors, RGB/EO cameras, and thermal infrared modules. Payload selection drives platform choice as well as data processing complexity and operational constraints such as flight duration and environmental robustness. Based on autonomy level, procurement and operations teams navigate trade-offs between assisted visual-line-of-sight operations, automated beyond-visual-line-of-sight missions, fully autonomous mission execution, manual visual-line-of-sight control, and swarm or multiple unmanned aerial system coordination, each presenting distinct regulatory and safety implications.

Based on application, priority use cases include drilling and blasting oversight, environmental monitoring, exploration and geology support, structural and asset inspection, logistics and asset tracking, safety and emergency response, stockpile measurement, and surveying and mapping, with operational cadence and data latency needs varying markedly across these functions. Based on sales channel, buyers balance options through direct purchases, distributor or reseller relationships, online marketplaces, and system integrators, where channel selection affects aftercare, warranty terms, and integration support. This segmentation matrix clarifies how technical, commercial, and operational vectors intersect to determine procurement pathways and implementation strategies.

Regional dynamics and operational prerequisites that drive differentiated adoption patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific mining operations

Regional dynamics are a critical determinant of how mining drone capabilities are adopted and scaled across jurisdictions. In the Americas, operators often prioritize safety-driven use cases and have established vendor ecosystems that support integration with established mine planning and asset management platforms. This region benefits from mature private-sector demand and a policy environment that increasingly supports commercial beyond-visual-line-of-sight operations, enabling larger operational footprints and more ambitious automation strategies.Europe, Middle East & Africa presents a heterogeneous landscape where regulatory frameworks and infrastructure maturity vary significantly. In some markets, stringent environmental reporting and community engagement imperatives create demand for precision monitoring and transparent data trails. Elsewhere, nascent regulatory regimes and infrastructure constraints make service models that provide turnkey solutions and managed fleet services more attractive to operators seeking to limit capital exposure while accessing advanced capabilities.

Asia-Pacific exhibits a blend of high-volume manufacturing capabilities and rapidly growing operational adoption. In regions where local manufacturing and assembly are prioritized, supply chain resilience supports rapid replenishment of critical spares and localized customization of payloads. Across the region, strong government-backed mining initiatives and investments in digital infrastructure accelerate the integration of advanced mapping, exploration support, and inspection workflows, shaping a competitive environment that stresses scale, interoperability, and cost-effectiveness.

Why integrated platform engineering, scalable analytics, and partner orchestration distinguish leading vendors and service providers in the mining drone ecosystem

Corporate strategies that succeed in the mining drone ecosystem combine platform engineering excellence with robust data services and strong systems integration capabilities. Leading equipment manufacturers focus on modular platforms that support rapid payload swaps and simplified maintenance, while software providers invest in scalable analytics that translate raw sensor inputs into actionable decision support for geotechnical, environmental, and operational stakeholders. Service specialists carve out value by packaging repeatable mission profiles, compliance documentation, and training curricula that reduce buyer friction.Partnership orchestration has become a key competence: firms that align hardware, sensor manufacturers, analytics vendors, and local integrators can deliver compelling end-to-end propositions. Meanwhile, companies that offer managed fleet services and maintenance contracts provide an attractive alternative for operators seeking predictable operational availability and consolidated vendor accountability. Competitive differentiation increasingly hinges on data interoperability, security practices, and the ability to embed drone-derived insights into broader mine management systems.

Procurement teams therefore evaluate suppliers not only on platform capabilities and price but also on ecosystem strength, after-sales support, and the maturity of their service delivery models. As adoption matures, companies that demonstrate repeatable field outcomes, measurable safety improvements, and seamless integration with enterprise workflows are gaining preference among strategic buyers.

A pragmatic, risk-focused blueprint of governance, procurement, and capability-building steps that industry leaders should adopt to scale drone operations effectively

Industry leaders should prioritize a pragmatic set of actions that reduce deployment risk and accelerate operational value realization. First, invest in clear governance and cross-functional sponsorship that aligns engineering, safety, procurement, and environmental teams around measurable objectives for drone use. This reduces siloed decision-making and ensures that deployments support enterprise-level KPIs rather than isolated pilot projects.Second, adopt a modular procurement approach that emphasizes interoperable payloads and open data standards, which mitigates supplier lock-in and simplifies upgrades. Third, consider hybrid ownership models where core capabilities are retained internally while specialized missions are outsourced to proven service providers; this balance secures long-term control while leveraging external execution efficiency. Fourth, integrate training and certification into workforce planning to cultivate internal capabilities and ensure regulatory compliance, pairing classroom instruction with supervised operational deployments.

Fifth, prioritize vendor selection criteria beyond price, including maintenance lead times, spare parts availability, and demonstrated experience in similar geographies or operational environments. Lastly, embed pilots within existing operational workflows and scale systematically based on defined performance thresholds, leveraging iterative learnings to refine mission profiles and operational governance.

A rigorous mixed-methods research framework combining primary interviews, technical assessments, and compliance synthesis to generate operationally relevant insights for decision-makers

The research underpinning this analysis employed a mixed-methods approach that integrates primary stakeholder interviews, operational case studies, technical assessments, and secondary literature review focused on regulations and technology roadmaps. Primary interviews were conducted with senior operational leaders, drone program managers, systems integrators, and sensor manufacturers to capture first-hand experience on deployment challenges, procurement rationales, and service model performance. These qualitative insights were augmented by field observations and anonymized case examples that illustrate real-world trade-offs.Technical assessments evaluated platform capabilities across payload integration, autonomy features, and maintainability, while compliance reviews synthesized regulatory guidance and public policy shifts that affect operational envelopes. Secondary materials included manufacturer technical briefs, regulatory notices, and academic and industry whitepapers that contextualize trends without relying on proprietary market estimations. Triangulation across these sources enabled a robust interpretation of technology trajectories, procurement behavior, and operational best practices, while measures to validate findings included cross-interview corroboration and scenario-based stress testing of key assumptions.

The methodology emphasizes transparency in data collection and a focus on operationally relevant findings, designed to provide decision-ready guidance for commercial teams, safety officers, and technical stakeholders evaluating drone adoption pathways.

Strategic synthesis that clarifies how governance, integration, workforce readiness, and supply chain resilience unlock measurable operational and safety outcomes from drone deployments

The synthesis of trends, segmentation dynamics, regional considerations, and supplier strategies leads to a clear strategic imperative: mining organizations must move from isolated pilots to governed, scalable programs that deliver operational outcomes and risk mitigation. Drones will not be a one-size-fits-all replacement for established processes but will instead provide targeted enhancements where their capabilities align with safety objectives, data cadence needs, and cost-to-benefit profiles.Successful integration requires deliberate investments in governance, interoperability, workforce capability, and vendor partnerships. Regulatory understanding and supply chain resilience are equally critical, particularly given how trade policy and regional manufacturing capabilities influence procurement agility. Organizations that adopt modular architectures, prioritize managed services for non-core missions, and embed drone-derived intelligence into enterprise workflows will realize the strongest operational returns.

In closing, the pathway from experimentation to scale is navigable but requires executive commitment, cross-functional collaboration, and disciplined vendor selection. With these elements in place, drones can materially improve safety, speed decision cycles, and enhance environmental stewardship across diverse mining operations.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Service Model

- Drones-as-a-Service

- Capture + Processing

- Data Capture Only

- End-to-End Insights

- Maintenance & Repair

- Managed Fleet Services

- Training & Certification

- Drones-as-a-Service

- Payload/Sensor

- Gas Detection

- Hyperspectral

- LiDAR

- Loudspeaker/PA

- Magnetometer

- Multispectral

- Radiation Sensor

- RGB/EO Camera

- Thermal Infrared

- Autonomy Level

- Assisted VLOS

- Automated BVLOS

- Fully Autonomous Mission

- Manual VLOS

- Swarm/Multiple UAS Coordination

- Application

- Drilling & Blasting

- Environmental Monitoring

- Exploration & Geology

- Inspection

- Logistics & Asset Tracking

- Safety & Emergency Response

- Stockpile Measurement

- Surveying & Mapping

- Sales Channel

- Direct

- Distributor/Reseller

- Online Marketplace

- System Integrator

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AgEagle Aerial Systems Inc.

- Airobotics Inc.

- Delair S.A.

- DroneDeploy Inc.

- Epiroc AB

- Exyn Technologies

- Hexagon AB

- Luleå University of Technology

- Nelson Brothers Inc.

- Ondas Holdings Inc.

- Parrot SA

- Percepto Inc.

- Sandvik AB

- Skycatch Inc.

- Skydio Inc.

- SPH Engineering

- SZ DJI Technology Co., Ltd.

- Terra Drone

- Topcon Corporation

- Trimble Inc.

- Vision Aerial, Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Mining Drones market report include:- AgEagle Aerial Systems Inc.

- Airobotics Inc.

- Delair S.A.

- DroneDeploy Inc.

- Epiroc AB

- Exyn Technologies

- Hexagon AB

- Luleå University of Technology

- Nelson Brothers Inc.

- Ondas Holdings Inc.

- Parrot SA

- Percepto Inc.

- Sandvik AB

- Skycatch Inc.

- Skydio Inc.

- SPH Engineering

- SZ DJI Technology Co., Ltd.

- Terra Drone

- Topcon Corporation

- Trimble Inc.

- Vision Aerial, Inc.

Table Information

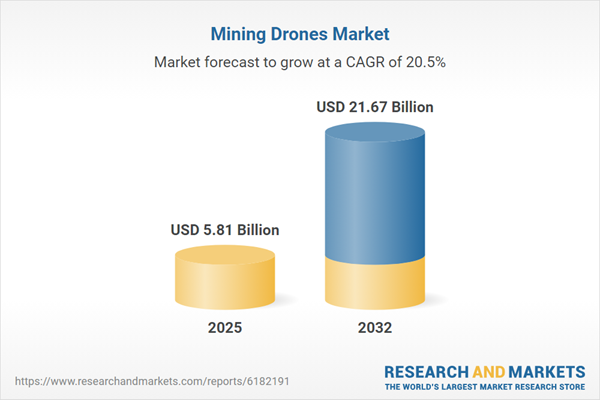

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 5.81 Billion |

| Forecasted Market Value ( USD | $ 21.67 Billion |

| Compound Annual Growth Rate | 20.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |